Global Sisal Market

Global Sisal Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (Fibers and Yarn), By Application (Rope & Cordage, Automotive, and Textile), and By Region (Asia Pacific, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Sisal Market Summary, Size & Emerging Trends

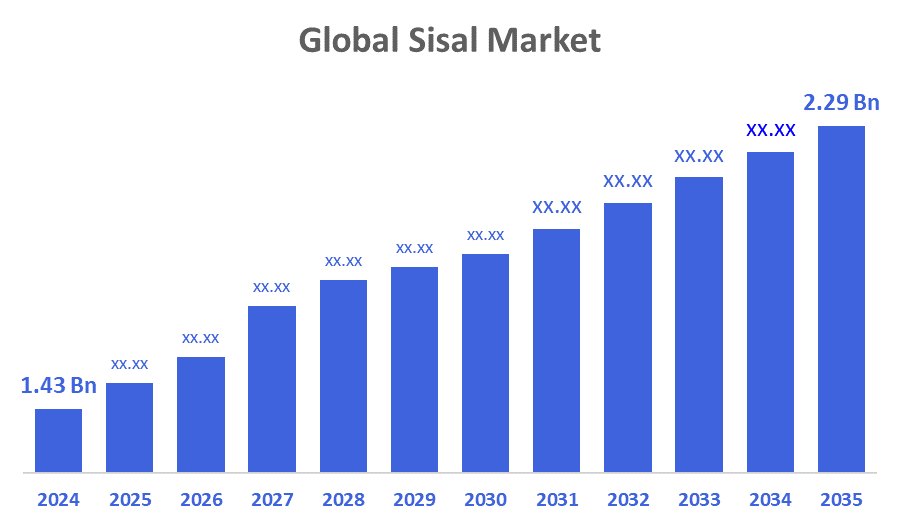

According to Decisions Advisors, The Global Sisal Market Size is expected to Grow from USD 1.43 Billion in 2024 to USD 2.29 Billion by 2035, at a CAGR of 4.37% during the forecast period 2025-2035. Rising demand for sustainable and biodegradable natural fibers in automotive, construction, and textile industries is a key growth driver for the sisal market.

Key Market Insights

- Asia Pacific is expected to hold the largest share in the sisal market during the forecast period.

- The fibers segment dominates in terms of revenue, owing to its extensive use in rope and cordage manufacturing.

- Automotive application segment shows significant growth due to increased use of sisal composites in lightweight vehicle components.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.43 Billion

- 2035 Projected Market Size: USD 2.29 Billion

- CAGR (2025-2035): 4.37%

- Asia Pacific: Largest market in 2024

- Latin America: Fastest growing market

Sisal Market

Sisal is a natural fiber derived from the leaves of the Agave sisalana plant, known for its excellent strength, durability, and biodegradability. It is widely used in manufacturing ropes, textiles, automotive composites, and construction materials due to its eco-friendly properties. The global sisal market is expanding as governments promote sustainable agriculture and environmentally friendly products. Consumers are increasingly choosing natural fibers over synthetic ones, driving demand for sisal. Additionally, trends such as green building practices and automotive lightweighting enhance the use of sisal fibers as a sustainable raw material. These factors position sisal as a vital component in developing eco-conscious products across multiple industries, supporting market growth worldwide.

Sisal Market Trends

- Growing focus on sustainable and biodegradable materials in textiles and automotive sectors.

- Increased R&D in sisal fiber composites enhancing mechanical properties and expanding applications.

- Strategic partnerships between fiber producers and automotive manufacturers to promote sisal composites.

Sisal Market Dynamics

Driving Factors: The sisal market is fueled by growing demand for eco-friendly materials

The sisal market is fueled by growing demand for eco-friendly materials, especially in automotive and construction sectors. In automotive manufacturing, sisal composites help reduce vehicle weight, leading to lower emissions and better fuel efficiency, aligning with global lightweighting initiatives. Infrastructure growth worldwide boosts sisal’s use in construction materials, such as insulation and panels. Increasing environmental awareness pushes consumers and industries to prefer natural fibers over synthetic ones in textiles and packaging. Additionally, government support through subsidies and sustainable agriculture certifications encourages sisal cultivation and promotes its applications, further driving market expansion.

Restrain Factors: The sisal market faces challenges from inconsistent raw fiber supply and processing complexities

The sisal market faces challenges from inconsistent raw fiber supply and processing complexities. Sisal fiber production depends heavily on favorable climate conditions and labor-intensive harvesting, causing supply fluctuations. Processing sisal involves costly fiber extraction and treatment, which can limit large-scale production. Moreover, synthetic fibers with lower costs and easier manufacturing processes pose strong competition, especially in price-sensitive markets. These factors restrain demand growth for sisal, as manufacturers balance cost efficiency with sustainability goals. Overcoming supply chain inefficiencies and reducing processing expenses are critical to improving market penetration.

Opportunity: Rapid infrastructure development and expanding automotive industries

Emerging economies in Asia Pacific and Latin America present significant growth potential for sisal due to rapid infrastructure development and expanding automotive industries. In automotive lightweighting, innovations in sisal fiber composites offer promising applications, such as lightweight panels that help reduce vehicle carbon footprints. These advances open new markets and use cases for sisal fibers. Additionally, countries producing sisal are benefiting from increasing export demand as global interest in sustainable materials rises. Together, these factors create robust opportunities for expanding sisal’s footprint and boosting economic benefits for producers worldwide.

Challenges: The sisal market is hindered by a lack of unified quality standards

The sisal market is hindered by a lack of unified quality standards, limiting sisal’s use in high-performance industries like automotive composites. Without standardization, manufacturers face difficulties ensuring consistent fiber quality, which affects product reliability. Additionally, the market is fragmented, with many small-scale producers operating independently, reducing economies of scale and complicating supply chain management. This fragmentation also leads to inconsistent supply and pricing. Addressing these issues requires coordinated efforts to standardize sisal fiber quality and improve processing technologies, enabling wider adoption and more efficient market operations.

Global Sisal Market Ecosystem Analysis

The sisal market ecosystem comprises sisal farmers, fiber processing units, composite manufacturers, and end-users in automotive, textile, and construction industries. Agricultural suppliers provide raw material inputs, while processing companies focus on fiber extraction and treatment. Composite manufacturers innovate to enhance material performance. Collaboration between stakeholders and government regulatory bodies promotes sustainable practices and market expansion.

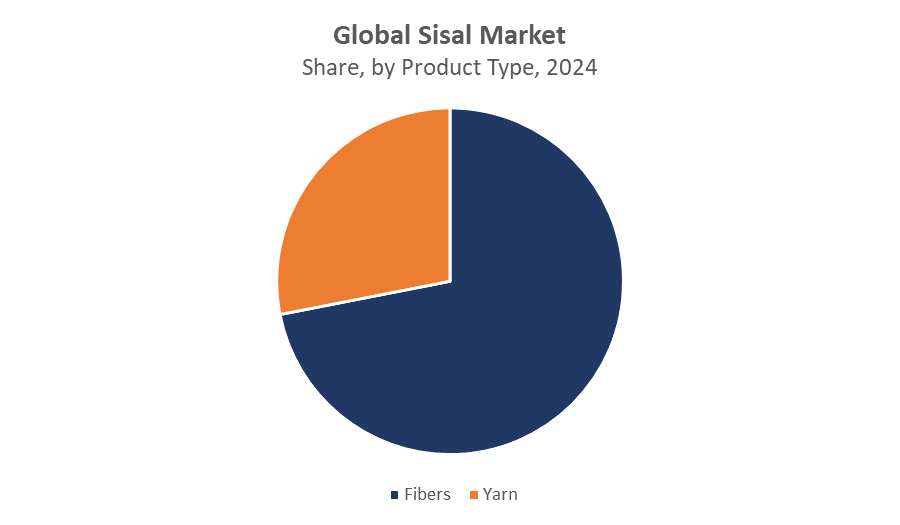

Global Sisal Market, By Product Type

The fibers segment dominates the global sisal market, accounting for the largest revenue share typically around 50% during the forecast period. This leadership is due to the direct use of raw sisal fibers in multiple sectors such as automotive composites, where fibers help reduce vehicle weight; construction, where they reinforce materials; and traditional industries like rope and mat manufacturing. The fibers’ natural strength, durability, and biodegradability make them indispensable for eco-friendly applications, which boosts consistent demand globally. Furthermore, government initiatives supporting sustainable raw materials reinforce this segment’s dominance.

The yarn segment is rapidly gaining substantial market share, expected to grow at a CAGR notably higher than fibers. Yarn accounts for roughly 25% of the market and is expanding due to rising adoption in textiles and packaging. Sisal yarn’s natural texture and eco-friendly appeal align well with consumer preferences for sustainable fashion, home décor, and biodegradable packaging. Innovations in spinning and processing technologies are improving yarn quality and applications, further driving growth in this segment.

Global Sisal Market, By Application

The rope and cordage application leads the sisal market, holding the largest revenue share, typically around 50%, due to sisal’s traditional and highly valued use in manufacturing durable, strong ropes and cords. Sisal fibers provide excellent tensile strength and resistance to moisture, making them ideal for marine, agricultural, and industrial rope applications. This segment’s dominance is sustained by ongoing demand in construction, shipping, and agriculture sectors worldwide.

The automotive segment is gaining substantial market share and is expected to grow rapidly at a high CAGR. Currently accounting for roughly 20% of the market, sisal is increasingly used in automotive composites and interior panels as part of lightweighting efforts to reduce vehicle emissions. Growing environmental regulations and a shift toward sustainable materials in vehicle manufacturing are driving this surge.

Asia Pacific holds the largest share of the global sisal market in 2024, driven by rapid industrialization, expanding infrastructure, and growing demand for sustainable materials in countries like India and China. The region benefits from abundant raw material availability and government support for eco-friendly agriculture, boosting sisal fiber production and usage in textiles, automotive, and construction sectors.

India plays a crucial role in the Asia Pacific sisal market, being one of the largest producers and consumers of sisal fiber. The country’s favorable climate and vast agricultural land support extensive sisal cultivation. Government initiatives promoting sustainable agriculture and rural development boost production. Additionally, rising demand from the automotive and textile industries for eco-friendly materials drives market growth.

Latin America is the fastest-growing sisal market, due to increasing investments in agricultural modernization and rising demand for natural fibers in the automotive and packaging industries. Brazil, as a key country, is witnessing significant growth supported by favorable climate conditions for sisal cultivation and expanding industrial applications.

WORLDWIDE TOP KEY PLAYERS IN THE SISAL MARKET INCLUDE

- REA Vipingo Group

- SFI Tanzania

- GuangXi Sisal Group

- METL Group

- Hamilton Rios

- Wild Fibres

- Lanktrad International Ltd

- International Fiber Corporation

- Agave Tanzania Limited

- Tongliao Xinghe Biotechnology Co., Ltd

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisorshas segmented the sisal market based on the below-mentioned segments:

Global Sisal Market, By Product Type

- Fibers

- Yarn

Global Sisal Market, By Application

- Rope & Cordage

- Automotive

- Textile

Global Sisal Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 156 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |