Singapore Social Commerce Market

Singapore Social Commerce Market Size, Share, and COVID-19 Impact Analysis, By Business Model (Business-to-Business (B2B), Business-to-Consumer (B2C), and Consumer-to-Consumer (C2C)), By Product Type (Personal & Beauty Care, Accessories, Apparel, Food & Beverages, and Health Supplements & Home Products), and Singapore Social Commerce Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Singapore Social Commerce Market Insights Forecasts to 2035

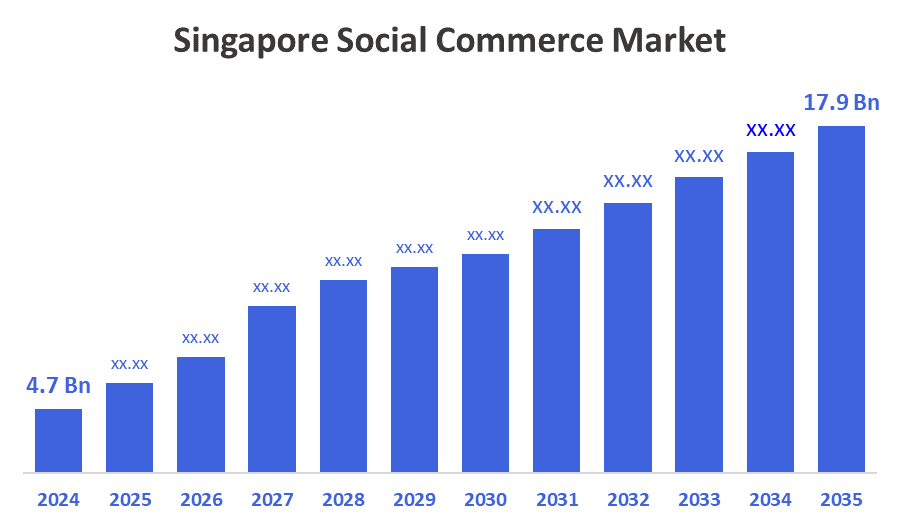

- The market for Social Commerce was estimated to be worth USD 4.7 Billion in 2024.

- The market is going to expand at a CAGR of 12.93 % between 2025 and 2035.

- The Singapore Social Commerce market is anticipated to reach USD 17.9 Billion by 2035.

According to a research report published by Spherical Insights & Consulting, the Singapore social commerce market is anticipated to Hold USD 17.9 Billion by 2035, growing at a CAGR of 12.93 % from 2025 to 2035. The Singapore Social Commerce Market offers future opportunities through rising social media engagement, influencer-driven marketing, AI-based personalization, seamless in-app shopping experiences, and increasing smartphone penetration supporting convenient, real-time product discovery and purchasing behaviour.

Market Overview

The Singapore social commerce market is witnessing strong growth driven by high social media penetration, increasing smartphone usage, and the integration of e-commerce within popular platforms like Instagram, TikTok, and Facebook. Consumers in Singapore increasingly prefer purchasing directly through social media due to convenience, personalized recommendations, and influencer endorsements. The trend is further supported by growing trust in peer reviews, live-stream shopping events, and AI-driven engagement tools that enhance customer experiences. Brands and retailers are leveraging data analytics and targeted advertising to improve conversion rates and customer retention. Additionally, collaborations between e-commerce players and social platforms are expanding market accessibility, making social commerce one of the fastest-growing segments in Singapore’s digital retail ecosystem.

Report Coverage

This research report categorizes the market for the Singapore social commerce market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore social commerce market. Recent market developments and competitive strategies such as expansion, Product Type launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore social commerce market.

Driving Factors

The Singapore social commerce market is driven by rising social media usage, growing influencer marketing, and the increasing popularity of in-app shopping experiences. High smartphone penetration and seamless mobile payment options enhance user convenience and trust. Consumers increasingly rely on peer reviews, live-stream shopping, and personalized content to guide purchasing decisions. Additionally, advanced AI and data analytics help brands deliver targeted marketing campaigns, while collaborations between e-commerce platforms and social networks further accelerate social commerce adoption across Singapore’s digital retail landscape.

Restraining Factors

The Singapore social commerce market faces restraints such as data privacy concerns, inconsistent product quality, and limited consumer trust in lesser-known sellers. Additionally, platform algorithm changes, intense competition, and regulatory challenges related to advertising transparency and cross-border transactions may hinder seamless growth and consumer confidence in social commerce platforms.

Market Segmentation

The Singapore social commerce market share is classified into business model and product type.

- The business-to-consumer (B2C) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore social commerce market is segmented by business model into business-to-business (B2B), business-to-consumer (B2C), and consumer-to-consumer (C2C). Among these, the business-to-consumer (B2C) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. B2C leads because consumers drive social-commerce adoption through mobile purchases, influencer/live-stream shopping, and seamless in-app payments. High smartphone penetration, strong digital trust, and platforms optimized for retail conversions make B2C the dominant, high-growth model in Singapore.

- The apparel segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore social commerce market is segmented by product type into personal & beauty care, accessories, apparel, food & beverages, and health supplements & home products. Among these, the apparel segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The apparel segment held a significant share in 2024 due to strong demand for fashion-driven, affordable clothing promoted by influencers and social media trends. Visual platforms like Instagram and TikTok boost engagement, driving impulse purchases and brand visibility across Singapore’s fashion-conscious consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore social commerce market along with a comparative evaluation primarily based on their Product Type offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes Product Type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sea Ltd (including the Shopee platform)

- Lazada Group

- Amazon.com, Inc. (Singapore operations)

- Qoo10 Pte Ltd

- ByteDance Ltd (owner of TikTok Shop)

- Carousell Pte Ltd

- Shein Singapore Pte Ltd

- Temu Singapore Pte Ltd

- Zalora South East Asia Pte Ltd

- Sephora Digital SEA Pte Ltd

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore social commerce market based on the following segments:

Singapore Social Commerce Market, By Business Model

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Consumer-to-Consumer (C2C)

Singapore Social Commerce Market, By Product Type

- Personal & Beauty Care

- Accessories

- Apparel

- Food & Beverages,

- Health Supplements & Home Products

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |