Singapore Footwear Market

Singapore Footwear Market Size, Share, and COVID-19 Impact Analysis, By Type (Casual, Sports, Formal, and Others), By Distribution Channel (Supermarket and Hypermarket, Speciality Store, Online and E-Commerce, and Others), By End User (Men, Women, and Kids), and Singapore Footwear Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Singapore Footwear Market Insights Forecasts to 2035

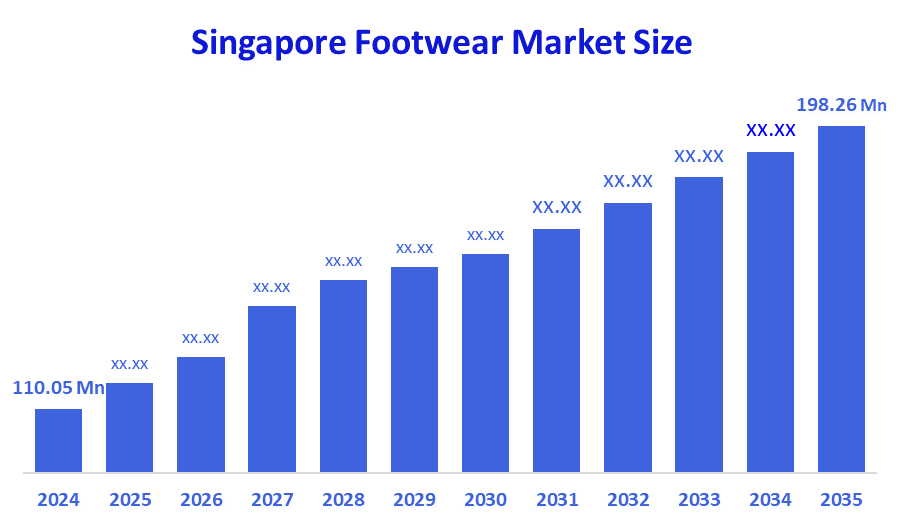

- The Singapore Footwear Market Size Was Estimated at USD 110.05 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.5% from 2025 to 2035

- The Singapore Footwear Market Size is Expected to Reach USD 198.26 Million by 2035

According to a research report published by Decision Advisors, the Singapore Footwear Market size is anticipated to reach USD 198.26 Million by 2035, growing at a CAGR of 5.5% from 2025 to 2035. The market for footwear in Singapore is mostly driven by influencing the footwear market share include the introduction of eco-friendly footwear, easy access to distinctive styles, rising demand for high-quality footwear, and an increasing number of organized retail shops.

Market Overview

Footwear is clothing that is worn on the feet to defend against environmental risks like temperature, wear from rough terrain, and stability on slick surfaces. When walking or doing other activities, it offers foot support and protection. expanding market for environmentally safe and sustainable shoes. Shoes consisting of sustainable textiles, recycled materials, and components acquired ethically are becoming more and more popular as consumers become more ecologically concerned.

Italy constituted the largest supplier of footwear to Singapore, comprising 48% of total imports. The second position in the ranking was held by China, with a 21% share of total imports. The Philippines, Japan and Malaysia were the largest markets for footwear exported from Singapore worldwide, together comprising 43% of total exports. The average footwear export price stood at $36 per pair in 2024, picking up by 12% against the previous year. In 2024, the average export price of shoes was $36 per pair, up 12% from the year before.

A permanent shoe waste collection ecosystem will be established in 2021 to recycle 170,000 pairs of used sports shoes annually, according to an announcement made by national sports agency Sport Singapore and leading materials science corporation Dow. Partners in this partnership include B.T. Sports, Alba WH, Decathlon, and Standard Chartered Bank.

Partnerships with tech firms to develop unique ideas or improve product features might provide significant opportunities for future growth.

Report Coverage

This research report categorizes the market for Singapore footwear market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore footwear market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore footwear market.

Driving Factors

The footwear market in Singapore is driven by rising consumer participation in sports like football, cricket, and athletics because of their entertainment value or physical advantages. Rising health and fitness awareness, growth of e-commerce platforms by consumers, increasing preference for online shopping for easy access, demographic shifts and rising disposable incomes. Automation and 3D printing are examples of manufacturing process innovations that save costs and increase production efficiency. Brands are implementing sustainable practices in their operations as a result of consumers' growing preference for eco-friendly products.

Restraining Factors

The Singapore footwear market is restrained by the market is flooded with low-quality alternatives due to the prevalence of counterfeit and imitation footwear, which damages brand names and lowers income for genuine manufacturers. It also causes supply chain disruptions and increases the expense of fighting counterfeit items. Counterfeit items damage brand reputation, reduce market share, and cause significant income losses for legitimate businesses. Luxury brands are severely impacted.

Market Segmentation

The Singapore footwear market share is classified into type, distribution channel, and end user.

- The casual segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore footwear market is segmented by type into casual, sports, formal, and others. Among these, the casual segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by wearing casual footwear on a daily basis is intended to be comfy. They go well with a variety of ensembles and events, including social events, professional settings, and outings. Additionally, they are designed in a variety of ways in accordance with current fashion trends. In this sense, casual footwear's comfort and adaptability contribute to segmental expansion.

- The supermarket and hypermarket segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on distribution channel, the Singapore footwear market is segmented into supermarket and hypermarket, speciality store, online and e-commerce, and others. Among these, the supermarket and hypermarket segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by due to these shop layouts make a variety of shoe companies easily accessible. They also offer a variety of shoes at reasonable costs and special discounts, which increases consumer interest

- The women segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore footwear market is segmented by end user into men, women, and kids. Among these, the women segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by women as a result of fashion's increasing influence and shifting preferences for shoes for formal, sporty, and casual events. In addition, women's growing interest in orthopaedic footwear is driving market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore footwear market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Peapes Footwear

- CFOOT

- Montreal Pte Ltd

- Anothersole

- Footkaki

- Hopla Kids Shoe Shop

- Actually Trading

- Sole 2 Sole

- Zanetta

- Bata Singapore

- Skechers Singapore

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2025, Kornit Digital Ltd., on-demand digital fashion and textile production technologies, announced a major industry milestone: the commercial launch of its groundbreaking digital footwear solution for sports and athleisure markets.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Singapore Footwear Market based on the below-mentioned segments:

Singapore Footwear Market, By Type

- Casual

- Sports

- Formal

- Others

Singapore Footwear Market, By Distribution Channel

- Supermarket and Hypermarket

- Speciality Store

- Online and E-Commerce

- Others

Singapore Footwear Market, By End User

- Men

- Women

- Kids

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 212 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |