Singapore Medical Automation Market

Singapore Medical Automation Market Size, Share, and COVID-19 Impact, By Type (Diagnostic & Monitoring Automation, Therapeutic Automation, Lab & Pharmacy Automation, and Medical Logistics & Training), By End User (Hospitals & Diagnostics Centers, Pharmacies, Research Labs & Institutes, and Others), and Singapore Medical Automation Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Singapore Medical Automation Market Insights Forecasts to 2035

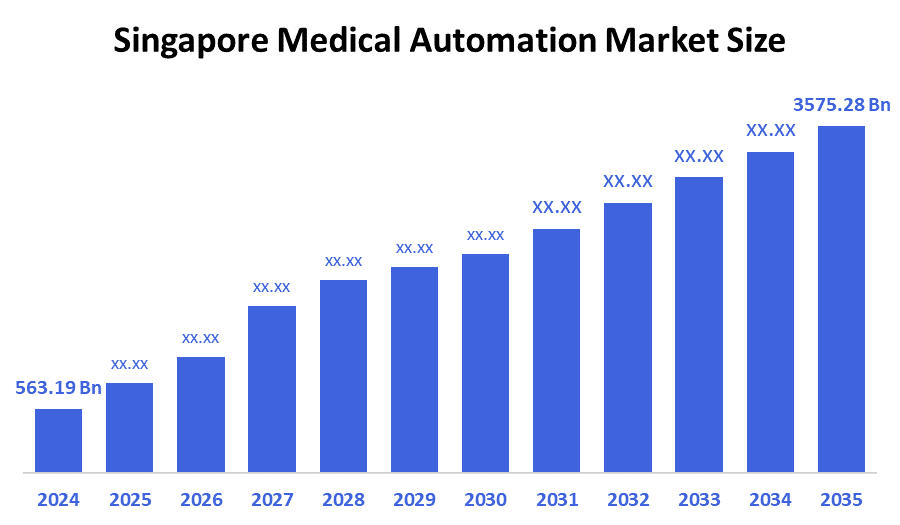

- The Singapore Medical Automation Market Size Was Estimated at USD 563.19 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 18.3% from 2025 to 2035

- The Singapore Medical Automation Market Size is Expected to Reach USD 3575.28 Billion by 2035

According to a research report published by decision advisor & Consulting, the Singapore Medical Automation Market size is anticipated to reach USD 3575.28 Billion by 2035, growing at a CAGR of 18.3% from 2025 to 2035. The market for medical automation in Singapore is mostly driven by the market's growth factors, including ongoing improvements in automation solutions, growing government funding for medical automation, rising labor costs, the growing need for accuracy and reproducibility, rising demand for pharmacies and laboratories, and the high potential for early disease detection and treatment due to automation.

Market Overview

Singapore has established itself as a leading regional hub for advancements in medical automation. Due to intentional expenditures in healthcare infrastructure and initiatives like the Smart Nation project.

The U.S. Food and Drug Administration (FDA) granted ANT-X a 510(k) clearance in 2023, according to NDR Medical Technology, an AI-powered interventional robotics business. With this clearance, ANT-X becomes the first automated robotic device in the world to help with needle alignment and positioning in order to enter the kidney for Percutaneous Nephrolithotomy (PCNL), a urological treatment used in Singapore to remove kidney stones.

Singapore's export of optical, medical, or surgical instruments is valued at $25.21 billion, representing 4.99% of total exports. Singapore's reputation for high-quality healthcare and medical research has driven exports in this sector.

On Wednesday, Otsaw, a Singapore-based company that develops autonomous mobile robots, increased the suggested transaction size for its impending initial public offering. The company intends to generate $22 million in July 2025 by selling 4.4 million shares at a price between $4.50 and $5.50. The business had earlier submitted a proposal to sell 4 million shares at the same price. At the midpoint, Otsaw will raise 11% more in proceeds than previously anticipated.

In order to improve patient access to healthcare, 45% of Singaporean hospitals will provide telemedicine services by 2023. Businesses create and sell cutting-edge platforms and technology that enhance the effectiveness of healthcare delivery and tackle the issues of an ageing population and rising chronic illness rates.

Report Coverage

This research report categorizes the market for Singapore medical automation market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore medical automation market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore medical automation market.

Driving Factors

The medical automation market in Singapore is driven by businesses seeking economical solutions due to healthcare expenditures are on the rise. Advances in robotic systems, such as automated pharmaceutical distribution systems and surgical robots, are making medical procedures safer and more accurate. A stronger focus on patient safety. Technology that lowers the possibility of human error is becoming increasingly crucial for healthcare organizations. The desire for healthcare operations to be more efficient is growing. Healthcare practitioners are increasingly searching for methods to enhance patient outcomes, reduce human error, and speed up processes. The regulatory bodies' growing in support of the use of automation technology in the healthcare industry. Governments are enacting laws that promote the use of automated technologies in order to improve patient safety and the standard of treatment.

Restraining Factors

The Singaporean medical automation market is restrained by supply chain interruptions, high production costs, and regulatory obstacles. High prices for medical automation equipment, technical difficulties with system integration and safety, and limitations in the industry survey and direct contributions from active players in this sector. Due to healthcare providers may be reluctant to spend money on equipment that doesn't offer financial incentives, a lack of reimbursement can hinder the market penetration and sales of cutting-edge medical technology. This would stop the development of creative solutions within the healthcare system.

Market Segmentation

The Singapore medical automation market share is classified into type and end user.

- The diagnostics & monitoring automation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on type, the Singapore medical automation market is segmented into diagnostic & monitoring automation, therapeutic automation, lab & pharmacy automation, and medical logistics & training. Among these, the diagnostics & monitoring automation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by improving both patient care and organizational effectiveness. Advanced technologies that improve workflow and accuracy in healthcare settings, like patient monitoring systems and diagnostic instruments, are included in this sector. It is widely used in medical facilities like hospitals. Technologies that offer real-time data and insights into patient health are included in this section, enabling prompt intervention

- The hospitals & diagnostics centers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore medical automation market is segmented by end user into hospitals & diagnostics centers, pharmacies, research labs & institutes, and others. Among these, the hospitals & diagnostics centers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by enhanced clinical workflows, data administration, and patient safety. These facilities place a high premium on automation integration to ensure accurate diagnosis, speed up procedures, and reduce wait times.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore medical automation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NDR Medical Technology

- Omni-Health Pte Ltd

- AS Tech

- MHC Asia Group

- Bot MD

- SCI Automation Pte Ltd

- Otsaw

- EM2Ai Group

- Excel Marco

- Delighteck

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Singapore General Hospital established a centre of excellence in robotic-assisted surgery training in partnership with Johnson & Johnson MedTech.

- In August 2025, the Medical Device Authority (MDA) of Malaysia and the Health Sciences Authority (HSA) of Singapore signed a Memorandum of Understanding (MoU) to deepen regulatory cooperation and officially launched a 6-month pilot of the Medical Device Regulatory Reliance Programme as part of the MoU.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. decision advisor has segmented the Singapore Medical Automation Market based on the below-mentioned segments:

Singapore Medical Automation Market, By Type

- Diagnostic & Monitoring Automation

- Therapeutic Automation

- Lab & Pharmacy Automation

- Medical Logistics & Training

Singapore Medical Automation Market, By End User

- Hospitals & Diagnostics Centers

- Pharmacies

- Research Labs & Institutes

- Others

FAQ’s

Q: What is the Singapore medical automation market size?

A: The Singapore Medical Automation Market size is expected to grow from USD 563.19 billion in 2024 to USD 3575.28 billion by 2035, growing at a CAGR of 18.3% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the enterprises looking for cost-effective alternatives due to rising healthcare costs. Medical treatments are becoming safer and more accurate with the advancements in robotic systems, such as automated medication distribution systems and surgical robots. Greater attention to patient safety. For the healthcare business, technology that reduces the likelihood of human mistakes is becoming more and more important.

Q: What factors restrain the Singapore medical automation market?

A: Constraints include the supply chain interruptions, high production costs, and regulatory obstacles. High prices for medical automation equipment, technical difficulties with system integration and safety, and limitations in the industry survey and direct contributions from active players in this sector. Healthcare providers may be reluctant to spend money on equipment that doesn't offer financial incentives.

Q: How is the market segmented by type?

A: The market is segmented into diagnostic & monitoring automation, therapeutic automation, lab & pharmacy automation, and medical logistics & training.

Q: Who are the key players in the Singapore medical automation market?

A: Key companies include NDR Medical Technology, Omni-Health Pte Ltd, AS Tech, MHC Asia Group, Bot MD, SCI Automation Pte Ltd, Otsaw, EM2Ai Group, Excel Marco, and Delighteck.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 214 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |