Global Rail Logistics Market

Global Rail Logistics Market Size, Share, and COVID-19 Impact Analysis, By Service (Transportation Services, Warehousing and Distribution Services, Freight Forwarding Services, Inventory Management Services, Value-Added Logistics Services, Integration & Consulting Services), By Cargo Type (Bulk, Containerized, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Rail Logistics Market Summary

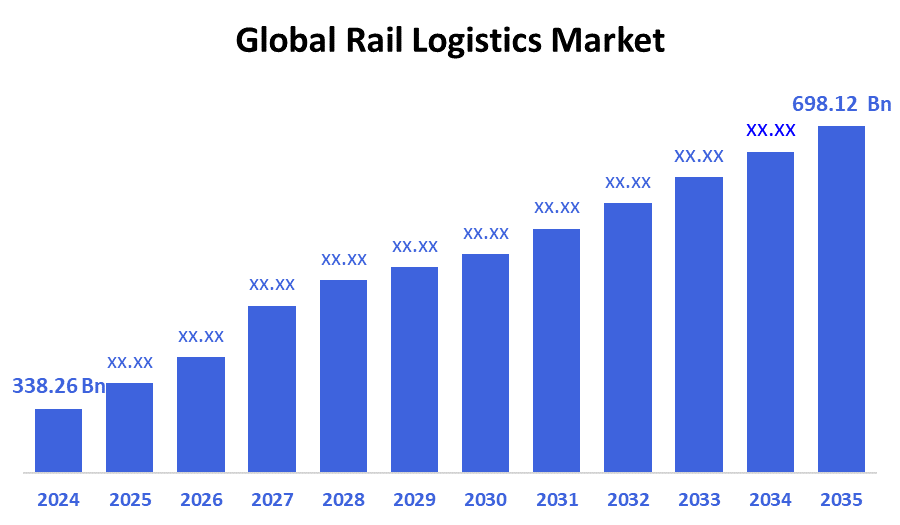

The Global Rail Logistics Market Size Was Estimated at USD 338.26 Billion in 2024 and is Projected to Reach USD 698.12 Billion by 2035, Growing at a CAGR of 6.81% from 2025 to 2035. The market for rail logistics is expanding due to several factors, including government measures supporting rail over road for bulk and long-distance goods, infrastructure development, increased freight demand, and cost-effective transportation.

Key Regional and Segment-Wise Insights

- With a revenue share of 42.82% in 2024, the Asia Pacific region dominated the worldwide rail logistics market.

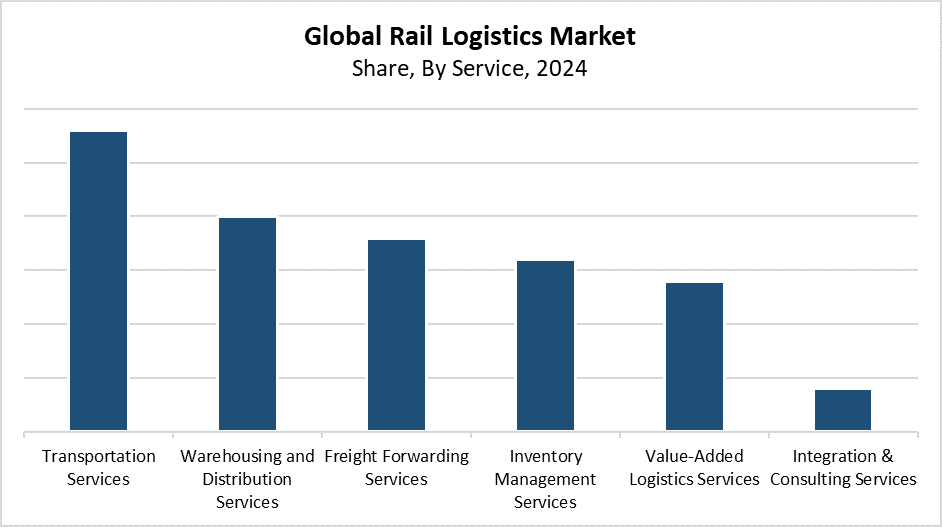

- In 2024, the transportation services segment held the largest revenue share, accounting for 28.3% and dominated the market based on services.

- In 2024, the bulk segment had the biggest market share based on the cargo type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 338.26 Billion

- 2035 Projected Market Size: USD 698.12 Billion

- CAGR (2025-2035): 6.81%

- Asia Pacific: Largest market in 2024

The rail logistics market describes the transportation of commodities and goods because rail networks operate as affordable, reliable, and green transportation methods for long-distance freight movement. This market plays a crucial role in supporting supply chain management and promoting trade and industrial development. The leading drivers include rising fuel prices, which make rail transportation cheaper than road transportation, as well as the necessity for efficient large-scale logistics systems, together with the expanding bulk cargo transport requirements. The demand for integrated rail logistics services has expanded since cross-border transportation, e-commerce, and international trade started to grow. The sector achieves financial benefits through expanding rail infrastructure alongside the rising popularity of multimodal transportation systems that optimize logistics operations.

The rail logistics industry undergoes a revolution through technological innovations, which enhance connections and safety and improve efficiency. Real-time tracking systems, together with automated rail yard operations and AI-powered logistics platforms, enable better efficiency in both route planning and cargo management. Various governments around the world establish regulations and financial support to advance rail infrastructure development and back sustainable freight transportation methods. The transition to rail logistics as a sustainable future transportation mode benefits from public-private partnerships, smart rail system integration, and subsidies for rail freight operators.

Service Insights

The transportation services segment led the rail logistics market with a 28.3% market share in 2024. The main driver of this market leadership exists in the increased requirement for cost-effective and efficient mass freight transportation systems. The dependable option for transporting bulk commodities such as coal, minerals, agricultural products, and industrial goods over long distances is rail transportation. The segment benefits from the expanding rail network infrastructure and the transfer of transportation from roads to rails because of rising fuel prices, along with expanding international trade activity. The logistics sector depends substantially on transportation services, which enable essential commodity movement between different business operations. The rising complexity of supply chains continues to expand this segment because businesses need dependable rail transportation services.

During the forecast period, the rail logistics market's warehousing and distribution services segment will experience a significant CAGR. The increasing requirement for integrated logistics solutions, including storage capabilities, inventory management, and last-mile delivery service, together with transportation functions, drives market expansion. The complexity of supply chains, along with their time-sensitive nature, pushes businesses to seek complete services that lower expenses and simplify their operations. Rail-linked warehousing facilities are gaining more popularity because they enable rapid movement of large commodity volumes. The segment's development gets support from e-commerce expansion, as well as just-in-time inventory management models and border-crossing trade patterns, which drive demand for distribution centers connected to vital rail networks.

Cargo Type Insights

The bulk segment dominated the rail logistics market with the largest revenue share in 2024. This sector maintains its lead due to the substantial need for transporting large quantities of uncontainerized products, including coal, minerals, cereals, chemicals, and building materials. The ability of rail to deliver large volumes efficiently at a low cost makes it the best choice for moving bulk items. The rail system functions as a vital component for delivering unprocessed materials efficiently and cost-effectively to processing facilities and ports, and final destinations within the mining and agricultural sectors and the energy sector. The market leadership of this segment gains additional strength through rail's environmentally friendly benefits when compared to road transportation of bulk products.

The containerized segment of the rail logistics market is anticipated to experience a substantial CAGR during the forecast period. The rising need for intermodal transportation, which moves containers easily between railroad and sea, leads to better efficiency and shorter handling times, driving this growth. Containerized rail logistics delivers enhanced tracking capabilities together with reduced damage risk and better cargo protection, which makes it suitable for sectors such as consumer products, electronics, retail, and automotive. Containerized freight transportation experiences growth because of increasing e-commerce activities as well as expanding worldwide trade and supply chain optimization efforts. The segment will experience robust growth because of investments made in modern container terminals and dedicated freight corridors.

Regional Insights

The North American rail logistics market is expected to grow at a substantial CAGR during the forecast period because of increasing requirements for cost-effective freight solutions over extended distances. The existing rail network structure, combined with rising fuel costs and increased roadway traffic, is driving people to select rail logistics options. The transportation of bulk and containerized goods through railways experiences strong demand because the manufacturing and energy sectors, together with agricultural industries, grow rapidly. Technological progress in automation systems, along with real-time tracking systems, enhances both operational efficiency and service reliability. The future growth of the market will rely on government initiatives that focus on developing rail infrastructure and strengthening intermodal transportation connections.

Europe Rail Logistics Market Trends

The European rail logistics market is growing significantly through increasing needs for efficient and eco-friendly transportation solutions. Environmental concerns, together with EU carbon emission reduction regulations, support rail transportation as an alternative to driving. Government support plays a vital role in the sector because the EU Green Deal and Shift2Rail programs and cross-border train infrastructure investments illustrate it. The region's logistics performance improves through additional rail freight corridors and improved intermodal connections, as well as increased trade levels. Modern technology, such as smart rail networks and digital freight platforms, enhances operational efficiency. Europe stands as a vital expansion zone for the worldwide rail logistics business because all these factors collectively promote its development.

Asia Pacific Rail Logistics Market Trends

The Asia Pacific rail logistics industry dominated globally with the highest revenue share of 42.82% during 2024. Rapid urbanization and industrialization, together with increasing trade activities between China, India, Japan, and Australia serve as the primary forces behind this market leadership. The growing manufacturing and agricultural sectors within the region mainly depend on rail logistics for transporting bulk commodities, along with containerized goods. The market growth benefits greatly from substantial investments into building new rail infrastructure that includes both high-speed rail systems and specialized freight tracks. The region's competitive advantage continues to grow because governments dedicate more attention to developing modern rail infrastructure and sustainable mobility solutions. The strong growth of the Asia Pacific rail logistics market receives support from increasing e-commerce operations and growing requirements for multimodal logistics delivery systems.

Key Rail Logistics Companies:

The following are the leading companies in the rail logistics market. These companies collectively hold the largest market share and dictate industry trends.

- US Rail & Logistics

- Canadian National Railway

- BNSF Railway

- CSX Transportation

- PLS Logistic Services

- CEVA Logistics

- DHL

- Rhenus Group

- Union Pacific

- Rail Logistics, Inc.

- Others

Recent Developments

- In September 2024, leading logistics solutions provider Noatum Logistics, a division of AD Ports Group, announced the opening of its rail logistics service in the Middle East. Each weekly departure from this service can carry up to 78 Forty-Foot Equivalent Units or 156 Twenty-Foot Equivalent Units in either direction on a single train. Depending on customer need, first- and last-mile trucking solutions can be added to the service to guarantee smooth end-to-end connectivity.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the rail logistics market based on the below-mentioned segments:

Global Rail Logistics Market, By Service

- Transportation Services

- Warehousing and Distribution Services

- Freight Forwarding Services

- Inventory Management Services

- Value-Added Logistics Services

- Integration & Consulting Services

Global Rail Logistics Market, By Cargo Type

- Bulk

- Containerized

- Others

Global Rail Logistics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |