Global Satellite IoT Market

Global Satellite IoT Market Size, Share, and COVID-19 Impact Analysis, By Service (Direct to Satellite, IoT Satellite Backhaul), By End Use (Transport and Logistics, Energy & Utilities, Agriculture, Environmental, Defense, Marine, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Satellite IoT Market Summary

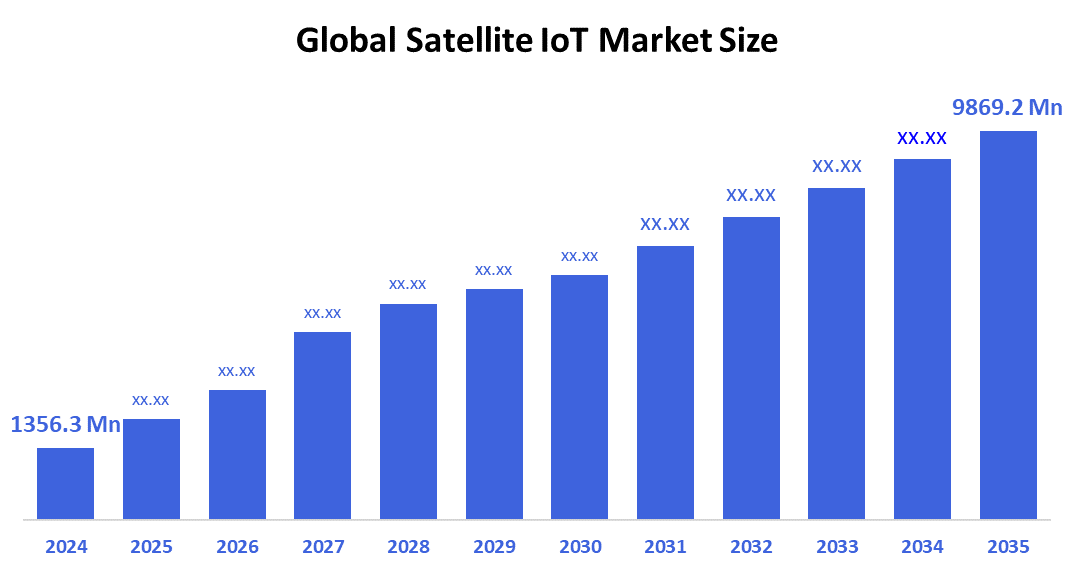

The Global Satellite IoT Market Size Was Estimated at USD 1356.3 Million in 2024 and is Projected to Reach USD 9869.2 Million by 2035, Growing at a CAGR of 19.77% from 2025 to 2035. The market for satellite IoT is expanding quickly because of the growing need for worldwide connectivity, especially in underserved and remote locations, which is being propelled by the installation of reasonably priced Low Earth Orbit (LEO) satellite constellations.

Key Regional and Segment-Wise Insights

- In 2024, North America held the greatest revenue share of 38.5% in the worldwide satellite IoT market.

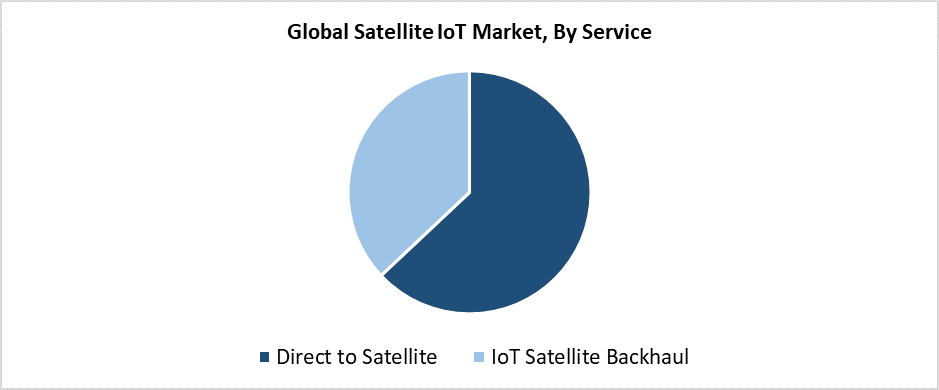

- In 2024, the direct-to-satellite segment held the largest revenue share based on service, accounting for 63.5% of the market.

- In 2024, the market by end use was led by the transport and logistics segment with the largest revenue share.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1356.3 Million

- 2035 Projected Market Size: USD 9869.2 Million

- CAGR (2025-2035): 19.77%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The satellite IoT market includes the integration of satellite communication technology with Internet of Things (IoT) for connecting devices and sensors in remote or difficult-to-reach locations where standard terrestrial networks fail or do not exist. The market advances because organizations across various sectors require uninterrupted global IoT connectivity, starting with environmental monitoring and logistics and extending to agriculture and oil & gas operations. The market expands mainly because of the requirement for immediate data transmission in distant locations, combined with rising smart device adoption and fast-paced IoT application growth. The growing adoption of low Earth orbit (LEO) satellites has made satellite IoT services both more budget-friendly and accessible while expanding network coverage capabilities.

The satellite IoT market experiences major changes due to recent technological advancements. The combination of LPWAN technology with smaller satellite terminals and enhanced data analytics enables improved efficiency and longer battery life for devices. Satellite IoT receives backing from global governments through funding initiatives together with regulatory support to develop digital infrastructure and reduce connectivity disparities in underserved regions. Space authorities along with commercial businesses, collaborate to speed up satellite deployment while developing the ecosystem to enable worldwide adoption of satellite IoT solutions.

Service Insights

The direct-to-satellite segment accounted for the highest revenue share of 63.5% in 2024 and led the Satellite IoT market. Its ability to provide uninterrupted access to remote and underserved areas without relying on ground-based infrastructure stands as the primary reason for its market dominance. Direct-to-satellite services enable devices to communicate directly with satellites, thus reducing latency while enhancing reliability for essential Internet of Things operations across defense and oil and gas and maritime, and agricultural sectors. The expanding requirements for widespread low-power connections, together with advancements in nanosatellite and LEO satellite constellations, have driven increased adoption of this service. The market continues to grow because industries seek scalable and cost-effective connectivity solutions that direct-to-satellite concepts offer.

During the forecast period, the IoT satellite backhaul segment of the Satellite IoT market is anticipated to grow at the fastest CAGR. The accelerating growth of the Internet and cellular coverage in remote areas without adequate terrestrial infrastructure drives this rapid expansion. Telecom operators can enable Internet of Things applications by linking edge devices to central networks through satellite backhaul. The increasing 5G network deployments, along with the growing IoT adoption across mining and transportation sectors and agricultural fields, accelerate this requirement. Satellite backhaul connects better with practical scalability features because of enhanced satellite technology developments and reduced launch expenses, making it a key market driver for satellite IoT operations.

End Use Insights

The transportation and logistics industry led the satellite IoT market by holding the largest revenue in 2024. The segment dominance emerges from the rising necessity for fleet administration and instant monitoring, together with route improvement in global supply chains. Satellite IoT delivers uninterrupted connectivity to assets and goods, and vehicles in remote and maritime locations where traditional terrestrial networks do not operate. The segment expands because businesses adopt more IoT-enabled sensors and tracking systems, which enhance operational performance while decreasing fuel costs and improving delivery precision. The increasing volume of international trade, together with e-commerce development, drives transportation and logistics to become the leading industry in satellite IoT adoption because of their need for reliable, scalable connectivity solutions.

Throughout the forecast timeframe, the agricultural segment is anticipated to grow at the fastest CAGR. The accelerating growth of this market stems primarily from factors such as precision agricultural practices gaining popularity and the essential need for proper resource control in remote and rural locations. The implementation of satellite IoT enables the real-time monitoring of livestock and weather patterns, together with crop health and soil conditions, even when terrestrial connections are unreliable. Farmers employ Internet of Things devices to enhance production efficiency while reducing waste through data-driven decision-making because food demand escalates and climate variability expands. The market will keep expanding rapidly throughout the forecasted period because agricultural IoT devices need satellite communication integration for their operations.

Regional Insights

North America Satellite IoT Market Trends

North America led the satellite IoT market with the largest revenue share of 38.5% in 2024. The market leadership position of North America stems from its prominent market company presence, together with its early technology adoption and advanced space infrastructure. The United States continues to dedicate major investments toward Internet of Things deployments together with satellite communication networks within multiple sectors, including energy, transportation, agriculture, and defense. The sector expansion happened because of supportive government programs combined with growing demand for instant data and widespread deployment of connected devices throughout rural and remote regions. The region maintains its leadership position through continuous innovation while focused on enhancing satellite connectivity through LEO satellite constellations.

Europe Satellite IoT Market Trends

Europe captured a substantial share of the worldwide satellite IoT market during 2024 following major investments in smart infrastructure and space technology, and sustainable development initiatives. European nations implement Satellite IoT solutions at increasing rates to enable transportation and maritime operations and agricultural and environmental monitoring applications. The European Space Agency (ESA), along with regional satellite operators, has driven accelerated deployment and technological advancement of Low-Earth orbit (LEO) satellite networks throughout the region. The European Union's rural connectivity focus through Horizon Europe and European Green Deal programs drives market expansion. These factors together establish Europe's supremacy within the worldwide satellite IoT market.

Asia Pacific Satellite IoT Market Trends

Throughout the forecast period, the Asia Pacific region will experience the fastest CAGR in satellite IoT market growth. The fast growth results from rising requirements for remote network connectivity across different geographical regions, starting with rural and hilly, and island areas lacking traditional network infrastructure. China, along with India, Japan, and Australia, dedicates substantial funding toward developing satellite infrastructure and Internet of Things technologies that support agricultural and transportation and maritime, and disaster management sectors. Market expansion receives additional support from government initiatives that boost digital connectivity, together with the growing adoption of smart farming and logistics technologies. The Asia Pacific region emerges as a leading satellite IoT development center because of its regional collaborations and the emergence of regional satellite startup companies.

Key Satellite IoT Companies:

The following are the leading companies in the satellite IoT market. These companies collectively hold the largest market share and dictate industry trends.

- ORBCOMM Inc.

- Myriota Pty Ltd.

- Inmarsat Group

- Swarm Technologies Inc.

- Iridium Satellite LLC

- Northrop Grumman Corporation

- Airbus SE

- EUTELSAT COMMUNICATIONS SA

- Kepler Communications Inc.

- Thales S.A.

- Globalstar, Inc.

- OQ Technology

- Others

Recent Developments

- In July 2025, Iridium Satellite LLC unveiled the Iridium Certus 9704 Launch Pad Developer Board, an Arduino-compatible board featuring a microSD interface, USB-C connectivity, an antenna, battery, and satellite transceiver built in for quick prototyping. Businesses and entrepreneurs in the satellite IoT sector can create and implement unique IoT solutions with the help of this developer board. In order to expedite the development of next-generation satellite IoT devices, the platform will simplify hardware integration and shorten development time.

- In July 2025, A ready-to-use certified eSIM and IoT connectivity solution was revealed by Thales S.A., improving scalable and safe device integration in sectors including agriculture and the automobile industry. By enabling smooth worldwide connectivity for distant assets, this solution can guarantee that IoT devices are placed in secure locations and maintain constant contact. Applications like real-time fleet tracking and agricultural monitoring greatly benefit from this capacity, which also greatly increases operational efficiency.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the satellite IoT market based on the below-mentioned segments:

Global Satellite IoT Market, By Service

- Direct to Satellite

- IoT Satellite Backhaul

Global Satellite IoT Market, By End Use

- Transport and Logistics

- Energy & Utilities

- Agriculture

- Environmental

- Defense

- Marine

- Others

Global Satellite IoT Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | May 2025 |

| Access | Download from this page |