Global Pullulan Market

Global Pullulan Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Form (Powder and Liquid), By Application (Food & Beverages, Pharmaceuticals, and Cosmetics), and By Region (Asia Pacific, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Pullulan Market Summary, Size & Emerging Trends

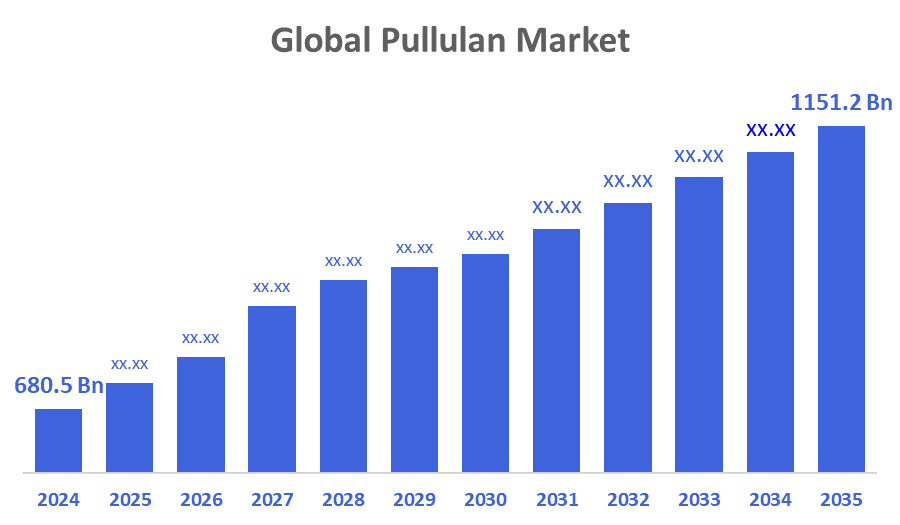

According to Decisions Advisors, The Global Pullulan Market Size is expected to Grow from USD 680.5 Million in 2024 to USD 1151.2 Million by 2035, at a CAGR of 4.9% during the forecast period 2025-2035. Increasing demand for natural and biodegradable food additives and pharmaceutical excipients is a key driver for the pullulan market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the pullulan market during the forecast period.

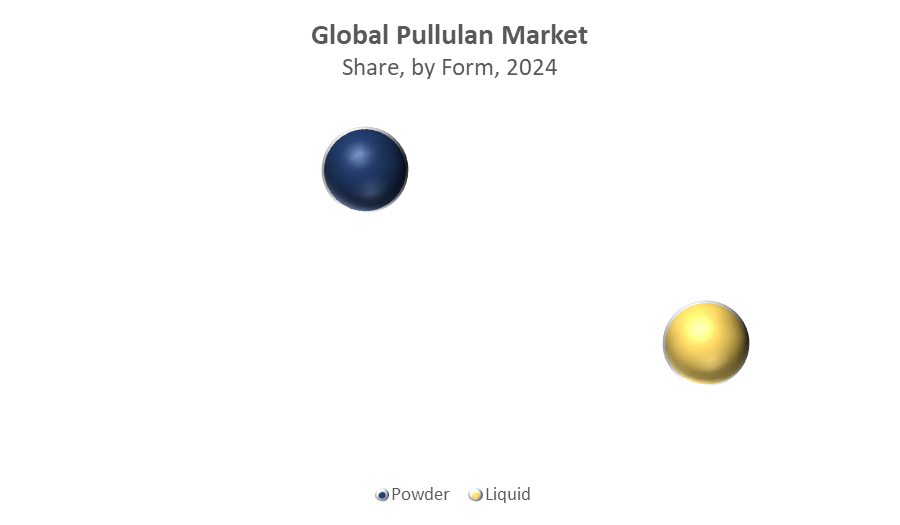

- In terms of form, the powder segment dominated in terms of revenue during the forecast period.

- In terms of application, the food & beverages segment accounted for the largest revenue share in the global pullulan market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 680.5 Million

- 2035 Projected Market Size: USD 1151.2 Million

- CAGR (2025-2035): 4.9%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Pullulan Market

The pullulan market centers on the production and use of a natural, water-soluble polysaccharide derived from the fungus Aureobasidium pullulans. Known for its excellent film-forming, thickening, and stabilizing properties, pullulan is widely used in the food, pharmaceutical, and cosmetics industries. It is especially valued for making edible films, oral capsules, and biodegradable packaging due to its non-toxic and biodegradable nature. Rising consumer demand for clean-label and natural ingredients is fueling its adoption across various sectors. In pharmaceuticals, pullulan is gaining traction for use in drug delivery systems, while cosmetics companies use it for its smooth texture and stability. Market growth is further supported by regulatory approval for food-grade use and increasing investments in sustainable biotechnologies. These factors position pullulan as a key ingredient in the global shift toward eco-friendly products.

Pullulan Market Trends

- Rising consumer demand for natural, biodegradable packaging and edible films is driving pullulan adoption.

- Advances in biotechnology enable enhanced pullulan production with better purity and functional properties.

- Companies are exploring new application areas such as pharmaceuticals and cosmetics to diversify product portfolios.

Pullulan Market Dynamics

Driving Factors: Growing preference for natural food additives and eco-friendly packaging

Key growth factors include increasing demand for natural polysaccharides in food and pharmaceutical industries, where pullulan serves as a preferred film-former and stabilizer. Rising health consciousness and regulatory encouragement for biodegradable materials boost market expansion. Increasing application in pharmaceuticals as a capsule-forming agent and drug delivery system further drives growth. The expanding cosmetic sector also creates new opportunities for pullulan use in skin-care and hair-care products.

Restrain Factors: High production cost and competition from synthetic polymers

Challenges include relatively high production costs compared to synthetic alternatives, limiting widespread adoption. Availability of cheaper substitutes and regulatory hurdles in some regions may restrict market growth. Variability in raw material supply and fermentation efficiency can impact production scalability. Lack of awareness in emerging markets and slow adoption in certain applications also act as restraints.

Opportunity: Innovations in fermentation technology and expanding applications

Emerging technological advancements in fermentation and strain improvement enable cost-effective and scalable pullulan production. Increasing demand for biodegradable packaging solutions and edible films presents significant growth opportunities. Expansion into pharmaceutical excipients and cosmetic formulations offer promising avenues. Growing investments in biotechnology and sustainability initiatives support long-term market potential.

Challenges: Regulatory complexities and supply chain limitations

Stringent regulatory approvals for food and pharmaceutical applications can delay product launches and increase costs. Supply chain disruptions affecting raw material availability and fermentation inputs pose risks to continuous production. Competition from synthetic polymers and changing consumer preferences require ongoing innovation and marketing efforts. Managing production costs while ensuring consistent quality remains a key challenge.

Global Pullulan Market Ecosystem Analysis

The global pullulan market ecosystem comprises raw material suppliers (mainly glucose and starch producers), fermentation technology providers, manufacturers such as Hayashibara Co. Ltd. and Nagase & Co. Ltd., and end-users in food, pharmaceutical, and cosmetic industries. Regulatory agencies oversee product approvals, ensuring safety and compliance. The balance between technological innovation, sustainable raw material sourcing, and expanding applications will drive market growth and competitive dynamics.

Global Pullulan Market, By Form

What factors enabled the powder form of pullulan to lead the market in 2024?

The powder form of pullulan led the global market in 2024, capturing approximately 68% of the revenue share, primarily due to its versatility, ease of handling, and wide range of industrial applications. Its superior solubility, stability, and film-forming properties made it the preferred choice for use in food, pharmaceuticals, and cosmetics. Unlike liquid or other forms, powdered pullulan offers longer shelf life, easier transportation, and greater flexibility in formulation, which significantly reduced logistical and manufacturing costs for end-users. Additionally, the growing demand for natural and clean-label ingredients in health-conscious markets further amplified its adoption.

Why is the liquid form of pullulan gaining traction in the global market in 2024?

The liquid form of pullulan currently holds a smaller market share at around 32%, it is rapidly gaining momentum due to its enhanced usability in specific industrial applications. Its fluid consistency makes it ideal for use in coatings, syrups, and cosmetic formulations where immediate solubility and ease of integration into aqueous systems are crucial. The liquid form also reduces the need for additional processing steps, making it attractive for manufacturers seeking efficiency and cost-effectiveness. Moreover, the growing demand for innovative delivery systems in pharmaceuticals and the rise of functional beverages are opening new opportunities for liquid pullulan.

Global Pullulan Market, By Application

How did the food & beverages segment gain a competitive edge in the pullulan market in 2024?

The food & beverages segment dominated the global pullulan market in 2024, contributing approximately 60% of the total revenue share. This leadership was driven by pullulan’s unique functional properties, such as its excellent film-forming ability, non-toxicity, and natural origin, which make it highly suitable for edible films, coatings, and packaging solutions. The increasing consumer demand for clean-label, biodegradable, and health-friendly food products has significantly boosted pullulan’s adoption in this sector. Additionally, pullulan’s capacity to extend shelf life and improve the texture and appearance of food products has made it a preferred ingredient among manufacturers. The growing trend toward sustainable packaging and innovative food preservation techniques further strengthened the segment’s position, enabling it to outperform other industries in pullulan consumption during the forecast period.

What made the pharmaceutical segment a key contributor to pullulan revenue in 2024?

The pharmaceutical segment accounted for a significant revenue share of about 30% in the global pullulan market in 2024, driven by pullulan’s exceptional biocompatibility, biodegradability, and film-forming properties. These characteristics make pullulan an ideal material for developing controlled-release drug delivery systems, capsules, and oral films, which are increasingly preferred for their safety and efficiency. Additionally, the rise in demand for innovative pharmaceutical formulations and patient-friendly dosage forms has accelerated pullulan’s adoption in this sector. The segment’s focus on natural and non-toxic excipients aligns well with regulatory trends, further enhancing pullulan’s market penetration. Collectively, these factors have enabled the pharmaceutical segment to secure a strong and growing position in the pullulan market.

Asia Pacific is expected to dominate the pullulan market, accounting for about 40% of the global market revenue during the forecast period.

This leadership is driven by rapid industrialization, rising health awareness, and expanding food and pharmaceutical sectors in key countries like China, Japan, and India. The region’s large consumer base increasingly prefers natural and sustainable ingredients, fueling pullulan demand for edible films, stabilizers, and drug delivery applications. Additionally, government support and investments in biotechnology further accelerate market growth in this region.

India is one of the fastest-growing markets within Asia Pacific, with a projected CAGR of around 10%.

This growth is supported by significant investments in biotechnology research, a rising number of health-conscious consumers, and the rapid expansion of pharmaceutical manufacturing facilities. The country’s emphasis on “Make in India” and infrastructure development also contributes to increased pullulan adoption in various industries.

North America is expected to register the fastest CAGR in the global pullulan market.

This growth stems from increasing consumer demand for clean-label and natural food products, innovations in pharmaceutical formulations using pullulan, and growing investments in the cosmetics sector. The presence of advanced research facilities and favorable regulatory policies also supports market expansion in the U.S. and Canada.

WORLDWIDE TOP KEY PLAYERS IN THE PULLULAN MARKET INCLUDE

- Hayashibara Co., Ltd.

- Mitsubishi Chemical Corporation

- KitoZyme

- Qingdao Vland Biotech Group

- Shanxi Pioneer Biotech

- Jungbunzlauer Suisse AG

- Ashland Global Holdings Inc.

- CP Kelco

- ADM (Archer Daniels Midland Company)

- Shandong Bailong Chuangyuan Biological Technology Co., Ltd.

- Others

Product launches in Pullulan Market

- In March 2023, WaterSolu launched a high-purity pullulan product featuring over 90% polysaccharide content. This product offers instant water solubility and a long shelf life of 60 months, making it ideal for clean-label applications in food, nutraceuticals, and pharmaceuticals. Its film-forming and stabilizing properties have made it popular for edible films, capsules, and packaging.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the pullulan market based on the below-mentioned segments:

Global Pullulan Market, By Form

- Powder

- Liquid

Global Pullulan Market, By Application

- Food & Beverages

- Pharmaceuticals

- Cosmetics

Global Pullulan Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 164 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |