Global Protein Degradation Market

Global Protein Degradation Market Size, Share, and COVID-19 Impact Analysis, By Technology (Targeted Protein Degradation, Proteolysis Targeting Chimeras, and Ubiquitin-Proteasome System), By Distribution Channel (Direct Sales, Online Sales, and Third Party Distributors), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

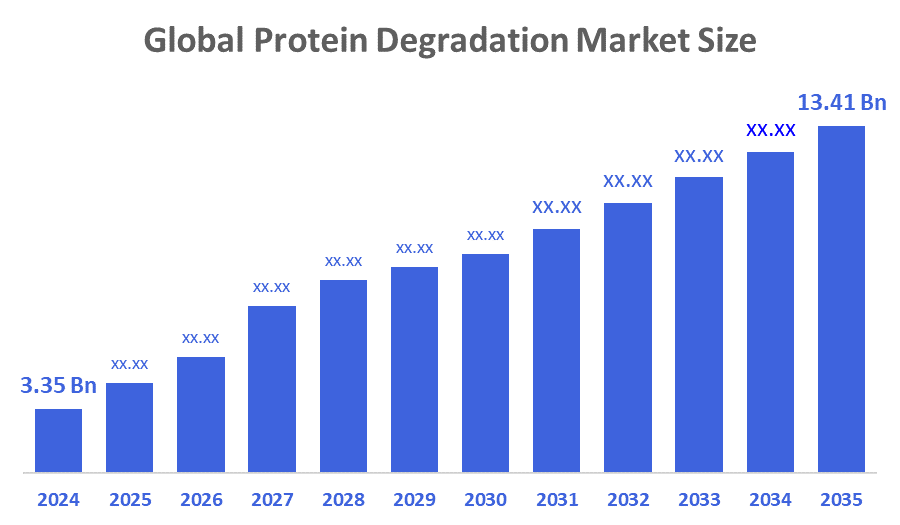

Global Protein Degradation Market Size Insights Forecasts to 2035

- The Global Protein Degradation Market Size Was Estimated at USD 3.35 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.44% from 2025 to 2035

- The Worldwide Protein Degradation Market Size is Expected to Reach USD 13.41 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Protein Degradation Market Size was worth around USD 3.35 Billion in 2024 and is predicted to Grow to around USD 13.41 Billion by 2035 with a compound annual growth rate (CAGR) of 13.44% from 2025 to 2035. In the protein degradation market, the use of AI in drug discovery is becoming a game-changer. Large datasets may be analysed by AI technology to find trends and forecast protein activity, which could speed up the creation of new treatments and improve current treatment plans.

Market Overview

The protein degradation industry is a growing biotechnology sector concerned with creating novel types of drugs that take advantage of the natural pathways in our bodies to eliminate proteins that cause disease. These include the proteasome and lysosome pathways, along with other pathways by which we degrade proteins. The protein degradation market consists of various technologies and includes PROTACs (proteolysis-targeting chimaeras), molecular glues, and other types of drugs that help us degrade targeted proteins. This allows us to create drugs for previously undeveloped or "undruggable" proteins. The growth of the protein degradation market has been fueled by the increase in demand for these types of drugs in several different therapeutic areas, including oncology, autoimmune disease, and neurodegenerative disease. The main advantage of using protein degradation as a therapeutic approach is the ability to reverse drug resistance, improve the specificity of therapy, and provide longer-lasting effects, along with precision medicine and the development of future therapeutic interventions.

Google and Johnson & Johnson’s venture arms have backed EpiBiologics, a protein degrader start-up, in a Series B round worth $107–109 million, announced in January 2026. EpiBiologics, a biotech startup founded by a professor of chemistry and biochemistry at UCSF, recently completed advancing the development of its protein-targeted drug candidates in clinical trials.

In a deal for up to $840 million, Amgen bought Dark Blue Therapeutics to $840 million for bolstering its oncology pipeline with a first-of-its-kind targeted protein degrader technology. It included targeting MLLT1/3 proteins to treat acute myeloid leukaemia (AML).

Report Coverage

This research report categorises the Protein Degradation market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Protein Degradation market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Protein Degradation market.

Driving Factors

The protein degradation market is rapidly changing and growing due to advances in biotechnology and the demand for more effective targeted therapies, with an increasing number of companies entering the marketplace as they develop new ways to utilise existing protein degradation mechanisms to serve a wide array of biological functions, as well as developing a deeper understanding. Research has already revealed the many complexities associated with protein interactions within the cell, which will continue to stimulate growth in this market and bring forth new investments from both pharmaceutical companies and research organisations. With the emergence of new technologies such as CRISPR and proteomics, the protein degradation market is evolving as researchers gain greater insight into how proteins are degraded and the effects that this biology has on the development of new therapeutic options for patients. The personalisation continues to emerge as a major trend; researchers and companies within the protein degradation market will continue to develop more specific solutions for their patient population, thus reshaping the healthcare system as a whole.

The article published by Natural Chemistry describes how a new targeted protein degradation strategy is breathing life into a long-standing immuno-oncology target. Instead of blocking proteins, scientists are now eliminating them by harnessing E3 ubiquitin ligases, which decide which proteins get destroyed inside cells.

Restraining Factors

High development costs, complicated regulatory procedures, and a lack of clinical validation of novel modalities present obstacles for the protein degradation sector. Furthermore, safety issues and production scalability limit wider deployment.

Market Segmentation

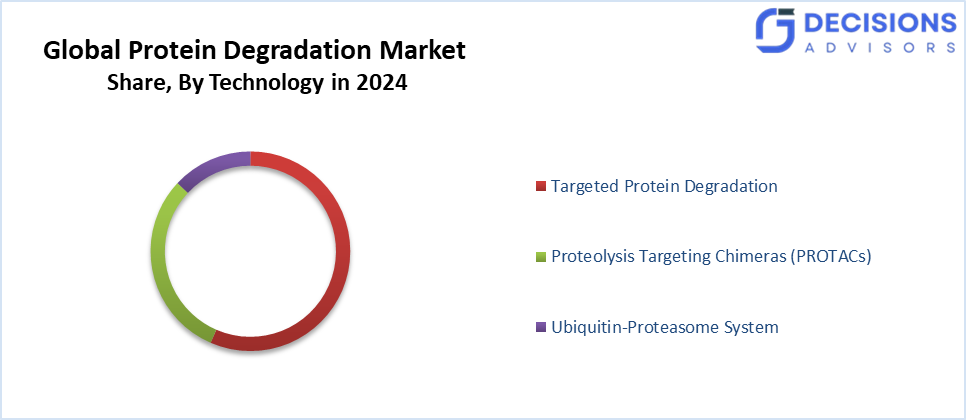

The protein degradation market share is classified into technology, and distribution channel.

- The targeted protein degradation segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the protein degradation market is segmented into targeted protein degradation, proteolysis targeting chimaeras, and ubiquitin-proteasome system. Among these, the targeted protein degradation segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to using cutting-edge methods like PROTAC technology to specifically remove proteins that cause sickness. This segment growth highlights the market expansion. In comparison to conventional medicines, this segment's strength is its capacity to offer more effective and focused treatments with possibly fewer side effects. This domain has a significant market presence because of its medicinal applications in a variety of disorders.

- The direct sales segment accounted for the highest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the protein degradation market is segmented into direct sales, online sales, and third party distributors. Among these, the direct sales segment accounted for the highest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because of enduring connections with important clients and the capacity to offer customised solutions that satisfy particular client requirements. Many companies that value in-person communication and direct involvement with suppliers continue to favour this conventional approach.

Regional Segment Analysis of the Protein Degradation Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the protein degradation market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the protein degradation market over the predicted timeframe. The main reason for the Asia Pacific region's leading position is its solid and quickly growing electronics manufacturing ecosystem. The regional market is growing due to robust healthcare costs, an increase in the number of chronic illnesses, and an increased emphasis on biopharmaceutical research in the regional landscape. The competitive environment is evolving, with startups and established businesses vying for market share. The region's position in the worldwide market is further strengthened by the presence of major businesses like Pfizer and Eli Lilly, which promote a thriving environment for protein degradation solutions.

China and India, for example, are making significant investments in biotechnology with the help of government programs meant to improve healthcare facilities and foster innovation in medication creation. With a rising biotech industry and an increasing number of partnerships between domestic businesses and international players, China is at the forefront.

North America is expected to grow at a rapid CAGR in the protein degradation market during the forecast period. The region boasts numerous advantages in terms of research and development. There are also substantial investments being made in biotechnology, and the whole system is well-regulated to encourage innovation. Market growth is being fueled by an increase in the number of people with chronic diseases and a growing demand for targeted therapies, along with government initiatives that are favourable for biopharmaceuticals. The major pharmaceutical companies' presence in the area significantly elevates the scope for collaboration, thus pushing the market growth further.

The United States is the main contributor, with key players like Thermo Fisher Scientific, Genentech, and Amgen at the forefront. The market competition globally is a blend of well-established companies and startups at the leading edge of a rapidly evolving innovation environment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the protein degradation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arvinas, Inc.

- Kymera Therapeutics

- Nurix Therapeutics

- C4 Therapeutics

- Molecular Templates

- Bristol Myers Squibb

- Roche Holding AG

- Pfizer Inc.

- Novartis AG

- Amgen Inc.

- Merck KGaA

- Thermo Fisher Scientific

- Sigma-Aldrich

- Boehringer Ingelheim

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, Ascentage Pharma announced that the U.S. FDA granted IND (Investigational New Drug) clearance for APG-3288, a novel BTK degrader. This means the company can now begin clinical trials in the U.S. to evaluate the drug’s safety and efficacy in patients.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the protein degradation market based on the below-mentioned segments:

Global Protein Degradation Market, By Technology

- Targeted Protein Degradation

- Proteolysis Targeting Chimaeras

- Ubiquitin-Proteasome System

Global Protein Degradation Market, By Distribution Channel

- Direct Sales

- Online Sales

- Third Party Distributors

Global Protein Degradation Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size and projected growth of the market?

The market was valued at USD 3.35 billion in 2024 and is expected to reach USD 13.41 billion by 2035, growing at a CAGR of 13.44% from 2025 to 2035.

- What are the main technologies in the protein degradation market?

Key segments include Targeted Protein Degradation, Proteolysis Targeting Chimaeras (PROTACs), and Ubiquitin-Proteasome System, with Targeted Protein Degradation leading in 2024.

- Which distribution channel holds the largest share?

Direct Sales dominated the market in 2024 and is projected to grow at a significant CAGR due to customised solutions and strong client relationships.

- Which region will have the largest market share?

Asia Pacific is expected to hold the largest share, driven by rising healthcare investments, chronic diseases, and biotech growth in countries like China and India.

- Which region is growing the fastest?

North America is anticipated to grow at the fastest CAGR, fueled by R&D investments, biotech firms like Amgen, and demand for targeted therapies.

- What drives the growth of this market?

Advances in biotech like PROTACs, AI in drug discovery, demand for treatments in oncology and neurodegenerative diseases, and investments from pharma giants.

- Who are the key players in the market?

Major companies include Arvinas, Kymera Therapeutics, Nurix Therapeutics, C4 Therapeutics, Bristol Myers Squibb, Pfizer, Novartis, and Amgen.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 287 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |