Global RF Filters Market

Global RF Filters Market Size, Share, and COVID-19 Impact Analysis, By Filter Type (SAW (Surface Acoustic Wave) Filters, BAW (Bulk Acoustic Wave) Filters), By End-use (Telecommunications, Automotive, Military & Defense, Consumer Electronics, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

RF Filters Market Summary

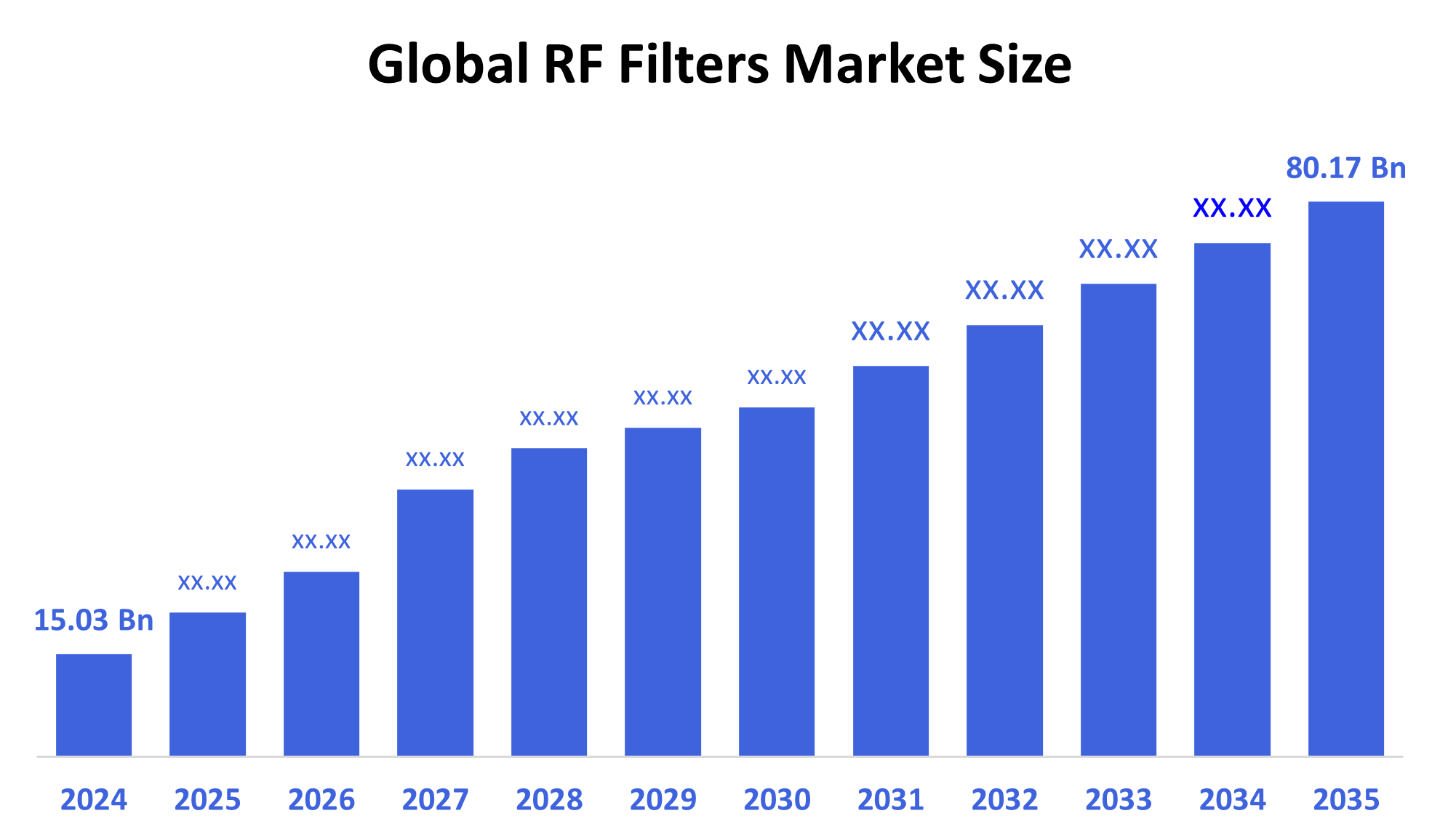

The Global RF Filters Market Size Was Estimated at USD 15.03 Billion in 2024 and is Projected to Reach USD 80.17 Billion by 2035, Growing at a CAGR of 16.44% from 2025 to 2035. The market for RF filters is expanding as a result of rising consumer demand for wireless gadgets like smartphones, the development of 5G networks and related infrastructure, and the spread of linked cars and the Internet of Things.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 38.3% and dominated the market globally.

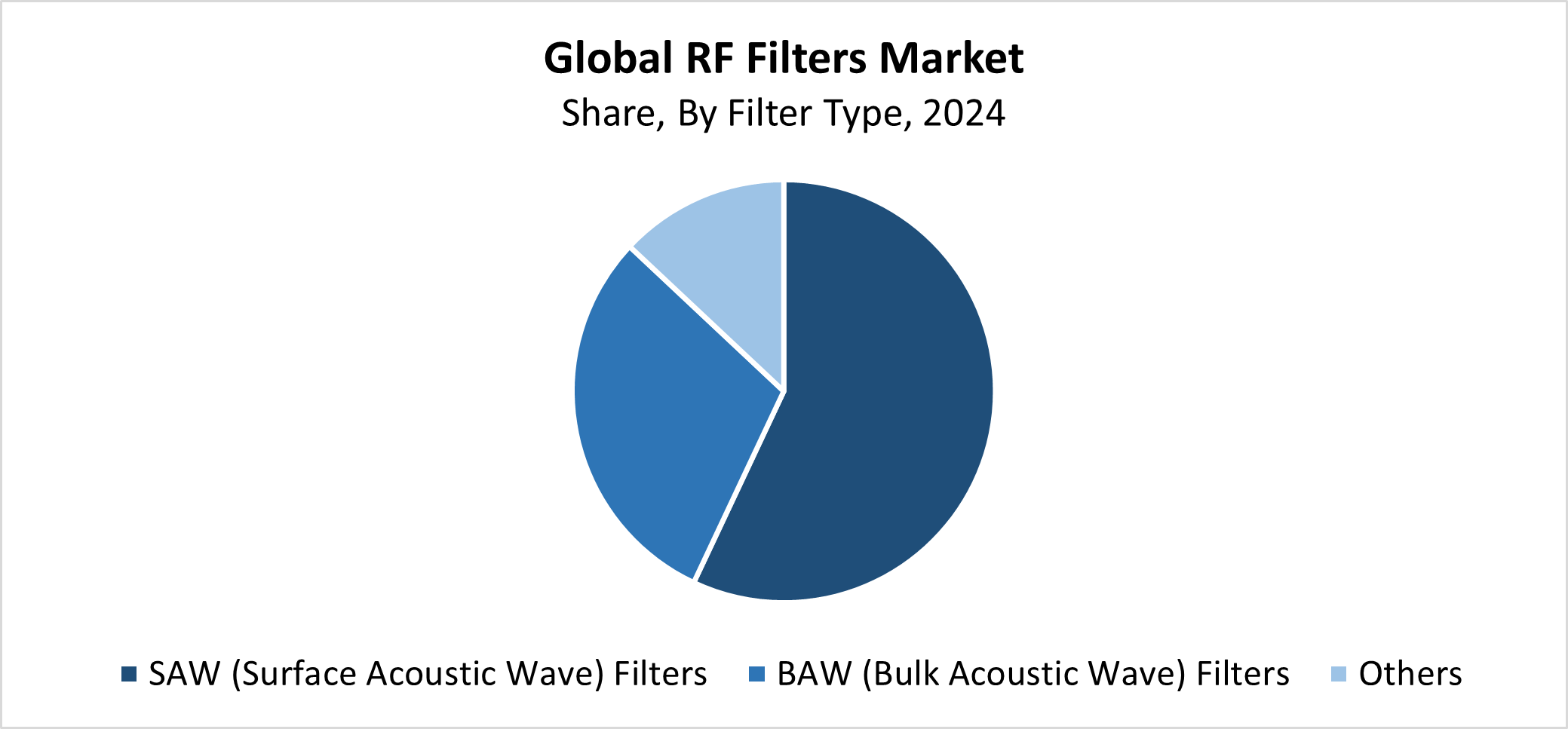

- In 2024, the surface acoustic wave (SAW) filters segment had the highest market share by type, accounting for 57.5%.

- In 2024, the telecommunications segment had the biggest market share by end use, accounting for 39.7%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 15.03 Billion

- 2035 Projected Market Size: USD 80.17 Billion

- CAGR (2025-2035): 16.44%

- Asia Pacific: Largest market in 2024

The RF (Radio Frequency) filters market operates within the electronics telecommunications sector, which produces devices to block specific frequencies while enhancing signal performance and decreasing wireless system interference. Base stations, along with cellphones, tablets, and various other wireless devices, rely on these filters as essential components. The industry experiences growth because of mobile device proliferation, coupled with 5G deployment and increasing requirements for advanced communication systems. The growing implementation of IoT devices across industrial automation, healthcare, and automotive sectors pushes the demand for sophisticated RF filters, which can manage complex signal frequencies effectively.

The RF filter market experiences substantial changes because of technological advancements that occur in the industry. Bulk acoustic wave (BAW) and surface acoustic wave (SAW) technologies enhance filter performance specifically for high-frequency 5G and Wi-Fi 6 network applications. Global market growth receives an extra boost from government-led 5G development programs, which allocate spectrum resources. Regional RF filter sectors develop stronger bases through government policies that promote domestic semiconductor manufacturing alongside research and development activities, particularly for the United States, China, and South Korea. These policies generate innovation while reducing dependence on international suppliers.

Filter Type Insights

In 2024 Surface Acoustic Wave (SAW) filters segment led the RF filters market by generating 57.5% of total revenue. The compact nature of SAW filters, along with their cost-effectiveness and excellent low-to-mid-frequency capabilities, has positioned them as a market leader for consumer electronics products, including smartphones and tablets. Their widespread application in 4G and future 5G mobile communication systems boosted the demand for these devices. Their manufacturing simplicity and straightforward integration methods helped them maintain their leading market position. The advancement of wireless communication technologies has maintained SAW filters as the preferred choice for OEMs needing superior filtering solutions within commercial and industrial RF front-end modules.

During the forecast period, the Bulk Acoustic Wave (BAW) filters segment of the RF filters market is anticipated to grow at the fastest CAGR. The quick growth stems from increasing requirements for advanced high-frequency filtering technologies in modern 5G and Wi-Fi 6/6E systems. BAW filters operate at superior frequencies and exhibit enhanced power handling and thermal stability when compared to SAW filters. The rising demand for efficient signal filtering, combined with increased bandwidth requirements in mobile devices and base stations, and Internet of Things devices, will drive the adoption of BAW filters. Next-generation wireless communication systems depend on these filters to meet their strict RF performance standards.

End Use Insights

The telecommunications segment dominated the RF filters market with the largest revenue share of 39.7% during 2024. The worldwide implementation of 4G and 5G networks, which need advanced RF filters for better signal quality and bandwidth efficiency, stands as the main reason behind this market leadership. Radio frequency filters (RF filters) perform essential functions in mobile devices and telecom infrastructure by separating specific frequency bands while filtering them to maintain clear communication. The market demand skyrocketed because of increasing smartphone adoption and advancements in wireless networks, and rising data consumption. The market segment will maintain its leadership position due to ongoing telecom operator investments in advanced network infrastructure, which drives continued demand for complex RF filtering solutions.

During the forecast period, the automotive segment within the RF filters market is anticipated to grow at the fastest CAGR. Modern vehicles utilize advanced wireless technology at a rapid pace because of V2X (vehicle-to-everything) communication along with GPS, Bluetooth, Wi-Fi, and 5G connectivity. The increasing need for sophisticated RF filters to manage complex signal environments shows itself as cars develop autonomous and connected capabilities. These filters play an essential role in ensuring reliable network connections without interference between external networks and multiple internal devices. The adoption rate of RF filters accelerates because of electric and smart vehicles, making the automotive industry a principal growth factor in the evolving RF filters market.

Regional Insights

The Asia Pacific RF filters market led globally with the largest revenue share of 38.3% in 2024. The main reason behind this market dominance stems from the robust electronics manufacturing base, which particularly thrives in China, Japan, South Korea, and Taiwan. High consumer goods and smartphone demand, together with fast 5G infrastructure deployment, have substantially driven RF filter adoption. The market expansion took shape through the efforts of major semiconductor and radio frequency component manufacturers in this territory. Asia Pacific will maintain its leadership position in the global RF filters market until the end of the forecast period because of continuous investment in advanced communication technologies and growing mobile usage and connected device development.

North America RF Filters Market Trends

The North American market for RF filters witnesses continuous growth because of quick 5G technology adoption and the increasing need for advanced wireless systems and connected device expansion. The area's strong telecom networks and big 5G investments from key carriers require advanced RF filters more and more. Market demand grows stronger because of the rising adoption of Internet of Things devices and autonomous vehicles, and intelligent residential systems. The United States tech giants, together with leading RF filter manufacturers, drive innovation and accelerate product development processes. The global RF filters market will maintain its strong growth through North America because of rising spectrum utilization and rising signal filtering needs during the projected period.

Europe RF Filters Market Trends

The European market for RF filters grows significantly because 5G networks expand, while IoT device usage increases, and vehicle electronics experience development. The adoption of RF filters in telecom applications is accelerated by the significant investments made by nations like Germany, the United Kingdom, and France in next-generation communication infrastructure. The automotive industry of Europe drives rapid integration of RF filters within both connected and autonomous vehicles. The region benefits from its dedication to smart city initiatives and industrial automation development, which drives demand for reliable RF components. Throughout the forecast period, regulatory bodies will push the European RF filters market toward continuous growth because of their requirements for improved spectrum efficiency and device performance standards.

Key RF Filters Companies:

The following are the leading companies in the RF filters market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom Inc.

- Akoustis Technologies Inc.

- Taiyo Yuden Co., Ltd.

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- Kyocera AVX Components Corporation

- Skyworks Solutions, Inc.

- Tai-Saw Technology Co., Ltd.

- Qorvo, Inc.

- Mitsubishi Electric Corporation

- Others

Recent Developments

- In June 2025, Qorvo introduced the QPQ3550, a compact high-rejection BAW filter, for 5G infrastructure.

- In June 2023, designed for Wi-Fi 7 access points, Broadcom unveiled FiFEM, the first wi-fi RF fem with filter integration in the world.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the RF filters market based on the below-mentioned segments:

Global RF Filters Market, By Filter Type

- SAW (Surface Acoustic Wave) Filters

- BAW (Bulk Acoustic Wave) Filters

- Others

Global RF Filters Market, By End Use

- Telecommunications

- Automotive

- Military & Defense

- Consumer Electronics

- Others

Global RF Filters Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 235 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |