Global Smart Logistics Service Market

Global Smart Logistics Service Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Service Type (Transportation Management, Warehouse Management, and Freight Forwarding), By Technology (IoT, AI & Machine Learning, and Blockchain), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Smart Logistics Service Market Summary, Size & Emerging Trends

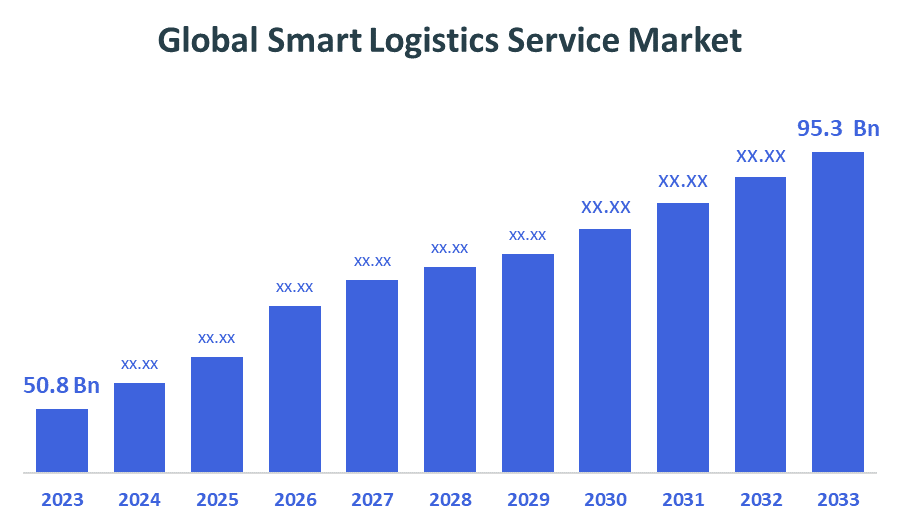

The Global Smart Logistics Service Market Size is Expected to Grow from USD 50.8 Billion in 2024 to USD 95.3 Billion by 2035, at a CAGR of 5.7% during the forecast period 2025-2035. The market growth is driven by the increasing adoption of IoT and AI technologies in logistics to improve supply chain visibility, efficiency, and reduce operational costs.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the smart logistics service market during the forecast period.

- In terms of service type, the transportation management segment accounted for the largest revenue share of the global smart logistics service market during the forecast period.

- In terms of technology, the IoT segment accounted for the highest market share of the global smart logistics service market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 50.8 Billion

- 2035 Projected Market Size: USD 95.3 Billion

- CAGR (2025-2035): 5.7%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Smart Logistics Service Market

The smart logistics service market focuses on the integration of advanced technologies such as IoT, AI, and blockchain into logistics operations to optimize transportation, warehouse management, and freight forwarding processes. These technologies enable real-time tracking, predictive analytics, and secure data sharing across supply chains. Governments worldwide are encouraging digital transformation in logistics through funding and policy support. For example, initiatives like the European Union’s Digital Logistics Program and China’s Smart Logistics Development Plan accelerate market adoption. The market growth is fueled by increasing demand for transparency, efficiency, and cost reduction in supply chains. Smart logistics services enhance operational agility and enable proactive decision-making, reshaping the future of logistics globally.

Smart Logistics Service Market Trends

• Growing adoption of IoT devices for real-time tracking and inventory management is enhancing supply chain transparency.

• AI and machine learning are increasingly used for predictive analytics, route optimization, and demand forecasting.

• Blockchain technology is gaining traction for secure and transparent data exchange in logistics networks.

• Increasing government initiatives are supporting smart logistics infrastructure development and digitalization.

Smart Logistics Service Market Dynamics

Driving Factors: Rising demand for supply chain transparency and cost efficiency

The smart logistics service market is driven by the rising demand for transparency and efficiency in supply chains. IoT and AI enable companies to monitor shipments in real-time and predict disruptions before they occur, reducing downtime and costs. Increasing e-commerce growth and customer expectations for faster delivery further propel market expansion. Government incentives and infrastructure investments accelerate technology adoption.

Restrain Factors: High Initial Investment and Data Security Concerns

One of the major challenges limiting the growth of the smart logistics service market is the high upfront cost required to implement advanced technologies like IoT devices, AI algorithms, and blockchain systems. Deploying these cutting-edge solutions involves significant capital investment not just for the hardware and software, but also for training staff, system integration, and ongoing maintenance. Additionally, data privacy and cybersecurity concerns pose serious obstacles. Smart logistics platforms handle vast amounts of sensitive information, including shipment details, customer data, and operational metrics. The risk of cyberattacks, data breaches, or unauthorized access raises fears among businesses and customers alike, making them hesitant to fully embrace digital logistics solutions without robust security measures.

Opportunity: Expansion in Emerging Markets and Digital Transformation

Emerging markets such as India, Southeast Asia, Latin America, and parts of Africa represent significant growth opportunities for the smart logistics service market. These regions are experiencing rapid e-commerce growth and modernization of logistics infrastructure, creating a fertile environment for technology adoption. The increasing penetration of smartphones, internet access, and cloud computing in these markets enables the use of digital platforms for managing logistics more efficiently. Cloud-based solutions allow for scalable, cost-effective operations that can adapt to varying business sizes and demands.

Challenges: Data Privacy Regulations and Interoperability Issues

As smart logistics systems become more interconnected, the need to share data across multiple partners and platforms increases. However, stringent data privacy regulations, such as GDPR in Europe or similar laws elsewhere, restrict how data can be collected, stored, and shared. Companies must navigate these complex rules carefully, which can slow down data exchange and reduce the effectiveness of integrated logistics networks. Another challenge is lack of standardization and interoperability between different technology platforms. Logistics providers often use varied software and hardware solutions that do not easily communicate with each other, creating silos of information.

Global Smart Logistics Service Market Ecosystem Analysis

The smart logistics service market ecosystem includes key players such as DHL, FedEx, Maersk, IBM, and SAP, along with technology providers specializing in IoT, AI, and blockchain. Collaboration between logistics firms and tech companies is critical to delivering integrated smart logistics solutions. Government bodies and regulatory authorities also play a pivotal role in setting standards and facilitating infrastructure development.

Global Smart Logistics Service Market, By Service Type

What Factors Enabled the Transportation Management Segment to Lead the Smart Logistics Service Market in 2024?

One of the primary drivers was the increasing demand for real-time visibility and control over transportation networks, which prompted widespread adoption of transportation management systems (TMS). These systems empowered businesses to optimize routes, track shipments, and reduce fuel and labor costs through automation and data-driven decision-making. The surge in global e-commerce further accelerated the need for efficient last-mile delivery solutions, placing transportation management at the forefront of logistics innovation. Additionally, advancements in AI, machine learning, and IoT enhanced the predictive and analytical capabilities of TMS, allowing companies to proactively manage disruptions and improve service reliability.

Why Did Warehouse Management Services Secure a Significant Share of the Smart Logistics Market in 2024?

Warehouse management services secured a significant share of the smart logistics market in 2024 due to their critical role in improving operational efficiency and inventory accuracy within supply chains. With the growing complexity of global trade and increasing customer expectations for faster delivery, businesses turned to advanced warehouse management systems (WMS) to optimize storage, streamline order fulfillment, and reduce errors. The integration of automation technologies such as robotics, IoT, and AI enabled warehouses to enhance productivity while minimizing labor costs.

Global Smart Logistics Service Market, By Technology

How Did IoT Technology Gain a Competitive Edge in the Smart Logistics Market with a 40% Share?

IoT technology gained a competitive edge in the smart logistics market by enabling unparalleled connectivity and real-time data exchange across the entire supply chain. Its ability to connect sensors, vehicles, warehouses, and shipments allowed companies to monitor assets continuously, predict maintenance needs, and optimize route planning, which significantly improved efficiency and reduced costs. The widespread adoption of IoT devices facilitated better inventory management and enhanced transparency, helping businesses respond quickly to disruptions and changing demand patterns.

How Did AI and Machine Learning Technologies Gain Prominence in the Smart Logistics Market with a 35% Share?

AI and machine learning technologies gained prominence in the smart logistics market by revolutionizing how data is analyzed and decisions are made throughout the supply chain. Their ability to process vast amounts of data in real time enabled predictive analytics for demand forecasting, route optimization, and inventory management, leading to greater efficiency and cost savings. These technologies also enhanced automation in warehouse operations, improved risk management by anticipating disruptions, and personalized customer experiences through smarter delivery scheduling.

Asia Pacific is anticipated to hold the largest market share of the smart logistics service market during the forecast period, accounting for approximately 37% of the global market, driven by several factors, including rapid industrialization, expanding e-commerce sectors, and significant investments in digital infrastructure across countries like China, India, and Southeast Asian nations. The region’s growing urbanization and increasing demand for efficient supply chain solutions have accelerated the adoption of smart logistics technologies. Additionally, government initiatives aimed at modernizing transportation and logistics networks, coupled with the presence of major manufacturing hubs, have further boosted market growth.

North America is projected to grow at the fastest CAGR in the smart logistics service market during the forecast period, capturing around 32% market share by 2025, fueled by strong technological advancements, widespread adoption of AI, IoT, and automation technologies, and significant investments in upgrading logistics infrastructure. The presence of major global logistics providers, a robust e-commerce ecosystem, and increasing demand for efficient and transparent supply chains also contribute to the region’s expansion. Furthermore, North America’s focus on sustainability and regulatory compliance drives innovation in smart logistics solutions, helping the region achieve a leading growth rate in the market.

WORLDWIDE TOP KEY PLAYERS IN THE SMART LOGISTICS SERVICE MARKET INCLUDE

- DHL International GmbH

- FedEx Corporation

- A.P. Moller – Maersk Group

- IBM Corporation

- SAP SE

- Oracle Corporation

- Kuehne + Nagel International AG

- XPO Logistics, Inc.

- C.H. Robinson Worldwide, Inc.

- J.B. Hunt Transport Services, Inc.

- Others

Product Launches in Smart Logistics Service Market

- In January 2025, IBM launched “IBM Logistics AI,” an AI-powered platform designed to enhance predictive analytics and supply chain visibility for logistics companies globally. This platform leverages advanced machine learning algorithms to forecast demand, detect potential disruptions, and optimize logistics operations in real-time. By integrating with existing transportation management systems, IBM Logistics AI enables companies to make data-driven decisions, minimize delivery delays, and reduce operational costs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Dicision Advisors has segmented the smart logistics service market based on the below-mentioned segments:

Global Smart Logistics Service Market, By Service Type

- Transportation Management

- Warehouse Management

- Freight Forwarding

Global Smart Logistics Service Market, By Technology

- IoT

- AI & Machine Learning

- Blockchain

Global Smart Logistics Service Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What are the key opportunities in the Global Smart Logistics Service Market?

A: Expansion in emerging markets such as India, Southeast Asia, and Latin America, and the rise of digital transformation initiatives present strong growth opportunities.

Q: Which service segment led the Smart Logistics Service Market in 2024?

A: The transportation management segment led the market due to the growing need for route optimization, real-time shipment tracking, and last-mile delivery solutions.

Q: Why did warehouse management services hold a significant share in 2024?

A: Warehouse management solutions gained share due to their ability to enhance inventory accuracy, streamline fulfillment, and integrate automation technologies like robotics and AI.

Q: Which technology held the largest market share in the Smart Logistics Service Market in 2024?

A: IoT held the largest market share at 40%, driven by its real-time data tracking and asset monitoring capabilities.

Q: How did AI and Machine Learning gain prominence in the Smart Logistics Market?

A: AI and ML technologies are increasingly used for predictive analytics, demand forecasting, and route optimization, contributing to a 35% market share in 2024.

Q: What are the latest trends in the Smart Logistics Service Market?

A: Key trends include increased use of IoT for real-time tracking, AI for predictive analytics, blockchain for secure data sharing, and strong government support for digital infrastructure.

Q: What are the top investment opportunities in the Global Smart Logistics Service Market?

A: Investments in AI-driven platforms, blockchain-enabled logistics, cloud-based solutions, and digital infrastructure in emerging markets present high potential.

Q: What is the long-term outlook (2025–2035) for the Smart Logistics Service Market?

A: The market is expected to experience steady growth, driven by technological advancements, evolving customer expectations, and global investments in logistics modernization.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jun 2025 |

| Access | Download from this page |