Singapore Cybersecurity Market

Singapore Cybersecurity Market Size, Share, and COVID-19 Impact, By Component (Solutions, Services), By Deployment Type (Cloud-Based, On-Premises), By User Type (Large Enterprises, Small and Medium Enterprises), By Industry Vertical (IT and Telecom, Retail, BFSI, Healthcare, and Others), and Singapore Cybersecurity Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Singapore Cybersecurity Market Insights Forecasts to 2035

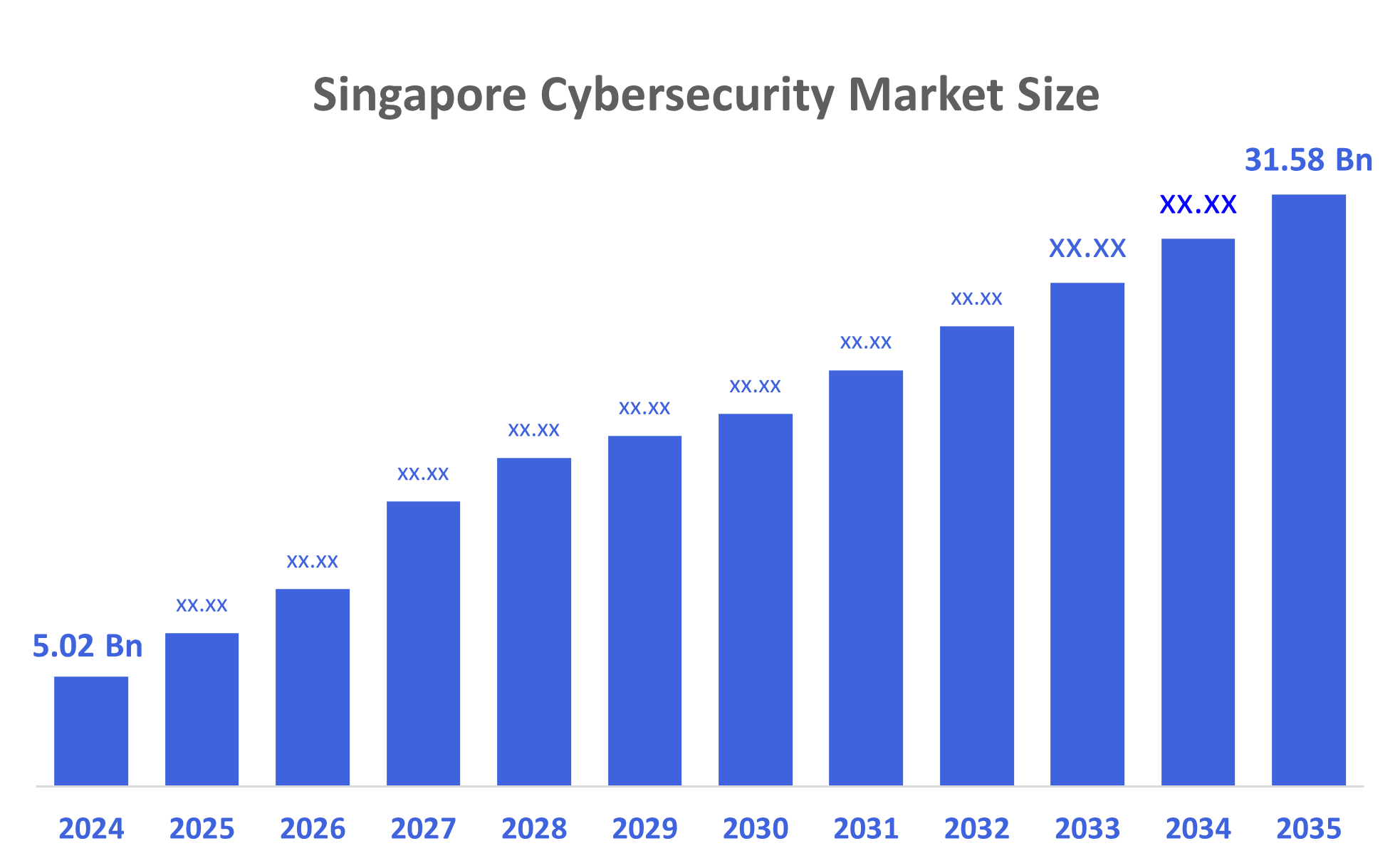

- The Singapore Cybersecurity Market Size Was Estimated at USD 5.02 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 18.2% from 2025 to 2035

- The Singapore Cybersecurity Market Size is Expected to Reach USD 31.58 Billion by 2035

According to a research report published by Decisions Advisors, The Singapore Cybersecurity Market Size is Anticipated to Reach USD 31.58 Billion by 2035, Growing at a CAGR of 18.2% from 2025 to 2035. The market for cybersecurity in Singapore is mostly driven by growing threats, increased cyberattacks on vital infrastructure, increased investments in sophisticated security measures, growing digitalization and strict regulations, the implementation of checkpoint software technologies by major players, and the growing demand for all-encompassing threat management solutions.

Market Overview

The procedure that guarantees confidentiality, integrity, availability, and privacy is known as cybersecurity. This includes actions for avoiding and dealing with all forms of fraud, including digital attacks and problems, in order to protect computer systems, networks, programs, and content. Cybersecurity is becoming increasingly important as organizations, governments, and individuals rely more and more on IT systems, which are vulnerable to malicious activities. Security has grown into a major problem for companies of all sizes as a result of the digital revolution.

In September, Singapore unveiled its new Cybersecurity Talent, Innovation and Growth (Cyber TIG) Plan. The Cyber TIG Plan is an all-encompassing strategy for ecosystem development that unifies and strengthens current talent and innovation programs for the sector.

From 16,117 incidents in 2020 to 22,219 cases in 2021, cybercrimes in Singapore increased by 38% year over year. Cybercrimes included offenses under the Computer Misuse Act (17%), cyber extortion (2%), and online frauds (81%).

The industry is rapidly growing as businesses and consumers understand how important it is to protect their digital assets from cyber threats. The industry is supported by government programs, a strong regulatory environment, and a vibrant community of cybersecurity businesses. Certain cybersecurity regulations are followed by government systems and are regularly reviewed. To keep up with advances in technology, we will also update the cybersecurity architecture of government systems. By offering consulting services and assigning Chief Information Security Officers (CISOs) throughout the government, the Smart Nation and Digital Government Group (SNDGG) assists in the implementation of IM8 security standards. As part of the IM8 audit, the government also regularly tests government systems for vulnerabilities that need to be fixed ahead of time could be exploited.

Report Coverage

This research report categorizes the market for Singapore cybersecurity market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore cybersecurity market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore cybersecurity market.

Driving Factors

The cybersecurity market in Singapore is driven by the rapid digitalisation of cybercrimes and attacks are becoming more frequent in Singapore due to the country's growing operational and information technology networks. Artificial intelligence-based cybersecurity products are becoming more and more popular in the nation to increase the cyber readiness of both small and large organizations by automating defence procedures and analyzing vast volumes of data. due to the growing dependence on internet services and the significance of cybersecurity for national security. increasing use of artificial intelligence and machine learning technology to automate network scanning, monitoring, and security event response.

Restraining Factors

The Singaporean cybersecurity market is restrained by the rise in cyberattacks is the dearth of skilled cybersecurity personnel across all industries. The necessity for security personnel to address cyber threats to financial institutions, governments, or industrial businesses outweighs the need for seasoned cybersecurity experts. Due to the difficulty and expense of putting comprehensive cybersecurity measures in place, as well as the fact that cyber threats are always changing, security measures must be updated and modified on a regular basis.

Market Segmentation

The Singapore cybersecurity market share is classified into component, deployment type, user type, and industry vertical.

- The services segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on component, the Singapore cybersecurity market is segmented into solutions, services. Among these, the services segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by due to the IT world is so complicated. Businesses are implementing a sophisticated IT architecture that includes multi-cloud, on-premises, and hybrid environments as the digital transformation process picks up speed. Effective security management is challenging for internal teams because of this complexity.

- The cloud-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore cybersecurity market is segmented by deployment type into cloud-based, on-premises. Among these, the cloud-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by cloud-based solutions are appropriate for companies of all sizes since they can swiftly scale up or down in accordance with company needs. Cloud solutions are affordable for organizations due to they have predictable subscription-based pricing models and lower upfront expenditures.

- The large enterprises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on user type, the Singapore cybersecurity market is segmented into large enterprises, small and medium enterprises. Among these, the large enterprises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the increasing complexity of IT environments due to the additional potential for attack that multi-cloud and hybrid architectures create. Additionally, as cyberthreats like cybercrime and data breaches increase, businesses are compelled to invest in comprehensive, state-of-the-art cybersecurity frameworks.

- The BFSI segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore cybersecurity market is segmented by industry vertical into IT and telecom, retail, BFSI, healthcare, and others. Among these, the BFSI segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the expanding need in banking, insurance, and financial organizations for robust security and digital privacy solutions. By utilizing cloud application security solutions, banks, insurance firms, and other financial organizations may defend highly sensitive data with real-time intelligence against ongoing cyberattacks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore cybersecurity market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cysecurity Pte. Ltd

- AppSecure Security

- The ITSEC Group

- One Secure Asia Pte

- Soverus Pte Ltd

- Insyghts Security Pte Ltd

- Insider Security

- F12 Data

- M Tech

- ABPCyber

- Altered Security

- View Qwest

- Cybervault Innovation Technologies

- Netpluz Asia Pte Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Singtel announced he fist telco in Singapore to deploy 700 MHz spectrum, further boosting its 5G coverage nationwide. With this enhancement, Singtel’s 5G will be known as Singtel 5G+ and feature increased signal strengths of up to 40% in high-rise indoor and underground spaces.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Singapore Cybersecurity Market based on the below-mentioned segments:

Singapore Cybersecurity Market, By Component

- Solutions

- Services

Singapore Cybersecurity Market, By Deployment Type

- Cloud-Based

- On-Premises

Singapore Cybersecurity Market, By User Type

- Large Enterprises

- Small and Medium Enterprises

Singapore Cybersecurity Market, By Industry Vertical

- IT and Telecom

- Retail

- BFSI

- Healthcare

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |