Singapore E-Commerce Market

Singapore E-Commerce Market Size, Share, and COVID-19 Impact, By Type (Home Appliances, Apparel, Footwear and Accessories, Books, Cosmetics, Groceries, and Others), By Transaction (Business-to-Consumer, Business-to-Business, Others), and Singapore E-Commerce Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Singapore E-Commerce Market Insights Forecasts to 2035

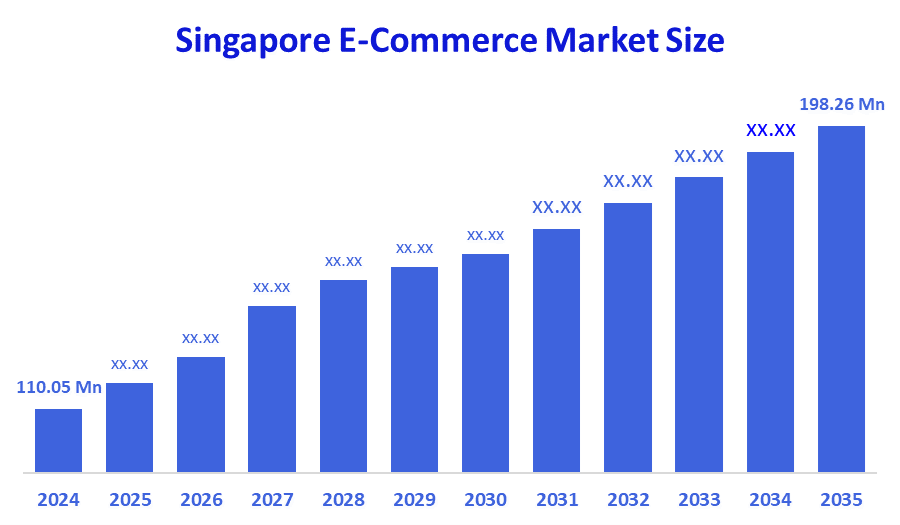

- The Singapore E-Commerce Market Size Was Estimated at USD 110.05 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.5% from 2025 to 2035

- The Singapore E-Commerce Market Size is Expected to Reach USD 198.26 Million by 2035

According to a research report published by Decision Advisor & Consulting, the Singapore E-Commerce Market size is anticipated to reach USD 198.26 Million by 2035, growing at a CAGR of 5.5% from 2025 to 2035. The market for e-commerce in Singapore is mostly driven by ascribed to widespread internet use, growing smartphone usage, especially among younger people, sophisticated logistical infrastructure, supportive government regulations, and an increasing inclination for online purchasing.

Market Overview

Business-to-consumer (B2C) and business-to-business (B2B) transactions involving the selling of products and services via online platforms such as websites and apps are included in the Singapore e-commerce market.

Exports from other countries US$942 billion in 2022, mainly goods, including foodstuffs, Cosmetics, Machinery and Equipment, electronics, pharmaceuticals, and other chemicals. Main export partners are the United States (22.43%), China (10.65%), Hong Kong (4.53%), and Japan (10.34%). Imports from Singapore US$870 billion in 2022, mainly goods including machinery and equipment, mineral fuels, chemicals, foodstuffs, and consumer goods. Main import partners are the United States (22.43%), China (10.65%), and Japan (4.71%).

The Shopee eCommerce network is owned by Singapore-based internet services company Sea Ltd., which has experienced rapid expansion lately. Sea Ltd. reported a 31% increase in revenues to USD 4.3 billion in December 2024, with a 41% increase in eCommerce revenue to USD 3.4 billion. Revenues at Sea Ltd. increased by 31% to USD 4.3 billion in December 2024, with eCommerce revenue rising by 41% to USD 3.4 billion.

GDP growth initiatives to raise digital literacy and connectivity in suburban areas have been started by the Infocomm Media Development Authority (IMDA). In 2024, the government offered incentives to e-commerce companies to invest in suburban delivery infrastructure to boost market penetration. Strong digital wallet use, government-led invoicing reforms, and same-day fulfillment investments all contribute to increased platform profits and strengthen Singapore's standing as the center of digital trade in Southeast Asia.

Report Coverage

This research report categorizes the market for Singapore e-commerce market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore e-commerce market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore e-commerce market.

Driving Factors

The e-commerce market in Singapore is driven by high internet usage and widespread use of mobile devices. The compound annual growth rate for online retail sales via mobile devices is 26.3%. actions by the government to support the digital economy. E-commerce grew thanks to the Singaporean government's commitment to creating a digital economy, and the ecosystem made it possible for the market to grow by 10.43% a year. Online shopping is becoming more and more popular, and this change in consumer behavior has led to an increase in e-commerce revenue, which could reach USD 5.04 billion in 2024 and USD billion in 2029. dissemination of safe and effective digital payment methods.

Restraining Factors

The Singaporean e-commerce market is restrained by despite Singapore's strong infrastructure, meeting the demand for prompt and reliable delivery is still challenging; online transactions are increasing, cybersecurity concerns are growing, and the market is fiercely competitive, with both domestic and foreign companies vying for customers' trust.

Market Segmentation

The Singapore e-commerce market share is classified into type and transaction.

- The home appliances segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore e-commerce market is segmented by type into home appliances, apparel, footwear and accessories, books, cosmetics, groceries, and others. Among these, the home appliances segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by increasing e-commerce popularity. Customers may now access, assess, and purchase household appliances from the comfort of their homes, eliminating the need for them to physically peruse the stores. People may select a product with just one search with the expanding array of opportunities made possible by easily accessible mobile apps and user-friendly websites, and major firms can take advantage of their information-driven purchasing behavior to support market growth.

- The business-to-business segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on transaction, the Singapore e-commerce market is segmented into business-to-consumer, business-to-business, others. Among these, the business-to-business segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by B2B e-commerce is the exchange of goods, services, or information between companies using a digital platform. Several factors are contributing to the rise in B2B e-commerce. Bulk orders and standardized goods are common in B2B transactions, which streamlines the purchasing procedure and reduces operating expenses. The International Trade Administration analysis projects that by 2026, the global B2B e-commerce sector will have grown to US$36 trillion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore e-commerce market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shopee

- Lazada

- Carousell

- Amazon

- Qoo10

- Castlery

- Ezbuy

- COURTS

- Zalora

- Love, Bonito

- FairPrice Online

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, Shopee, the leading e-commerce platform in launched its Shopee Rai Lokal Jelajah Komuniti in Sabah, as part of the Consumers Consultative Council’s Semarak Konsumerisme Programme in Papar.

- In October 2025, Carousell Luxury launched its first-ever offline store at The Centrepoint on Orchard Road in Singapore, expanding beyond its online platform to a permanent retail space.

- In July 2025, Amazon announced the launch of Amazon Bazaar, a new low-cost e-commerce platform, expanding its presence to 14 additional markets. The move is part of the company’s strategy to compete with Chinese fast-commerce rivals, including Shein and PDD Holdings’ Temu.

- In June 2025, Lazada announced a $100m annual investment into its Lazada Affiliate Programme. The goal is to scale affiliate marketing into a performance-driven growth channel across Southeast Asia

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Singapore E-Commerce Market based on the below-mentioned segments:

Singapore E-Commerce Market, By Type

- Home Appliances

- Apparel

- Footwear and Accessories

- Books

- Cosmetics

- Groceries

- Others

Singapore E-Commerce Market, By Transaction

- Business-to-Consumer

- Business-to-Business

- Others

FAQ’s

Q: What is the Singapore e-commerce market size?

A: The Singapore E-Commerce Market size is expected to grow from USD 110.05 million in 2024 to USD 198.26 million by 2035, growing at a CAGR of 5.5% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the Singaporean government's dedication to developing a digital economy helped e-commerce flourish, and the ecosystem allowed the sector to expand by 10.43% annually. The growing popularity of online shopping has resulted in a growth in e-commerce income, which is expected to reach USD 5.04 billion in 2024 and USD billion in 2029. distribution of secure and practical digital payment options.

Q: What factors restrain the Singapore e-commerce market?

A: Constraints include that, despite Singapore's strong infrastructure, meeting the demand for prompt and reliable delivery is still challenging; online transactions are increasing, cybersecurity concerns are growing, and the market is fiercely competitive, with both domestic and foreign companies vying for customers' trust.

Q: How is the market segmented by type?

A: The market is segmented into home appliances, apparel, footwear and accessories, books, cosmetics, groceries, and others.

Q: Who are the key players in the Singapore e-commerce market?

A: Key companies include Shopee, Lazada, Carousell, Amazon, Qoo10, Castlery, Ezbuy, COURTS, Zalora, Love, Bonito, and FairPrice Online.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 185 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |