Global Preclinical Imaging Market

Global Preclinical Imaging Market Size, Share, and COVID-19 Impact Analysis, By Product (Modality, Reagent, and Service), By End-User (Biotech Companies, Pharmaceutical Companies, and Research Institutes), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

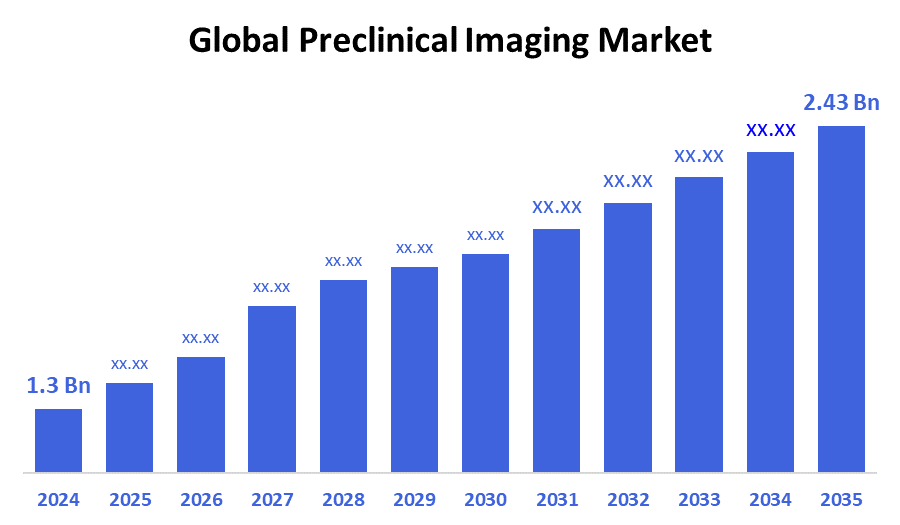

Global Preclinical Imaging Market Size Insights Forecasts to 2035

- The Global Preclinical Imaging Market Size Was Estimated at USD 3.59 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.31% from 2025 to 2035

- The Worldwide Preclinical Imaging Market Size is Expected to Reach USD 5.71 Billion by 2035

- Europe is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Preclinical Imaging Market Size was worth around USD 3.59 Billion in 2024 and is predicted to Grow to around USD 5.71 Billion by 2035 with a compound annual growth rate (CAGR) of 4.31% from 2025 to 2035. Some of the key reasons driving the market include the increasing incidence of various chronic diseases, the growing focus on personalised treatment and precise diagnostics to cater to specific patient profiles, and the growing desire for accurate and non-invasive imaging technologies.

Market Overview

Preclinical imaging industry refers to observing the living things which help conumers to analyse things such as how drugs work and how we create new drugs. Further, Different types of imaging and drug creation are very important to researchers. Besides, the amount of funding that has been given to researchers by different organisations has been increasing, which is a great assistance to the field of preclinical research. Also, with the increased demand for preclinical imaging, the market will continue to grow at an accelerated pace. The growth of preclinical research is critical to improving modern medicine and how those medicines can be administered to patients to correct their health issues. The number of clinical research organisations continues to increase, which will also contribute to the growth of the market. AI uses a variety of sophisticated algorithms and machine learning capabilities to process medical images faster than in the past. This can save time and improve the accuracy of the diagnosis. AI improves diagnosis accuracy for the majority of diagnoses by using pattern recognition and anomaly understanding across huge datasets. In cases like cancer, it can also be used as a diagnostic prediction to enable early illness diagnosis and improve patient outcomes.

Bruker’s Energy & Supercon Technologies (BEST) division has secured approximately $500 million in multi-year supply agreements with two global healthcare companies for its high-performance superconductors used in next-generation MRI magnets. Moreover, to meet the strict requirements for field stability and homogeneity, Bruker's cutting-edge superconductors also enable innovative helium-free MRI magnet topologies.

Report Coverage

This research report categorises the preclinical imaging market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the preclinical imaging market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the preclinical imaging market.

Driving Factors

The emergence of advanced technologies for imaging, along with the increasing emphasis on early drug development, has been influencing the global preclinical imaging market through significant changes. The integration of these different modalities into a research protocol has improved our understanding of the mechanisms of disease and response to therapy and, therefore, improved drug discovery and opened up new market opportunities. Moreover, the increasing collaborations between Universities through the pharmaceutical industry will likely promote new imaging innovation development and continue to drive growth in this market. Additionally, the increasing number of people suffering from chronic diseases and the increasing demand for personalised medicine have increased the need for specialised imaging solutions. Preclinical research is being market is being supported by government initiatives, such as grants and financing from institutions like the National Institutes of Health (NIH) and comparable agencies.

Restraining Factors

The industry is hampered by rigorous government laws, procedural restrictions, and limitations on animal experimentation. These studies are very costly due to high equipment installation and operating expenses. These factors taken together will considerably impede market slow adoption.

Market Segmentation

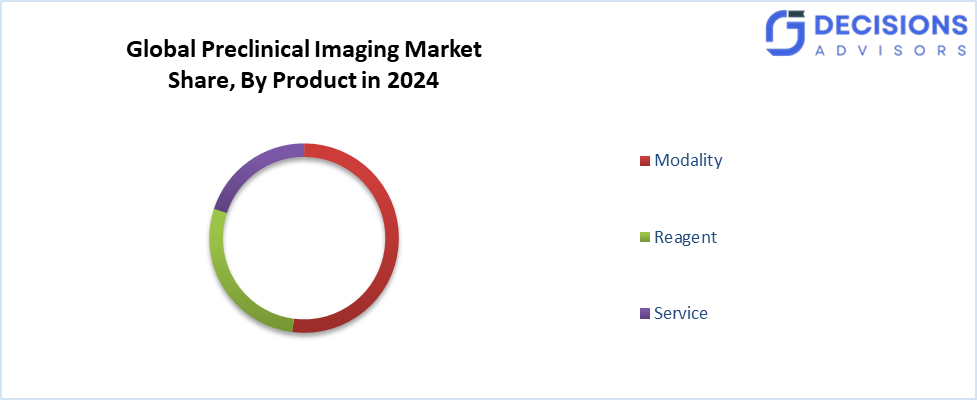

The preclinical imaging market share is classified into product, and end user.

- The modality segment accounted for the largest market share in 2024 and is expected to grow at a substantial CAGR over the forecast period.

Based on the product, the preclinical imaging market is divided into modality, reagent, and service. Among these, the modality segment accounted for the largest market share in 2024 and is expected to grow at a substantial CAGR over the forecast period. Modality provides the essential link between the physicians' ability to provide definitive diagnostic images through MRI, CT and Optical Imaging technologies and the researcher's ability to conduct detailed image quality analysis. For instance, the MRI produces high-quality images for anatomical assessment and identification, through the visualisation of tissues and the study of their physiology.

- The research institutes segment accounted for the highest market share in 2024 and is anticipated to grow at a rapid pace over the forecast period.

Based on the end user, the preclinical imaging market is segmented into biotech companies, pharmaceutical companies, and research institutes. Among these, the research institutes segment accounted for the highest market share in 2024 and is anticipated to grow at a rapid pace over the forecast period. The high numbers of R&D performed have increased considerably, and so has the funding for it. Furthermore, there is a continuing need from consumers for high-quality data from the R&D industry, which thrives as the market needs more and more advanced medicines.

Regional Segment Analysis of the Preclinical Imaging Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the preclinical imaging market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the preclinical imaging market over the predicted timeframe. This is due to the region's advantages of low research costs, few research limitations, and increased government financing for research and development. Asia Pacific will be more attractive for preclinical research and clinical research outsourcing (CRO) due to these strategic benefits, particularly in developing nations like China, Japan, and India.

Additionally, Japan's healthcare sector has embraced new developments and breakthroughs for diagnosis, contributing to the expansion of the preclinical imaging market worldwide. Japan has established national Diagnostic Reference Levels (DRLs) to optimise patient radiation exposure, first introduced in 2015, revised in 2020, and most recently updated in 2025. These DRLs serve as benchmarks for medical imaging procedures such as CT, nuclear medicine, and interventional radiology, ensuring patient safety while maintaining diagnostic quality.

Europe is projected to grow at a rapid CAGR in the preclinical imaging market during the forecast period. The use of cutting-edge imaging technologies to expedite drug discovery and development is being fueled by local key pharmaceutical and biotechnology companies' increasing R&D expenditures. Moreover, the regional market growth is further supported by government grants and funding, and demand is strengthened by the focus on translational research and personalised medicine. High-resolution, non-invasive imaging is made possible by technological developments, which boost productivity and cut expenses. High-quality preclinical data is emphasised by regulatory organisations like the EMA, which increases the demand for sophisticated imaging systems which highlighting the regional market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the preclinical imaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aspect Imaging

- Bruker Corporation

- Cubresa Inc.

- FUJIFILM VisualSonics

- Mediso Ltd.

- MR Solutions

- Revvity (PerkinElmer, Inc)

- Rigaku (MILabs B.V.)

- Siemens Healthineers

- TriFoil Imaging

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, FUJIFILM VisualSonics officially launched the Vevo F2 LAZR-X20, a next-generation photoacoustic imaging platform designed for preclinical ultrasound research. It combines ultra-high to low frequency ultrasound with intelligent laser technology, enabling advanced tissue characterisation across oncology, cardiovascular, neurobiology, and molecular biology applications.

- In February 2024, Bruker Corporation announced that it acquired Spectral Instruments Imaging (SII), a Tucson-based leader in preclinical in-vivo optical imaging systems. This acquisition strengthens Bruker’s BioSpin Preclinical Imaging division by adding advanced optical imaging technologies to its portfolio, enhancing disease research capabilities.

- In April 2022, PerkinElmer launched the Vega Widefield Preclinical Ultrasound Imaging System, introducing a first-of-its-kind hands-free, automated ultrasound platform designed to accelerate non-invasive preclinical research. Brightness and motion modes, acoustic angiography mode for microvasculature imaging, and Shear Wave Elastography (SWE) mode for measuring and assessing tissue stiffness, a marker utilised in numerous disease states, such as liver, kidney, and different stages of cancer.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the preclinical imaging market based on the below-mentioned segments:

Global Preclinical Imaging Market, By Product

- Modality

- Reagent

- Service

Global Preclinical Imaging Market, By End User

- Biotech Companies

- Pharmaceutical Companies

- Research Institutes

Global Preclinical Imaging Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global preclinical imaging market?

The market was valued at USD 3.59 billion in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 5.71 billion by 2035.

- What is the CAGR for the forecast period?

The market is projected to grow at a CAGR of 4.31% from 2025 to 2035.

- Which product segment holds the largest share?

The modality segment accounted for the largest market share in 2024 and is expected to grow substantially.

- Which end-user segment leads the market?

Research institutes held the highest market share in 2024 and are anticipated to grow rapidly.

- Which region will dominate the market?

Asia Pacific is expected to hold the largest share, driven by low costs, fewer restrictions, and government funding in countries like China, Japan, and India.

- What are the main growth drivers?

Key factors include rising chronic diseases, demand for personalised medicine, advanced imaging technologies, and increased R&D funding from governments and organisations.

- Who are some key players in the market?

Major companies include Bruker Corporation, FUJIFILM VisualSonics, Siemens Healthineers, Revvity (PerkinElmer), and Mediso Ltd.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |