Singapore Metal Cans Market

Singapore Metal Cans Market Size, Share, and COVID-19 Impact, By Material (Aluminium, Steel), By Product (2-Piece Draw Redraw, 2-Piece Drawn and Ironed, 3-Piece), By Closure Type (Easy-Open End, Peel-Off End, Others), By Applications (Food & Beverages, and Others), and Singapore Metal Cans Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Singapore Metal Cans Market Insights Forecasts to 2035

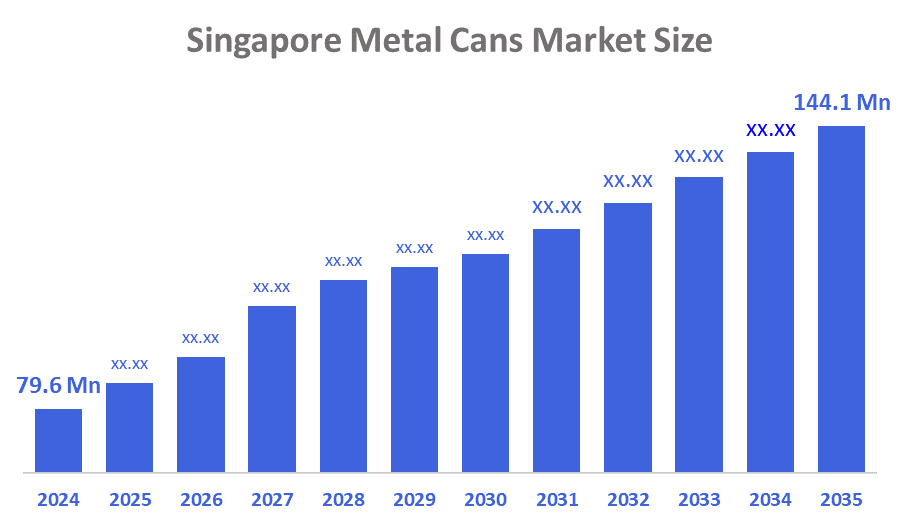

- The Singapore Metal Cans Market Size Was Estimated at USD 79.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.54% from 2025 to 2035

- The Singapore Metal Cans Market Size is Expected to Reach USD 144.1 Million by 2035

According to a research report published by Decision Advisor & Consulting, the Singapore Metal Cans Market size is anticipated to reach USD 144.1 million by 2035, growing at a CAGR of 5.54% from 2025 to 2035. The market for metal cans in Singapore is driven by the growing consumer awareness of environmentally friendly packaging and rising demand for canned goods, ready-to-drink drinks, and durable packaging solutions are driving market expansion.

Market Overview

Metal cans are a type of metal packaging that was initially utilized for wrapping wine until being expanded to include additional final-use items such as food and drink, chemicals, and oils. Considering metal cans are recyclable, durable, and protected from the elements, they are frequently used to package food, drinks, and household goods. The market provides a variety of can shapes, sizes, and coverings to suit various goods and advertising needs.

Singapore exported 59 metals can shipments. 25 buyers received these products from 28 Singaporean exporters. Singapore exports the majority of its metal cans to the Philippines, Sri Lanka, and the United States. From May 2024 to April 2025, 13 cargoes of metal cans were imported from Singapore. Seven Singaporean exporters delivered these imports to seven global buyers, representing a -7% increase over the previous twelve months.

The NEA's aluminium can return program was launched in March 2023 in an effort to boost Singapore's recycling rate. The organization wants to increase Singapore's recycling rate via this program. The scheme will require all pre-packaged beverages and aluminium cans to have a 10-cent refundable deposit.

Governmental legislation, the pace of the financial industry, and changing company strategy are all contributing to the growth of ESG-focused market research in Singapore. Singaporean customers' tastes are also changing, with Gen Z and millennials basing their purchases on environmental credentials. As a result, companies are investing in ESG research for ethical branding and honest storytelling.

Report Coverage

This research report categorizes the market for Singapore metal cans market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore metal cans market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore metal cans market.

Driving Factors

The metal cans market in Singapore is driven by the requirements for food and beverage packaging. Metal cans are well known for their durability, cleanliness, and ability to keep their contents fresh. The need for metal cans for export and packaging has grown dramatically due to Singapore's position as a regional center for food and drink. Recyclable and environmentally friendly metal can package has also been developed as a result of the sustainability trend, which has accelerated market expansion.

Restraining Factors

The Singaporean metal cans market is restrained by the sustainability and competition from alternative packaging materials, consumers seek eco-friendly options, manufacturers must make metal cans more recyclable and reduce their environmental footprint. Additionally, the market faces stiff competition from plastic and glass containers, requiring constant innovation and differentiation.

Market Segmentation

The Singapore metal cans market share is classified into material, product, closure type, and applications.

- The aluminium segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on material, the Singapore metal cans market is segmented into aluminium, steel. Among these, the aluminium segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by aluminium is a common material for food and beverage packaging because it is lightweight, corrosion-resistant, and easily recyclable. lowering the cost of aluminium cans for broad use, which is particularly favored in the power and beverages sectors where pressure resistance and product quality are essential.

- The 2-piece drawn and ironed segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore metal cans market is segmented by product into 2-piece draw redraw, 2-piece drawn and ironed, 3-piece. Among these, the 2-piece drawn and ironed segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the especially preferred in the energy and fizzy drink industries, where product quality and pressure resistance are crucial. The production method reduces waste and works with aluminium, improving sustainability by enabling complete recyclability without sacrificing quality.

- The easy-open end segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on closure type, the Singapore metal cans market is segmented into easy-open end, peel off end, others. Among these, the easy-open end segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by its compatibility with steel and aluminium cans, as well as its adaptability to different can sizes. In industries including canned goods, soft drinks, and specialty beverages, its ease of usage has made it a popular option.

- The food & beverages segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore metal cans market is segmented by application into food & beverages, and others. Among these, the food & beverages segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the development, changing customer preferences, and the growing demand for easily carried, one-serve dietary substitutes Metal cans are a common option for refreshments, energy drinks, and alcoholic beverages since they maintain the quality of the product and carbonation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore metal cans market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MC Packaging

- Jack Metal Industries

- Interwaters

- Consurf Solutions Pte Ltd

- Hoe Cgong Tin Pte Ltd

- AluCont Packaging Pte Ltd

- K5 Metal Pte Ltd

- Soon Lee Recycle Pte Ltd

- Straight Stainless-Steel Pte Ltd

- Superior Multi Packaging Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Singapore Metal Cans Market based on the below-mentioned segments:

Singapore Metal Cans Market, By Material

- Aluminium

- Steel

Singapore Metal Cans Market, By Product

- 2-Piece Draw Redraw

- 2-Piece Drawn and Ironed

- 3-Piece

Singapore Metal Cans Market, By Closure Type

- Easy-Open End

- Peel Off End

- Others

Singapore Metal Cans Market, By Application

- Food & Beverages

- Others

FAQ’s

Q: What is the Singapore metal cans market size?

A: The Singapore Metal Cans Market size is expected to grow from USD 79.6 million in 2024 to USD 144.1 million by 2035, growing at a CAGR of 5.54% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the requirements for food and beverage packaging. Metal cans are well known for their durability, cleanliness, and ability to keep their contents fresh. The need for metal cans for export and packaging has grown dramatically due to Singapore's position as a regional center for food and drink.

Q: What factors restrain the Singapore metal cans market?

A: Constraints include the sustainability and competition from alternative packaging materials, consumers seek eco-friendly options, manufacturers must make metal cans more recyclable and reduce their environmental footprint. Additionally, the market faces stiff competition from plastic and glass containers, requiring constant innovation and differentiation.

Q: How is the market segmented by material?

A: The market is segmented into aluminium, steel.

Q: Who are the key players in the Singapore metal cans market?

A: Key companies include MC Packaging, Jack Metal Industries, Interwaters, Consurf Solutions Pte Ltd, Hoe Cgong Tin Pte Ltd, AluCont Packaging Pte Ltd, K5 Metal Pte Ltd, Soon Lee Recycle Pte Ltd, Straight Stainless-Steel Pte Ltd, and Superior Multi Packaging Ltd.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |