Global Probiotic Dairy Products Market

Global Probiotic Dairy Products Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (Yogurt, Kefir, Cheese, and Sour Cream), By Probiotic Strain (Lactobacillus Acidophilus, Bifidobacterium, Streptococcus Thermophilus, Lactobacillus Plantarum, and Lactobacillus Casei), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 ? 2035

Report Overview

Table of Contents

Probiotic Dairy Products Market Summary, Size & Emerging Trends

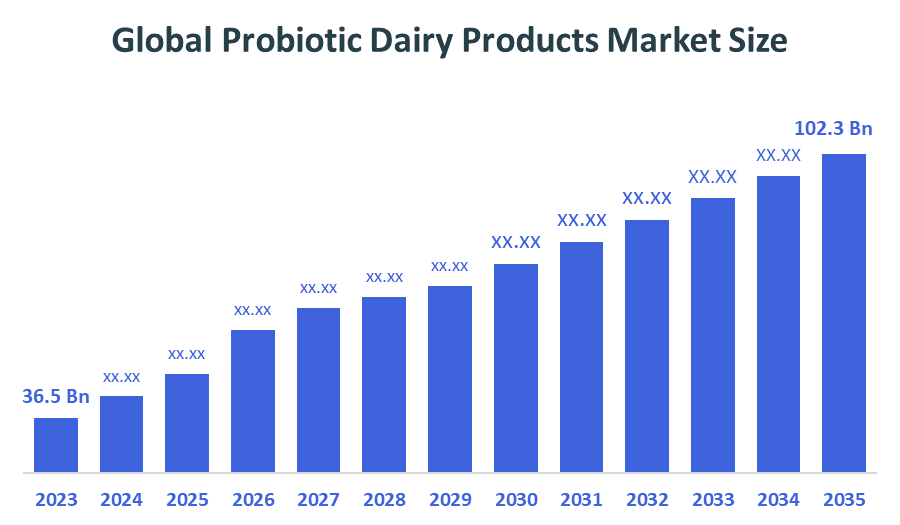

According to Decision Advisor, the Global Probiotic Dairy Products Market Size is Expected to Grow from USD 36.5 Billion in 2024 to USD 102.3 Billion by 2035, at a CAGR of 9.82% during the forecast period 2025-2035. The increasing awareness of gut health, immune system benefits, and the shift toward functional foods are major driving factors in the probiotic dairy products market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the probiotic dairy products market during the forecast period.

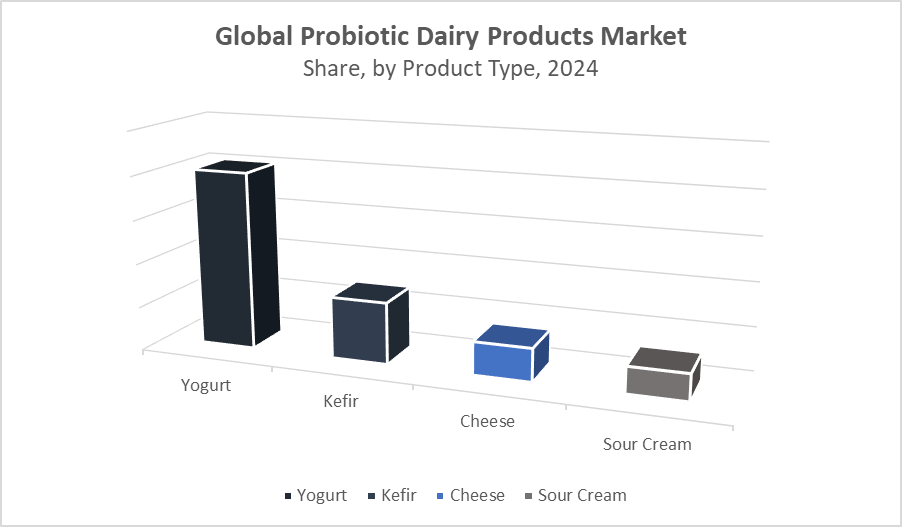

- In terms of product type, the yogurt segment dominated in terms of revenue during the forecast period.

- In terms of probiotic strain, the Lactobacillus acidophilus segment accounted for the largest revenue share in the global probiotic dairy products market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 36.5 Billion

- 2035 Projected Market Size: USD 102.3 Billion

- CAGR (2025-2035): 9.82%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Probiotic Dairy Products Market

The probiotic dairy products market focuses on dairy-based foods enriched with live beneficial microorganisms that support digestive health and boost immunity. These products include yogurt, kefir, probiotic cheese, and sour cream, among others. As consumers increasingly shift toward health-conscious and preventive dietary choices, probiotic dairy has emerged as a leading category in functional foods. Manufacturers are investing in advanced fermentation technologies, shelf-stable formulations, and multi-strain products to meet evolving consumer preferences. Governments and regulatory bodies across key regions are also emphasizing the promotion of health-enhancing food categories, thereby fueling further market growth. As the demand for convenient, healthy, and sustainable food options rises, the probiotic dairy market is set to expand significantly across both developed and emerging markets.

Probiotic Dairy Products Market Trends

- Growing consumer focus on gut and immune health is increasing demand for probiotic dairy.

- Innovation in product types, including drinkable yogurts and probiotic cheeses, is expanding category reach.

- Clean-label, low-sugar, and lactose-free formulations are gaining traction.

- E-commerce and online grocery delivery are driving new growth channels for probiotic dairy.

Probiotic Dairy Products Market Dynamics

Driving Factors: Rising demand for functional foods and preventive health solutions

Key growth factors for the probiotic dairy products market include the increasing demand for functional foods that support digestive health and immunity. Rising health awareness, urbanization, and lifestyle-related health concerns are driving consumers toward probiotic-rich diets. Expansion of modern retail formats and improved cold chain logistics have also made probiotic dairy more accessible. Additionally, government guidelines promoting gut health and innovations in probiotic strains are fueling market adoption. The demand is further supported by ongoing product diversification, improved packaging, and rising interest in clean-label and naturally sourced ingredients.

Restrain Factors: Cold chain requirements and regulatory compliance may limit growth

Restraints in the probiotic dairy products market include the need for a robust cold chain to maintain live culture viability, which increases distribution costs. Regulatory differences across regions can limit product claims and delay market entry. Additionally, consumer skepticism regarding health benefits, high production costs, and limited awareness in rural or underdeveloped areas may affect market penetration. The growing popularity of plant-based alternatives also presents competitive pressure on traditional dairy probiotics.

Opportunity: Technological innovations and personalized nutrition trends

The probiotic dairy products market presents promising opportunities driven by personalized nutrition trends, technological innovation in probiotic formulation, and the expansion of probiotic food offerings. Increased investments in R&D are enabling the development of new strains with improved survival rates and targeted health benefits. Opportunities are also emerging from growing health-conscious populations in developing countries, rising per capita dairy consumption, and partnerships between probiotic ingredient suppliers and dairy manufacturers. The emergence of digital health platforms is supporting tailored diet plans, encouraging further adoption of functional dairy products.

Challenges: Consumer education and product stability concerns

Challenges in the probiotic dairy products market include maintaining the stability and efficacy of live cultures throughout the product's shelf life. Educating consumers on the benefits and proper consumption of probiotic products remains essential. Market fragmentation and lack of standardization in health claims pose difficulties for brand differentiation. High refrigeration costs, limited shelf life, and the risk of culture degradation during processing and storage also challenge manufacturers, especially in developing markets.

Global Probiotic Dairy Products Market Ecosystem Analysis

The global probiotic dairy products market ecosystem includes key stakeholders such as dairy producers, probiotic culture suppliers, packaging companies, distribution partners, and regulatory bodies. Dairy manufacturers collaborate with biotech companies to develop and incorporate effective probiotic strains. Retailers and online platforms serve as crucial channels for consumer access. Regulatory agencies play a central role in standardizing health claims and ensuring product safety. The ecosystem is further supported by R&D institutions working to develop next-generation probiotics and processing technologies. Together, these stakeholders drive innovation, compliance, and consumer trust across the global probiotic dairy value chain.

Global Probiotic Dairy Products Market, By Product Type

What factors enabled the yogurt segment to lead the global probiotic dairy products market in 2024?

The yogurt segment dominated the global probiotic dairy products market in 2024, accounting for approximately 52% of the market revenue, due to several key factors. Firstly, yogurt’s widespread consumer acceptance and established position as a convenient, tasty, and nutritious probiotic dairy product gave it a strong competitive edge. Its versatility in flavors, formats, and health benefits, such as aiding digestion and boosting immunity, resonated well with health-conscious consumers. Additionally, ongoing product innovations, including the introduction of low-fat, organic, and plant-based yogurt varieties, expanded its appeal to a broader audience. Robust distribution networks and effective marketing strategies further solidified yogurt’s preference over other probiotic dairy products.

Why did the kefir segment account for approximately 17% of the revenue share in the probiotic dairy products market?

The kefir segment accounted for a significant revenue share of approximately 17% during the forecast period due to several important factors. Kefir’s unique probiotic profile and health benefits, including improved digestion and immune support, made it increasingly popular among health-conscious consumers. Its distinct tangy flavor and versatility in consumption, whether as a drink or ingredient, helped it stand out in the probiotic dairy market. Additionally, rising awareness about fermented foods and growing demand for natural and functional beverages contributed to kefir’s strong market position. Effective marketing campaigns and expanding distribution channels further boosted its reach and preference.

Global Probiotic Dairy Products Market, By Probiotic Strain

How did the Lactobacillus acidophilus segment gain a competitive edge in the probiotic dairy products market during the forecast period?

The Lactobacillus acidophilus segment accounted for the largest revenue share of approximately 34% in the global probiotic dairy products market during the forecast period due to several critical factors. This probiotic strain is well-known for its proven health benefits, such as improving gut health, enhancing digestion, and boosting the immune system, which significantly drove consumer demand. Its widespread application across various dairy products, including yogurt and supplements, contributed to its strong market presence. Furthermore, extensive research and clinical studies supporting its efficacy helped build consumer trust and preference. The segment also benefited from increasing consumer awareness about the importance of probiotics for overall wellness, alongside strategic marketing efforts and broad distribution networks.

What made the Bifidobacterium segment a preferred choice among probiotic dairy products?

The Bifidobacterium segment holds a significant share in the global probiotic dairy products market due to its well-recognized health benefits, including promoting digestive health, enhancing immune function, and balancing gut microbiota. This probiotic strain is widely used in various dairy products, making it highly versatile and accessible to consumers. Increased consumer awareness regarding gut health and the rising preference for natural and functional foods have boosted the demand for Bifidobacterium-based products. Additionally, ongoing research validating its efficacy has strengthened consumer confidence.

Asia Pacific is expected to account for the largest share of the probiotic dairy products market during the forecast period, holding approximately 39% of the global market revenue. This dominance is driven by rapid urbanization, rising disposable incomes, and a traditional cultural familiarity with fermented dairy products. Key countries like China, India, and Japan lead consumption due to increasing health awareness, dietary diversification, and government initiatives promoting nutrition and wellness. The expanding middle class and growing retail infrastructure further support market growth across the region.

India is witnessing particularly strong growth within the Asia Pacific region, with a projected CAGR of approximately 10.2% during the forecast period. This growth is fueled by the rapid expansion of organized retail chains, frequent new product launches tailored to local tastes, and increasing consumer education about the benefits of gut health and probiotics. Urban populations in metropolitan areas such as Mumbai, Delhi, and Bangalore are major contributors to market demand.

North America is anticipated to register a significant CAGR during the forecast period and is expected to hold approximately 25% of the global probiotic dairy products market share. This growth is driven by health-conscious consumers increasingly seeking functional foods and beverages. Innovation in probiotic dairy formulations, such as lactose-free and fortified products, caters to a growing lactose-intolerant population and those seeking digestive health benefits. The U.S. and Canada lead this region’s market, supported by well-established dairy industries and widespread availability of probiotic products.

Europe remains a mature and stable market in probiotic dairy products, with steady revenue contributions supported by favorable regulatory frameworks for probiotic labeling and claims. Consumers across countries such as Germany, France, and the UK exhibit high acceptance and trust in probiotic dairy offerings, driven by strong awareness of health benefits. The market benefits from well-developed retail channels, consistent product innovation, and government health initiatives promoting balanced diets.

WORLDWIDE TOP KEY PLAYERS IN THE PROBIOTIC DAIRY PRODUCTS MARKET INCLUDE

- Danone S.A.

- Nestlé S.A.

- Yakult Honsha Co., Ltd.

- Lifeway Foods, Inc.

- Arla Foods amba

- Meiji Holdings Co., Ltd.

- Valio Ltd.

- Fonterra Co-operative Group Limited

- Gujarat Cooperative Milk Marketing Federation Ltd. (Amul)

- Chr. Hansen Holding A/S

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the probiotic dairy products market based on the below-mentioned segments:

Global Probiotic Dairy Products Market, By Product Type

- Yogurt

- Kefir

- Cheese

- Sour Cream

Global Probiotic Dairy Products Market, By Probiotic Strain

- Lactobacillus Acidophilus

- Bifidobacterium

- Streptococcus Thermophilus

- Lactobacillus Plantarum

- Lactobacillus Casei

Global Probiotic Dairy Products Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Probiotic Dairy Products Market in 2024?

A: The Global Probiotic Dairy Products Market size was estimated at USD 36.5 billion in 2024.

Q: What is the forecasted CAGR of the Global Probiotic Dairy Products Market from 2025 to 2035?

A: The market is expected to grow at a CAGR of approximately 9.82% during the forecast period 2025–2035.

Q: What is the projected market size of the Global Probiotic Dairy Products Market by 2035?

A: The market is projected to reach USD 102.3 billion by 2035.

Q: Which region holds the largest market share in the Global Probiotic Dairy Products Market?

A: Asia Pacific is expected to account for the largest share, holding approximately 39% of the global market revenue during the forecast period.

Q: Which region is expected to grow the fastest in the probiotic dairy products market?

A: North America is anticipated to register the fastest growth, driven by rising demand for functional and lactose-free probiotic dairy products.

Q: What product type dominates the probiotic dairy products market?

A: The yogurt segment dominated the market in 2024, accounting for approximately 52% of market revenue.

Q: Which probiotic strain holds the largest revenue share in the market?

A: Lactobacillus acidophilus accounted for the largest revenue share of approximately 34% during the forecast period.

Q: Who are the leading companies operating in the Global Probiotic Dairy Products Market?

A: Key players include Danone S.A., Nestlé S.A., Yakult Honsha Co., Ltd., Lifeway Foods, Inc., Arla Foods amba, Meiji Holdings Co., Ltd., Valio Ltd., Fonterra Co-operative Group Limited, Gujarat Cooperative Milk Marketing Federation Ltd. (Amul), and Chr. Hansen Holding A/S.

Q: What are the key growth drivers of the probiotic dairy products market?

A: Rising awareness of gut and immune health, increasing demand for functional foods, urbanization, improved retail infrastructure, and government health initiatives are major growth drivers.

Q: What challenges are limiting the growth of the probiotic dairy products market?

A: Challenges include cold chain requirements to maintain probiotic viability, regulatory compliance variations, high production costs, consumer skepticism, and competition from plant-based alternatives.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |