Singapore Education Market

Singapore Education Market Size, Share, and COVID-19 Impact Analysis, By Education Level (Preschool Education, Primary Education, Secondary Education, and Professional Training), By Delivery Mode (Traditional Classroom Education, Online Learning, and Blended Learning), By Type of Institutions (Public Institutions, Private Education Institutions, and International Schools), and Singapore Education Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Singapore Education Market Insights Forecasts to 2035

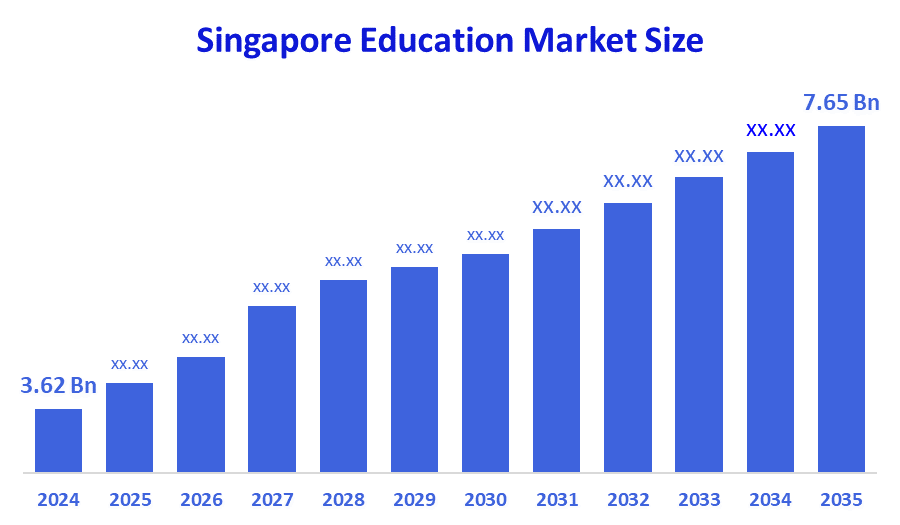

- The Singapore Education Market Size Was Estimated at USD 3.62 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.04% from 2025 to 2035

- The Singapore Education Market Size is Expected to Reach USD 7.65 Billion by 2035

According to a research report published by Decision Advisors, the Singapore Education Market size is anticipated to reach USD 7.65 Billion by 2035, growing at a CAGR of 7.04% from 2025 to 2035. The market for education in Singapore is mostly driven by continuous government support, ongoing advancements in technology, and increasing consumer demand for flexible and quality learning options.

Market Overview

The Ministry of Education is in charge of education in Singapore. It has consultation and regulatory authority over private schools in along with controlling the growth and management of governmental organizations that receive government financing.

Singapore's education market will undergo substantial shifts in the next years. The Ministry of Education aims to establish hybrid learning environments with AI-assisted feedback systems, smart classrooms, and learning analytics in all 360 public schools by 2030. The National Digital Literacy Program had trained more than 15,000 teachers in edtech pedagogy by 2024. Children under the age of six receive a pre-school education to get them ready for formal education. Pre-schools currently number over 1,800, and the Ministry of Education intends to expand this figure.

As of 2024, e-learning systems are used in more than 97% of Singaporean schools, with over S$700 million in state funding. Singapore's literacy rate had risen significantly over the previous 20 years in 2021. There are around 50,000 overseas students in Singapore who are between the ages of 13 and 23. Therefore, in addition to Singaporeans, U.S. universities and colleges ought to consider Singapore's substantial foreign student population. Singaporeans utilize the internet extensively; therefore, digital marketing is a helpful tool. When conducting online research, Singaporean students primarily use Google and government websites; for offline research, they use libraries.

Report Coverage

This research report categorizes the market for Singapore education market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore education market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore education market.

Driving Factors

The education market in Singapore is driven by support for curriculum development, teacher preparation, and infrastructure improvements, ultimately fostering a high standard of education in this area, which attracts international students due to its strong educational foundation and multicultural setting. increases the number of overseas students by offering financial aid and scholarships.

Restraining Factors

The Singaporean education market is restrained by internationalisation, denationalisation of economies, weakening of nation-states, and commodification of education are some of the main consequences of globalisation, and handling of growing cultural diversity in Singapore's educational system. Increase the pre-school teachers' professionalism to improve the quality of instruction and teachers in the pre-school sector.

Market Segmentation

The Singapore education market share is classified into education level, delivery mode and type of institutions.

- The professional training segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore education market is segmented by education level into preschool education, primary education, secondary education, and professional training. Among these, the professional training segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by significant expenditures made by companies and people in professional development, accreditation, and upgrading programs. Through programs aimed at workplace development, the government plays a significant role.

- The online learning segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on delivery mode, the Singapore education market is segmented into traditional classroom education, online learning, and blended learning. Among these, the online learning segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by technology advancements and changes in consumer expectations for flexible learning options. The epidemic caused many schools and institutions to embrace online platforms in order to continue offering instruction, which led to these modifications. Reputable domestic and international universities increased the number of online programs they provided, rendering study easier and more accessible for a larger variety of students.

- The public education segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore education market is segmented by type of institutions into public institutions, private education institutions, and international schools. Among these, the public education segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the large number of children in the area who attend government-sponsored schools, which mostly offer free public education to elementary, secondary, and post-secondary pupils.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore education market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- National University of Singapore

- Nanyang Technological University

- Singapore Management University

- LingoAce

- Geniebook

- Cialfo

- KooBits Learning Pte. Ltd

- Playware Studios

- NUS

- Flying Cape Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In February 2025, Singapore’s ITEES, the leader in technical training, a partnership with the Adani Group, launched the world’s largest finishing schools in Mundra.

In December 2024, the Nanyang Technological University, Singapore, launched the NBS Global Leaders Program to give students a supercharged business education.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Singapore Education Market based on the below-mentioned segments:

Singapore Education Market, By Education Level

- Preschool Education

- Primary Education

- Secondary Education

- Professional Training

Singapore Education Market, By Delivery Mode

- Traditional Classroom Education

- Online Learning

- Blended Learning

Singapore Education Market, By Type of Institutions

- Public Institutions

- Private Education Institutions

- International Schools

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |