Global Resistant Hypertension Market

Global Resistant Hypertension Market Size, Share, and COVID-19 Impact Analysis, By Treatment (Diuretic therapy, Combination therapy, and Mineralocorticoid receptor antagonists), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

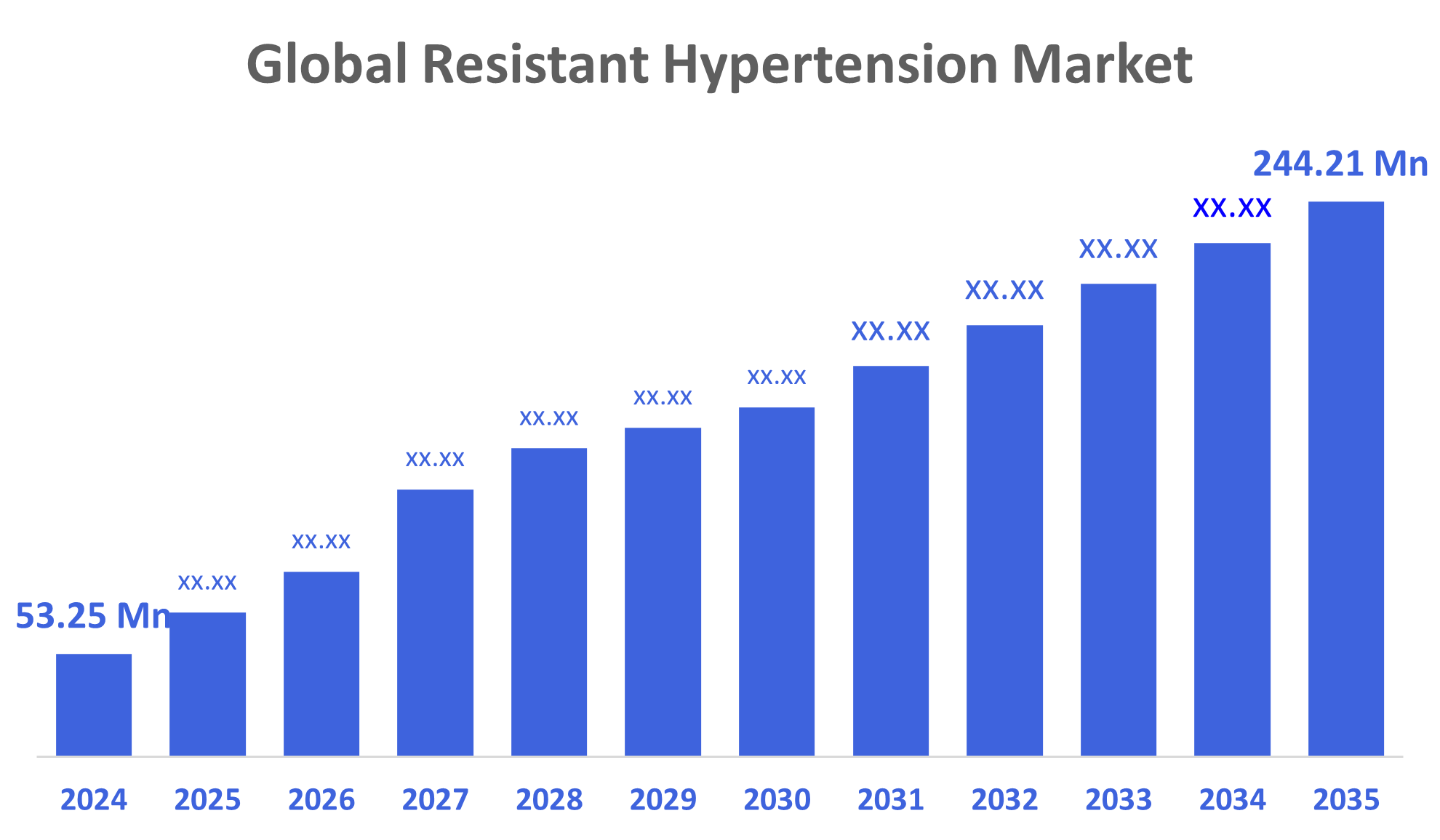

Global Resistant Hypertension Market Size Insights Forecasts to 2035

- The Global Resistant Hypertension Market Size Was Estimated at USD 53.25 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.85 % from 2025 to 2035

- The Worldwide Resistant Hypertension Market Size is Expected to Reach USD 244.21 Million by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Resistant Hypertension Market Size was worth around USD 53.25 Million in 2024 and is Predicted to Grow to around USD 244.21 Million by 2035 with a Compound Annual Growth Rate (CAGR) of 14.85 % from 2025 to 2035. The market for resistant hypertension is developing as a result of the need for long-term management techniques, the increasing prevalence of hypertension worldwide, and increased awareness of cardiovascular consequences. The demand for specialist treatment approaches has increased due to an increase in the number of patients exhibiting limited response to traditional medicines.

Market Overview

The resistant hypertension market refers to the healthcare and pharmaceutical segment focused on diagnosing, managing, and treating patients whose blood pressure remains uncontrolled despite the use of multiple antihypertensive drugs. Resistant hypertension is currently being described in the latter two cases as either uncontrolled blood pressure (BPs of =130 mmHg Systolic Blood Pressure (SBP) and =80 mm Hg Diastolic Blood Pressure (DBP)) on three or four antihypertensives of different classes that are concomitantly prescribed or controlled blood pressure on four or more antihypertensives with both cases including a thiazide diuretic and all medications at the maximum tolerated doses. It is noticed that patients who have their blood pressure under control by using more than three antihypertensive drugs may also be suitable for a review in a specialist setting.

This will help to make sure that pseudo, resistant and secondary hypertension are not the cases and the best drugs and the right doses are given, thus the patients will be protected from over-treatment. It is defined by the unmet need for therapies that can lower blood pressure in patients resistant to standard treatments, and it is projected to grow rapidly as prevalence rises and novel therapies like lorundrostat enter the pipeline.

Retension Pharmaceuticals invested a $15 million in a Series B financing round to advance its Phase 2b trial of RTN-001 for uncontrolled and resistant hypertension, while also securing a new U.S. patent that extends protection for its lead candidate through 2044.

Report Coverage

This research report categorises the resistant hypertension market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the resistant hypertension market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the resistant hypertension market.

Driving Factors

The resistant hypertension business has grown significantly due to both increased prevalence and the emergence of effective medications for the treatment of this condition. Additionally, the resistant hypertension market will continue growing. This continued growth will coincide with the changing demographics associated with the ageing population. Several new therapeutic options for the treatment of resistant hypertension are becoming available to treat this condition. New agents' therapeutic options will contribute to the continued growth of the treatment-resistant hypertension market. Advancements in digital health technology, such as telemedicine and remote patient monitoring, will also drive the continued growth of the treatment-resistant hypertension market. Digital health technologies provide healthcare providers with the ability to monitor patients for treatment-resistant hypertension closely and make changes to treatment plans based on the results of monitoring.

The Barts Health NHS news release confirms that patients with resistant hypertension now have new hope due to clinical trial results showing lorundrostat, an aldosterone synthase inhibitor, can significantly lower blood pressure in those who fail standard therapies.

Restraining Factors

Managing resistant hypertension can be expensive, especially if several drugs and therapies are needed. For patients, especially in low- and middle-income nations, this can be a major obstacle to access. Additionally, patients with resistant hypertension may find it difficult to follow complicated treatment plans, which could reduce the efficacy of their care.

Market Segmentation

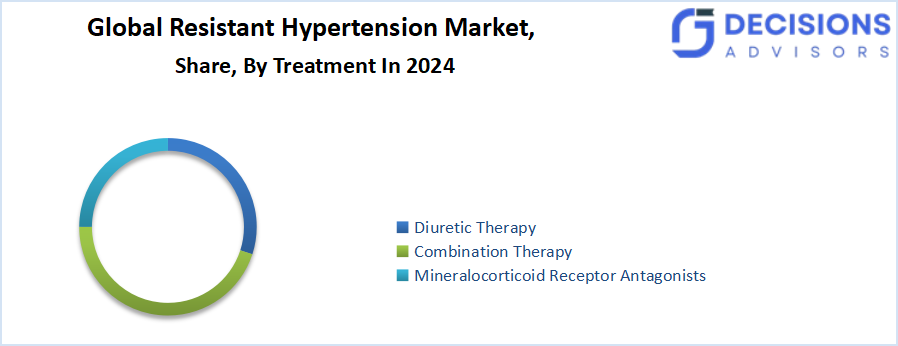

The resistant hypertension market share is classified into treatment, and distribution channel.

- The combination therapy segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period.

Based on the treatment, the resistant hypertension market is segmented into diuretic therapy, combination therapy, and mineralocorticoid receptor antagonists. Among these, the combination therapy segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period. Combination therapy typically involves the use of two or more drugs that work through different mechanisms to properly control blood pressure in patients with resistant hypertension. Patients with resistant hypertension who are not responding to monotherapy or have complicating conditions often require combination treatment. Some of the most popular double, drug combinations that are used include diuretics paired with either ACE inhibitors or ARBs, beta blockers along with CCBs, and MRAs combined with either ACE inhibitors or ARBs.

- The hospital pharmacy segment accounted for the highest revenue share in 2024 and is projected to grow at a notable CAGR over the forecast period.

Based on the distribution channel, the resistant hypertension market is divided into hospital pharmacy, retail pharmacy, and online pharmacy. Among these, the hospital pharmacy segment accounted for the highest revenue share in 2024 and is projected to grow at a notable CAGR over the forecast period. Access to a variety of drugs and specialist treatment alternatives, such as invasive procedures and cutting-edge imaging techniques, is made possible by hospital pharmacists and is crucial for the management of treatment-resistant hypertension. A team approach is essential for the successful handling of TRH as it yields tailored treatment regimens that perfectly fit the patient's particular requirements.

Regional Segment Analysis of the Resistant Hypertension Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the resistant hypertension market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the resistant hypertension market over the predicted timeframe. The South and East Asia region has a high rate of hypertension, and treatment-resistant hypertension is becoming more common. This is due to the rising prevalence of hypertension and the need for better treatment options for treatment-resistant hypertension. The treatment market for resistant hypertension management in South and East Asia is slated for high growth. An aging population that is more prone to developing hypertension and treatment, resistant hypertension is one of the major treatment, resistant hypertension management market drivers in the region. Besides that, lifestyle factors like unhealthy diets, lack of physical activity, and stress are resulting in more cases of hypertension in the region. There are several countries in the region, like China, India, and Indonesia, that have huge populations and a high incidence of hypertension, hence, a major market for the treatment of resistant hypertension management.

North America is expected to grow at a rapid CAGR in the resistant hypertension market during the forecast period. Hypertension is very common in North America, with the elderly being at a higher risk of developing treatment-resistant hypertension. Hence, this represents a huge market potential for the treatment of resistant hypertension management. North America has an advanced healthcare system offering patients with treatment-resistant hypertension a wide array of treatment options. This also entails reaching out to speciality care and cutting-edge therapies like renal denervation and baroreceptor activation therapy. There is a solid foundation for research and development in North America that facilitates the creation of new therapies for the treatment of resistant hypertension management. It comprises partnerships among the academic sector, industry, and the government, which can speed up the development as well as the acceptance of new therapeutic methods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the resistant hypertension market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arrowhead Pharmaceuticals

- AstraZeneca (Alexion Pharmaceuticals)

- Biogen

- F. Hoffmann-La Roche

- Ionis Pharmaceuticals

- Novartis

- NovelMed

- Otsuka Pharmaceutical

- Q32 Bio

- Takeda Pharmaceutical

- Vera Therapeutics

- Vertex Pharmaceuticals

- Walden Biosciences

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, Mineralys Therapeutics’ Phase 3 Launch-HTN trial of lorundrostat. It was recognised by the Journal of the American Medical Association (JAMA) in its inaugural “Research of the Year” roundup, highlighting it as one of the nine most impactful studies of the year.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the resistant hypertension market based on the below-mentioned segments:

Global Resistant Hypertension Market, By Treatment

- Diuretic therapy

- Combination therapy

- Mineralocorticoid receptor antagonists

Global Resistant Hypertension Market, By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Global Resistant Hypertension Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global resistant hypertension market?

The market was valued at USD 53.25 million in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 244.21 million by 2035.

- What is the forecasted CAGR for 2025-2035?

The market is projected to grow at a CAGR of 14.85%.

- What are the main treatment segments?

The market is segmented into diuretic therapy, combination therapy, and mineralocorticoid receptor antagonists, with combination therapy holding the largest share in 2024.

- Which distribution channel leads the market?

Hospital pharmacies accounted for the highest revenue share in 2024 and are expected to grow notably.

- Which region will have the largest market share?

Asia-Pacific is anticipated to hold the largest share, driven by high hypertension prevalence in countries like China and India.

- Which region is expected to grow the fastest?

North America is projected to grow at the fastest CAGR, supported by advanced healthcare and R&D.

- Who are some key companies in this market?

Major players include AstraZeneca, Novartis, Takeda Pharmaceutical, Mineralys Therapeutics, and Arrowhead Pharmaceuticals.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |