Singapore Deodorants Market

Singapore Deodorants Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Spray, Roll-On, Stick, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, E-retailers, and Others), By End User (Men and Women), and Singapore Deodorants Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Singapore Deodorants Market Insights Forecasts to 2035

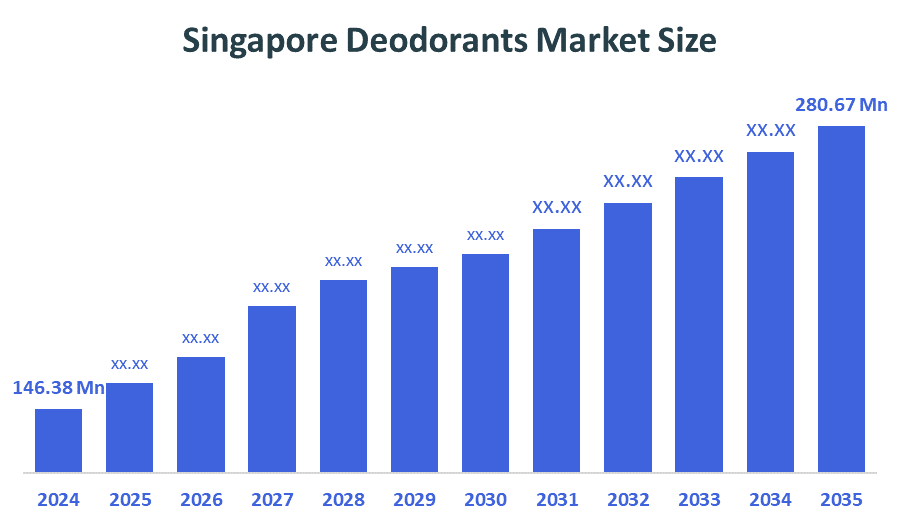

- The Singapore Deodorants Market Size Was Estimated at USD 146.38 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The Singapore Deodorants Market Size is Expected to Reach USD 280.67 Million by 2035

According to a research report published by Spherical Insights & Consulting, The Singapore Deodorants Market Size is anticipated to reach USD 280.67 Million by 2035, growing at a CAGR of 6.1% from 2025 to 2035. The market for deodorants in Singapore is mostly driven by consumers' growing knowledge of sustainability and their desire to make healthier decisions. More people are choosing natural and eco-friendly deodorants because they don't want to use dangerous chemicals and because they care about the environment.

Market Overview

The products called deodorants are applied to the body to prevent body odor, which is produced by bacteria that break down perspiration in certain areas. The companies in the market launched a pocket-sized deodorant that is affordable and easy to carry anywhere. Also, the innovation has enhanced the quality of perfumes, which are long-lasting and feel fresh after a muggy day. Rising demand for such deodorants increases the chances of the market in the forecast period.

Singapore's strict regulatory structure is supervised by the Health Sciences Authority (HSA), which mandates strict adherence to cosmetic safety laws, including ingredient disclosure, safety assessments, and labeling requirements. Understanding these rules' nuances is essential for global firms wishing to launch natural or organic deodorants. The HSA demands comprehensive documentation attesting to the safety of products that contain natural compounds investigated under the Singapore Cosmetic Act or make claims of health benefits.

Report Coverage

This research report categorizes the market for Singapore Deodorants Market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore Deodorants Market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore Deodorants Market.

Driving Factors

The deodorants market in Singapore is driven by the growing consumer desire for natural products will increase the importance of personal hygiene during the forecast period. Due to deodorant revenue and consumer preference, more products with a wider range of smells are being produced, giving consumers more options. This is anticipated to propel market expansion.

Restraining Factors

The Singaporean deodorant market is constrained by high expenses of the product, as many other products cause skin irritation or allergic reactions. Also, some factors like trade regulations, import export analysis, production analysis, impact of domestic and localized market players, and product launch.

Market Segmentation

The Singapore deodorants market share is classified into product type, distribution channel, and end user.

- The spray segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore deodorants market is segmented by product type into spray, roll-on, stick, and others. Among these, the spray segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is driven by due to broad coverage area, rapid drying time, and the capacity to reach challenging regions are the main reasons for its appeal. Additionally, the format gives manufacturers flexibility in product creation because it works with both alcohol-based and water-based formulations.

- The supermarket & hypermarket segment accounted for the largest revenue in 2024 during the forecast period.

The Singapore deodorants market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, e-retailers, and others. Among these, the supermarket & hypermarket segment accounted for the largest share in 2024 during the forecast period. The segment is driven by utilizing both the ease of one-stop shopping and its wide physical presence. Particular stores remain important because they provide well-considered alternatives and informed guidance, particularly for environmentally friendly and luxurious deodorant goods.

- The men segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Singapore deodorants market is segmented by end-user type into men and women. Among these, the men segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is driven by changing gender stereotypes and the masculinization of personal hygiene, where grooming is becoming more and more linked to professionalism and self-assurance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore Deodorants Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Unilever Singapore

- Procter & Gamble Co

- Colgate-Palmolive Pte. Ltd.

- Beiersdorf AG

- Corlison

- TAKASAGO SINGAPORE PTE LTD

- Syntech Chemicals Pte Ltd

- Taytonn ASCC

- ESOTERIC ECHO

- Luminar Pte Ltd

- UNIVA AROMATICS PTE LTD

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development:

- In October 2025, Unilever announced the sale of the Kate Somerville brand to Rare Beauty Brands. The Kate Somerville includes skincare and body care.

- In January 2025, Procter & Gamble due to the doubling down on innovation, resulting in launches like its whole-body deodorants across the Old Spice, Secret, and Native brands.

- In October 2024, Mintel announced three key trends set to impact the beauty and personal care industry in 2025 and beyond.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore Deodorants market based on the below-mentioned segments:

Singapore Deodorants Market, By Product Type

- Spray

- Roll-On

- Stick

- Others

Singapore Deodorants Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- E-retailers

- Others

Singapore Deodorants Market, By End User

- Men

- Women

FAQ’s

Q: What is the Singapore Deodorants Market size?

A: The Singapore Deodorants market was estimated at USD 146.38 million in 2024 and is projected to reach USD 280.67 million by 2035, growing at a CAGR of 6.1% during 2025–2035.

Q: What are Deodorants and their primary use?

A: Deodorants are products that are put on the body to stop or cover up body odor that is created by bacteria breaking down sweat in areas like the groin and armpits. It is used to reduce the unpleasant smell of body parts and provides a fragrance to the body.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the rising demand for natural and organic products, which will make personal hygiene more important over the projection period. Due to the demand and sales of deodorants.

Q: What factors restrain the Singapore Deodorants Market?

A: Constraints include high expenses of the product, as many other products cause skin irritation or allergic reactions.

Q: How is the market segmented by product type?

A: The market is segmented into spray, roll-on, stick, and others

Q: Who are the key players in the Singapore Deodorants market?

A: Key companies include Unilever Singapore, Procter & Gamble Co, Colgate-Palmolive Pte. Ltd., Beiersdorf AG, Corlison, TAKASAGO SINGAPORE PTE LTD, Syntech Chemicals Pte Ltd, Taytonn ASCC, ESOTERIC ECHO, Luminar Pte Ltd, and UNIVA AROMATICS PTE LTD.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 217 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |