Russia Industrial Process Automation Market

Russia Industrial Process Automation Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By End User (Oil & Gas, Chemicals & Refining, Energy & Power, Pulp & Paper, Metals & Mining, Pharma, & Others), and Russia Industrial Process Automation Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Russia Industrial Process Automation Market Insights Forecasts to 2035

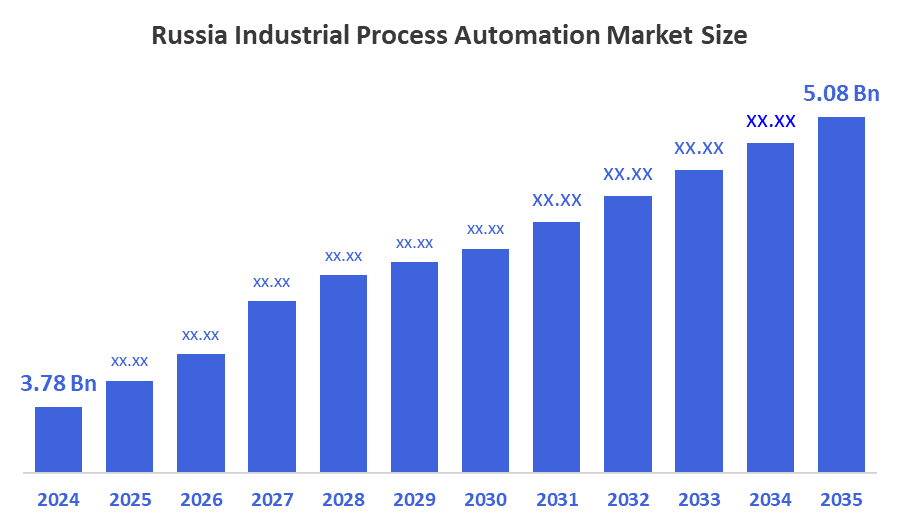

- The Russia Industrial Process Automation Market Size Was Estimated at USD 3.78 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 2.72% from 2025 to 2035

- The Russia Industrial Process Automation Market Size is Expected to Reach USD 5.08 Billion by 2035

According to a research report published by Decision Advisors, the Russia Industrial Process Automation Market size is anticipated to reach 5.08 billion by 2035, growing at a CAGR of 2.72% from 2025 to 2035. The demand for industrial automation is further fueled by growing investment in Russia's semiconductor sector. In order to increase accuracy, productivity, and yield in semiconductor production, automation technologies are essential for wafer processing, lithography, and quality control.

Market Overview

The Russia industrial process automation market refers to the sector focused on deploying technologies and systems that automate industrial operations across key industries such as oil & gas, power generation, chemicals, mining, and manufacturing. The growth of Russia's oil industry is propelling the use of industrial process automation as businesses look for more accuracy, safety, and efficiency in their exploration, drilling, and refining processes. The need for automation technologies to improve wafer processing, lithography, and quality control while also increasing manufacturing efficiency and precision is being driven by growing investment in the semiconductor sector.

Report Coverage

This research report categorizes the market for the Russian industrial process automation market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russian industrial process automation market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russian industrial process automation market.

Driving Factors

The market for industrial process automation is being driven by Russia's expanding oil industry, which is seeking increased operational precision, efficiency, and safety. In order to lower errors, improve efficiency, and cut expenses, automation technologies are being used more and more in the drilling, refining, and exploration processes. Russia produced 6,122 TWh of oil in 2024, according to the 2025 Energy Institute Statistical Review of World Energy. The industry's growth speeds up the implementation of automation to maximize output, improve sustainability, and preserve operational effectiveness. According to CNews, the Russian government set aside more than USD 2.54 billion in 2024 to develop indigenous raw materials, CAD tools, and semiconductor equipment. This investment promotes the use of automation to improve manufacturing capabilities, cut expenses, and streamline production.

Tariff Impact on Russia’s Agriculture Robot Market

Tariffs on imported automation equipment, such as PLCs, sensors, drives, and control software—have raised operational costs for Russian industries. This has especially affected sectors like oil & gas, chemicals, and manufacturing, which rely heavily on foreign technologies for precision and scalability. Domestic alternatives often lack the sophistication and reliability of Western systems, slowing the pace of automation upgrades.

Impact of Russia-Ukraine War on Industrial process automation Market

The Russia-Ukraine war has severely disrupted supply chains and led to the loss of skilled automation professionals across Russian industries. Sanctions have restricted access to critical components and software from Western suppliers, forcing companies to rely on “gray market” solutions or outdated systems. While demand for automation remains strong, driven by labor shortages and efficiency goals, economic uncertainty and geopolitical isolation have stalled investment and innovation.

Restraining Factors

The prolonged conflict in Russia poses serious obstacles to the expansion of the Russian industrial process automation sector. Businesses are reluctant to implement cutting-edge automation technology due to supply chain disruptions, funding obstacles, and uncertainty caused by geopolitical instability. Despite high sectoral demand, these circumstances impede market growth.

Market Segmentation

The Russia Industrial process automation market share is classified into component and technology.

- The hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia Industrial process automation market is segmented by component into hardware, software, and services. Among these, the hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In Russia, industries like oil & gas and mining require rugged, scalable hardware to operate in harsh environments. The need for reliable physical infrastructure drives consistent investment in automation hardware.

- The oil & gas segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia Industrial process automation market is segmented by end user into oil & gas, chemicals & refining, energy & power, pulp & paper, metals & mining, pharma, & others. Among these, the oil & gas segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to Russia’s global position as a leading energy producer. Automation is critical for optimizing drilling, refining, and pipeline operations, especially in remote and hazardous regions. The sector’s demand for safety, efficiency, and real-time monitoring makes it the top consumer of industrial automation solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia Industrial process automation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- Emerson Electric Co.

- Honeywell International Inc.

- Rockwell Automation

- Yokogawa Electric Corporation

- General Electric (GE)

- Omron Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Russia Industrial process automation market based on the below-mentioned segments:

Russia Industrial Process Automation Market, By Component

- Hardware

- Software

- Services

Russia Industrial Process Automation Market, By End User

- Oil & Gas

- Chemicals & Refining

- Energy & Power

- Pulp & Paper

- Metals & Mining

- Pharma

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |