Global Reproductive Hormones and Proteins Tests Market

Global Reproductive Hormones and Proteins Tests Market Size, Share, and COVID-19 Impact Analysis, By Test Type (Anti-Mullerian Hormone (AMH) Lab Tests, Dehydroepiandrosterone Sulphate (DHEAS) Lab Tests, Estradiol Lab Tests, Follicle-Stimulating Hormone (FSH) Lab Tests, Luteinizing Hormone (LH) Lab Tests, Progesterone Lab Tests, Prolactin Lab Tests, and Testosterone Lab Tests), By Technology (Immunoassay-Based Tests, Chromatography-Based Tests, PCR (Polymerase Chain Reaction) Tests, and Mass Spectrometry), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Reproductive Hormones and Proteins Tests Market Size Insights Forecasts to 2035

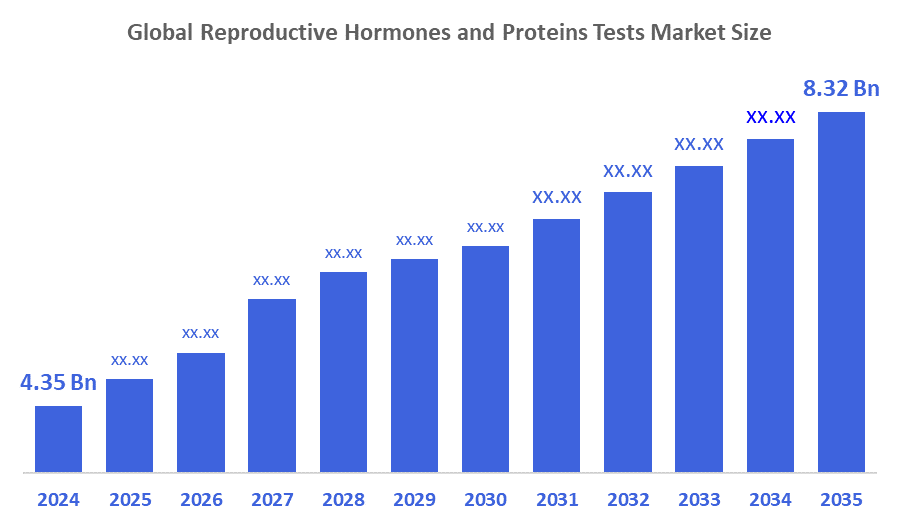

- The Global Reproductive Hormones and Proteins Tests Market Size Was Estimated at USD 4.35 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.07 % from 2025 to 2035

- The Worldwide Reproductive Hormones and Proteins Tests Market Size is Expected to Reach USD 8.32 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Reproductive Hormones And Proteins Tests Market Size Was Worth Around USD 4.35 Billion In 2024 And Is Predicted To Grow To Around USD 8.32 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 6.07 % From 2025 To 2035. The reproductive hormones and proteins tests market is primarily driven by rising infertility rates, growing awareness of reproductive health, technological advancements in diagnostic assays, and increasing demand from fertility clinics and diagnostic laboratories worldwide.

Market Overview

Tests for reproductive hormones and proteins include a variety of diagnostic procedures intended to quantify the amounts of hormones and proteins essential for reproductive health. Follicle-stimulating hormone (FSH), luteinizing hormone (LH), estrogen, progesterone, anti-Müllerian hormone (AMH), human chorionic gonadotropin (HCG), inhibin, and prolactin are among these essential molecules that are crucial to many reproductive processes. These tests are essential for determining fertility, tracking the course of pregnancy, diagnosing reproductive disorders like menopause, hypogonadism, and polycystic ovarian syndrome (PCOS), and directing the use of assisted reproductive technologies (ART) like in vitro fertilisation (IVF). The fertility diagnostics market is driven by personalised medicine. For example, genomics and hormone profiling allow tailor-made treatment, which increases the success rate and decreases the risk. Developing non-invasive tests such as saliva-based kits and wearable sensors not only improves patient convenience but also makes reproductive health services available to more people. Also, partnerships between top diagnostic companies and fertility clinics are helping innovation, simplifying care, and speeding up the use of advanced testing solutions. Infertility diagnosis, treatment, and reproductive care remainfold areas where the market for reproductive markers and technologies is crucial for intervention, better health outcomes and decision making. By looking at complex hormonal profiles, predicting how the ovaries respond in IVF, and customising treatment protocols more accurately, artificial intelligence (AI) and machine learning are revolutionising reproductive endocrinology. The precision of these technologies enables clinicians to make better decisions and patients to benefit from treatments that are more suitable for their specific situations.

UK-based healthtech start-up Level Zero Health has raised £5.5 million in a pre-seed funding round to develop the world’s first reliable remote and continuous hormone monitoring device using DNA-based sensors. The funding was led by Swiss VC Redalpine, with participation from HAX (SOSV), Entrepreneur First, and industry experts.

Report Coverage

This research report categorises the Reproductive Hormones and Proteins Tests Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the reproductive hormones and proteins tests market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the reproductive hormones and proteins tests market.

Driving Factors

Globally, lifestyle factors such as stress, obesity, exposure to environmental toxins, and postponement of childbearing have led to a rise in infertility rates, thereby further increasing the need for fertility testing. Technological advancements like automated analyzers, high, sensitivity immunoassays, and portable point, of, care devices are making the diagnostic process not only more accurate but also more accessible, which in turn helps facilitate timely interventions. At the same time, awareness-raising efforts by entities like the WHO and the ASRM, coupled with digital health platforms, are playing a crucial role in breaking down the stigma and motivating people to seek aid for their reproductive health. Besides, the demographic shift towards an ageing population, in which more women are postponing childbirth to their 30s and 40s, has led to a surge in the demand for ovarian reserve tests, most notably anti, Mllerian hormone (AMH) measurement, which is essential for treatment guidance and helping individuals make well-informed reproductive choices. The fertility diagnostics market is driven by personalised medicine. Also, partnerships between top diagnostic companies and fertility clinics are helping innovation, simplifying care, and speeding up the use of advanced testing solutions.

Eli Health announced plans to launch its at-home progesterone test in February 2026, expanding its Hormometer platform for saliva-based hormone monitoring.

Restraining Factors

The market for reproductive hormones and protein tests is constrained by high testing prices, tight regulatory clearances, and low awareness in rural and low-income areas. Stringent regulations, social stigma, and inconsistent insurance reimbursement collectively delay market entry and limit patient access to fertility diagnostics, hindering overall growth.

Market Segmentation

The reproductive hormones and proteins tests market share is classified into test type and technology.

- The anti-mullerian hormone (AMH) lab tests segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology type, the reproductive hormones and proteins tests market is divided into anti-mullerian hormone (AMH) lab tests, dehydroepiandrosterone sulphate (DHEAS) lab tests, estradiol lab tests, follicle-stimulating hormone (FSH) lab tests, luteinizing hormone (LH) lab tests, progesterone lab tests, prolactin lab tests, and testosterone lab tests. Among these, the anti-mullerian hormone (AMH) lab tests segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. AMH is an essential ovarian reserve marker that indicates a woman's fertility potential. Testing for the same is reserved primarily for those women whose decision to have children later in life is driven by their desire for such a setup. Apart from the above, AMH testing is also being increasingly used in the use of assisted reproductive technologies (ART) as a way of predicting the degree of ovarian response to stimulation protocols, thereby personalising the treatment plan and increasing the chances of success.

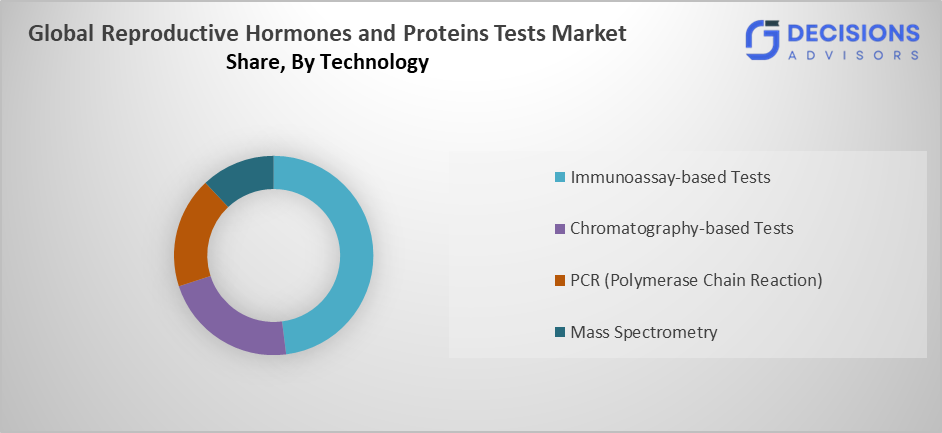

- The immunoassay-based tests segment accounted for the highest revenue share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

Based on the technology, the reproductive hormones and proteins tests market is segmented into immunoassay-based tests, chromatography-based tests, PCR (polymerase chain reaction) tests, and mass spectrometry. Among these, the immunoassay-based tests segment accounted for the highest revenue share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. Enzyme, Linked Immunosorbent Assays (ELISA) and chemiluminescence immunoassays are examples of immunoassays that have been extensively utilised for the determination and measurement of reproductive hormones. These methods have been praised for their high sensitivity, specificity, and moderate cost, which are the factors that make them ideal for regular clinical application. At present, the majority of reproductive hormone testing is done by immunoassays.

Regional Segment Analysis of the Reproductive Hormones And Proteins Tests Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the reproductive hormones and proteins tests market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the reproductive hormones and proteins tests market over the predicted timeframe. The regional market is growing due to the need for fertility assessments and therapies, which is being greatly increased by rising rates of infertility, which are being driven by lifestyle modifications, postponed childbearing, and environmental factors. This trend is especially noticeable in emerging economies, where the expanding middle class in nations like China and India has easier access to modern fertility testing and therapies. Simultaneously, significant expenditures in healthcare infrastructure, including the construction of novel hospitals, specialist reproductive clinics, and diagnostic labs, are bolstering market growth. Moreover, these elements are fostering innovation, accessibility, and better patient outcomes in many parts of the world, as well as a strong environment for the expansion of fertility-related healthcare services.

North America is expected to grow at a rapid CAGR in the reproductive hormones and proteins tests market during the forecast period. North Americas reproductive diagnostics market is mainly driven by an advanced healthcare system that has access to very sophisticated facilities, state, of, the, art diagnostic capabilities, and medical services that are easily accessible to all. Besides, this region is very much into the use of assisted reproductive technologies (ART), mainly in vitro fertilisation (IVF), which leads to higher demand for fertility evaluations and hormone monitoring services. Moreover, leading industry players like Roche Diagnostics, Abbott Laboratories, and Siemens Healthineers, which have their headquarters in this region, are a continuous source of innovation and advances in technology. All these factors collectively result in a thriving market, improved patient outcomes, and position North America as the world leader in fertility diagnostics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the reproductive hormones and proteins tests market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Beckman Coulter Inc

- Danaher Corp

- F. Hoffmann-La Roche Ltd

- Quest Diagnostics

- Quidelortho Corp

- Roche Diagnostics

- Siemens AG

- Siemens Healthineers

- Thermo Fisher Scientific

- Tosoh Corp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2023, Quest Diagnostics and Proov partnered to launch the Proov Confirm PdG home fertility test through questhealth.com, giving women the first and only FDA-cleared at-home test to confirm successful ovulation. This collaboration expands access to fertility diagnostics by combining Quest’s consumer-initiated testing platform with Proov’s hormone testing innovation.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the reproductive hormones and proteins tests market based on the below-mentioned segments:

Global Reproductive Hormones and Proteins Tests Market, By Test Type

- Anti-Mullerian Hormone (AMH) Lab Tests

- Dehydroepiandrosterone Sulphate (DHEAS) Lab Tests

- Estradiol Lab Tests

- Follicle-Stimulating Hormone (FSH) Lab Tests

- Luteinizing Hormone (LH) Lab Test

- Progesterone Lab Tests

- Prolactin Lab Tests

- Testosterone Lab Tests

Global Reproductive Hormones and Proteins Tests Market, By Technology

- Immunoassay-Based Tests

- Chromatography-Based Tests

- PCR (Polymerase Chain Reaction) Tests

- Mass Spectrometry

Global Reproductive Hormones and Proteins Tests Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current market size?

The global reproductive hormones and proteins tests market was valued at USD 4.35 billion in 2024.?

- What is the projected growth?

It is expected to reach USD 8.32 billion by 2035, growing at a CAGR of 6.07% from 2025 to 2035.?

- Which test type leads the market?

Anti-Müllerian Hormone (AMH) lab tests held the largest share in 2024 due to their role in assessing ovarian reserve for fertility.

- What technology dominates?

Immunoassay-based tests accounted for the highest revenue in 2024, valued for their high sensitivity and cost-effectiveness in clinical use.?

- Which region has the largest share?

Asia-Pacific is anticipated to hold the largest market share, driven by rising infertility, healthcare investments, and middle-class expansion in China and India.?

- Who are the key market players?

Leading companies include Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Quest Diagnostics, and Thermo Fisher Scientific.

- What drives market growth?

Growth is fueled by rising infertility rates, technological advances like immunoassays, and demand from fertility clinics amid delayed childbearing.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |