Global Retail Audience Measurement Solutions Market

Global Retail Audience Measurement Solutions Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, Services), By Application (Customer Traffic & Footfall, Queue Management, Store Layout & Planogram Optimization, Demographic & Behavioral Profiling, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Retail Audience Measurement Solutions Market Summary

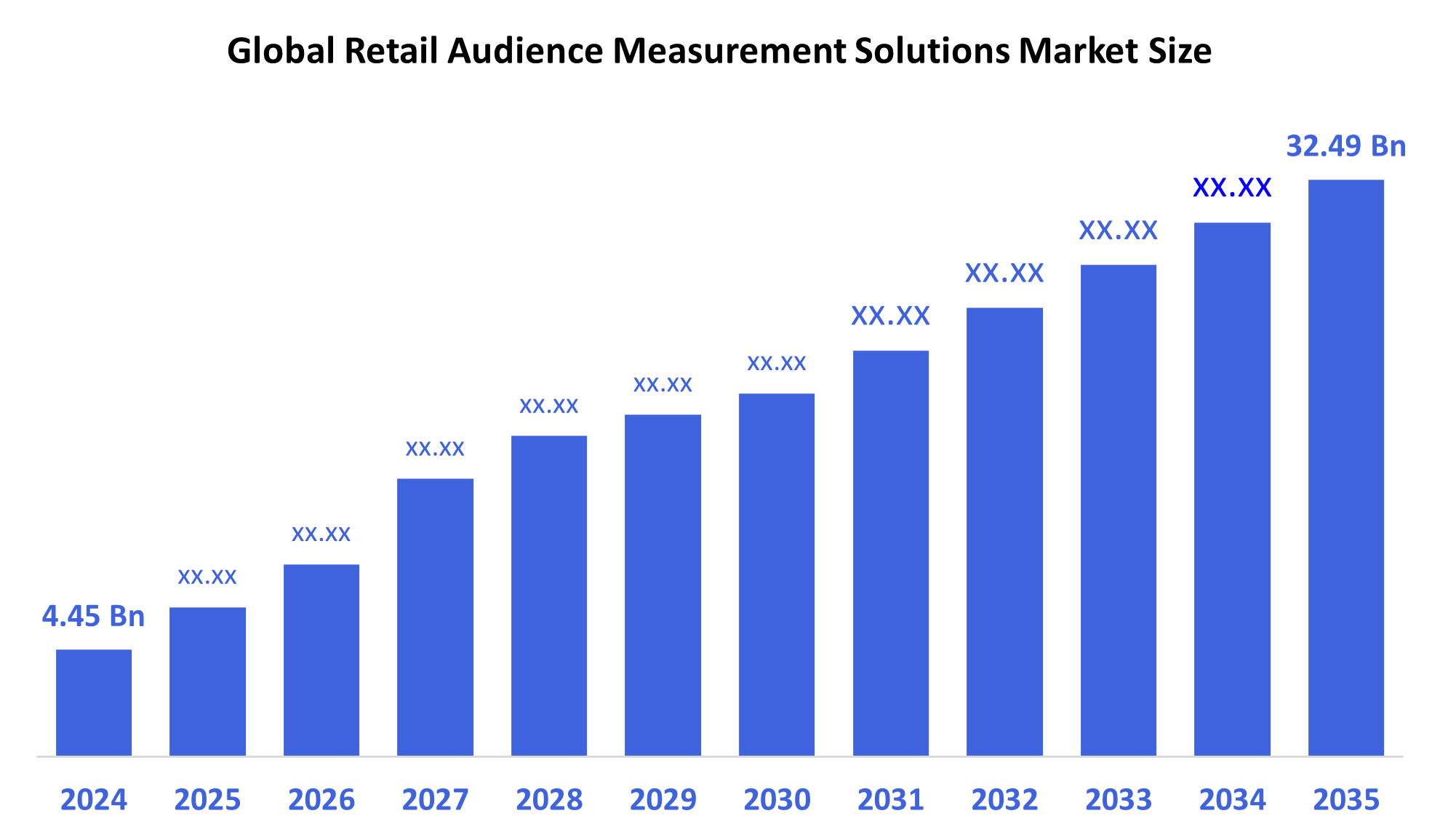

- The Global Retail Audience Measurement Solutions Market Size Was Estimated at USD 4.45 Billion in 2024 and is Projected to Reach USD 32.49 Billion by 2035, Growing at a CAGR of 19.81% from 2025 to 2035.

- Increased need for instore analytics, AI powered insights, better customer interaction, smart retail technology, and heightened competition among physical retailers are the main factors propelling the growth of the retail audience measurement solutions market.

Key Regional and Segment-Wise Insights

- In 2024, North America led globally and accounted for 33.5% of the global market for retail audience measuring systems.

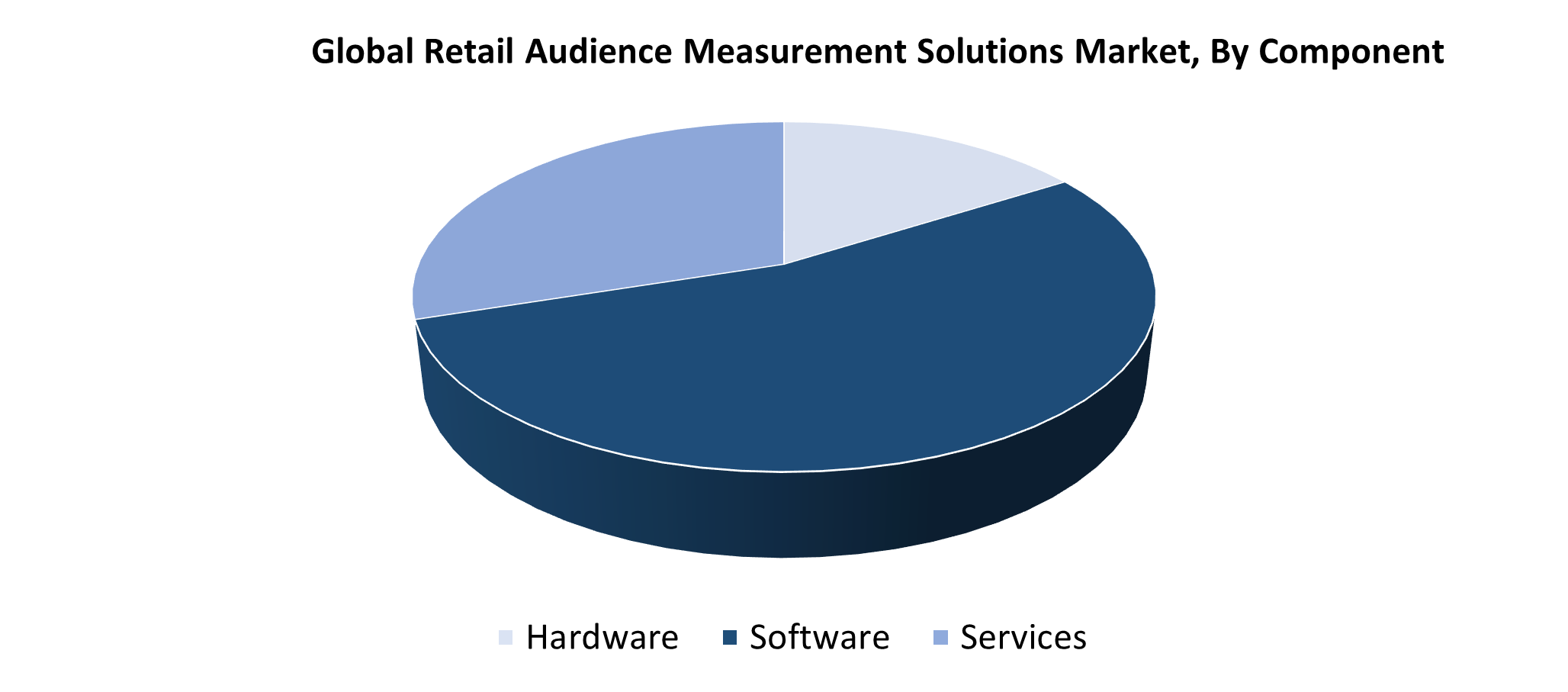

- In 2024, the software segment had the highest revenue share by component, accounting for 54.7%.

- With a revenue share of more than 28.5% in 2024, the customer traffic & footfall category led the retail audience measurement systems market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4.45 Billion

- 2035 Projected Market Size: USD 32.49 Billion

- CAGR (2025-2035): 19.81%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Retail audience measurement solutions Market consists of the technological systems together with operational procedures that track and analyze customer behavior within retail environments. These solutions enable retailers to track foot traffic movement as well as customer interaction duration and population characteristics, along with their display and merchandise interaction behavior. The primary targets focus on enhancing consumer experiences while optimizing store design and marketing approaches. The market expansion occurs because businesses increasingly need data-driven decision-making and face growing competition in physical retail and omnichannel practices. Retailers employ audience measurement tools to bridge the data divide between their online and offline operations because individualized shopping experiences dominate the contemporary retail landscape.

The retail audience measurement industry is being significantly shaped by technological breakthroughs. The precision and efficacy of audience measuring systems have been improved by innovations including real-time data dashboards, IoT sensors, facial recognition, and AI-powered video analytics. Without sacrificing privacy, these tools offer more in-depth data into consumer behavior. Retailers are also being encouraged to use advanced analytics solutions by government programs that support digital transformation and smart retail infrastructure, particularly in North America, Europe, and Asia. Market adoption and innovation are also being accelerated by public-private partnerships and funding initiatives targeted at updating retail technologies.

Component Insights

The software segment dominated the worldwide retail audience measurement solutions market in 2024 with the largest revenue share of 54.7%. The main factor driving this increase is the rising need for real-time data collecting technologies and advanced analytics, which assist retailers in better understanding consumer behavior, streamlining shop designs, and improving marketing tactics. Software programs that are frequently driven by AI and machine learning give companies the ability to collect comprehensive data on foot traffic trends and consumer involvement. In order to obtain a competitive advantage, boost operational effectiveness, and provide individualized consumer experiences, retailers are investing more and more in these technologies. Consequently, the market share and acceptance of software continue to surpass that of hardware and service components.

Over the course of the projection period, the retail audience measurement solutions market's services segment is anticipated to grow at the fastest CAGR. The increasing need for end-to-end support, which includes installation, maintenance, training, and consulting services, is what is causing this growth. Retailers are depending more and more on outside service providers to guarantee smooth deployment and peak performance as they embrace sophisticated audience measurement tools. Service offers assistance to companies in deciphering gathered data, extracting useful insights, and incorporating fixes into current processes. Further propelling market expansion is the move toward managed and subscription-based service models. The services sector is anticipated to be crucial in assisting businesses in optimizing the return on their technological expenditures as retail settings grow more data-driven.

Application Insights

The customer traffic and foot traffic segment led the retail audience measurement solutions market with the largest revenue share of 28.5%, in 2024. This dominance is a result of retailers' growing desire to better allocate workers, manage shop layouts, and track in-store customer behavior. By offering real-time insights into store performance, foot traffic analytics assist businesses in understanding peak hours, gauging the success of marketing activities, and improving the consumer experience. Tools that track and analyze client movement have become crucial as physical stores compete with online platforms. Because of this, there is a growing need for foot traffic and customer traffic analysis, which makes it a crucial application area in the retail audience measurement solutions sector.

In the retail audience measurement solutions market, the store layout and planogram optimization segment is anticipated to grow significantly over the forecast period. The expected increase is fueled by retailers' growing emphasis on improving in-store experiences and optimizing sales per square foot. Utilizing audience measuring technology, companies can examine dwell periods, consumer movement patterns, and high-traffic areas to enhance store layouts and product placement. Planogram optimization makes sure that products are presented in a way that will draw in customers and increase conversion rates. Companies are prioritizing data-driven tactics to enhance visual merchandising and operational efficiency as the retail industry becomes more competitive. This is setting up this application category for robust and long-term growth in the years to come.

Regional Insights

North America held the largest revenue share of 33.5% in 2024, dominating the retail audience measurement solutions market. The region's strong presence of large retail chains, high adoption of cutting-edge retail technologies, and increased investment in customer analytics are the main factors driving this leadership position. In order to boost in-store engagement, obtain real-time insights on customer behavior, and increase overall operational efficiency, retailers in the United States and Canada are utilizing audience measuring systems. Furthermore, the region's market position has been further reinforced by the early adoption of AI, IoT, and computer vision technologies in retail settings. North America is anticipated to continue to dominate the retail audience measurement solutions market as the need for data-driven decision-making grows.

Asia Pacific Retail Audience Measurement Solutions Market Trends

Over the course of the forecast period, the retail audience measurement solutions market in the Asia Pacific is anticipated to expand at the fastest CAGR. The region's growing retail industry, growing use of smart technology, and increased investments in AI-driven analytics across emerging economies like China, India, and Southeast Asia are all contributing factors to this fast rise. In order to improve in-store experiences, better understand customer preferences, and increase marketing effectiveness, retailers in the area are using audience measuring technologies more and more. Real-time data analytics are becoming more and more in demand as smartphones, digital signs, and IoT-enabled devices become more widely used. Asia Pacific is therefore well-positioned to develop into a significant audience measurement solutions growth hub in the years to come.

Europe Retail Audience Measurement Solutions Market Trends

Over the course of the forecast period, the European retail audience measurement solutions market is anticipated to experience significant expansion. The region's strong emphasis on digital transformation in retail, expanding use of AI and data analytics, and heightened attention on improving in-store consumer engagement are the main drivers of this rise. Retailers are investing in technologies that offer real-time insights into foot traffic, conversion rates, and customer behavior in important European markets like the UK, Germany, France, and the Netherlands. Furthermore, the usage of secure, compliant audience measurement solutions is being encouraged by stringent data protection legislation. The need for intelligent, analytics-driven solutions is predicted to increase gradually in Europe as physical stores strive to better compete with e-commerce.

Key Retail Audience Measurement Solutions Companies

The following are the leading companies in the retail audience measurement solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Advertima

- V-Count

- Broox Technologies S.L.U.

- Convenience StoresNext

- Dor Technologies

- Raydiant (Sightcorp)

- Macnica, Inc.

- AdQuick

- Engagis Pty Ltd

- Quividi

- Nielsen

- Kantar

- Walkbase

- Others

Recent Developments

- In May 2025, Advertima partnered with Publicis Media Middle East to integrate its real-time audience targeting and measurement capabilities into in-store retail media campaigns, enabling advertisers to buy physical retail media using audience segments just like online ads. This collaboration bridges the gap between in-store shopper behavior and digital advertising, enhancing cross-channel campaign performance and measurability.

- In March 2025, Nielsen and LiveRamp extended their collaboration to enable direct access to Nielsen's Marketing Cloud audience segments via LiveRamp's Data Marketplace. Through this integration, Nielsen's retail, media, and demographic data may be easily activated by publishers and advertisers for highly specialized, cross-channel advertising campaigns.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the retail audience measurement solutions market based on the below-mentioned segments:

Global Retail Audience Measurement Solutions Market, By Component

- Hardware

- Software

- Services

Global Retail Audience Measurement Solutions Market, By Application

- Customer Traffic & Footfall

- Queue Management

- Store Layout & Planogram Optimization

- Demographic & Behavioral Profiling

- Others

Global Retail Audience Measurement Solutions Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |