Singapore Cold Chain Logistics Market

Singapore Cold Chain Logistics Market Size, Share, and COVID-19 Impact Analysis, By Business Type (Warehousing, Transportation), By End User (Fruits and Vegetables, Bakery and Confectionery, Dairy and Frozen Desserts, Drugs and Pharmaceuticals, Meat, Fish, and Sea Food), and Singapore Cold Chain Logistics Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Singapore Cold Chain Logistics Market Insights Forecasts to 2035

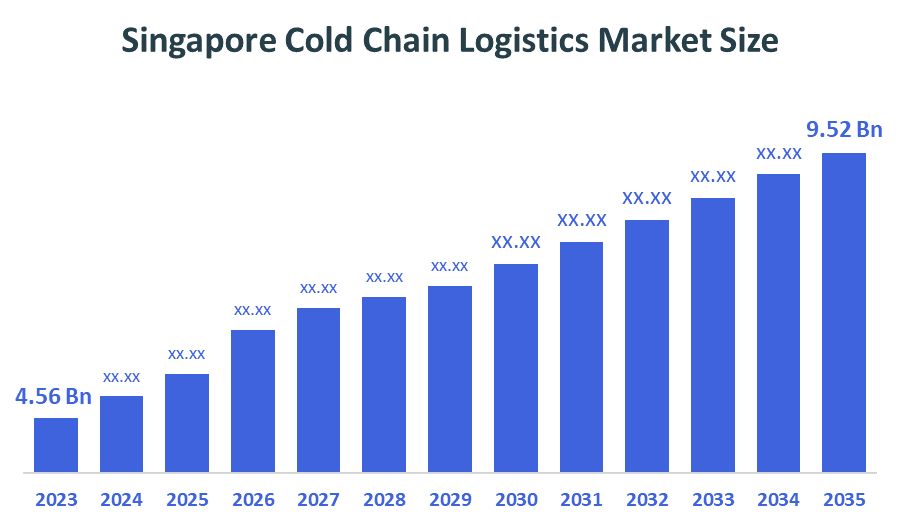

- The Singapore Cold Chain Logistics Market Size Was Estimated at USD 4.56 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.92% from 2025 to 2035

- The Singapore Cold Chain Logistics Market Size is Expected to Reach USD 9.52 Billion by 2035

According to a research report published by Spherical Insights & Consulting, the Singapore Cold Chain Logistics Market size is anticipated to reach USD 9.52 Billion by 2035, growing at a CAGR of 6.92% from 2025 to 2035. The market for cold chain logistics in Singapore is mostly driven by a growing need for perishable goods, such as food and drink and medications, as a result of demographic increase and revenue levels, strict laws guaranteeing safety and quality standards, the use of cutting-edge technologies for temperature-controlled storage and transportation, and the growth of the food and healthcare sectors.

Market Overview

Cold chain logistics is the process of handling heat non tolerance products by preserving their sample from production to consumption. The goods, such as food, drugs, and vaccines, require specific storage conditions, shipment, and observing method to maintain a constant temperature between 2°C and to 8°C.

To rise in competition between the Singaporean pharmaceutical manufacturing companies, the government made a partnership with the pharmaceutical companies to develop training programs for new and established medications. Additionally, the Pharma Innovation Programme Singapore (PIPS) consortium was established to advance new manufacturing technologies. To guarantee the security and caliber of food items delivered via cold chain logistics, the Singaporean government has put laws into place.

Maintaining the quality and safety of food, pharmaceuticals, and healthcare is too important to ensure consumer satisfaction and health for and cold chain logistics is very crucial. Cold chain management efficiency has increased, and profitable market prospects have been generated by the development of automated software solutions, sophisticated algorithms, Internet of Things sensors, and predictive analytics.

Report Coverage

This research report categorizes the market for Singapore cold chain logistics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore cold chain logistics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore cold chain logistics market.

Driving Factors

The cold chain logistics market in Singapore is driven by the expansion the as these facilities expand, the reliability and efficiency of the cold chain infrastructure are improved, ensuring that product quality is maintained throughout the supply chain. increasing need to transport and store critical medical supplies at a regulated temperature. Dependability and efficiency are increased by advancements in refrigeration and monitoring technology, which support industry growth. E-commerce retail, countries' heavy reliance on food imports, and rising disposable income are all factors propelling the growth of the food retail sector.

Restraining Factors

The Singaporean cold chain logistics market is restrained by the monitoring of temperature changes in real time at all supply chain locations, including warehouses and vehicles. Regulatory compliance to handle the protocols and early disposal of damaged or expired commodities is crucial. Supply chain disruption and limited raw materials and components are required for the manufacturing of respiratory devices. Production and distribution networks may be disrupted by political unrest in important manufacturing areas, leading to delays and higher expenses.

Market Segmentation

The Singapore cold chain logistics market share is classified into business type and end user.

- The transportation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore cold chain logistics market is segmented by business type into warehousing and transportation. Among these, the transportation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by roadways is one of the transportation subsegments that tends to dominate due to its vast network and ability to easily reach a variety of destinations. The cold chain logistics industry relies heavily on road transport because of Singapore's strong road system and accessibility, which ensures the timely and safe delivery of perishable goods around the region.

- The meat, fish, and seafood segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Singapore cold chain logistics market is segmented into fruits and vegetables, bakery and confectionery, dairy and frozen desserts, drugs and pharmaceuticals, meat, fish, and seafood. Among these, the meat, fish, and seafood segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by it can be attributed to Singapore's varied culinary culture and the country's high demand for fresh, high-quality meat and seafood. An effective cold chain logistics network becomes essential when stringent rules guarantee food safety requirements, including the importation of meat products. It includes a range of goods, including fish, chicken, beef, pig, and seafood, and serves both domestic and foreign markets, making it a significant part of Singapore's cold chain logistics sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore cold chain logistics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DHL Supply Chain

- YCH Group

- ST Logistics

- CJ Logistics Asia

- Pan Ocean

- Keppel Logistics

- AirOcean Group

- Freight Links Express

- Toll (Asia) Pte Ltd

- Pacorini Toll Pte Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In April 2025, DHL Supply Chain launched a new pharma hub in Singapore, a dedicated facility for pharmaceutical logistics.

In April 2025, DHL Supply Chain opened a new Pharma Hub in Singapore, adding to its expanding Life Sciences and Healthcare (LSHC) infrastructure across the Asia Pacific. Highlights the group’s commitment to delivering improved logistics for life-saving treatments and products.

In February 2025, Logistics tech SaaS AI platform Elixia launched its cold chain logistics marketplace. Elixia’s cold chain marketplace promises to streamline operations for more than 2,000 shippers and hundreds of transporters dealing with temperature-sensitive goods.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore Cold Chain Logistics Market based on the below-mentioned segments

Singapore Cold Chain Logistics Market, By Business Type

- Warehousing

- Transportation

Singapore Cold Chain Logistics Market, By End User

- Fruits and Vegetables

- Bakery and Confectionery

- Dairy and Frozen Desserts

- Drugs and Pharmaceuticals

- Meat, Fish, and Seafood

FAQ’s

Q: What is the Singapore cold chain logistics market size?

A: The Singapore cold chain logistics market size is expected to grow from USD 4.56 billion in 2024 to USD 9.52 billion by 2035, growing at a CAGR of 6.92% during the forecast period 2025-2035.

Q: What is the Singapore cold chain logistics market and their primary use?

A: Cold chain logistics is the process of handling heat non tolerance products by preserving their sample from production to consumption. Cold chain logistics efficiency has increased, and profitable market prospects have been generated by the development of automated software solutions, sophisticated algorithms, Internet of Things sensors, and predictive analytics.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the expansion is these as these facilities expand, the reliability and efficiency of the cold chain infrastructure are improved, ensuring that product quality is maintained throughout the supply chain. increasing need to transport and store critical medical supplies at a regulated temperature. Dependability and efficiency are increased by advancements in refrigeration and monitoring technology, which support industry growth. E-commerce retail, countries' heavy reliance on food imports, and rising disposable income are all factors propelling the growth of the food retail sector.

Q: What factors restrain the Singapore cold chain logistics market?

A: Constraints include the monitoring of temperature changes in real time at all supply chain locations, including warehouses and vehicles. Regulatory compliance to handle the protocols and early disposal of damaged or expired commodities is crucial. supply chain disruption and limited raw materials and components required for the manufacturing of respiratory devices. Production and distribution networks may be disrupted by political unrest in important manufacturing areas, leading to delays and higher expenses.

Q: How is the market segmented by business type?

A: The market is segmented into warehousing, transportation.

Q: Who are the key players in the Singapore cold chain logistics market?

A: Key companies include DHL Supply Chain, YCH Group, ST Logistics, CJ Logistics Asia, Pan Ocean, Keppel Logistics, AirOcean Group, Freight Links Express, Toll (Asia) Pte Ltd, Pacorini Toll Pte Ltd.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |