Singapore Data Center Market

Singapore Data Center Market Size, Share, and COVID-19 Impact, By Component (Solutions, Services), By Type (Colocation, Hyperscale, Edge, and Others), By Enterprise Size (Large Enterprises, Small and Medium Enterprises), By End User (BFSI, IT and Telecom, Government, Energy and Utilities, and Others), and Singapore Data Center Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Singapore Data Center Market Insights Forecasts to 2035

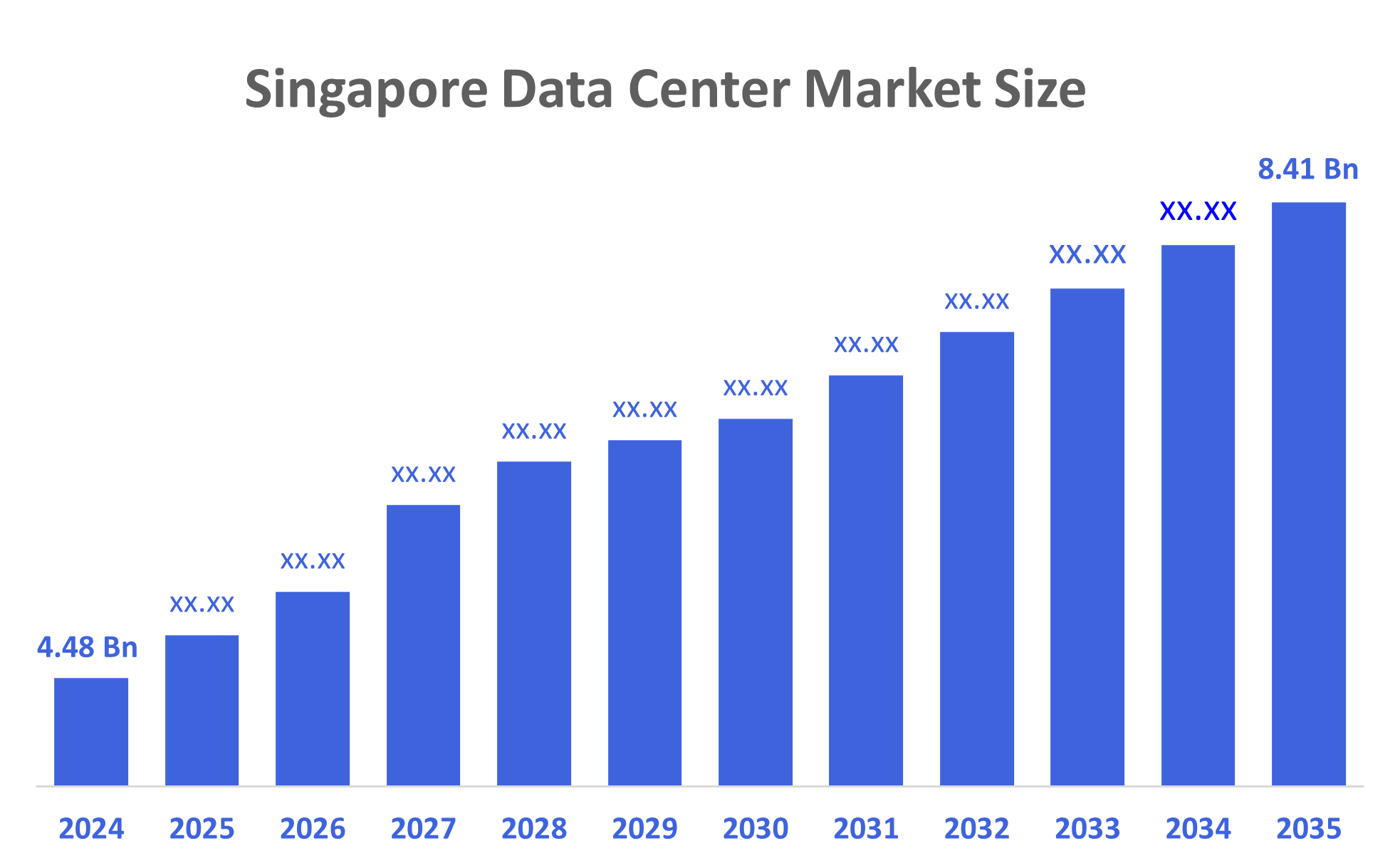

- The Singapore Data Center Market Size Was Estimated at USD 4.48 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.89% from 2025 to 2035

- The Singapore Data Center Market Size is Expected to Reach USD 8.41 Billion by 2035

According to a research report published by Decisions Advisors, The Singapore Data Center Market size is Anticipated to Reach USD 8.41 Billion by 2035, Growing at a CAGR of 5.89% from 2025 to 2035. The market for data center in Singapore is mostly driven by advanced infrastructure, robust connectivity, and proximity to important business districts. It is a promising site for data center concentration and expansion because to its strategic location, which draws large businesses and maintains the strong demand for data-intensive services.

Market Overview

A data center is an advanced facility that contains servers, storage systems, networking devices, and other computing infrastructure for controlling, organizing, and evaluating a huge quantity of information. Singapore's improved connection and state-of-the-art technology infrastructure have made it a vital hub for regional digital platforms. Singapore's highly developed IT ecosystem, stable political climate, and sophisticated infrastructure provide a solid foundation for the growth of data centers. Due to its reputation as a financial and technological center, Singapore attracts international companies and service providers in need of robust, scalable, and secure data storage. The nation's robust regulatory framework guarantees adherence to international standards, fostering investor trust and growth in the data center sector.

In January 2025, the Johor-Singapore Special Economic Zone (JSSEZ) was introduced as a potential location for Singaporean data center investment. The area's proximity to Singapore is advantageous for businesses looking to grow their digital operations. In comparison to other APAC locations, the cost of building a data center in Singapore in 2024 was between $150 and $300 per square foot.

The Green Data Center Standard, which was introduced by the Singaporean government in 2023, requires new data centers to adhere to strict environmental and energy efficiency standards. Princeton Digital Group announced the purchase of Yahoo's Singapore data center in August 2024. The entire area of the facility was 5,400 square meters. Future projections indicate that Singapore's digital economy will contribute SGD 30 billion to the country's GDP, indicating a notable development trend. The government intends to set aside SGD 600 million for the development of digital infrastructure in the future.

The rise of cutting-edge computing presents an immense chance for Singapore's data centers. To satisfy the increasing demand for low-latency services, investments in edge infrastructure are required. The use of green technology in data centers is growing as sustainable development takes precedence. Future expenditures on energy-efficient technologies and renewable energy sources are expected to exceed SGD 400 million.

Report Coverage

This research report categorizes the market for Singapore data center market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore data center market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore data center market.

Driving Factors

The data center market in Singapore is driven by due to its advantageous location at the intersection of several trade routes. Singapore is linked to more than 20 underwater cable networks that offer high-speed and low-latency data transfer capabilities, according to a recent survey by the Infocomm Media Development Authority. The government has put in place a number of programs and regulations to draw in foreign capital for the data center industry. One of the main factors driving the market is the rapid uptake of cloud computing and digital transformation in many different industries. Singapore is a perfect place for edge data centers, which are smaller facilities near end users to enable low-latency applications, due to its dense metropolitan environment and sophisticated technological infrastructure.

Restraining Factors

The Singaporean data center market is restrained by the excessive price of real estate and the scarcity of land. Data center operators are under even more financial strain due to the fierce rivalry for key real estate locations. Land scarcity raises property values, which raises the capital costs needed to build new data centers. controlling energy use and fulfilling sustainability requirements. Data centers use a lot of energy, and Singapore's hot, muggy weather makes large cooling systems necessary, which raises power consumption even more.

Market Segmentation

The Singapore data center market share is classified into component, type, enterprise size, and end user.

- The solutions segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on component, the Singapore data center market is segmented into solutions, services. Among these, the solutions segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by businesses that are looking for end-to-end solutions that include infrastructure, security, and managed services in response to the growing need for cloud services, artificial intelligence, and a digital shift. Hyperscalers and businesses in need of all-encompassing solutions are drawn to Singapore due to its advantageous location, strong connectivity, and pro-tech regulations.

- The colocation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore data center market is segmented by type into colocation, hyperscale, edge, and others. Among these, the colocation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by in-house data center development is costly and limited by the scarcity of land in Singapore and the high cost of real estate. By offering shared spaces with cutting-edge power, cooling, and infrastructure technologies, colocation provides a scalable and safe substitute. Businesses, cloud service providers, and hyperscalers looking to cut capital costs without sacrificing hardware control find it appealing.

- The large enterprises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on enterprise size, the Singapore data center market is segmented into large enterprises, small and medium enterprises. Among these, the large enterprises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by substantial requirements for digital infrastructure, global operations, and data processing. To support mission-critical workloads, cloud computing, big data analytics, and AI applications, these companies heavily rely on data centers. Singapore's favorable location, robust regulatory structure, and state-of-the-art connectivity make it the ideal regional headquarters for large multinational companies.

- The IT and telecom segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore data center market is segmented by end user into BFSI, IT and telecom, government, energy and utilities, and others. Among these, the IT and telecom segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by as demand for cloud computing, 5G, IoT, and AI rises, IT and telecom companies need robust, high-performance data centers to manage enormous volumes of data and offer low-latency services. Singapore's excellent location as a digital gateway to Asia, along with its reliable power supply, political stability, and state-of-the-art connectivity, make it the perfect foundation for regional operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore data center market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ST Telemedia Global Data Centres

- Keppel Data Centres

- Singtel

- STT GDC

- Princeton Digital Group

- Iron Mountain

- 1-Net Singapore Pte. Ltd

- Empyrion Digital

- Telehouse Singapore

- YTL Data Center Holdings

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, Singapore introduced a new standard to help data centre operators and users adopt energy-efficient IT equipment. According to the Infocomm Media Development Authority (IMDA), this initiative aims to reduce IT energy consumption in data centres by at least 30%.

- In February 2025, Singtel’s regional data centre arm, Nxera DCT Pte Ltd., secured a S$643 million five-year green loan to finance the development of a new 58MW data centre in Singapore, DC Tuas. DBS, OCBC, Standard Chartered, HSBC and UOB are financing the loan and have been appointed as green loan coordinators.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Singapore Data Center Market based on the below-mentioned segments:

Singapore Data Center Market, By Component

- Solutions

- Services

Singapore Data Center Market, By Type

- Colocation

- Hyperscale

- Edge

- Others

Singapore Data Center Market, By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises

Singapore Data Center Market, By End User

- BFSI

- IT and Telecom

- Government

- Energy and Utilities

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 198 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |