Global Rig Control System Market

Global Rig Control System Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Type (Hydraulic, Electric, and Pneumatic), By Application (Onshore and Offshore), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Rig Control System Market Summary, Size & Emerging Trends

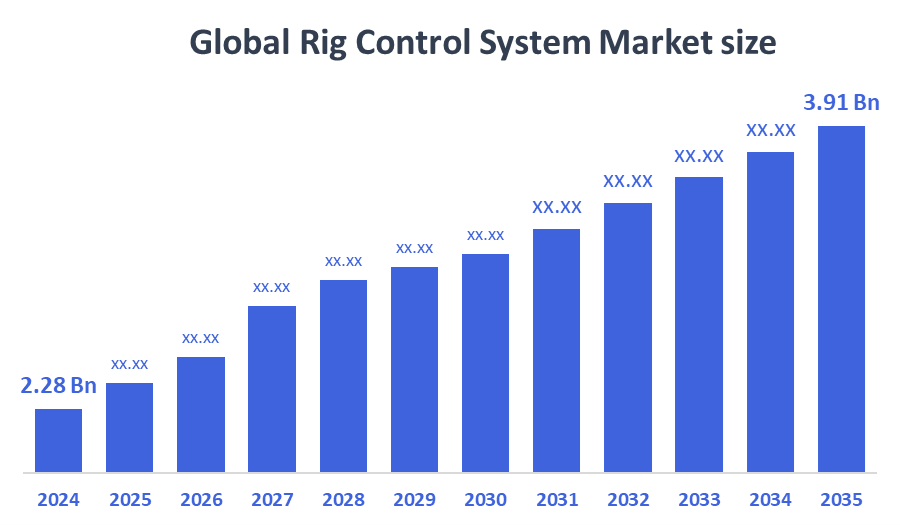

According to Decision Advisor, The Global Rig Control System Market Size is Expected to Grow from USD 2.28 Billion in 2024 to USD 3.91 Billion by 2035, at a CAGR of 5.03% during the forecast period 2025-2035. Increasing exploration and production activities, rising offshore drilling projects, and growing automation in drilling operations are key drivers for the rig control system market.

Key Market Insights

- North America is expected to account for the largest share in the rig control system market during the forecast period.

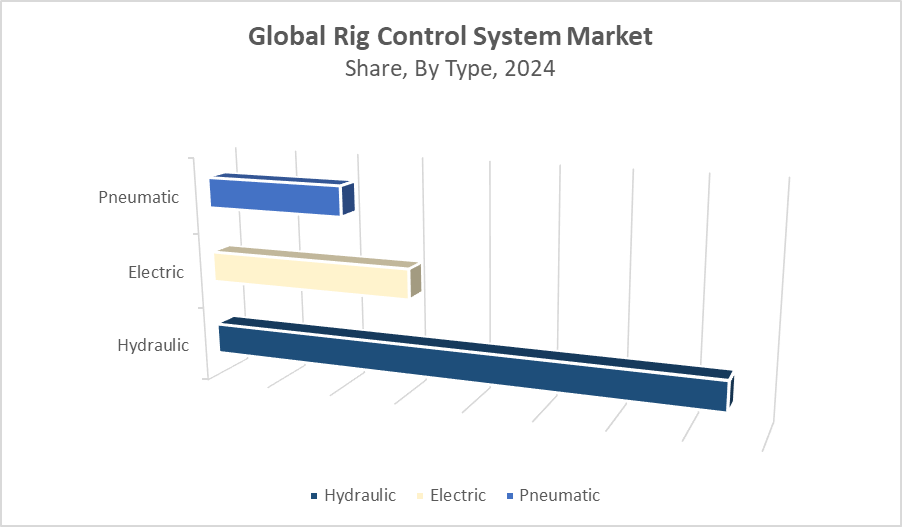

- In terms of type, hydraulic rig control systems hold the largest revenue share due to their reliability and wide usage.

- Onshore drilling applications dominate the market due to large-scale oil and gas extraction projects globally.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.28 Billion

- 2035 Projected Market Size: USD 3.91 Billion

- CAGR (2025-2035): 5.03%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Rig Control System Market

Rig control systems are essential in drilling rigs, managing key mechanical functions like hoisting, rotary motion, and mud circulation. These systems significantly improve operational efficiency, safety, and automation in drilling activities. The market growth is driven by increasing digitalization and automation trends within the oil and gas sector. Moreover, the rising number of deepwater and ultra-deepwater drilling projects worldwide further boosts demand. Leading companies are focusing on developing advanced rig control systems integrated with cutting-edge technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI). These innovations help optimize drilling precision, reduce operational downtime, and lower costs, making rig control systems indispensable for modern drilling operations. Overall, technological advancements and expanding exploration activities are key growth factors in this market.

Rig Control System Market Trends

- Increasing adoption of automation and digital control technologies.

- Development of remote monitoring and control systems enhancing operational safety.

- Growing integration of AI and machine learning for predictive maintenance and process optimisation.

- Rising demand for environmentally compliant and energy-efficient control systems.

Rig Control System Market Dynamics

Driving Factors: Rising offshore drilling activities and the shift toward automated

Rising offshore drilling activities and the shift toward automated, remote-controlled rigs significantly boost the rig control system market. Precise control is essential to enhance drilling efficiency, reduce operational hazards, and ensure safety. Regulatory focus on environmental protection and worker safety encourages investment in advanced rig control technologies. Together, these factors drive industry adoption of innovative control systems that improve operational accuracy and reduce downtime, making modern rigs more efficient and safer to operate in challenging environments.

Restraint Factors: Many mature oilfields still use legacy systems

High initial costs and complex maintenance requirements pose barriers to widespread adoption of rig control systems. Economic fluctuations, especially volatile oil prices, lead to reduced exploration budgets and delayed rig upgrades. Additionally, many mature oilfields still use legacy systems, which slows integration of newer technologies. These financial and operational challenges can limit market growth, particularly in regions where cost sensitivity and infrastructure constraints persist.

Opportunity: Increased oil and gas exploration

Emerging markets such as Southeast Asia and Africa are seeing increased oil and gas exploration, offering strong growth prospects for rig control systems. Technological innovations like cloud-based control platforms and AI integration enhance system efficiency, predictive maintenance, and remote monitoring capabilities. These advances open new avenues for market expansion by enabling smarter, more flexible rig operations and attracting investments aimed at modernizing drilling infrastructure globally.

Challenges: Ensuring the reliability of rig control systems in harsh

Ensuring the reliability of rig control systems in harsh, often unpredictable offshore environments is a critical challenge. Cybersecurity risks increase with the integration of connected and automated control systems, requiring robust protection. Additionally, the need to customise control solutions for various rig types and configurations adds complexity to product design and implementation. Overcoming these technical and security challenges is essential for market players to succeed.

Global Rig Control System Market Ecosystem Analysis

The global rig control system market ecosystem includes hardware manufacturers, software developers, drilling service providers, and end-users in upstream oil and gas sectors. Leading technology providers focus on integrating advanced automation, real-time data analytics, and safety features. Regulatory bodies emphasize compliance with environmental and safety standards, influencing system design and deployment. Strategic collaborations between technology firms and drilling operators drive innovation and market expansion.

Global Rig Control System Market, By Type

Hydraulic rig control systems accounted for approximately 35% of the global market share in 2024. These systems are widely used due to their proven reliability and robustness in harsh drilling environments, particularly in older and conventional rigs. Hydraulic systems provide strong mechanical force, making them ideal for heavy-duty operations where precision electronic controls might be less effective. Despite the rise of digital solutions, hydraulic systems maintain a significant presence, especially in regions with legacy drilling infrastructure or where ruggedness is prioritized over automation.

Electronic rig control systems dominated the market with around 55% market share in 2024. This segment’s growth is driven by the increasing demand for high precision, automation, and integration with advanced digital tools like IoT and AI. Electronic systems enable real-time data monitoring, remote operation, and better control accuracy, leading to improved drilling efficiency and safety. Their ease of integration with digital platforms makes them the preferred choice in modern rigs, especially in offshore and shale gas drilling operations. The trend toward digital oilfields further supports the expansion of this segment.

Global Rig Control System Market, By Application

The onshore segment accounted for approximately 60% of the global rig control system market share in 2024. This significant share is driven primarily by conventional oilfields and extensive shale gas exploration activities, especially in North America and parts of Asia Pacific. Onshore rigs benefit from rig control systems to improve drilling efficiency, safety, and automation, which are critical for cost-effective operations in mature and unconventional fields. The large number of active onshore drilling sites worldwide supports the dominance of this segment.

The offshore segment represented around 30% of the market share in 2024 but is the fastest-growing segment with a projected CAGR exceeding that of onshore drilling. The rapid growth is fueled by increasing deepwater and ultra-deepwater exploration and production projects, particularly in regions such as the Gulf of Mexico, North Sea, Brazil, and West Africa. Offshore rigs require advanced rig control systems for precise operation under challenging environmental conditions, including automated controls, real-time monitoring, and enhanced safety features. This rising demand for offshore exploration is expected to significantly boost the adoption of sophisticated rig control systems.

North America holds the largest market share with approximately 45% of the global rig control system market in 2024.

This dominance is driven primarily by the extensive oil and gas production activities in the United States and Canada. The region benefits from advanced drilling technologies and strong adoption of both electronic and hybrid rig control systems. The thriving shale gas exploration, mature conventional fields, and ongoing infrastructure upgrades contribute to steady demand for sophisticated rig control solutions. The presence of major oilfield service companies and continuous innovation also reinforce North America’s leading position in this market.

Europe accounts for around 20% of the market share in 2024, showing stable growth.

This is largely fueled by offshore drilling projects in the North Sea and other European waters, along with ongoing technological upgrades in existing rigs. Regulatory emphasis on safety and environmental standards in European countries also encourages adoption of advanced rig control systems. While the market is relatively mature, continuous modernization of offshore platforms and increased investment in deepwater exploration maintain steady demand.

Asia Pacific is the fastest-growing region, currently holding about 25% of the market share in 2024.

Rapid expansion in oil and gas exploration and production activities in countries like China, India, Indonesia, and Malaysia drives this growth. The region is witnessing significant investments in both onshore and offshore drilling operations, supported by government initiatives and rising energy demand. Increasing adoption of automation and digital drilling technologies enhances the market for rig control systems, positioning Asia Pacific for substantial growth during the forecast period.

WORLDWIDE TOP KEY PLAYERS IN THE RIG CONTROL SYSTEM MARKET INCLUDE

- Schlumberger (SLB)

- National Oilwell Varco (NOV)

- Halliburton

- Baker Hughes

- Siemens AG

- ABB Ltd.

- Honeywell International Inc.

- Rockwell Automation

- GE Power

- Transocean

- Others

Product Launches in the Rig Control System Market

- In December 2024, Epiroc released RCS 5.7, an update to their Rig Control System. This version introduced features like the Automatic Bit Changer with Teleremote support, allowing operators to change bits safely from the control room. Additionally, AutoDrill 2 was upgraded, enhancing rotary and DTH operations with improved air controls and hole cleaning for higher accuracy and efficiency.

- In February 2025, Orica Digital Solutions launched the AXIS Aligner™, a rig alignment tool that integrates into drilling workflows. It features a north-seeking gyro, ergonomic one-arm lift, and an innovative push-button clamping mechanism, enhancing safety and precision in rig alignment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the rig control system market based on the below-mentioned segments:

Global Rig Control System Market, By Type

- Hydraulic

- Electric

- Pneumatic

Global Rig Control System Market, By Application

- Onshore

- Offshore

Global Rig Control System Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Rig Control System Market in 2024?

A: The Global Rig Control System Market size was estimated at USD 2.28 billion in 2024.

Q: What is the projected market size by 2035?

A: The market is expected to reach USD 3.91 billion by 2035.

Q: What is the forecasted CAGR of the Global Rig Control System Market from 2025 to 2035?

A: The market is projected to grow at a CAGR of 5.03% during the forecast period.

Q: Which type of rig control system holds the largest market share?

A: Electronic rig control systems dominate the market with approximately 55% share in 2024, driven by their high precision, automation, and compatibility with digital technologies.

Q: What is the revenue share of hydraulic rig control systems?

A: Hydraulic rig control systems accounted for around 35% of the global market share in 2024 due to their reliability in harsh environments and use in conventional rigs.

Q: Which application segment leads the rig control system market?

A: The onshore segment leads with about 60% market share in 2024, supported by extensive shale gas exploration and conventional oilfield drilling.

Q: Which application segment is growing the fastest?

A: The offshore segment is growing the fastest, fueled by rising investments in deepwater and ultra-deepwater drilling in regions such as the Gulf of Mexico, Brazil, and West Africa.

Q: Which region had the largest market share in 2024?

A: North America held the largest market share (approx. 45%) in 2024, driven by active shale gas production and technological advancements in the U.S. and Canada.

Q: Which region is the fastest growing in the rig control system market?

A: Asia Pacific is the fastest-growing region, led by expanding oil & gas activities and digital transformation in China, India, and Southeast Asia.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 159 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |