Global Recycled Plastic Pipes Market

Global Recycled Plastic Pipes Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Polyvinyl Chloride (PVC), Polypropylene (PP), Polyethylene (PE), Other Materials), By Application (Water Supply & Sanitation, Sewer/Drainage, HVAC, Agricultural Irrigation, Electrical/Telecom Conduit, Other Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Recycled Plastic Pipes Market Summary

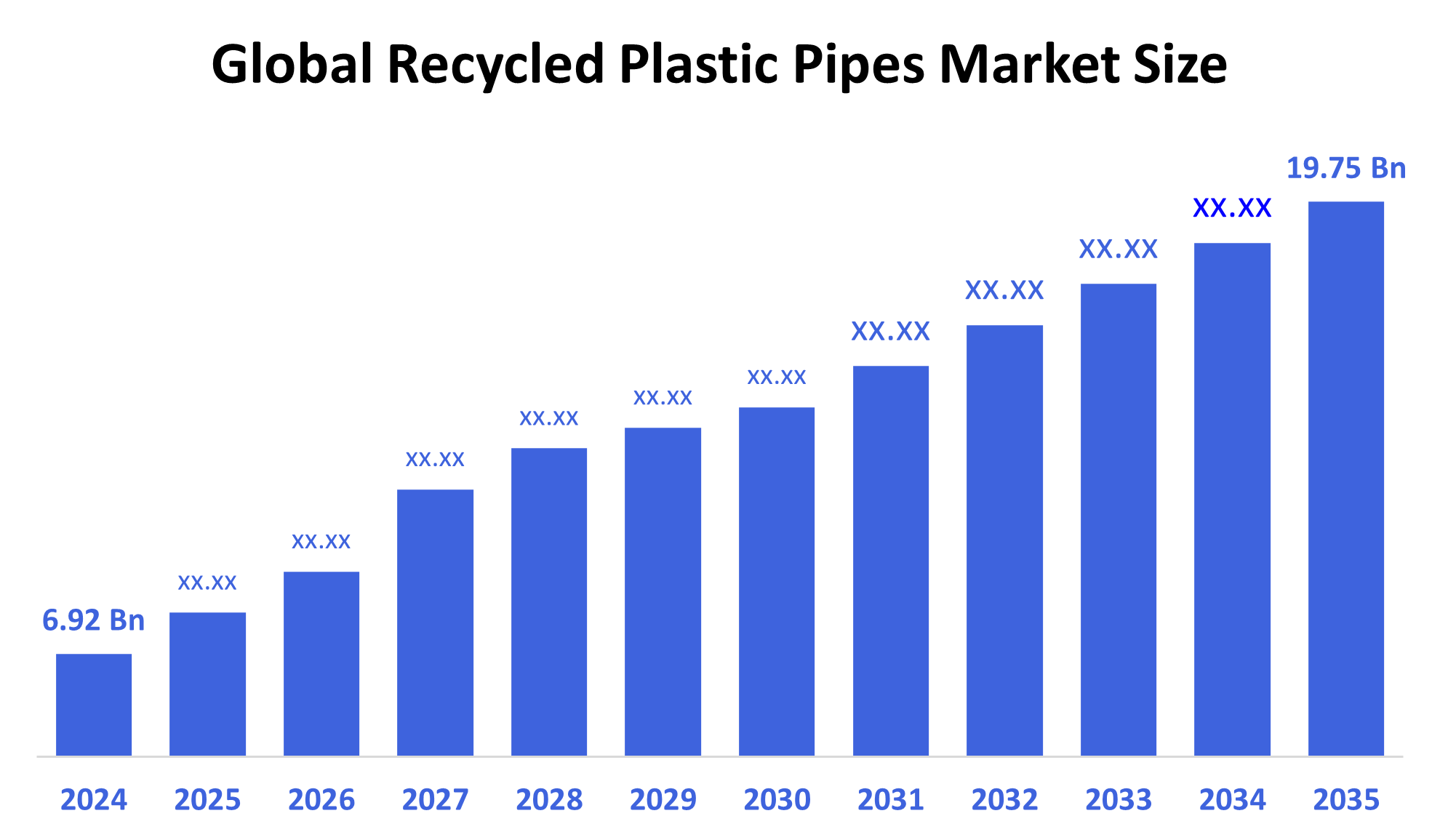

- The Global Recycled Plastic Pipes Market Size Was Estimated at USD 6.92 Billion in 2024 and is Projected to Reach USD 19.75 Billion by 2035, Growing at a CAGR of 10% from 2025 to 2035.

- The market for recycled plastic pipes is growing as a result of growing environmental awareness, strict laws encouraging sustainable practices, improvements in technology that improve the quality and durability of recycled pipes, and the financial gains from less waste going to landfills and resource conservation.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 41.2% and dominated the market globally.

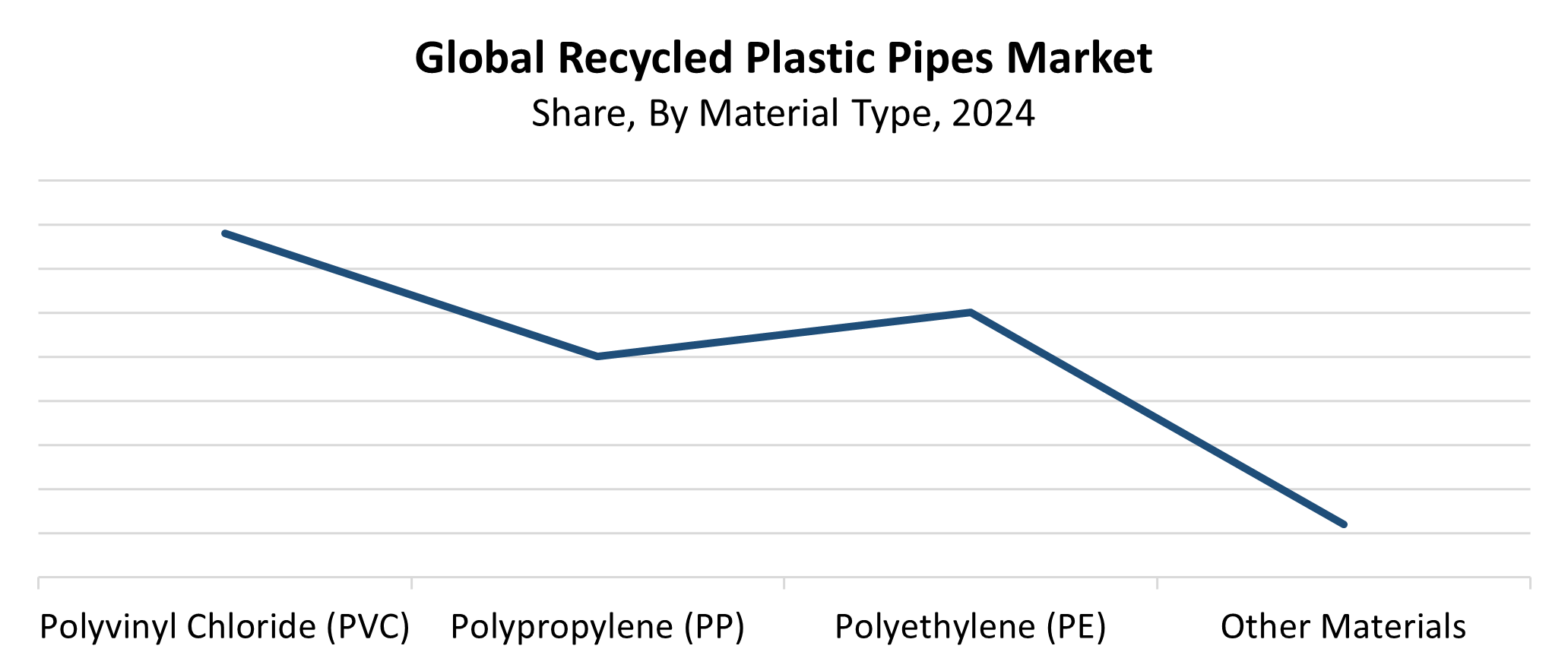

- In 2024, the polyvinyl chloride (PVC) segment had the highest market share by material type, accounting for 39.27%.

- In 2024, the water supply & sanitation segment had the biggest market share by application, accounting for 40.36%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 6.92 billion

- 2035 Projected Market Size: USD 19.75 billion

- CAGR (2025-2035): 10%

- Asia Pacific: Largest market in 2024

The recycled plastic pipes market encompasses the production and usage of piping systems made from post-consumer and post-industrial recycled plastic materials, including HDPE, PVC, and PP. The pipes find widespread application across drainage, sewage, water management, construction, and agricultural sectors due to their extended lifespan and cost-effectiveness, together with environmental benefits. The rising construction activities in developing countries, together with the growing sustainable materials usage and plastic waste reduction awareness, propel this market. Manufacturers and end users choose recycled plastic pipes for their multiple industry applications because they cost less than virgin materials yet deliver equivalent performance.

Technological advancements serve as the primary force behind improvements in recycled plastic pipe quality, along with their functional capabilities. The combination of advanced sorting techniques along with washing and extrusion operations enables the production of high-quality recycled polymers suitable for pressure and non-pressure pipe applications. Co-extrusion methods combine virgin and recycled layers to boost the durability and strength of pipes. Many governments implement recycled content standards for building materials, along with benefits and policies that support circular economies. The growing use of recycled plastic pipes happens because public infrastructure investments, combined with plastic waste laws and green building standards, drive both financial feasibility and ecological preservation.

Material Type Insights

How Did the Polyvinyl Chloride (PVC) Segment Capture a 39.27% Market Share in the Recycled Plastic Pipes Market in 2024?

The polyvinyl chloride (PVC) segment dominated the recycled plastic pipes market by securing 39.27% market share in 2024. The combination of durability with chemical resistance and low cost and processing simplicity makes PVC the preferred material for numerous applications, including drainage systems and sewage infrastructure, as well as irrigation and water supply systems. The demand for recycled PVC pipes continues to grow because they deliver excellent performance characteristics along with environmental sustainability benefits for both residential and commercial building projects. The reliability and quality of recycled PVC products have improved through advancements in PVC recycling methods, which include both mechanical and chemical processing techniques. The segment maintains its market dominance through its role in supporting both circular economy practices and sustainable construction methods.

The Polyethylene segment of the recycled plastic pipes market is anticipated to grow at a significant rate throughout the forecast period. The growth of PE stems from its outstanding characteristics of flexibility, along with its impact resistance and corrosion resistance, which make it ideal for drainage systems and gas distribution and water supply, and agricultural applications. The growing popularity of recycled PE, particularly high-density polyethylene (HDPE), results from its cost-effective nature and stable operational characteristics. The rising demand for recycled PE pipes in rural development and urban infrastructure projects, combined with environmental concerns, has accelerated their market growth. Modern sorting and extrusion operations have enhanced the quality of recycled PE so it can serve high-performance applications.

Application Insights

Why Did the Water Supply & Sanitation Segment Dominate the Recycled Plastic Pipes Industry in 2024?

The water supply & sanitation segment held the highest market share of 40.36% in 2024, and led the recycled plastic pipes industry. The market strength of recycled plastic pipes mainly stems from the increasing demand for economical, durable, and corrosion-resistant piping systems needed in both sewage infrastructure, wastewater treatment, and potable water distribution. The ideal water infrastructure solution contains recycled plastic pipes constructed from PVC and HDPE materials since these pipes deliver extended durability, together with minimal upkeep and chemical and biological resistance. Moreover, growing government investment in rural water supply programs and sustainable infrastructure development, and urban sanitation initiatives mainly in developing nations, strengthens recycled plastic pipe adoption in this sector, which leads to its market dominance.

The Sewer/Drainage segment within the recycled plastic pipes market will demonstrate a robust CAGR during the forecast period. The increasing requirement for affordable, sustainable solutions in wastewater management, along with urban infrastructure development, drives this growth. Recycled plastic pipes made from HDPE and PVC materials serve as excellent solutions for sewer and drainage systems because they possess both chemical resistance and flexibility, along with durability and simple installation procedures. Smart city projects and infrastructure replacement alongside stricter waste disposal regulations are driving up demand. The circular economy approach and rising interest in sustainable construction products support the growing adoption of recycled plastic pipes throughout this market segment.

Regional Insights

In 2024, the Asia Pacific recycled plastic pipes market dominated globally by securing the largest revenue share of 41.2%. This dominant position stems primarily from rapid urbanization along with population expansion, and growing infrastructure development investments in China, India, and Southeast Asian nations. Recycled plastic pipes continue to gain popularity because the region needs cost-effective, environmentally friendly piping solutions for sectors including construction and sanitation, water distribution, and agricultural operations. The increasing use of recycled materials benefits from both supportive government regulations that promote plastic waste recycling and rising awareness about environmental sustainability. The Asia Pacific region dominates the global recycled plastic pipes market due to its cost-effective manufacturing facilities and expanding recycling systems.

North America Recycled Plastic Pipes Market Trends

The North American recycled plastic pipe market maintains a steady expansion because of new infrastructure development alongside growing environmental awareness and strong government backing for sustainable construction practices. The increasing market growth comes from rising customer interest in economical, durable, eco-friendly piping systems that serve drainage, sewage, water supply, and agricultural needs. Government programs promoting plastic recycling alongside Extended Producer Responsibility (EPR) schemes and tax incentives support infrastructure projects that use recycled materials. Technology advancements in extrusion and recycling processes have improved recycled plastic pipe quality and functionality, thus enabling them to compete with traditional materials. North America holds vital importance for market growth because of increasing investments in green infrastructure and circular economy targets.

Europe Recycled Plastic Pipes Market Trends

The European market for recycled plastic pipes grows significantly through stringent environmental regulations, together with well-established recycling systems and growing adoption of sustainable construction practices. The European Union promotes circular economy principles through its plastic waste reduction policies and recycled material utilization guidelines, which drive the adoption of recycled plastic pipes across sewage networks, water management facilities, agricultural operations, and industrial settings. Technological improvements in mechanical and chemical recycling processes have boosted the quality and endurance of recycled pipes so they now serve as dependable alternatives to traditional materials. The market growth in major European countries continues because of government incentives for sustainable building solutions, along with increasing green infrastructure funding.

Key Recycled Plastic Pipes Companies:

The following are the leading companies in the recycled plastic pipes market. These companies collectively hold the largest market share and dictate industry trends.

- PIPELIFE

- Pacific Corrugated Pipe Company

- NEPROPLAST

- Advanced Drainage Systems (ADS)

- UPONOR

- Particules Plastiques Inc.

- Others

Recent Developments

- In September 2024, Reifenhäuser Middle East and Africa (MEA) and Rollepaal Pipe Extrusion Technology established a strategic alliance to increase the company's market share in both the Middle East and Africa. With almost 60 years of experience, Rollepaal established cutting-edge technology for plastic pipe extrusion that increases sustainability and efficiency.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the recycled plastic pipes market based on the below-mentioned segments:

Global Recycled Plastic Pipes Market, By Material Type

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polyethylene (PE)

- Other Materials

Global Recycled Plastic Pipes Market, By Application

- Water Supply & Sanitation

- Sewer/Drainage

- HVAC

- Agricultural Irrigation

- Electrical/Telecom Conduit

- Other Applications

Global Recycled Plastic Pipes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |