Saudi Arabia Air Defence System Market

Saudi Arabia Air Defence System Market Size, Share, By Type (Missile Defense System, Anti-Aircraft System, Counter Unmanned Aerial Systems (C-UAS), Counter Rocket, Artillery and Mortar Systems (C-RAM)), By Component (Weapon System, Fire Control System, Command and Control System, Others), By Range (Long Range, Medium Range, Short Range), By Platform (Land, Airborne, Naval), Saudi Arabia Air Defence System Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Saudi Arabia Air Defence System Market Insights Forecasts to 2035

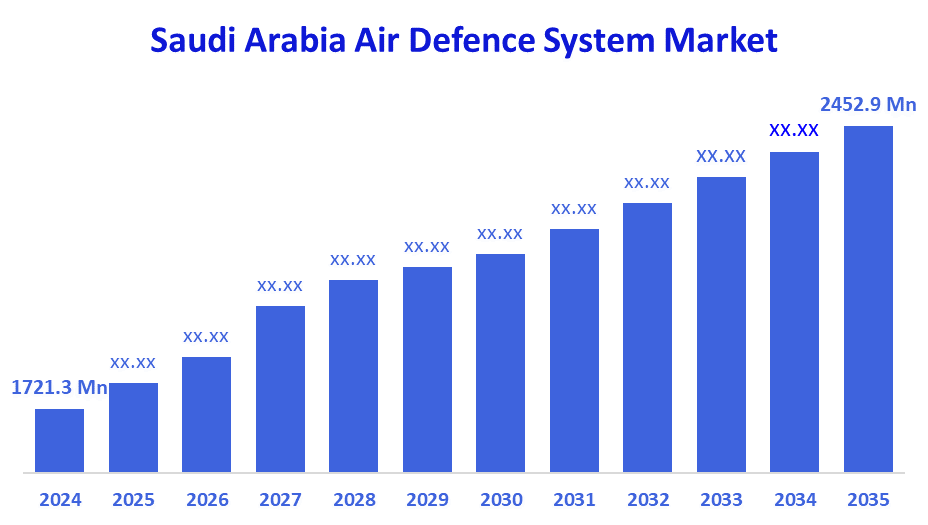

- Saudi Arabia Air Defence System Market Size 2024: USD 1721.3 Mn

- Saudi Arabia Air Defence System Market Size 2035: USD 2452.9 Mn

- Saudi Arabia Air Defence System Market CAGR 2024: 3.27%

- Saudi Arabia Air Defence System Market Segments: Type, Component, Range, and Platform

Air defence systems are a set of military inventions programmed to find, follow and destroy one or more of the enemies that can be hit from the air. These can be hostile missiles, aircraft, or even uncrewed aerial vehicles (drones), and air defence systems will try to protect the national airspace or strategic assets. Such systems are used in border security, critical infrastructure protection, and the operations of the Saudi Arabian military corps across the three branches. According to the official U.S. government trade data on defence and security exports, Saudi Arabia has been importing nearly 80 % of its arms from the United States. This heavy import dependence has set the stage for the acquisition of advanced radar, missile defence and integrated air defence platforms.

The Saudi government moves its internal aerial air defence industry to be compatible with international standards through the Vision 2030 initiative. The General Authority for Military Industries (GAMI) has informed that nearly one, quarter (24.89%) of the military expenditure was localized by the end of 2024, thus showing a considerable move towards the Vision 2030 goal of more than 50% localization by 2030. The achievement of this goal is largely due to changes in the regulatory framework, supply chain development, and investment facilitation. The Saudi Arabian government has assembled a defence budget worth around USD 78 billion for 2025, which is mostly aimed at air defence missile and sensor network upgrades and electronic warfare systems. New openings for the future can be a result of higher domestic research & development, the export potential of locally made defence systems, and foreign technology collaborations that facilitate advanced CUAS and long-range interception capabilities.

Market Dynamics of The Saudi Arabia Air Defence System Market:

Increasing missile and drone attacks in the region are the main reason for the rising demand of advanced air defence systems. protection of oil facilities, airports, and other critical infrastructures remains the top priority. the rapid evolution of UAV and ballistic missile threats is the main reason for continuous system upgrades. the use of layered and network, centric air defence architectures is getting more and more popular which is leading to faster market growth.

The high procurement and lifecycle costs of air defence platforms are the main reasons why the rapid deployment is limited. long acquisition and integration timelines are the reasons for system readiness delay. the dependence on foreign suppliers is the main reason for the lack of supply flexibility. complex system integration is the main reason for the increase in operational challenges.

The growth of domestic defence manufacturing capabilities is the main reason for the long, term growth potential. the development of indigenous c, UAS and missile defence solutions is the main reason behind the localisation goals. technology transfer partnerships are the main reason for the advanced system deployment. local defence capabilities maturity is the main reason for future export opportunities.

Market Segmentation

The Saudi Arabia Air Defence System Market share is classified into type, component, range, and platform.

By Type:

The Saudi Arabia air defence system market by type includes missile defense system, anti-aircraft system, counter unmanned aerial systems (C-UAS), and counter rocket, artillery and mortar systems (C-RAM). Among these, the missile defense system segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The expansion is mostly attributed to an increase in the number of threats of ballistic and cruise missiles, needs for long, range interception, and the use of layered air defence architectures for the protection of, especially, critical infrastructures.

By Component:

The Saudi Arabia air defence system market by component includes weapon system, fire control system, command and control system, and others. Among these, the weapon system segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Growth is mainly caused by a high procurement value of interceptors, launchers, and missile units, while system upgrades and replacement programs that enhance operational readiness are continuously running.

By Range:

The Saudi Arabia air defence system market by range is classified into long range, medium range, and short-range systems. Among these, the long-range segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment increases its size due to the requirement of early, warning systems, wide, area surveillance, and long, range interception for border and critical infrastructure protection.

By Platform:

The Saudi Arabia air defence system market by platform is segmented into land, airborne, and naval systems. Among these, the land segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Expansion is supported by a comprehensive deployment that takes place at borders, oil facilities, city centres, and military bases and thus, ensures multi, layered protection against aerial threats.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Saudi Arabia air defence system Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Saudi Arabia Air Defence System Market:

- Lockheed Martin

- BAE Systems

- Raytheon Technologies

- Northrop Grumman

- Boeing

- General Dynamics

- Thales Group

- Saab AB

- L3Harris Technologies

- Advanced Electronics Company

Recent Developments in Japan Clinical Trials Support Services Market:

In July 2025, the Royal Saudi Air Defence Forces / Ministry of Defence set up the first THAAD (Terminal High Altitude Area Defense) missile defense unit at the Air Defence Forces Institute in Jeddah after system testing and field training. This capability limits the kingdom's ballistic missile interception to a higher altitude and adds a layer of security for strategic infrastructure as well as the national airspace.

In May 2025, Lockheed Martin / General Authority for Military Industries (GAMI) revealed the first locally produced THAAD missile system transporter (MRPT) developed with AIC Steel under localisation goals. This landmark event invigorates the domestic defence sector, lessens the country's dependence on imports, and aligns with Saudi Vision 2030 industrialisation targets for the air defence sector.

In May 2025, In Jeddah, The General Authority for Military Industries / Lockheed Martin has locally produced the first locally manufactured components of the THAAD system, thus, marking a significant step in the local production of launcher parts. This project fulfilment extends the supply chains for national air defence from local sources and is a considerable step towards the kingdom's strategic goal of increasing the local defence industrial capacity.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Saudi Arabia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Saudi Arabia air defence system market based on the below-mentioned segments:

Saudi Arabia Air Defence System Market, By Type

- Missile Defense System

- Anti-Aircraft System

- Counter Unmanned Aerial Systems (C-UAS)

- Counter Rocket, Artillery and Mortar Systems (C-RAM)

Saudi Arabia Air Defence System Market, By Component

- Weapon System

- Fire Control System

- Command and Control System

- Others

Saudi Arabia Air Defence System Market, By Range

- Long Range

- Medium Range

- Short Range

Saudi Arabia Air Defence System Market, By Platform

- Land

- Airborne

- Naval

FAQ

Q: What is the Saudi Arabia air defence system market size?

A: Saudi Arabia Air Defence System Market is expected to grow from USD 1,721.3 million in 2024 to USD 2,452.9 million by 2035, growing at a CAGR of 3.27% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by rising missile and drone attacks across the region, the protection of oil facilities, airports, and strategic infrastructure, rapid evolution of UAV and ballistic missile threats, and adoption of layered and network-centric air defence architectures.

Q: What factors restrain the Saudi Arabia air defence system market?

A: Constraints include high procurement and lifecycle costs of air defence platforms, long acquisition and integration timelines, dependence on foreign suppliers, and complex system integration, which increase operational challenges.

Q: How is the market segmented by type, component, range, and platform?

A: The market is segmented by type into missile defense system, anti-aircraft system, counter unmanned aerial systems (C-UAS), and counter rocket, artillery and mortar systems (C-RAM); by component into weapon system, fire control system, command and control system, and others; by range into long range, medium range, and short range; and by platform into land, airborne, and naval systems.

Q: Who are the key players in the Saudi Arabia air defence system market?

A: Key companies include Lockheed Martin, BAE Systems, Raytheon Technologies, Northrop Grumman, Boeing, General Dynamics, Thales Group, Saab AB, L3Harris Technologies, and Advanced Electronics Company.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |