Russia Agriculture Robots Market

Russia Agriculture Robots Market Size, Share, and COVID-19 Impact Analysis, By Type (Driverless Tractors, Unmanned Aerial Vehicles (UAVs), Milking Robots, Automated Harvest Robots, and Others), By Farming Type (Indoor Farming and Outdoor Farming), and Russia Agriculture Robots Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Russia Agriculture Robots Market Insights Forecasts to 2035

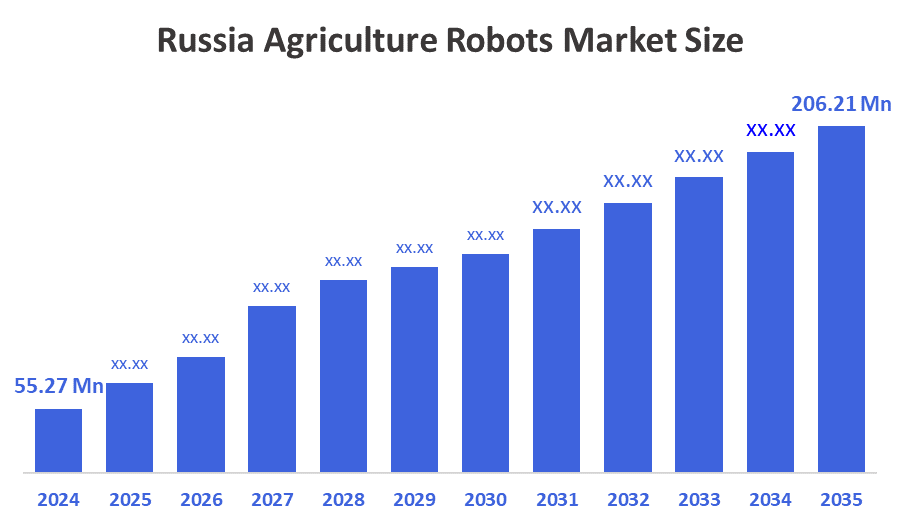

- The Russia Agriculture Robots Market Size Was Estimated at USD 55.27 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 12.72% from 2025 to 2035

- The Russia Agriculture Robots Market Size is Expected to Reach USD 206.21 Million by 2035

According to a research report published by Decision Advisors, the Russia Agriculture Robots Market Size is Anticipated to Reach 206.21 Million by 2035, growing at a CAGR of 12.72% from 2025 to 2035. The increasing need for prompt and effective delivery is another factor driving market expansion. Customers in Russia are expecting their goods to be delivered precisely and promptly, which has led to an increase in demand for quick and efficient delivery.

Market Overview

Agricultural robots, sometimes referred to as agribots or agri-robots, are devices designed to automate or partially automate specific agricultural tasks. Crop planting, harvesting, monitoring, and spraying are among the tasks these robots may perform. In addition to lowering the need for manual labor and enhancing farmer working conditions, these robots are being designed to boost agricultural productivity, accuracy, and efficiency. They employ state-of-the-art technologies, including artificial intelligence (AI) and computer vision. In Russia, precision farming techniques are quickly becoming popular as farmers look to maximize crop yields while reducing resource waste. Agricultural robots with sophisticated sensors, data analytics, and AI algorithms are essential in this situation. By utilizing real-time data to optimize resource utilization and promote crop health, these robots enable accurate and focused agricultural operations. Russian farmers can increase production and efficiency in their farming operations by adopting precision farming methods and employing agricultural robots.

Report Coverage

This research report categorizes the market for the Russia agriculture robots market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia agriculture robots market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia agriculture robots market.

Driving Factors

Artificial intelligence (AI), machine learning, and robots are just a few of the rapidly developing technologies that Russia's agriculture industry stands to gain from. Agricultural robots in Russia have the potential to become more complex, intelligent, and capable of carrying out a variety of activities with more precision and efficiency as technology develops. The country's market for agricultural robots is anticipated to benefit greatly from these developments. Russia's agriculture industry faces severe manpower shortages, which have raised demand for agricultural robots as a practical way to lessen reliance on manual labor. As a way to lessen reliance on physical labor, this aspect has raised demand for agricultural robots.

Tariff Impact on Russia’s Agriculture Robot Market

Tariffs on imported agricultural robotics and precision farming technologies have significantly raised costs for Russian agritech firms. This has slowed the adoption of advanced solutions such as autonomous tractors, drone-based crop monitoring, and robotic harvesters. Domestic alternatives often lack the sophistication, durability, and AI capabilities of foreign systems.

Impact of Russia-Ukraine War on Agriculture Robots Market

The Russia-Ukraine war has disrupted agricultural supply chains and delayed modernization efforts across the region. Sanctions and geopolitical tensions have restricted imports of key components like sensors, chips, and software used in agricultural robots. Rising fuel prices and labor shortages have increased the demand for automation, but investment in robotics has stalled due to economic uncertainty.

Restraining Factors

Farmers, especially those operating on a small scale, may find it challenging to purchase agricultural robots in Russia due to their high initial cost. The general adoption of these systems among farmers who might not have the financial means to invest in them is limited by the unreasonably high costs of acquiring, maintaining, and integrating the necessary robotics technology and equipment.

Market Segmentation

The Russia agriculture robots market share is classified into type and farming types.

- The unmanned aerial vehicles (UAVs) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia agriculture robots market is segmented by type into driverless tractors, unmanned aerial vehicles (UAVs), milking robots, automated harvest robots, and others. Among these, the unmanned aerial vehicles (UAVs) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Their versatility in crop monitoring, spraying, and mapping across vast agricultural landscapes makes them highly valuable. UAVs are cost-effective, scalable, and well-suited to Russia’s large open-field farming operations, which has driven their widespread adoption.

- The outdoor farming segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia agriculture robots market is segmented by farming types into indoor farming and outdoor farming. Among these, the and outdoor farming segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to Russia’s extensive arable land and traditional reliance on open-field agriculture. Technologies like autonomous tractors and UAVs are more applicable in outdoor settings, where large-scale operations benefit most from automation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia agriculture robots market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Agrobot

- Naïo Technologies

- Ecorobotix

- Autonomous Tractor Corporation

- CNH Industrial

- Kubota Corporation

- Yanmar Holdings

- Small Robot Company

- Agribotix

- Blue River Technology

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Russia agriculture robots market based on the below-mentioned segments:

Russia Agriculture Robots Market, By Type

- Driverless Tractors

- Unmanned Aerial Vehicles (UAVs)

- Milking Robots

- Automated Harvest Robots

- Others

Russia Agriculture Robots Market, By Farming Type

- Indoor Farming

- Outdoor Farming

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 212 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |