Global Ready-to-Eat Soup Market

Global Ready-to-Eat Soup Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (Creamy Soups, Broth-based Soups, Chunky Soups, and Clear Soups), By Packaging Type (Cans, Pouches, Cups, and Bowls), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Ready-to-Eat Soup Market Summary, Size & Emerging Trends

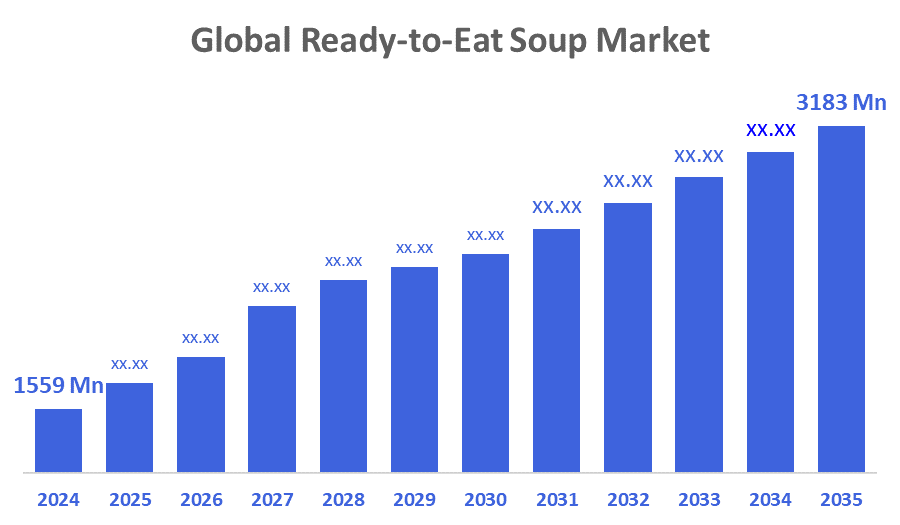

According to Decisions Advisors, The Global Ready-to-Eat Soup Market Size is expected to Grow from USD 1559 Million in 2024 to USD 3183 Million by 2035, at a CAGR of 6.7% during the forecast period 2025-2035. Increasing urbanization, changing consumer lifestyles favoring convenience foods, and growing health consciousness are key drivers boosting the demand for ready-to-eat soups globally.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the ready-to-eat soup market during the forecast period.

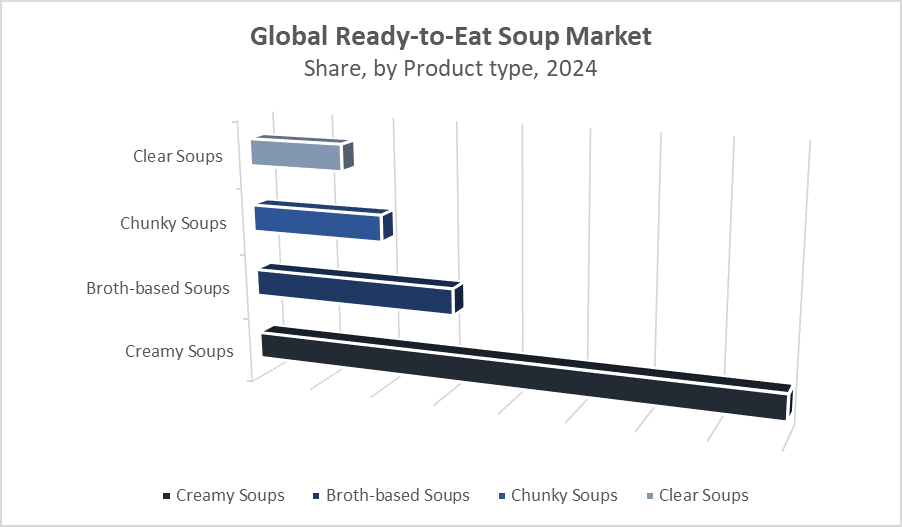

- In terms of product type, creamy soups dominate revenue generation due to their popularity and variety.

- Among packaging types, pouches are projected to witness the highest growth rate driven by convenience and portability.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1559 Million

- 2035 Projected Market Size: USD 3183 Million

- CAGR (2025-2035): 6.7%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Ready-to-Eat Soup Market

The ready-to-eat soup market centers on convenient, pre-packaged soups designed for quick and easy meal solutions, ideal for busy consumers. These soups come in various types, including creamy, broth-based, and chunky, often enriched with vitamins and minerals to meet nutritional needs. The market growth is fueled by rising urbanization and fast-paced lifestyles, driving demand for healthy, tasty, and convenient food options. Manufacturers are responding by developing products with natural ingredients, clean-label certifications, and eco-friendly packaging to attract health-conscious and environmentally aware buyers. Additionally, government programs that promote nutritional education and ensure food safety further bolster market expansion. Overall, the ready-to-eat soup market is evolving to satisfy modern consumer preferences for convenience, wellness, and sustainability.

Ready-to-Eat Soup Market Trends

- Growing demand for organic and plant-based ready-to-eat soups as consumers seek healthier and sustainable food options.

- Innovative packaging solutions like recyclable and microwave-safe pouches enhancing consumer convenience.

- Expansion of flavor profiles with global and ethnic recipes catering to diverse consumer tastes.

Ready-to-Eat Soup Market Dynamics

Driving Factors: Convenience, health consciousness, and busy lifestyles

The ready-to-eat soup market benefits from consumers’ increasing demand for convenient, nutritious food. Busy lifestyles and urbanization drive the need for quick meal options, making ready-to-eat soups popular. Additionally, health-conscious consumers prefer low-calorie, low-fat, and immune-boosting soups, especially following the COVID-19 pandemic. The market is also fueled by a rising working population seeking on-the-go meals without compromising health. This combination of convenience and wellness is a strong growth driver, encouraging manufacturers to develop healthier, easily accessible soup varieties that cater to modern consumers’ fast-paced lives.

Restrain Factors: Competition from fresh and homemade soups

The ready-to-eat soup market faces stiff competition from fresh and homemade soups, which many consumers perceive as tastier and healthier. Fresh soups often appeal to those prioritizing natural ingredients and customized flavors. Supply chain disruptions can lead to inconsistent raw material availability and increased production costs, negatively impacting profitability. Additionally, environmental concerns over packaging waste add pressure on manufacturers to adopt sustainable materials and practices. These factors collectively challenge market growth, requiring companies to innovate and improve both product quality and environmental responsibility to stay competitive.

Opportunity: Expansion in emerging markets and product innovation

Emerging markets offer significant growth potential due to rising disposable incomes and evolving lifestyles. Consumers in these regions are increasingly open to convenient meal options, creating a fertile ground for ready-to-eat soups. Product innovation, such as plant-based, organic, and fortified soups, attracts health-conscious and niche consumer segments. Moreover, expanding e-commerce and retail networks improve accessibility, enabling quicker market penetration. Companies that adapt products to local tastes and invest in innovative packaging and marketing strategies stand to benefit substantially from these emerging opportunities, broadening their consumer base globally.

Challenges: Regulatory compliance and shelf-life limitations

Manufacturers face challenges in meeting stringent food safety regulations to ensure ready-to-eat soups are safe and of high quality. Balancing preservative use with consumer demand for natural, clean-label ingredients complicates product formulation. Additionally, maintaining adequate shelf-life without compromising taste or nutrition requires advanced preservation techniques and reliable packaging. Transport and storage conditions further affect product stability, demanding robust supply chain management. These regulatory and technical hurdles require continuous innovation and investment to deliver safe, fresh-tasting soups that meet consumer expectations and comply with global food standards.

Global Ready-to-Eat Soup Market Ecosystem Analysis

The global ready-to-eat soup market ecosystem comprises raw material suppliers providing vegetables, grains, and spices, food manufacturers specializing in processing and packaging, distributors, and retailers such as supermarkets and online platforms. Key industry players focus on research and development to create innovative flavors and sustainable packaging that meet consumer demands. Regulatory agencies play a crucial role by enforcing strict food safety standards to ensure product quality and protect consumer health. Collaboration among suppliers, manufacturers, and distributors promotes innovation, enhances supply chain efficiency, and helps bring diverse, convenient, and safe ready-to-eat soup products to the global market.

Global Ready-to-Eat Soup Market, By Product Type

What key advantages helped the creamy soups segment outperform other categories in 2024?

The creamy soups segment dominated the ready-to-eat soup market in 2024, driven by rising consumer preference for rich, indulgent flavors and comfort foods. Creamy soups are perceived as more filling and satisfying, aligning well with consumer demand for convenient yet hearty meal options. Their thicker texture and premium positioning appeal to both traditional tastes and evolving palates seeking gourmet-style experiences at home. Moreover, manufacturers have expanded the range of creamy soup flavors, incorporating health-conscious ingredients like plant-based creamers, fortified nutrients, and low-sodium options, which broadened their appeal across demographics. The segment also benefited from effective marketing and attractive packaging, reinforcing its premium image. These factors collectively helped creamy soups outperform other varieties, securing a leading share in the RTE soup market during the forecast period.

How did the broth-based segment sustain its market share in the ready-to-eat soup industry in 2024?

Broth-based soups held around 30% of the ready-to-eat soup market in 2024, supported by their strong appeal among health-conscious and calorie-aware consumers. These soups are perceived as lighter, more hydrating, and often lower in fat and calories compared to creamy varieties, making them a preferred option for those seeking balanced nutrition without compromising on taste. Their versatility, ranging from chicken and beef broths to vegetable-infused blends, also contributed to their steady demand across a wide consumer base. Additionally, the rising popularity of clean-label and low-sodium products has further elevated the appeal of broth-based soups, as many offerings align with dietary and wellness trends. With a reputation for being both comforting and nutritious, broth-based soups have successfully maintained a solid market share amid growing competition in the RTE soup category.

Global Ready-to-Eat Soup Market, By Packaging Type

How is the pouches segment gaining a competitive edge in the packaging industry by 2035?

Pouches are emerging as the fastest-growing packaging segment, projected to capture approximately 35% of market revenue by 2035. This growth is largely driven by their lightweight, flexible, and space-efficient design, which significantly reduces transportation and storage costs for manufacturers and retailers. Consumers also favor pouches for their convenience, resealability, and portability, especially as on-the-go lifestyles continue to rise. Additionally, advancements in barrier technology have enabled pouches to preserve product freshness and extend shelf life, making them highly suitable for ready-to-eat foods, soups, and other perishable items.

What makes cans a trusted and preferred packaging format in 2024?

Cans have retained their popularity in the packaging market, accounting for approximately 30% of the total market share in 2024. This sustained demand is largely due to their exceptional durability and extended shelf life, making them ideal for preserving perishable products like soups, vegetables, and ready-to-eat meals. Cans offer robust protection against external elements such as light, air, and moisture, ensuring product integrity over long periods. Additionally, their recyclability adds to their appeal among environmentally conscious consumers and regulators promoting circular economy practices. For manufacturers, cans remain a reliable and established packaging format with wide consumer acceptance, strong supply chain infrastructure, and excellent stacking and storage efficiency.

Asia Pacific holds the largest share of the global ready-to-eat soup market, accounting for approximately 40% of total revenue.

This dominance is fueled by rapid urbanization, rising disposable incomes, and growing demand for convenient meals in densely populated countries like China, India, and Japan. The expansion of modern retail infrastructure, including supermarkets and e-commerce platforms, has also made ready-to-eat soups more accessible across urban and semi-urban areas.

North America is witnessing rapid growth in the ready-to-eat soup market,

primarily due to changing consumer lifestyles, hectic work schedules, and an increasing preference for convenient yet healthy food options. In countries like the United States and Canada, consumers are increasingly seeking organic, low-sodium, gluten-free, and plant-based soups, reflecting a shift toward clean-label and functional foods. The rise of health-conscious consumers, growing awareness of immune-boosting nutrition post-COVID, and advancements in food packaging technologies have further accelerated demand.

Europe represents a mature and stable ready-to-eat soup market,

driven by consumers’ preference for premium, gourmet, and organic soup varieties. Western European countries such as Germany, the UK, France, and the Netherlands lead the region’s demand, where busy yet health-conscious lifestyles drive interest in low-calorie, additive-free, and sustainably packaged soups. European consumers value quality, transparency, and sustainability, making them more likely to choose products with natural ingredients, minimal preservatives, and environmentally friendly packaging.

WORLDWIDE TOP KEY PLAYERS IN THE READY-TO-EAT SOUP MARKET INCLUDE

- Campbell Soup Company

- Nestlé S.A.

- General Mills, Inc.

- ConAgra Brands, Inc.

- Hain Celestial Group, Inc.

- Pacific Foods of Oregon

- Dr. McDougall’s Right Foods

- Amy’s Kitchen, Inc.

- Hearthside Food Solutions

- The Simply Good Foods Company

- Others

Product launches in Ready-to-Eat Soup Market

- In February 2024, Campbell Soup Company launched a new line of organic ready-to-eat soups inspired by global flavors, such as Thai coconut, Moroccan lentil, and Mediterranean vegetable. This product line targets health-conscious consumers seeking flavorful, nutritious, and clean-label meal options. The launch reflects Campbell’s commitment to expanding its better-for-you product portfolio, catering to the growing demand for organic and internationally inspired convenience foods. It also aligns with consumer trends favoring natural ingredients and culinary diversity in ready-made meals.

- In October 2023, Nestlé introduced a range of microwaveable soup pouches with recyclable packaging, emphasizing both convenience and sustainability. These pouches, designed for its broth-based soup lines, allow for faster heating and easier consumption, appealing to busy professionals and on-the-go consumers. The eco-friendly packaging reflects Nestlé’s broader goal to reduce its environmental footprint, supporting its global sustainability commitments. This innovation enhances product accessibility while resonating with environmentally aware customers who prioritize both ease of use and green packaging solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the ready-to-eat soup market based on the below-mentioned segments:

Global Ready-to-Eat Soup Market, By Product Type

- Creamy Soups

- Broth-based Soups

- Chunky Soups

- Clear Soups

Global Ready-to-Eat Soup Market, By Packaging Type

- Cans

- Pouches

- Cups

- Bowls

Global Ready-to-Eat Soup Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 166 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |