Russia Real Estate Market

Russia Real Estate Market Size, Share, and COVID-19 Impact Analysis, By Property Type (Residential, Commercial, Land, and Industrial), By Ownership (Owner-occupied Properties, Rental Properties, and Co-ownership), and Russia Real Estate Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Russia Real Estate Market Insights Forecasts to 2035

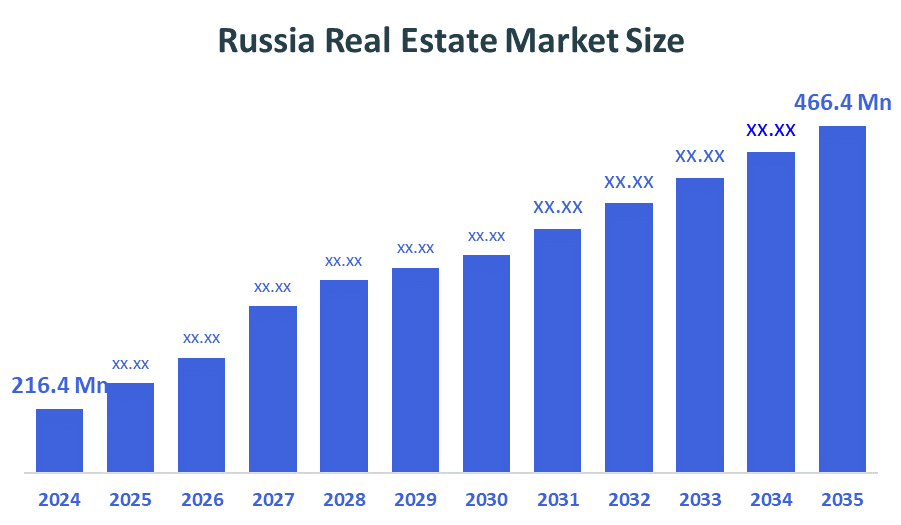

- The Russia Real Estate Market Size Was Estimated at USD 216.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of 7.28% from 2025 to 2035

- The Russia Real Estate Market Size is Expected to Reach USD 466.4 Million by 2035

According to a research report published by Decision Advisors, the Russia Real estate Market Size is Anticipated to Reach 466.4 Million by 2035, growing at a CAGR of 7.28% from 2025 to 2035. The market for trash management is expanding due to the increase in garbage production. The amount of garbage generated rises with population growth and shifting consumption habits, calling for more effective and efficient real estate techniques.

Market Overview

The Russia real estate market is undergoing a transformation driven by urban expansion, infrastructure modernization, and evolving consumer preferences. Despite geopolitical challenges, demand remains strong in residential, commercial, and industrial segments. Government initiatives and digitalization are reshaping property transactions and development strategies. The dynamics of the market are also influenced by a variety of professional services, such as those offered by property managers and real estate brokers. The real estate market is a dynamic landscape where various stakeholders engage in activities that shape urban settings, foster economic growth, and provide investment opportunities. These elements are influenced by economic trends, demographic shifts, and regulatory issues.

Report Coverage

This research report categorizes the market for the Russia real estate market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia real estate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia real estate market.

Driving Factors

Key drivers propelling the Russia Real Estate Market include increasing urbanization and infrastructure development across major cities, supporting both residential and commercial construction growth. Government initiatives promoting affordable housing and mortgage subsidies are encouraging homeownership, while foreign investments in premium real estate segments continue to stimulate market activity. The growing demand for logistics and industrial spaces, driven by e-commerce expansion, further contributes to the sector’s steady performance.

Tariff Impact on Russia’s Agriculture Robot Market

Import tariffs on construction materials, machinery, and equipment have raised overall project costs, particularly for large-scale and high-rise developments reliant on imported building technologies. This has prompted construction companies to seek local alternatives and source domestically produced materials to mitigate cost pressures.

Impact of Russia-Ukraine War on Real estate Market

The Russia-Ukraine conflict has created significant uncertainties in investment flows and increased construction delays due to supply chain disruptions affecting steel, cement, and key building components. Sanctions and restricted access to Western financing have impacted large commercial and infrastructure projects, leading developers to rely more on domestic banks and investors.

Restraining Factors

Restraining factors in the Russia Real Estate Market include high construction costs resulting from import tariffs and material shortages, which have limited developers’ ability to maintain affordable pricing. Geopolitical tensions and sanctions have reduced foreign investment inflows, constraining liquidity in the commercial and luxury property segments.

Market Segmentation

The Russia real estate market share is classified into property type and ownership.

- The residential segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia real estate market is segmented by property type into residential, commercial, land, and industrial. Among these, the residential segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. High demand persists in major cities like Moscow and St. Petersburg, with growing interest in suburban housing and premium apartments. Mortgage programs and demographic shifts influence buying behavior.

- The owner-occupied properties segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia real estate market is segmented by ownership into owner-occupied properties, rental properties, and co-ownership. Among these, the owner-occupied properties segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Owner-occupied properties include primary residences such as apartments, houses, and condominiums where the occupant is the legal owner.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia real estate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samolet Group

- PIK Group

- LSR Group

- MR Group

- Setl Group

- Capital Group

- CMI Development

- Coalco

- Griffin Partners

- SRV

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Russia real estate market based on the below-mentioned segments:

Russia Real Estate Market, By Property Type

- Residential

- Commercial

- Land

- Industrial

Russia Real Estate Market, By Ownership

- Owner-occupied Properties

- Rental Properties

- Co-ownership

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |