Singapore Healthcare Supply Chain Management Market

Singapore Healthcare Supply Chain Management Market Size, Share, By and COVID-19 Impact, By Product (Hardware, Software, and Services), By Mode of Delivery (On-Premises, Web-Based, and Cloud-Based), By End User (Distributors, Healthcare Manufacturers, Healthcare Providers, and Logistics), and Singapore Healthcare Supply Chain Management Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Singapore Healthcare Supply Chain Management Market Insights Forecasts to 2035

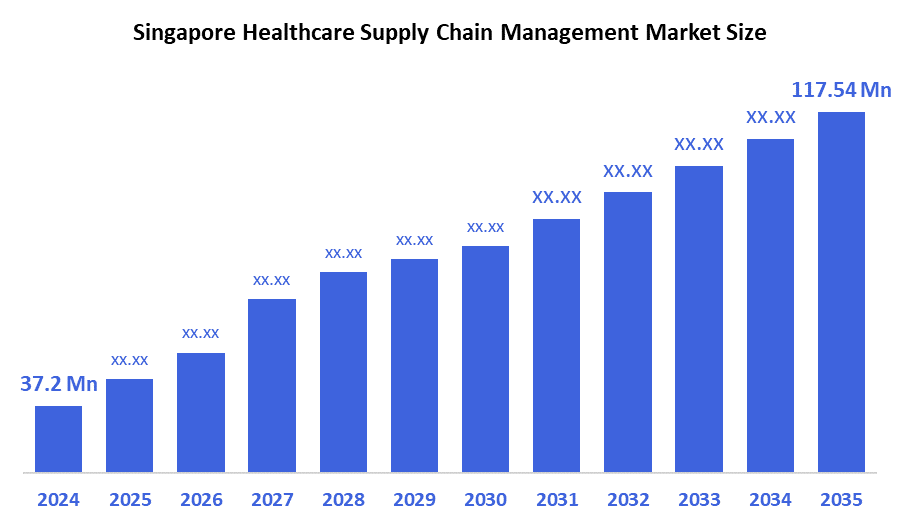

- The Singapore Healthcare Supply Chain Management Market Size Was Estimated at USD 37.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11.03% from 2025 to 2035

- The Singapore Healthcare Supply Chain Management Market Size is Expected to Reach USD 117.54 Million by 2035

According to a research report published by decision advisor & Consulting, the Singapore Healthcare Supply Chain Management Market size is anticipated to reach USD 117.54 Million by 2035, growing at a CAGR of 11.03% from 2025 to 2035. The market for healthcare supply chain management in Singapore is mostly driven by the adoption of solutions that improve inventory management, cut waste, and lower operating costs is driven by rising healthcare costs and the need for operational efficiency.

Market Overview

The goal of the healthcare supply chain, which is a component of the healthcare product delivery system, is to ensure that medical goods and related items are available and delivered from the manufacturer to the final customer in an economical, timely, and efficient manner. The health care industry is constantly expanding, bringing with it many levels and extremely complex supply chain procedures. These tasks include distribution, procurement, logistics, and inventory management to meet the needs of healthcare providers.

Industry 4.0 technologies are being rapidly adopted by Singapore in an effort to future-proof its industrial sector. Singapore's efforts to create production ecosystems that are resilient, data-driven, and flexible can be aided by exports of sophisticated CNC machines, robotic systems, automation control units, and smart sensors.

In 2019, Singapore imported raw materials from 157 additional partner nations (45.4%) as well as the United Arab Emirates (20.1%), Qatar (13.4%), Saudi Arabia (9%), Malaysia (6.4%), and Cambodia (5.8%). Additionally, Singapore has signed 26 free trade agreements (FTAs) over the years with economies that account for more than 85% of the world's GDP.

Companies in the healthcare supply chain management market have profitable potential to improve consumer engagement, optimize inventory management, and expedite procurement procedures thanks to the growth of e-commerce platforms and digital marketplaces. For healthcare professionals, digital platforms offer individualized recommendations, order tracking, and customer service, which enhances the entire purchasing process.

Report Coverage

This research report categorizes the market for Singapore healthcare supply chain management market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore healthcare supply chain management market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore healthcare supply chain management market.

Driving Factors

The healthcare supply chain management market in Singapore is driven by a rising attention to quality control and regulatory bodies. To confirm the efficacy and security of healthcare products, authorities and regulatory organisations enforce stringent regulations on their shipping, storage and purchase. increasing need for patient-centred treatment and personalised medications. These shifts necessitate adaptable supply chain approaches that can manage smaller, more frequent shipments without compromising the product's quality, especially for temperature-sensitive biologics. The expansion of e-commerce in the healthcare sector, including the telemedicine services and online pharmacies, is changing supply chain dynamics.

Restraining Factors

The Singaporean healthcare supply chain management market is restrained due to the need for large investments in infrastructure, training, and system integration. Cutting-edge healthcare supply chain technologies like AI, blockchain, and IoT may be difficult for smaller healthcare providers and companies with tight budgets to embrace. Cyberattacks on supply chain systems could compromise sensitive patient and product data and cause operational disruptions.

Market Segmentation

The Singapore healthcare supply chain management market share is classified into product, mode of delivery, and end user.

- The software segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore healthcare supply chain management market is segmented by product into hardware, software, and services. Among these, the software segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by as a result of the introduction of new apps to improve the efficiency of supply chain management processes. Additionally, segment growth is a result of healthcare businesses' increasing use of cutting-edge software for workflow management.

- The on-premise segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on mode of delivery, the Singapore healthcare supply chain management market is segmented into on-premises, web-based, and cloud-based. Among these, the on-premise segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by due to it is necessary to safeguard private and sensitive information and manage the organization's information flow. The acceptance of on-premises solutions is further fueled by the lack of additional costs over the course of ownership when compared to cloud-based deployment. Furthermore, the necessity for security standards, internet penetration, accessibility, online documentation, and in-house hosting choices

- The healthcare manufacturers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore healthcare supply chain management market is segmented by end user into distributors, healthcare manufacturers, healthcare providers, and logistics. Among these, the healthcare manufacturers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by due to the increasing demand for effective medical product manufacturing, delivery, and inventory control. In order to monitor materials, improve production schedules, and guarantee the prompt delivery of medications, equipment, and medical devices, manufacturers rely on sophisticated logistical networks. severe legal limitations and a rise in the demand for medical goods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore healthcare supply chain management market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mi Care Healthcare Tech Holdings

- Epic Medical

- Alliance Healthcare

- Econ Healthcare Asia

- 20Cube Logistics

- Healthcare Asia Pte Ltd

- Verita Healthcare Group

- Dltledgers

- Omni-Health Pte Ltd

- Supplify

- MGH Logistics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In April 2025, DHL Supply Chain, the global leader in contract logistics, launched a new Pharma Hub in Singapore, a dedicated facility for pharmaceutical logistics. The €10 million facility is part of DHL Group's €500 million investment into Asia Pacific to bolster its Life Sciences and Healthcare (LSHC) infrastructure across all business units.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. decision advisor has segmented the Singapore Healthcare Supply Chain Management Market based on the below-mentioned segments:

Singapore Healthcare Supply Chain Management Market, By Product

- Hardware

- Software

- Services

Singapore Healthcare Supply Chain Management Market, By Mode of Delivery

- On-Premises

- Web-Based

- Cloud-Based

Singapore Healthcare Supply Chain Management Market, By End User

- Distributors

- Healthcare Manufacturers

- Healthcare Providers

- Logistics

FAQ’s

Q: What is the Singapore healthcare supply chain management market size?

A: The Singapore Healthcare Supply Chain Management Market size is expected to grow from USD 37.2 million in 2024 to USD 117.54 million by 2035, growing at a CAGR of 11.03% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by increasing focus on regulatory agencies and quality control. Authorities and regulatory bodies impose strict rules on the transportation, storage, and acquisition of healthcare products in order to verify their effectiveness and security. growing demand for individualized medicine and patient-centred care.

Q: What factors restrain the Singapore healthcare supply chain management market?

A: Constraints include due to the need for large investments in infrastructure, training, and system integration. Cutting-edge healthcare supply chain technologies like AI, blockchain, and IoT may be difficult for smaller healthcare providers and companies with tight budgets to embrace. Cyberattacks on supply chain systems could compromise sensitive patient and product data and cause operational disruptions.

Q: How is the market segmented by product?

A: The market is segmented into hardware, software, and services.

Q: Who are the key players in the Singapore healthcare supply chain management market?

A: Key companies include Mi Care Healthcare Tech Holdings, Epic Medical, Alliance Healthcare, Econ Healthcare Asia, 20Cube Logistics, Healthcare Asia Pte Ltd, Verita Healthcare Group, Dltledgers, Omni-Health Pte Ltd, Supplify, MGH Logistics.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 207 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |