Global Psoriatic Arthritis Market

Global Psoriatic Arthritis Market Size, Share, and COVID-19 Impact Analysis, By Route of Administration (Oral, Parenteral, and Topical), By Drugs Class (Non-steroidal Anti-inflammatory Drugs (NSAIDS), Non-biologic Disease Modifying Anti-Rheumatic Drugs (DMARDs), Biologic Disease Modifying Anti-Rheumatic Drugs (DMARDs), and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025?2035

Report Overview

Table of Contents

Global Psoriatic Arthritis Market Insights Forecasts to 2035

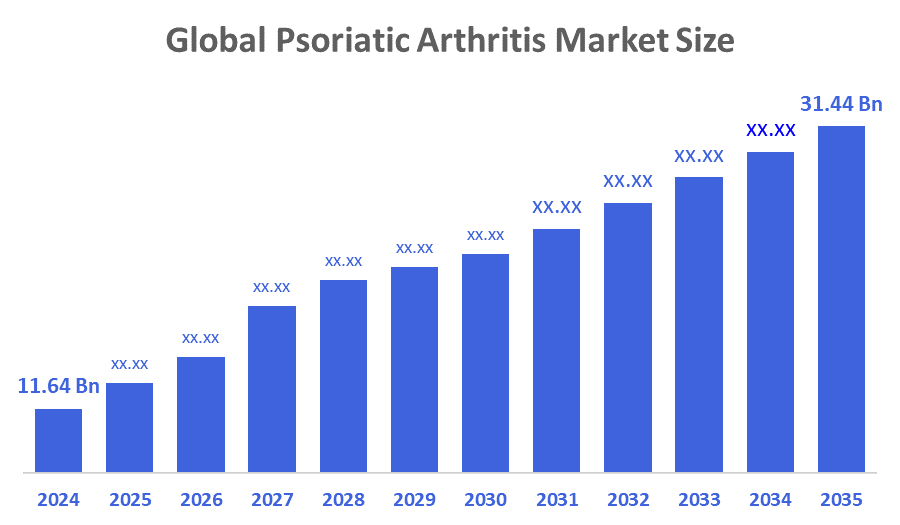

- The Global Psoriatic Arthritis Market Size Was Estimated at USD 11.64 billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.45% from 2025 to 2035

- The Worldwide Psoriatic Arthritis Market Size is Expected to Reach USD 31.44 billion by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Psoriatic Arthritis Market Size was Worth around USD 11.64 Billion in 2024 And is Predicted to Grow to around USD 31.44 Billion by 2035 With a Compound Annual Growth Rate (CAGR) of 9.45% from 2025 to 2035. Research and development (R&D) expenditures have increased, resulting in the creation of novel treatments and cutting-edge solutions. By addressing the various demands of psoriatic arthritis patients, these initiatives have also aided in the development of biological agents and precision medicine techniques, which are propelling the market's growth. Additionally, developments in customised medicine and biologic medications, as well as increased awareness of early diagnosis and treatment, are greatly boosting market growth.

Market Overview

The psoriatic arthritis market showcased a worldwide healthcare and pharmaceutical segment dedicated to the diagnosis, management, and treatment of psoriatic arthritis, a chronic autoimmune disease that combines joint inflammation with psoriasis. It encompasses drugs, biologics, devices, and distribution channels aimed at reducing symptoms, preventing structural damage, and improving patient quality of life. Psoriatic arthritis is an autoimmune disease in which inflammation is brought on by the immune system attacking the joints. Oral drugs that lessen inflammation and swelling, as well as biological therapies that target a particular immune system, are among the therapy options available. Treatment is based on the degree of stiffness, oedema, and pain. Important players are currently developing novel therapeutic approaches that help stop the condition from becoming worse, lessen discomfort, safeguard joints, and maintain range of motion. These techniques can be used in conjunction with physical therapy to improve general stability and strengthen joints and muscles. Psoriasis and psoriatic arthritis are related chronic degenerative conditions. This is especially true as psoriatic arthritis occurs most often between the ages of 30 and 50; the increase in the adult population worldwide is also driving the growth of this market.

York University launched Canada’s first dedicated psoriatic arthritis research hub, the Psoriatic Arthritis Collaborative and Applied Research Excellence (PsA CARE) Hub, owing to a transformational gift from the Krembil Foundation. Krembil Foundation's nearly $4 million donation, including slightly more than $1.5 million for the "Targeting TRAF1 in Psoriatic Arthritis" program, will enable the Hub to not only further advance the knowledge base around psoriatic arthritis but also provide the mentoring opportunities, modern scientific tools and tools that support. This initiative will advance fundamental science, mechanistic understanding, and new treatment strategies for psoriatic arthritis.

Report Coverage

This research report categorises the psoriatic arthritis market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the psoriatic arthritis market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the psoriatic arthritis market.

Driving Factors

The psoriasis industry has an increased risk of developing arthritis. Also, the continued rise in the number of cases of psoriasis, which can develop from a variety of factors such as stress, obesity, skin injuries, alcohol use, and vitamin deficiency, is expected to positively impact the growth of the psoriasis arthritis treatment market. In addition, children with this condition have an increased chance of developing UVEITIS (inflammation of the middle tissue layer of the eye wall), and due to increasing concerns from parents about their child's health, there will likely be an increase in the use of psoriatic arthritis treatments across the globe. Furthermore, with more customers recognising the benefits of early diagnosis and treatment of psoriatic arthritis (to prevent severe damage), the demand for psoriatic arthritis treatments will continue to rise. Further, an increase in disposable income, improvements in healthcare facilities, and further increases in health awareness among the general public.

For instance, the once-daily oral medication Sotyktu (deucravacitinib) was initially authorised in September 2022 for the treatment of psoriasis. It is a member of the class of drugs known as tyrosine kinase 2 (TYK2) inhibitors. By inhibiting a protein known as TYK2, these drugs reduce inflammation.

Restraining Factors

However, the upcoming goods limit their usage via the penetration of these technologies in developing markets with sizable targeted populations, which is threatened by economically weak regions with little healthcare spending and a bad reimbursement scenario. Furthermore, the industry is confronted with some of the most significant obstacles, including the high cost of biologic medicines, which makes them costly in developing nations, along with delays in diagnosis, gaps in clinical management, and disagreements regarding treatment outcomes.

Market Segmentation

The psoriatic arthritis market share is classified into route of administration and drug class.

- The oral segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

Based on the route of administration, the psoriatic arthritis market is differentiated into oral, parenteral, and topical. Among these, the oral segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is because of their outstanding efficacy profiles, cost-effectiveness, and convenience of administration; the oral segment is growing. Oral drugs provide a high level of patient convenience and adherence, particularly for those looking for less intrusive long-term treatment regimens, and their positive safety results from recent clinical trials are making them more appealing.

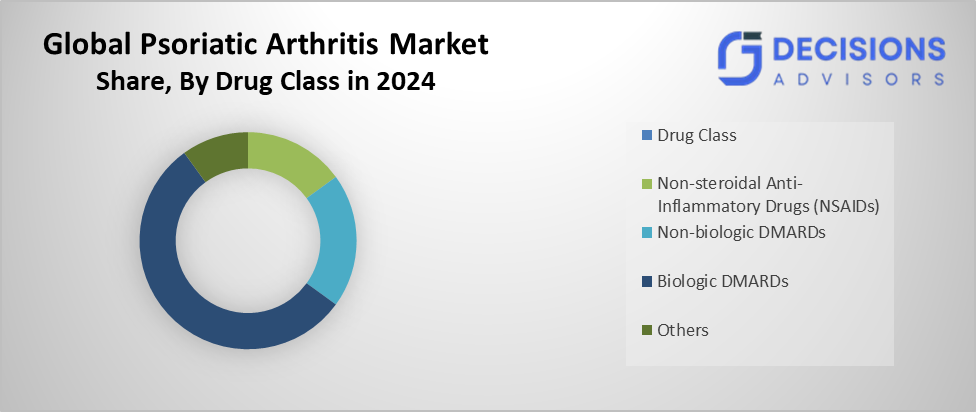

- The biologic disease-modifying anti-rheumatic drugs (DMARDs) segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the drug class, the psoriatic arthritis market is segmented into non-steroidal anti-inflammatory drugs (NSAIDs), non-biologic disease-modifying anti-rheumatic drugs (DMARDs), biologic disease-modifying anti-rheumatic drugs (DMARDs), and others. Among these, the biologic disease-modifying anti-rheumatic drugs (DMARDs) segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Research-driven knowledge of the pathophysiology of psoriatic arthritis is driving the development of new treatments in the market. The market for psoriatic arthritis treatments is growing as a result of stimulating new ideas among industry participants. In the psoriatic arthritis market, targeted biological therapy is still in demand due to its reasonable success rate in reducing temporary pain.

Regional Segment Analysis of the Psoriatic Arthritis Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the psoriatic arthritis market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the psoriatic arthritis market over the predicted timeframe. The rising incidence of psoriatic arthritis in the region may be attributed to several factors, including evolving lifestyles, improved awareness of the condition, and advances in diagnostic techniques. Collectively, the countries within the region are making significant investments in their healthcare systems, including the construction of new facilities and access to innovative therapies.

As countries such as China, India, and Japan continue to experience economic growth, the cost of healthcare has increased, leading to increased affordability of treatments for many patients with psoriatic arthritis and other conditions. Furthermore, the demand for effective therapies has increased due to this increased awareness, combined with earlier diagnosis and treatment.

North America is expected to grow at a rapid CAGR in the psoriatic arthritis market during the forecast period. The North American market for treating psoriatic arthritis is likely to see a steady growth pattern as new treatments are introduced to this chronic disease through the approval process by the regulatory agencies. In addition to an increase in the number of available treatment options, the number of psoriatic arthritis cases continues to increase, with an increase in the incidence of rheumatoid arthritis. Furthermore, there has been an increase in the number of manufacturers producing biologics and biosimilars for the treatment of psoriatic arthritis.

Arthritis Society Canada has announced a major investment of more than CAD $3.5 million over three years to support 13 new research projects across the country. These projects, funded through Strategic Operating Grants, Stars Career Development Awards, and Ignite Innovation Grants, aim to advance prevention, detection, diagnosis, treatment, and patient support for arthritis.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the psoriatic arthritis market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AbbVie Inc.

- Amgen Inc.

- Johnson & Johnson Services, Inc.

- Bristol-Myers Squibb Company

- Novartis AG

- Eli Lilly and Company

- Pfizer, Inc.

- Samsung Biologics

- UCB S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, Eli Lilly’s weight-loss drug Zepbound (tirzepatide), when combined with its immunology therapy Taltz (ixekizumab), significantly reduced psoriatic arthritis symptoms in obese patients compared to Taltz alone. This late-stage Phase 3b trial (TOGETHER-PsA) highlights how treating obesity can directly improve autoimmune joint disease outcomes.

- In November 2025, Johnson & Johnson’s TREMFYA (guselkumab) released new long-term Phase 3b APEX trial data showing it is the only IL-23 inhibitor proven to substantially inhibit structural joint damage in patients with active psoriatic arthritis, with benefits sustained through 48 weeks.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the psoriatic arthritis market based on the below-mentioned segments:

Global Psoriatic Arthritis Market, By Route of Administration

- Oral

- Parenteral

- Topical

Global Psoriatic Arthritis Market, By Drug Class

- Non-steroidal Anti-inflammatory Drugs (NSAIDS)

- Non-biologic Disease Modifying Anti-Rheumatic Drugs (DMARDs)

- Biologic Disease Modifying Anti-Rheumatic Drugs (DMARDs)

- Others

Global Psoriatic Arthritis Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global psoriatic arthritis market?

The market was valued at USD 11.64 billion in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 31.44 billion by 2035.

- What is the forecasted CAGR for 2025-2035?

The market is projected to grow at a CAGR of 9.45%.

- Which route of administration leads the market?

The oral segment held the largest market share in 2024 and is expected to grow at a substantial CAGR.

- Which drug class dominates revenue?

Biologic DMARDs accounted for the highest revenue in 2024 and are anticipated to expand significantly.

- Which region will have the largest market share?

Asia-Pacific is expected to hold the largest share, driven by rising incidence and healthcare investments in China, India, and Japan.

- Which region is expected to grow fastest?

North America is projected to grow at the fastest CAGR, supported by new biologics approvals and increasing cases.

- What are recent key developments?

Eli Lilly's January 2026 Phase 3b trial showed Zepbound plus Taltz reduced symptoms in obese PsA patients; J&J's TREMFYA demonstrated sustained joint protection in November 2025 data.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |