Russia Distributed Control System (DCS) Market

Russia Distributed Control System (DCS) Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By Architecture (Centralized Controller Systems, Hybrid / Distributed Hybrid Systems, and Fully Redundant High-Availability Systems), and Russia Distributed Control System (DCS) Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Russia Distributed Control System (DCS) Market Insights Forecasts to 2035

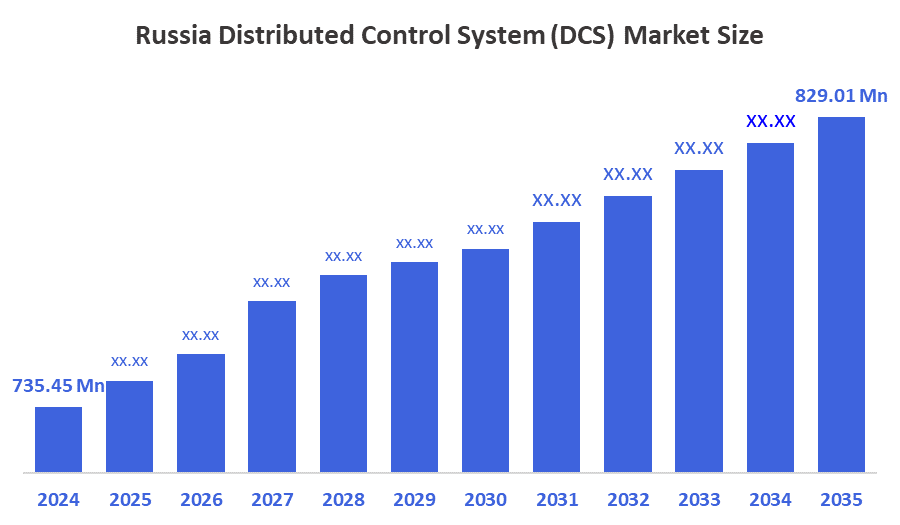

- The Russia Distributed Control System (DCS) Market Size Was Estimated at USD 735.45 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 1.09% from 2025 to 2035

- The Russia Distributed Control System (DCS) Market Size is Expected to Reach USD 829.01 Million by 2035

According to a research report published by Decision Advisors, the Russia Distributed Control System (DCS) Market size is Anticipated to Reach 829.01 Million by 2035, growing at a CAGR of 1.09% from 2025 to 2035. In Russia's automation landscape, the transition to modular and flexible DCS designs is opening up new growth opportunities. Because traditional DCS solutions are frequently centralized and complicated, installation and scaling are expensive and time-consuming.

Market Overview

The Russia DCS market encompasses hardware, software, and services used to automate and monitor industrial processes through distributed control networks. These systems allow real-time data acquisition, process optimization, and centralized supervision across multiple plant units. DCS solutions are vital for industries requiring continuous operations, safety, and scalability, especially in Russia’s energy and manufacturing sectors. A computer-based control system called a Distributed Control System (DCS) is frequently used to monitor and automate industrial processes. In order to facilitate communication and coordination in the automation of diverse processes, it consists of a network of controllers dispersed across industrial facilities. DCS systems are used in many different industries, such as the food and beverage, chemical, petrochemical, pharmaceutical, and power generation sectors.

Report Coverage

This research report categorizes the market for the Russia distributed control system (DCS) market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia distributed control system (DCS) market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia distributed control system (DCS) market.

Driving Factors

As a strategic goal, industrial automation is being actively promoted by the Russian federal government. The government stated in March 2025 that domestic producers of automation systems and production equipment would get subsidies of RUB 4.62 billion (~US$53 million) for the year. The state is also focusing on the development of domestic automation platforms and performance measures for integrated control systems under the national "Production and Automation Systems" project. These regulations lower the financial barriers to DCS platform adoption and encourage end users and local system integrators to modernize current facilities with cutting-edge distributed control technologies.

Tariff Impact on Russia’s Distributed Control System (DCS) Market

Tariffs on imported DCS components, such as controllers, sensors, and software, have increased costs for Russian industries. This has made it harder for manufacturers to upgrade legacy systems or adopt advanced automation platforms. Domestic alternatives often lack the integration and scalability of global brands, limiting modernization efforts.

Impact of Russia-Ukraine War on Distributed Control System (DCS) Market

The Russia-Ukraine war has disrupted industrial supply chains and delayed infrastructure projects across energy, mining, and manufacturing sectors. Sanctions have restricted access to Western technologies and engineering services critical for DCS deployment. While demand for automation remains strong, economic uncertainty and limited imports have slowed investment in new control systems.

Restraining Factors

The potential of cyber threats has grown to be a major issue in Russia as DCS platforms become increasingly networked and digitally connected. Cyberattacks on industrial control systems have the potential to compromise sensitive operational data, interfere with production, and affect vital infrastructure, especially in the manufacturing, chemical, and energy industries.

Market Segmentation

The Russia distributed control system (DCS) Market share is classified into component and architecture.

- The hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia distributed control system (DCS) market is segmented by component into hardware, software, and services. Among these, the hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Controllers, I/O modules, and field devices are essential for real-time process control, especially in energy and manufacturing sectors. With ongoing infrastructure upgrades, demand for robust and scalable hardware remains dominant.

- The hybrid / distributed hybrid systems segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia distributed control system (DCS) market is segmented by architecture into centralized controller systems, hybrid / distributed hybrid systems, and fully redundant high-availability systems. Among these, the hybrid / distributed hybrid systems segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their flexibility in integrating legacy systems with modern automation platforms. These systems allow decentralized control while maintaining centralized oversight, making them ideal for Russia’s large-scale oil & gas and power generation facilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia Distributed Control System (DCS) market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens AG

- ABB Ltd.

- Honeywell International Inc.

- Emerson Electric Co.

- Schneider Electric SE

- Yokogawa Electric Corporation

- Rockwell Automation

- General Electric (GE)

- Azbil Corporation

- Metso Automation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Russia Distributed Control System (DCS) Market based on the below-mentioned segments:

Russia Distributed Control System (Dcs) Market, By Component

- Hardware

- Software

- Services

Russia Distributed Control System (Dcs) Market, By Architecture

- Centralized Controller Systems

- Hybrid / Distributed Hybrid Systems

- Fully Redundant High-Availability Systems

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 212 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |