Global Retail Cooler Market

Global Retail Cooler Market Size, Share, and COVID-19 Impact Analysis, By Capacity (Below 10 Quarts, Between 11-25 Quarts, Between 26-50 Quarts, Above 50 Quarts), By Distribution Channel (Offline, Online), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Retail Cooler Market Summary

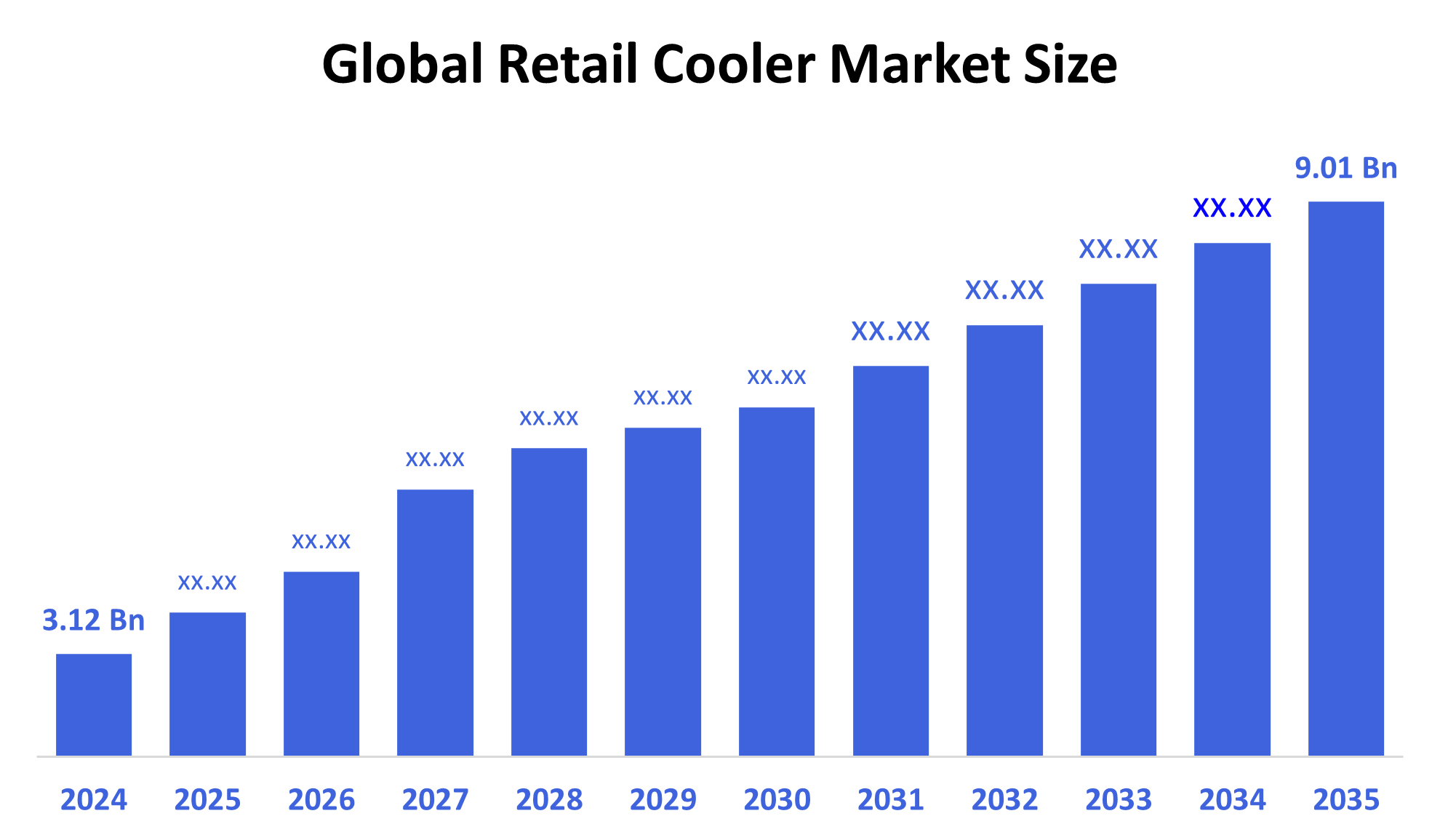

- The Global Retail Cooler Market Size Was Estimated at USD 3.12 Billion in 2024 and is Projected to Reach USD 9.01 Billion by 2035, Growing at a CAGR of 10.12% from 2025 to 2035.

- Increased need for cold storage in supermarkets, the rise of the food and beverage industries, energy-efficient technology, urbanization, and consumer preferences for fresh and chilled goods are all factors propelling the retail cooler industry.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 37.25% and dominated the market globally.

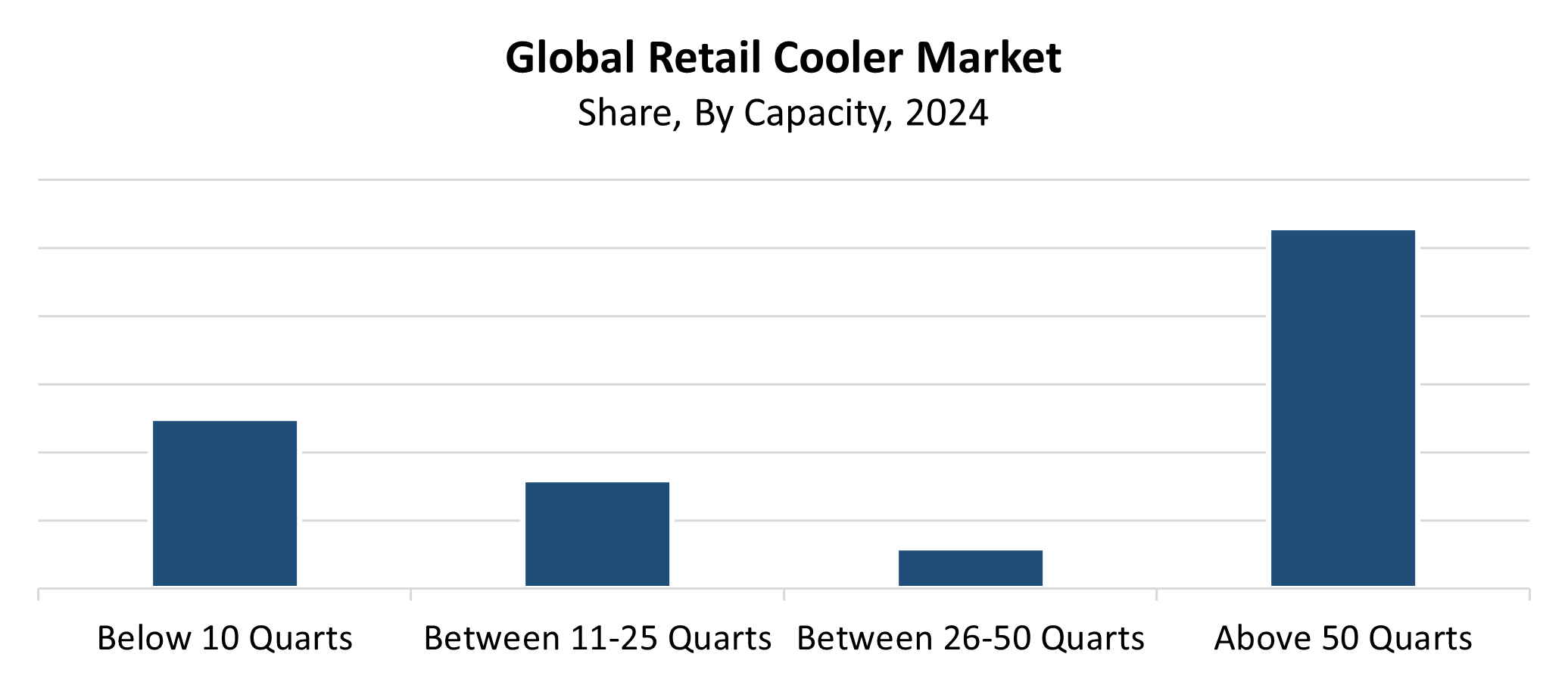

- In 2024, the above 50-quart segment had the highest market share by capacity, accounting for 53.74%.

- In 2024, the offline segment had the biggest market share by distribution channel, accounting for 82.67%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3.12 Billion

- 2035 Projected Market Size: USD 9.01 Billion

- CAGR (2025-2035): 10.12%

- North America: Largest market in 2024

The retail cooler market functions as an industry dedicated to creating and distributing refrigeration equipment for supermarkets and convenience stores, along with food establishments and specialty stores. These coolers function to hold and showcase perishable products, including beverages and dairy, as well as frozen foods and grab-and-go meals. The market expands because of the booming food and beverage sector, along with retail industry growth and consumer preference for fresh chilled products, and worldwide quick-service restaurant and convenience store proliferation. The need for proper retail cooling systems has grown because urbanization and changing consumer habits, together with increasing disposable income levels, have boosted packaged and frozen food consumption.

The retail cooler industry faces a major transformation because of technological advancements. Manufacturers dedicate funds to developing energy-saving models with digital temperature controls and environmentally friendly refrigerants, and connected smart coolers that provide remote monitoring and maintenance capabilities. The new advancements reduce operational costs and comply with worldwide environmental protection standards. Governments throughout the world enact regulations and give benefits to encourage the adoption of sustainable cooling systems that use advanced and efficient technology. Retail businesses receive help through programs that drive the switch to smart refrigeration systems that cut greenhouse gas emissions while eliminating dangerous HFC refrigerants.

Capacity Insights

The above 50-quart segment led the retail cooler market with the largest revenue share of 53.74% in 2024. The substantial demand for coolers with large storage space in food service facilities and supermarkets, and hypermarkets, which store dairy products and frozen foods, and beverages in bulk, stands as the primary reason for this market leadership. Commercial operations select these coolers because they provide long-lasting durability combined with advanced cooling performance and large storage capacity. The market continues to grow because convenience stores, along with organized retail and retail businesses, need bigger cold storage solutions. Technology improvements in temperature control and energy efficiency are creating rising international demand for retail coolers that handle large volumes.

The below-10-quart segment of the retail coolers market is anticipated to grow at the fastest CAGR throughout the forecast period. The rising consumer interest in compact cooling devices that serve individual users and small businesses, as well as portable applications including travel and outdoor, and workplace activities, drives this market expansion. Modern consumers embrace compact, lightweight coolers because convenience-based lifestyles continue to spread throughout urban areas. The growing popularity of e-commerce and online grocery delivery services requires better cooling units for brief storage needs. Today's consumers gravitate toward small-capacity coolers because manufacturers deliver innovative designs that enhance insulation while reducing energy consumption and creating modern aesthetics.

Distribution Channel Insights

The offline segment accounted for the largest revenue share of 82.67% and led the retail cooler market during 2024. The offline segment controls the retail cooler market primarily because physical stores, including supermarkets and appliance showrooms and specialized retail outlets, and hypermarkets, offer customers the opportunity to inspect product features along with dimensions and construction quality before purchasing. Offline channels deliver immediate product access along with post-sale support and installation services, which strongly influence buyer decisions, especially for big and commercial coolers. The segment's outstanding market position, together with its enduring market leadership throughout the world retail cooler industry, stems from its extensive dealer networks combined with brand-specific retail outlets operating throughout urban and semi-urban regions.

During the forecast period, the online segment of the retail cooler market is expected to grow at the fastest CAGR. The fast growth of e-commerce platforms, together with expanding internet access and changing consumer preferences for easy delivery options, explains the fast expansion. Online retail allows customers to quickly find suitable coolers because it offers an extensive selection of products at competitive prices, with customer feedback. Third-party marketplaces like Amazon, as well as Walmart and Alibaba, together with DTC brand websites, have expanded their reach, especially in rural and underdeveloped regions. Online retail cooler sales continue to grow because of advancements in supply chain management systems, together with diverse payment methods and discount programs.

Regional Insights

The retail cooler market in North America dominated the global industry with a 37.25% revenue share in 2024. This region holds dominance because of its advanced retail network and its strong consumer demand for packaged and refrigerated goods, combined with extensive adoption of energy-saving refrigeration technology. Commercial-grade cooler demand remains substantial because major grocery chains and convenience stores, and quick-service eateries thrive in both United States and Canadian markets. The demand for portable retail coolers has escalated because of increased road vacations and tailgating, and outdoor leisure activities. Market expansion occurs because of strong e-commerce penetration, together with rising consumer preference for eco-friendly products and technological improvements. The worldwide retail cooler market receives both innovation and income from North America, which remains a significant market leader.

Europe Retail Cooler Market Trends

The European retail cooler market maintained a substantial revenue share in 2024 because of strong requirements from the food and beverage and retail, and hospitality sectors. The region's focus on ecological technology, together with customer demand for fresh and chilled products, drives countries such as Germany UK, France, and Italy to lead the market. The market experienced increased growth because of environmentally friendly refrigerant implementation and EU regulations supporting energy-efficient, low-emission cooling systems. The growing number of convenience stores and cafés, and food delivery services across metropolitan areas has caused people to seek reliable portable cooling solutions. The global retail cooler market bases its importance on European environmental standards and innovative refrigeration technology development.

Asia Pacific Retail Cooler Market Trends

The Asia Pacific retail cooler market will experience a substantial CAGR during the forecast period because of quick urbanization, along with growing retail infrastructure and increasing consumer demand for packaged chilled food and beverages. The fast-growing retail sector, including supermarkets and convenience stores, food service outlets in China and India and Japan, and Southeast Asia, requires proper cooling solutions. Shifting lifestyles and higher disposable incomes, together with increased food safety awareness, drive the growing demand for retail coolers. Market growth receives support from government initiatives promoting energy-efficient appliances, together with increasing emphasis on cold chain logistics. The retail cooler sector in this region receives additional growth potential from the development of e-commerce and modern trade structures.

Key Retail Cooler Companies:

The following are the leading companies in the retail cooler market. These companies collectively hold the largest market share and dictate industry trends.

- Polar Bear Coolers

- The Coleman Company, Inc.

- Bison Coolers

- Lifoam Industries LLC

- Grizzly Coolers LLC

- Plastilite Corporation

- Huntington Solutions

- ORCA Coolers, LLC

- ICEE Containers Pty Ltd.

- YETI Holdings, Inc.

- Others

Recent Developments

- In June 2023, Cooler Screens, a digital retail media firm, announced the release of Cooler Health, a health-focused product. With this calculated action, the company hopes to increase its visibility in pharmacies, medical clinics, and other health-related settings. Cooler Screens creates smart screen software that replaces conventional glass doors in stores by displaying cooler doors.

- In May 2023, the American retailer Kroger announced that it is extending its collaboration with Cooler Screens to put digital smart screens in 500 of its locations nationwide.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the retail cooler market based on the below-mentioned segments:

Global Retail Cooler Market, By Capacity

- Below 10 Quarts

- Between 11-25 Quarts

- Between 26-50 Quarts

- Above 50 Quarts

Global Retail Cooler Market, By Distribution Channel

- Offline

- Online

Global Retail Cooler Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |