Global Retail Sourcing And Procurement Market

Global Retail Sourcing And Procurement Market Size, Share, and COVID-19 Impact Analysis, By Deployment (Cloud, On-premise), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Retail Sourcing And Procurement Market Summary

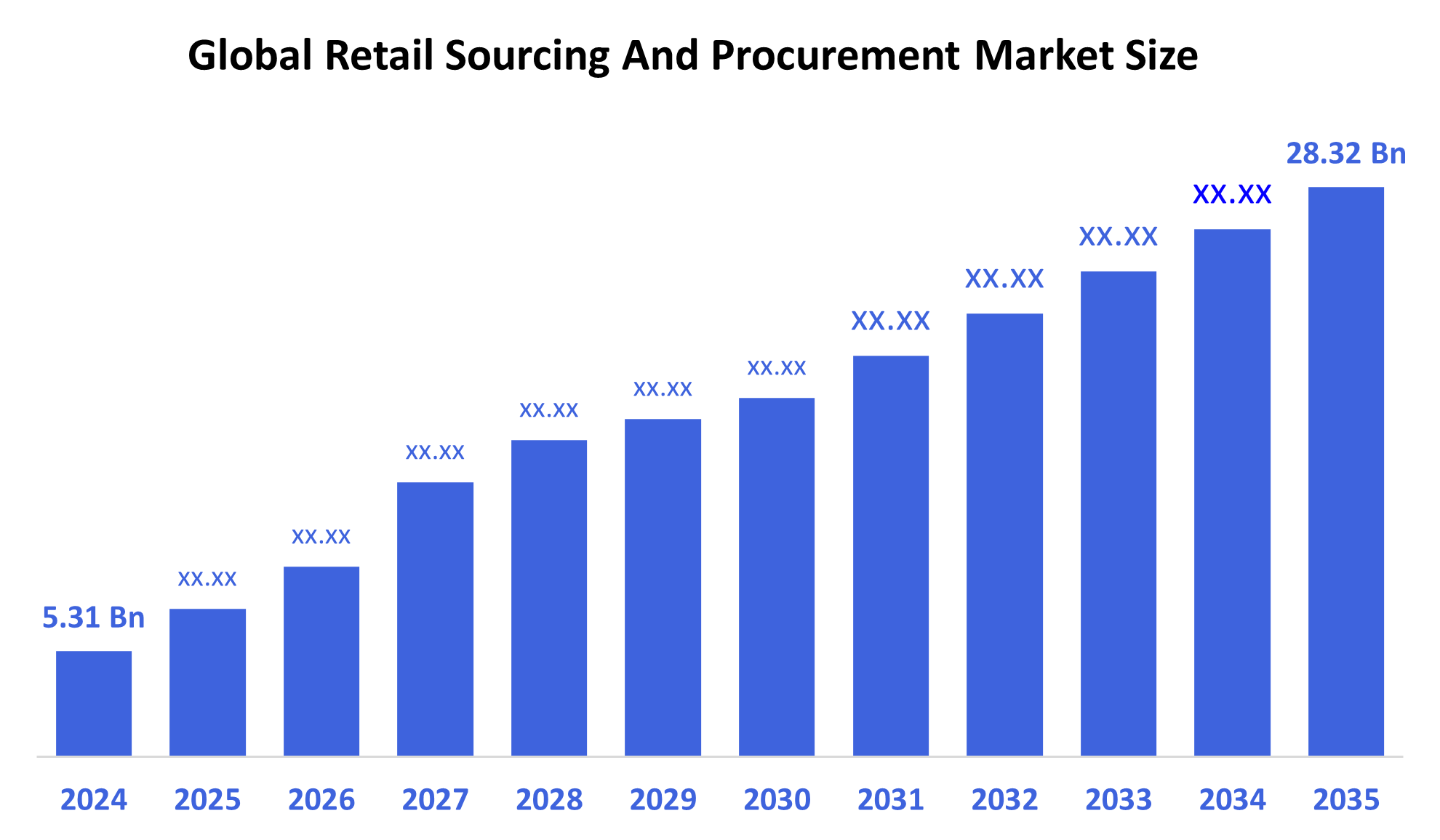

- The Global Retail Sourcing And Procurement Market Size Was Estimated at USD 5.31 Billion in 2024 and is Projected to Reach USD 28.32 Billion by 2035, Growing at a CAGR of 16.44% from 2025 to 2035.

- The growing complexity of global supply chains, the broad adoption of digital transformation, the growing demand for ethical and sustainable sourcing practices, the need for risk mitigation and cost optimization, the general increase in consumer demand, and the expansion of e-commerce are the main factors propelling the retail sourcing and procurement market.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 34.3% and dominated the market globally.

- In 2024, the crude oil segment had the highest market share by deployment.

- In 2024, the fixed roof segment had the biggest market share by enterprise size.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 5.31 Billion

- 2035 Projected Market Size: USD 28.32 Billion

- CAGR (2025-2035): 16.44%

- North America: Largest market in 2024

The Retail Sourcing and Procurement Market refers to the industry focused on the processes and systems retailers use to identify, evaluate, and acquire products and services from suppliers to meet consumer demand effectively. It encompasses supplier selection, contract negotiation, purchasing, and inventory management aimed at optimizing costs and ensuring timely delivery. The market is driven by the increasing complexity of global supply chains, the need for cost efficiency, and a growing emphasis on transparency and sustainability in procurement practices. Additionally, the surge in e-commerce and omnichannel retail models has heightened the demand for agile sourcing strategies that can quickly adapt to changing consumer preferences and market dynamics.

Technology is revolutionizing retail sourcing and procurement through enhanced supplier relationship management, automation, and real-time data analytics. AI, blockchain, cloud computing, and the Internet of Things are some of the technologies that are assisting merchants in improving supply chain visibility, guaranteeing product authenticity, and optimizing inventory levels. Additionally, governments all over the world are promoting sustainable sourcing methods and digital transformation projects through funding programs, incentives, and regulations. These programs further stimulate market expansion and innovation in the retail industry by fostering transparency, minimizing environmental effects, and encouraging ethical sourcing.

Deployment Insights

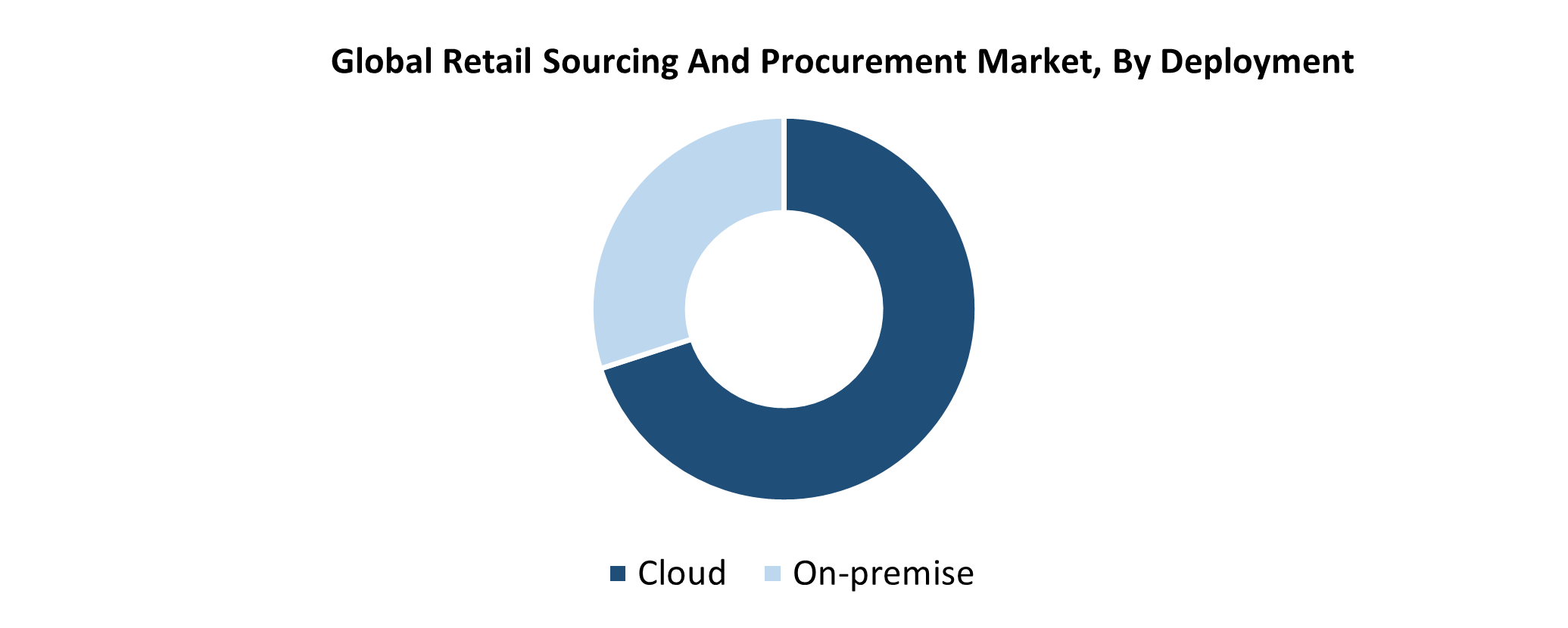

How did the Cloud Segment Achieve Market Leadership with the largest revenue share in the Retail Sourcing and Procurement Market in 2024?

In 2024, the retail sourcing and procurement market's greatest revenue share was held by the cloud segment. Because of their scalability, affordability, and simplicity of interaction with current retail systems, cloud-based solutions are preferred. Retailers can access real-time data, expedite procurement procedures, and improve supplier collaboration across borders with cloud deployment. Cloud systems also facilitate automation and advanced analytics, which aid companies in making better decisions and cutting down on operational inefficiencies. The increasing use of cloud technology, which offers better security and flexible, remote access, is also in line with retailers' digital transformation ambitions. The deployment environment for retail sourcing and procurement solutions is thus still dominated by the cloud segment.

The on-premise segment in the retail sourcing and procurement market is anticipated to advance at a substantial growth rate throughout the forecasted period. Despite the growing popularity of cloud solutions, many retailers continue to prefer on-premise deployments due to greater control over data security, customization, and compliance with internal policies. On-premise systems allow businesses to tailor procurement processes to their specific needs and maintain direct oversight of sensitive supplier and contract information. This preference is especially strong among large retail organizations with complex supply chains and stringent regulatory requirements. Additionally, investments in upgrading legacy infrastructure and integrating advanced technologies into on-premise setups are expected to drive significant growth in this segment.

Enterprise Size Insights

What Factors Enabled the large enterprise segment to capture the Largest Revenue Share in the Retail Sourcing and Procurement Market in 2024?

In 2024, the retail sourcing and procurement market's large enterprise segment held the largest revenue share. The significant procurement requirements of big retail companies that run intricate supply chains and operate in several locations are what propel this supremacy. To reduce expenses, improve supplier cooperation, and guarantee regulatory compliance, large businesses need advanced sourcing and procurement solutions. These companies also have larger budgets to spend on cutting-edge technology like analytics, automation, and artificial intelligence (AI), which enhance decision-making and procurement efficiency. Large businesses are positioned as major contributors to market revenue due to the size and complexity of their operations, and there is a constant need for integrated and adaptable procurement platforms to support international retail operations.

Over the course of the forecast period, the retail sourcing and procurement market's small and medium enterprises (SMEs) sector is anticipated to grow at the fastest CAGR. Advanced procurement solutions are being adopted by SMEs more frequently in an effort to improve supplier management, cut expenses, and streamline operations. Smaller merchants can now access technologies that were previously only available to larger businesses, due to the growing number of reasonably priced, cloud-based procurement platforms. In order to increase productivity, improve supply chain visibility, and maintain their competitiveness in the quickly changing retail market, SMEs are also concentrating on digital transformation. The market for SMEs is expanding quickly due to the rising need for flexible and scalable sourcing and procurement solutions.

Regional Insights

North America dominated the retail sourcing and procurement market, with the largest revenue share of 34.3% in 2024. The existence of significant retail companies, sophisticated IT infrastructure, and broad use of digital procurement solutions are all factors contributing to the region's dominance. Automation, artificial intelligence, and cloud-based platforms are being used more and more by North American retailers to streamline sourcing procedures, foster supplier cooperation, and increase supply chain transparency. Strong investments in omnichannel shopping and e-commerce have also increased the need for effective procurement systems. North America is positioned as a major force in the global retail sourcing and procurement market due to its emphasis on innovation and operational efficiency.

Europe Retail Sourcing and Procurement Market Trends

Europe held a significant revenue share in the worldwide retail sourcing and procurement market in 2024. The growing use of cutting-edge procurement technologies and the focus on ethical and sustainable sourcing methods are the main drivers of the region's expansion. European retailers are concentrating on cutting expenses, improving supply chain transparency, and adhering to strict legal requirements. Procurement process optimization is also being aided by digital transformation projects and the use of cloud-based solutions, automation, and artificial intelligence. The substantial market share of Europe is also a result of the robust presence of both big retail companies and an increasing number of SMEs implementing creative sourcing techniques. Europe is anticipated to continue playing a significant role in the global market environment as the retail industry develops.

Asia Pacific Retail Sourcing And Procurement Market Trends

Over the course of the forecast period, the retail sourcing and procurement market in Asia Pacific region is expected to expand at the fastest CAGR. The growing retail industry, increased digital use, and growing investments in cutting-edge procurement technology in emerging economies like China, India, and Southeast Asia are all contributing factors to this fast rise. Through creative sourcing strategies, retailers in the area are concentrating on improving supplier collaboration, cutting operational expenses, and optimizing supply chains. The industry is also expanding as more small and medium-sized businesses (SMEs) use cloud-based and AI-powered procurement systems. The growth trajectory of the retail sourcing and procurement industry in the Asia Pacific is further accelerated by government programs that encourage infrastructural development and digital transformation.

Key Retail Sourcing And Procurement Companies:

The following are the leading companies in the retail sourcing and procurement market. These companies collectively hold the largest market share and dictate industry trends.

- Cegid

- SAP SE

- International Business Machines Corporation

- Epicor Software Corporation

- Oracle

- Blue Yonder Group, Inc.

- Infor

- GEP

- Ivalua Inc.

- Proactis Holdings Limited

- Others

Recent Developments

- In August 2024, Costa Coffee revealed that it would automate its worldwide direct and indirect spending procurement process by utilizing the GEP SOFTWARE procurement platform. To help multinational corporations become more resilient, agile, competitive, and profitable, GEP SOFTWARE provides AI-enabled digital supply chain and procurement platforms.

- In June 2024, in collaboration with Burton Snowboards, Infor Nexus announced the release of the "Map and Trace" application, which facilitates the efficient mapping of suppliers, their suppliers, and transactional records that support the chain of custody.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the retail sourcing and procurement market based on the below-mentioned segments:

Global Retail Sourcing And Procurement Market, By Deployment

- Cloud

- On-premise

Global Retail Sourcing And Procurement Market, By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

Global Retail Sourcing And Procurement Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |