Singapore Healthcare Claims Management Market

Singapore Healthcare Claims Management Market Size, Share, By and COVID-19 Impact, By Product (Medical Billing, Claims Processing), By Component (Software, Services), By Solution Type (Integrated, Standalone), By Deployment Mode (On-Premises, Cloud-Based, and Web-Based), and Singapore Healthcare Claims Management Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Singapore Healthcare Claims Management Market Insights Forecasts to 2035

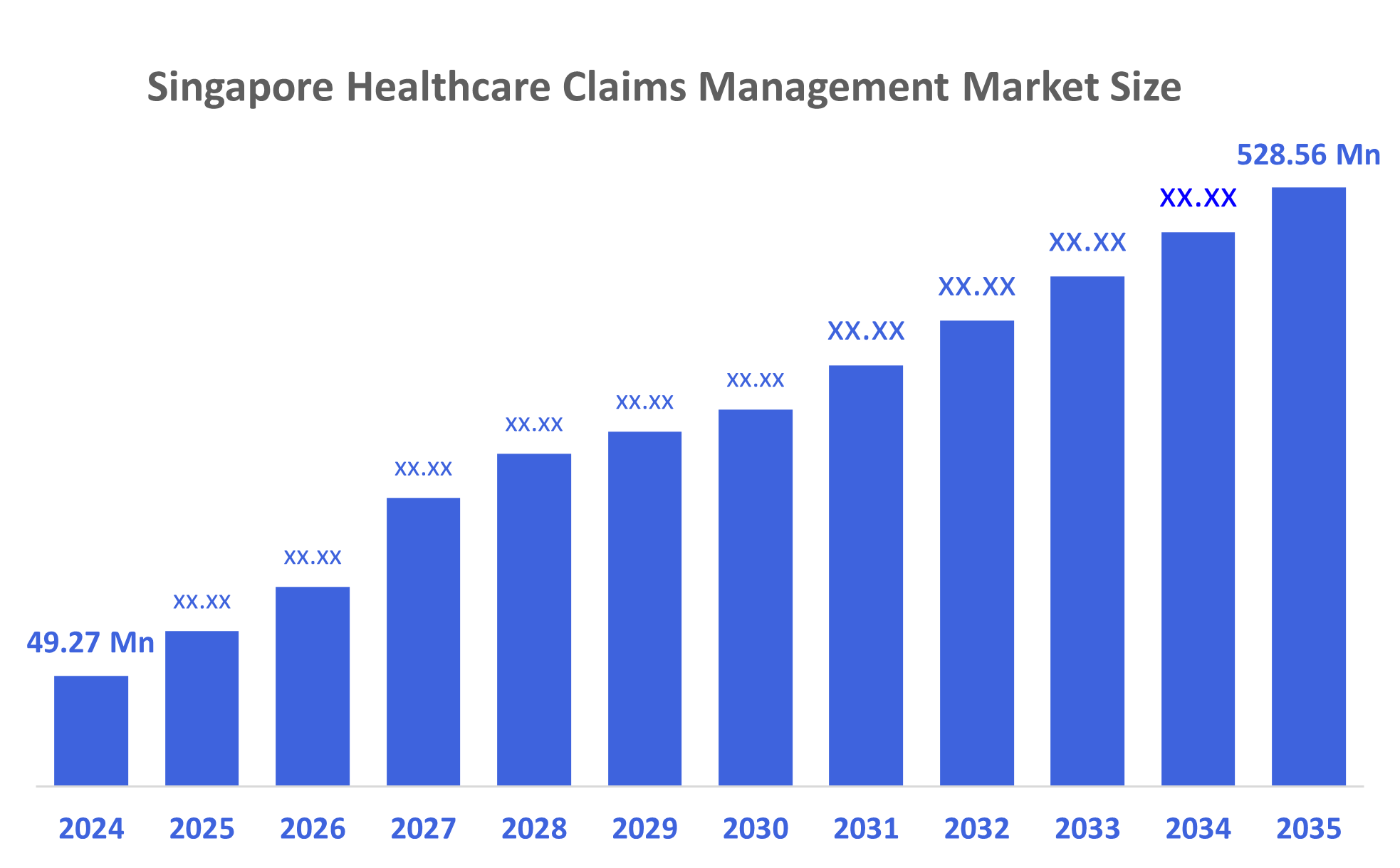

- The Singapore Healthcare Claims Management Market Size Was Estimated at USD 49.27 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 24.07% from 2025 to 2035

- The Singapore Healthcare Claims Management Market Size is Expected to Reach USD 528.56 Million by 2035

According to a research report published by Decisions Advisors, The Singapore Healthcare Claims Management Market Size is Anticipated to Reach USD 528.56 Million by 2035, growing at a CAGR of 24.07% from 2025 to 2035. The market for healthcare claims management in Singapore is mostly driven by low cost-sharing and advancements in pharmaceuticals. A greater emphasis on offering the general public high-quality healthcare services and an increase in the use of services connected to technology.

Market Overview

The multitasking process of arranging, billing, filing, processing, and updating medical claims pertaining to patient diagnosis, medicine, and treatment is known as healthcare claims management. Healthcare insurance claims administration currently heavily relies on automation and artificial intelligence technology, which helps insurers improve accuracy, reduce human labour, and streamline operations. The Department of Statistics Singapore reports that medical inflation reached 10.1% in 2024 as a result of new medical technologies. Singlife with Aviva is a domestically successful business that blends traditional insurer competencies with InsurTech innovation, with the strategic partnership between Aviva Singapore and Singlife. The business has launched mobile-first insurance, which lets customers manage their policies, savings, and investments via their mobile device and its user-friendly app.

By running its cutting-edge insurance exchange platform, which links insurance companies to distributors and consumers, Bolttech is a prominent InsurTech business in Singapore. Igloo, a Singapore-based InsurTech start up, focuses on digital protection and microinsurance coverage for markets lacking adequate insurance services. Igloo's collaboration with ride-hailing services, e-commerce platforms, and digital wallets enables the business to provide bite-sized insurance solutions that are both reasonably priced and customised for online shoppers. Healthcare expenses are rising, the market for health coverage is expanding, revenue cycle management (RCM) solutions are becoming more popular, digital and cloud-based solutions are becoming more popular, AI and analytics are becoming more widely used in claim processing, value-based healthcare models are becoming more popular, and telemedicine and remote healthcare services are expanding.

Report Coverage

This research report categorizes the market for Singapore healthcare claims management market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore healthcare claims management market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore healthcare claims management market.

Driving Factors

The Singapore healthcare claims management market is driven by the rising adoption of digital health technologies, increasing healthcare expenditure, and the need for efficient claims processing to reduce administrative burdens. Growing insurance penetration and the shift toward value-based care models further accelerate demand for automated claim solutions. Government support for healthcare digitalization, including initiatives promoting electronic medical records and AI-driven systems, enhances operational efficiency. Additionally, the surge in data analytics usage for fraud detection and real-time claim validation boosts market growth.

Restraining Factors

The Singapore healthcare claims management market is restrained by compliance with severe rules and regulations since the healthcare industry is heavily regulated, which limits the ability of businesses to innovate and develop new technology. Even though more Singapore are getting health insurance, a significant section of the population is still uninsured. In order to remain competitive, costs must be kept under control due to rising labour costs and the need to invest in new technology.

Market Segmentation

The Singapore healthcare claims management market share is classified into product, component, solution type, and deployment mode.

- The medical billing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore healthcare claims management market is segmented by product into medical billing, claims processing. Among these, the medical billing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by drafting and submitting claims to insurance companies in order to get payment. It contains a thorough description of the patients' diagnosis, treatments, and prescription drugs. Medical billing is becoming more and more necessary as hospital admissions rise. Automation of the medical billing process, brought forth by technological improvements, lessens the workload for administrative personnel.

- The software segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on component, the Singapore healthcare claims management market is segmented into software, services. Among these, the software segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by AI and ML are examples of cutting-edge technologies that completely change the claims process, from billing to payment. Software improves invoice tracking, billing accuracy, and minimizes human mistakes. Software use is encouraged by the government's and business organizations' growing investments in cutting-edge technologies.

- The integrated segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore healthcare claims management market is segmented by solution type into integrated, standalone. Among these, the integrated segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by integrated claims processing systems that act as a single system by combining several software programs. By doing away with the requirement for several independent systems, these solutions lower the likelihood of inconsistent and redundant data. They make it possible to update data in real time, resulting in correctness and consistency.

- The web-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on deployment mode, the Singapore healthcare claims management market is segmented into on-premises, cloud-based, and web-based. Among these, the web-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the usage of web-based claims administration is encouraged by the increasing use of the Internet. Multiple insurance businesses from a nation are brought together by web-based servers, which makes the management team's job easier. By streamlining the claim settlement procedure, the platform helps patients and healthcare professionals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore healthcare claims management market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MiCare HealthTech Holdings

- Fullerton Health

- HMI Managed Healthcare

- Cigna Healthcare Singapore

- Alliance Healthcare Group

- EnoviQ Technology

- Adept Health Pte Ltd

- The Medical Concierge Group Pte Ltd

- Azura Medica

- Medisys Innovations Pte Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2025, Brian Yang, head of claims Singapore and regional practice leader, energy, property and construction claims at AXA XL, said that client engagement and technology are key to a more demanding claims environment in Asia.

In September 2025, Shift Technology, the leading AI platform for insurance, launched Shift Claims. Powered by agentic artificial intelligence (AI), Shift Claims helps transform claims operations by assessing and prioritizing cases, guiding and assisting claim handlers and automating tasks across the claims lifecycle.

In January 2025, MSIG Singapore announced the appointment of Inova Care as its new health claims service provider. This strategic partnership underscores MSIG’s commitment to delivering superior value and enhanced services to its customers, ensuring the sustainability and affordability of health plans for corporate clients.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Singapore Healthcare Claims Management Market based on the below-mentioned segments:

Singapore Healthcare Claims Management Market, By Product

- Medical Billing

- Claims Processing

Singapore Healthcare Claims Management Market, By Component

- Software

- Services

Singapore Healthcare Claims Management Market, By Solution Type

- Integrated

- Standalone

Singapore Healthcare Claims Management Market, By Deployment Mode

- On-Premises

- Cloud-Based

- Web-Based

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |