Singapore Convenience Stores Market

Singapore Convenience Stores Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Food and Beverages, Tobacco Products, Health and Beauty Products, Home and Office Supplies, and Others), By Ownership Type (Franchise-Owned, Independent), By Store Size (Small Format, Medium Format, and Large Format), and Singapore Convenience Stores Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Singapore Convenience Stores Market Insights Forecasts to 2035

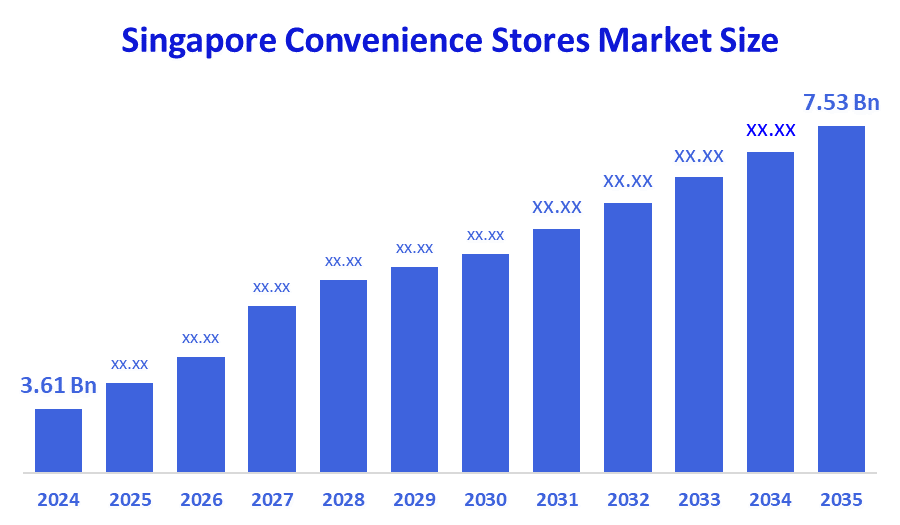

- The Singapore Convenience Stores Market Size Was Estimated at USD 3.61 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.91% from 2025 to 2035

- The Singapore Convenience Stores Market Size is Expected to Reach USD 7.53 Billion by 2035

According to a research report published by Decision Advisors, the Singapore Convenience Stores Market Size is Anticipated to Reach USD 7.53 Billion by 2035, Growing at a CAGR of 6.91% from 2025 to 2035. The market for convenience stores in Singapore is mostly driven by an increased urban population density, growing investments in the retail industry in developing countries, and the growing appeal of the franchising concept.

Market Overview

The convenience stores market is a tiny retail establishment that houses a variety of commonplace goods under one roof, including convenience meals, groceries, drinks, tobacco products, lottery tickets, over-the-counter medications, toiletries, newspapers, and periodicals.

Singapore continued to be a net exporter of goods in 2022 despite a 14.4% increase in item exports and a 17.7% increase in imports. It is anticipated that Singapore will continue to be among the richest countries in the world. Singapore's reputation as a desirable location for multinational corporations has been solidified by its sophisticated technology sector and broad free trade rules.

In 2023, Singapore ranked third in the region and imported US$555.4 million in processed food exports from the United States, accounting for 59% of all agricultural exports. This is a pretty startling 27% decline. To lessen financial hardship, the Singaporean government keeps offering financial assistance and economic stimulus programs to both individuals and companies. For c-stores to expand and remain viable, e-commerce platform integration into the retail industry is becoming more and more important. Urbanization and a busy, tech-savvy populace are driving tremendous growth.

Report Coverage

This research report categorizes the market for Singapore convenience stores market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore convenience stores market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore convenience stores market.

Driving Factors

The convenience stores market in Singapore is driven by the focus on customer health and wellness, the availability of convenience stores at every location, the increasing need for stores due to customers rising demand, expansion of e-commerce and delivery services, and the increasing stores range from small to large size, product selection and customisation. convenience stores may offer a seamless shopping experience by allowing customers to order products online and have them delivered their product to their homes. Businesses can differentiate themselves in a highly competitive market by catering to regional preferences.

Restraining Factors

The Singaporean convenience stores market is restrained by geopolitical and demographic challenges, including an ageing labor population, a mature economy, and growing competition from other trade deals. Singapore is heavily reliant on foreign labor, who make up around 40% of the workforce. Additionally, the increasing commodity price has an impact on Singapore's economy. Supply chain disruptions that cause delivery delays due to they rely on inventory management to lower prices.

Market Segmentation

The Singapore convenience stores market share is classified into product type, ownership, and store size.

- The food and beverages segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore convenience stores market is segmented by product type into food and beverages, tobacco products, health and beauty products, home and office supplies, and others. Among these, the food and beverages segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by a large range of goods that satisfy customers' demands for convenience and rapid feeding. Convenience stores are becoming indispensable shopping destinations for those with hectic schedules, which is driving this market.

- The franchise-owned segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the ownership, the Singapore convenience stores market is segmented into franchise-owned, independent. Among these, the franchise-owned segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by a utilizing franchisors' operational assistance and brand equity. These stores are a dependable option for customers because they often have regular product offers, comprehensive marketing efforts, and established supplier networks.

- The small format segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore convenience stores market is segmented by store size into small format, medium format, and large format. Among these, the small format segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by its small size, giving priority to necessary items and prompt service. Busy city dwellers prefer these stores since they typically focus on everyday needs and ready-to-eat foods and offer a limited selection of goods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore convenience stores market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sheng Siong Group

- Market Place by Jasons

- Smart Retail

- YouMart Pte. Ltd.

- Aw’s Market

- StoreWise AI

- Future Retail Pte. Ltd.

- Kean Ann Co

- Alimentation Couche Tard Inc

- Seven & i Holdings Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In August 2025, the Seven & i Holdings Co., Ltd. announced a transformation plan for 7-Eleven Stores. The 7-Eleven operator stated that its objective is to satisfy changing customer needs with new formats and accelerate openings.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Singapore Convenience Stores Market based on the below-mentioned segments:

Singapore Convenience Stores Market, By Product Type

- Food and Beverages

- Tobacco Products

- Health and Beauty Products

- Home and Office Supplies

- Others

Singapore Convenience Stores Market, By Ownership

- Franchise-Owned

- Independent

Singapore Convenience Stores Market, By Store Size

- Small Format

- Medium Format

- Large Format

FAQ’s

Q: What is the Singapore convenience stores market size?

A: The Singapore Convenience Stores Market size is expected to grow from USD 3.61 billion in 2024 to USD 7.53 billion by 2035, growing at a CAGR of 6.91% during the forecast period 2025-2035.

Q: What is the Singapore convenience stores market and its primary use?

A: The convenience stores market is a tiny retail establishment that houses a variety of commonplace goods under one roof, including convenience meals, groceries, drinks, tobacco products, lottery tickets, over-the-counter medications, toiletries, newspapers, and periodicals.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the Focus on customer health and wellness, the availability of convenience stores at every location, the increasing need for stores due to customers' rising demand, the expansion of e-commerce and delivery services, and the increasing stores range from small to large size, product selection and customisation. convenience stores may offer a seamless shopping experience by allowing customers to order products online and have them delivered their product to their homes. Businesses can differentiate themselves in a highly competitive market by catering to regional preferences.

Q: What factors restrain the Singapore convenience stores market?

A: Constraints include the geopolitical and demographic challenges, including an ageing labor population, a mature economy, and growing competition from other trade deals. Singapore is heavily reliant on foreign labor, who make up around 40% of the workforce. Additionally, the increasing commodity price has an impact on Singapore's economy. Supply chain disruptions that cause delivery delays due to they rely on inventory management to lower prices.

Q: How is the market segmented by product type?

A: The market is segmented into food and beverages, tobacco products, health and beauty products, home and office supplies, and others.

Q: Who are the key players in the Singapore convenience stores market?

A: Key companies include Sheng Siong Group, Market Place by Jasons, Smart Retail, YouMart Pte. Ltd., Aw’s Market, StoreWise AI, Future Retail Pte. Ltd., Kean Ann Co., Alimentation Couche Tard Inc., and Seven & i Holdings Co. Ltd.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |