Global Rheumatology Therapeutics Market

Global Rheumatology Therapeutics Market Size, Share, and COVID-19 Impact Analysis, By Disease (Rheumatoid Arthritis, Osteoarthritis, Gout, Ankylosing Spondylitis, Lupus, and Others), By Route of Administration (Oral, Injectable/Infusion, and Topical), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

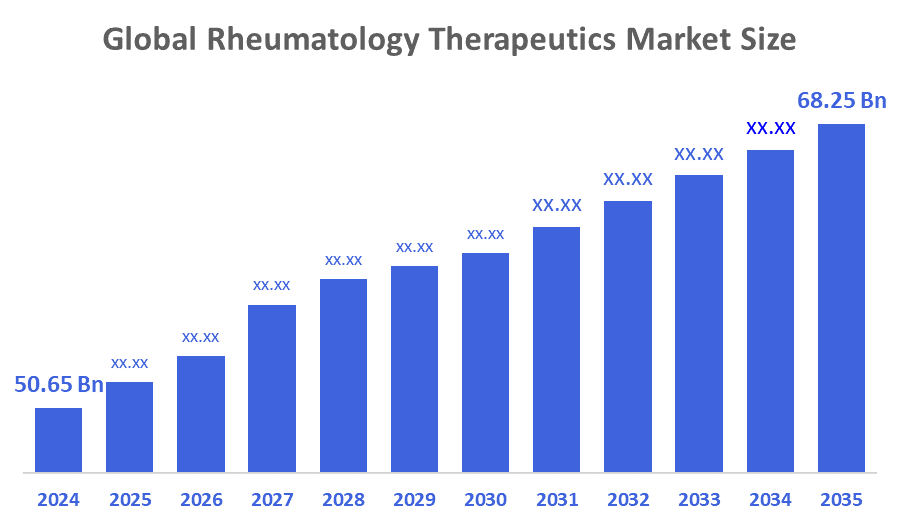

Global Rheumatology Therapeutics Market Size Insights Forecasts to 2035

- The Global Rheumatology Therapeutics Market Size Was Estimated at USD 50.65 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.75% from 2025 to 2035

- The Worldwide Rheumatology Therapeutics Market Size is Expected to Reach USD 68.25 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Rheumatology Therapeutics Market Size was worth around USD 50.65 Billion in 2024 and is predicted to Grow to around USD 68.25 Billion by 2035 with a compound annual growth rate (CAGR) of 2.75% from 2025 to 2035. The increasing incidence of autoimmune disorders, the expanding use of biologics, and the incorporation of cutting-edge technology, such as artificial intelligence, for individualised care, are the main drivers of market expansion.

Market Overview

The rheumatology therapeutics market is defined as the global industry that develops, manufactures, and distributes drugs and treatments aimed at managing rheumatic diseases, chronic, autoimmune, and inflammatory conditions affecting joints, muscles, and connective tissues. It includes disease-modifying anti-rheumatic drugs (DMARDs), biologics, NSAIDs, corticosteroids, uric acid–lowering agents, and emerging targeted therapies. Rheumatology is the medical science devoted to rheumatic diseases and musculoskeletal disorders. It is the study of autoimmune diseases and connective tissue diseases. Osteoarthritis, rheumatoid arthritis, seronegative spondyloarthropathy, crystal-induced arthritis, systemic lupus erythematosus, and vasculitis are different types of rheumatologic diseases. Rheumatic diseases are mainly seen in people over 50 years of age. Age, obesity, occupation, and past medical history are some of the risk factors for these diseases.

Elevara Medicines raised $70 million in a Series A round to advance its Phase 2 rheumatoid arthritis (RA) trial and broaden its pipeline of therapies for chronic inflammatory diseases. Elevara's planned Phase 2 clinical trial of its flagship candidate, ELV001, will be financed by the Series A revenues, which will also support exploratory projects in women's health and other chronic inflammatory disorders.

SetPoint Medical raised $140 million in private financing to commercialise its novel neuroimmune modulation therapy for rheumatoid arthritis (RA). This funding will accelerate the launch of the SetPoint System, a first-of-its-kind device-based therapy, and expand its pipeline into other autoimmune diseases.

Report Coverage

This research report categorises the rheumatology therapeutics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the rheumatology therapeutics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the rheumatology therapeutics market.

Driving Factors

The global rheumatology therapeutics market has been revitalised by the increasing prevalence of rheumatic disorders and the rising geriatric population in developed countries. A significant factor in this scenario is the increase in the number of new drug approvals and the growing investments in R&D. The growing ageing population in developed countries is expected to be the major driving force behind the global rheumatology therapeutics market. The rise in the prevalence of rheumatoid arthritis is thus motivating the increase in the size of the rheumatology therapeutics market. Investment in research to discover diseases, modify therapies, and personalised medicine approaches for rheumatoid arthritis is the major factor driving the rheumatology therapeutics market to expand. A better understanding of the unique genetics of each individual is bound to open up a range of opportunities for the rheumatology therapeutics market. Moreover, to address the complexities of immune-mediated diseases, vendors are working on combination therapies where two therapy agents are delivered in one package.

Restraining Factors

The market for rheumatology therapeutics is constrained by high drug prices, competition from biosimilars, safety issues, and restricted availability in developing nations. Despite significant advancements in biologics and targeted medicines, these obstacles hinder acceptance.

Market Segmentation

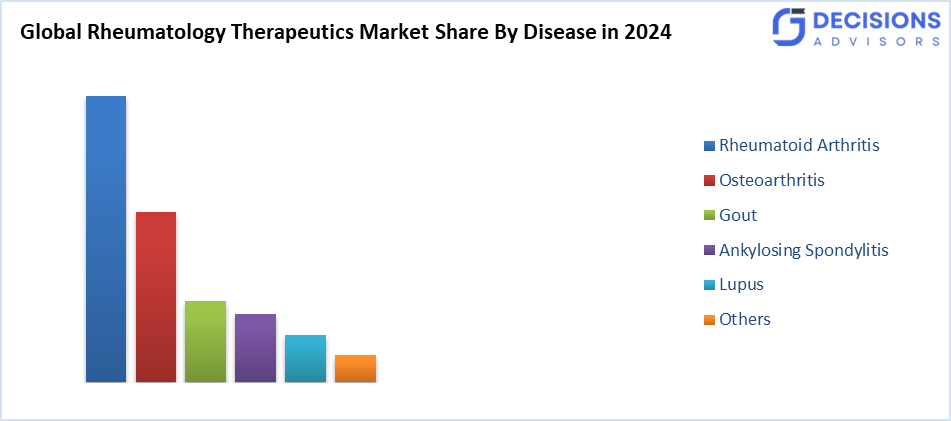

The rheumatology therapeutics market share is classified into disease and route of administration.

- The rheumatoid arthritis segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the disease, the rheumatology therapeutics market is divided into rheumatoid arthritis, osteoarthritis, gout, ankylosing spondylitis, lupus, and others. Among these, the rheumatoid arthritis segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This increase contributes to the higher incidence of therapy acceptance. Besides that, the wealthy countries have changed the reimbursement channels to help those patients who are eligible to be in the treat, to, target category, thus probably to keep prescription volumes and long-term disease, control plans.

- The oral segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the route of administration, the rheumatology therapeutics market is divided into oral, injectable/infusion, and topical. Among these, the oral segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The convenience of administering the treatment at home not only supports compliance but also saves time as it greatly reduces the number of visits to the clinic. In addition, the JAK inhibitors, such as tofacitinib, baricitinib, and upadacitinib, were progressively used over the different indications of inflammatory arthritides and should therefore result in continued oral use with a fast onset of effect and ease of dosing.

Regional Segment Analysis of the Rheumatology Therapeutics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the rheumatology therapeutics market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the rheumatology therapeutics market over the predicted timeframe. The increased awareness of the disease has resulted in a significant acceleration of the regulatory approvals. The total consumption of the therapies in the region is thus anticipated to rise at a more rapid pace with the larger middle-class populations and access to biologics due to price regulation and the inclusion of reimbursement.

China is the major contributor to the accelerated pace of growth in the Asia-Pacific region, which is largely a result of the expanded healthcare coverage and local biologic production. In 2024, the Chinese Rheumatology Association (CRA) estimated that close to the adult population in China has rheumatoid arthritis, with lifestyle and metabolic-related causes attributed. Moreover, more rheumatology training centres are being established in big hospitals, and the use of AI-based diagnostic imagery is expected to greatly propel the market in the subsequent years.

North America is expected to grow at a rapid CAGR in the Rheumatology Therapeutics market during the forecast period. The region's success can be mainly attributed to robust patient advocacy networks and a relatively straightforward approval process by the FDA for biologic and biosimilar drugs. The American College of Rheumatology (ACR) clinical guidelines, which advocate for early intervention and combination therapy, have been a significant factor in ramping up prescription volumes and biologic use retention. Moreover, the presence of top-notch healthcare facilities and high rates of autoimmune diagnoses gives the region a further push.

The United States is essentially the engine of innovation in rheumatology therapeutics, which is the main driver of North America. Furthermore, as more and more patients get access to digital therapeutics, uninterrupted treatment becomes a major factor that paves the way for precision rheumatology and makes the U.S. the most attractive market for rheumatology therapeutics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the rheumatology therapeutics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AbbVie, Inc.

- Amgen, Inc.

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche AG

- Genentech, Inc.

- Johnson & Johnson Innovative Medicine

- Merck & Co., Inc.

- Novartis AG

- Pfizer, Inc.

- Sanofi

- Takeda Pharmaceutical Company Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Kyverna Therapeutics presented promising Phase 1 data for KYV?101 in rheumatoid arthritis (RA) at ACR Convergence 2025, showing strong safety and efficacy signals in patients with difficult-to-treat disease. The COMPARE trial consists of an open-label, randomised, controlled Phase 1/2 study designed to assess the efficacy of KYV, 101 versus the anti-CD20 monoclonal antibody rituximab in patients with anti, anti-anti-citrullinated protein antibody (ACPA), positive, treatment-refractory RA and moderate to high disease activity.

- In August 2025, the FDA approved the SetPoint System, a first-of-its-kind neuroimmune modulation device, for adults with moderate-to-severe rheumatoid arthritis (RA) who have not responded adequately to biologics or targeted synthetic DMARDs. This marks a major milestone in rheumatology, introducing a device-based therapy alongside traditional drug treatments.

- In November 2024, Johnson & Johnson showcased its leadership in rheumatology at ACR 2024 with 43 abstracts, highlighting new data across its pipeline. It includes investigational therapies like ipilimumab for Sjögren’s disease and TREMFYA® (guselkumab) for psoriatic arthritis.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the rheumatology therapeutics market based on the below-mentioned segments:

Global Rheumatology Therapeutics Market, By Product Type

- Rheumatoid Arthritis

- Osteoarthritis

- Gout

- Ankylosing Spondylitis

- Lupus

- Others

Global Rheumatology Therapeutics Market, By Application

- Oral

- Injectable/Infusion

- Topical

Global Rheumatology Therapeutics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global rheumatology therapeutics market?

The market was valued at USD 50.65 billion in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 68.25 billion by 2035.

- What is the CAGR for the forecast period?

The market is projected to grow at a CAGR of 2.75% from 2025 to 2035.

- Which disease segment dominates the market?

Rheumatoid arthritis held the largest share in 2024 and is expected to grow significantly.

- Which route of administration leads in revenue?

The oral segment accounted for the highest revenue in 2024 due to convenience and drugs like JAK inhibitors.

- Which region will grow the fastest?

North America is expected to grow at the fastest CAGR, driven by FDA approvals and strong healthcare infrastructure.

- What are the main growth drivers?

Rising prevalence of autoimmune disorders, ageing populations, new drug approvals, and R&D investments in biologics and personalised therapies.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Disease

- Market Attractiveness Analysis By Route of Administration

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increasing incidence of autoimmune disorders, the expanding use of biologics

- Restraints

- High drug prices, competition from biosimilars

- Opportunities

- The incorporation of cutting-edge technology, such as artificial intelligence

- Challenges

- Safety issues and restricted availability in developing nations

- Global Rheumatology Therapeutics Market Analysis and Projection, By Disease

- Segment Overview

- Rheumatoid Arthritis

- Osteoarthritis

- Gout

- Ankylosing Spondylitis

- Lupus

- Others

- Global Rheumatology Therapeutics Market Analysis and Projection, By Route of Administration

- Segment Overview

- Oral

- Injectable/Infusion

- Topical

- Global Rheumatology Therapeutics Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Rheumatology Therapeutics Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Rheumatology Therapeutics Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- AbbVie, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Amgen, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Bristol-Myers Squibb Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- F. Hoffmann-La Roche AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Genentech, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Johnson & Johnson Innovative Medicine

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Merck & Co., Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Novartis AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Pfizer, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sanofi

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Takeda Pharmaceutical Company Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Others

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- AbbVie, Inc.

List of Table

- Global Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- Global Rheumatoid Arthritis, Rheumatology Therapeutics Market, By Region, 2024-2035(USD Billion)

- Global Osteoarthritis, Rheumatology Therapeutics Market, By Region, 2024-2035(USD Billion)

- Global Gout, Rheumatology Therapeutics Market, By Region, 2024-2035(USD Billion)

- Global Ankylosing Spondylitis, Rheumatology Therapeutics Market, By Region, 2024-2035(USD Billion)

- Global Lupus, Rheumatology Therapeutics Market, By Region, 2024-2035(USD Billion)

- Global Others, Rheumatology Therapeutics Market, By Region, 2024-2035(USD Billion)

- Global Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- Global Oral, Rheumatology Therapeutics Market, By Region, 2024-2035(USD Billion)

- Global Injectable/Infusion, Rheumatology Therapeutics Market, By Region, 2024-2035(USD Billion)

- Global Topical, Rheumatology Therapeutics Market, By Region, 2024-2035(USD Billion)

- Global Rheumatology Therapeutics Market, By Topical, 2024-2035(USD Billion)

- North America Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- North America Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- U.S. Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- U.S. Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- Canada Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- Canada Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- Mexico Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- Mexico Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- Europe Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- Europe Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- Germany Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- Germany Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- France Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- France Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- U.K. Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- U.K. Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- Italy Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- Italy Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- Spain Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- Spain Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- Asia Pacific Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- Asia Pacific Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- Japan Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- Japan Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- China Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- China Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- India Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- India Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- South America Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- South America Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- Brazil Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- Brazil Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- The Middle East and Africa Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- The Middle East and Africa Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- UAE Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- UAE Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

- South Africa Rheumatology Therapeutics Market, By Disease, 2024-2035(USD Billion)

- South Africa Rheumatology Therapeutics Market, By Route of Administration, 2024-2035(USD Billion)

List of Figures

- Global Rheumatology Therapeutics Market Segmentation

- Rheumatology Therapeutics Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Rheumatology Therapeutics Market

- Top Winning Strategies, 2024-2035

- Top Winning Strategies, By Development, 2024-2035(%)

- Top Winning Strategies, By Company, 2024-2035

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Top Player Positioning, 2024

- Market Share Analysis, 2024

- Restraint and Drivers: Rheumatology Therapeutics Market

- Rheumatology Therapeutics Market Segmentation, By Disease

- Rheumatology Therapeutics Market For Rheumatoid Arthritis, By Region, 2024-2035 ($ Billion)

- Rheumatology Therapeutics Market For Osteoarthritis, By Region, 2024-2035 ($ Billion)

- Rheumatology Therapeutics Market For Gout, By Region, 2024-2035 ($ Billion)

- Rheumatology Therapeutics Market For Ankylosing Spondylitis, By Region, 2024-2035 ($ Billion)

- Rheumatology Therapeutics Market For Lupus, By Region, 2024-2035 ($ Billion)

- Rheumatology Therapeutics Market For Others, By Region, 2024-2035 ($ Billion)

- Rheumatology Therapeutics Market Segmentation, By Route of Administration

- Rheumatology Therapeutics Market For Oral, By Region, 2024-2035 ($ Billion)

- Rheumatology Therapeutics Market For Injectable/Infusion, By Region, 2024-2035 ($ Billion)

- AbbVie, Inc.: Net Sales, 2024-2035 ($ Billion)

- AbbVie, Inc.: Revenue Share, By Segment, 2024 (%)

- AbbVie, Inc.: Revenue Share, By Region, 2024 (%)

- Amgen, Inc.: Net Sales, 2024-2035 ($ Billion)

- Amgen, Inc.: Revenue Share, By Segment, 2024 (%)

- Amgen, Inc.: Revenue Share, By Region, 2024 (%)

- Bristol-Myers Squibb Company: Net Sales, 2024-2035 ($ Billion)

- Bristol-Myers Squibb Company: Revenue Share, By Segment, 2024 (%)

- Bristol-Myers Squibb Company: Revenue Share, By Region, 2024 (%)

- F. Hoffmann-La Roche AG: Net Sales, 2024-2035 ($ Billion)

- F. Hoffmann-La Roche AG: Revenue Share, By Segment, 2024 (%)

- F. Hoffmann-La Roche AG: Revenue Share, By Region, 2024 (%)

- Genentech, Inc.: Net Sales, 2024-2035 ($ Billion)

- Genentech, Inc.: Revenue Share, By Segment, 2024 (%)

- Genentech, Inc.: Revenue Share, By Region, 2024 (%)

- Johnson & Johnson Innovative Medicine: Net Sales, 2024-2035 ($ Billion)

- Johnson & Johnson Innovative Medicine: Revenue Share, By Segment, 2024 (%)

- Johnson & Johnson Innovative Medicine: Revenue Share, By Region, 2024 (%)

- Merck & Co., Inc.: Net Sales, 2024-2035 ($ Billion)

- Merck & Co., Inc.: Revenue Share, By Segment, 2024 (%)

- Merck & Co., Inc.: Revenue Share, By Region, 2024 (%)

- Novartis AG: Net Sales, 2024-2035 ($ Billion)

- Novartis AG: Revenue Share, By Segment, 2024 (%)

- Novartis AG: Revenue Share, By Region, 2024 (%)

- Pfizer, Inc: Net Sales, 2024-2035 ($ Billion)

- Pfizer, Inc: Revenue Share, By Segment, 2024 (%)

- Pfizer, Inc: Revenue Share, By Region, 2024 (%)

- Sanofi: Net Sales, 2024-2035 ($ Billion)

- Sanofi: Revenue Share, By Segment, 2024 (%)

- Sanofi: Revenue Share, By Region, 2024 (%)

- Takeda Pharmaceutical Company Limited: Net Sales, 2024-2035 ($ Billion)

- Takeda Pharmaceutical Company Limited: Revenue Share, By Segment, 2024 (%)

- Takeda Pharmaceutical Company Limited: Revenue Share, By Region, 2024 (%)

- Others: Net Sales, 2024-2035 ($ Billion)

- Others: Revenue Share, By Segment, 2024 (%)

- Others: Revenue Share, By Region, 2024 (%)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 264 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |