Global Smart Suturing System Market

Global Smart Suturing System Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Type (Reusable and Disposable), By Application (Open Surgery, Minimally Invasive Surgery, and Trauma), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Smart Suturing System Market Summary, Size & Emerging Trends

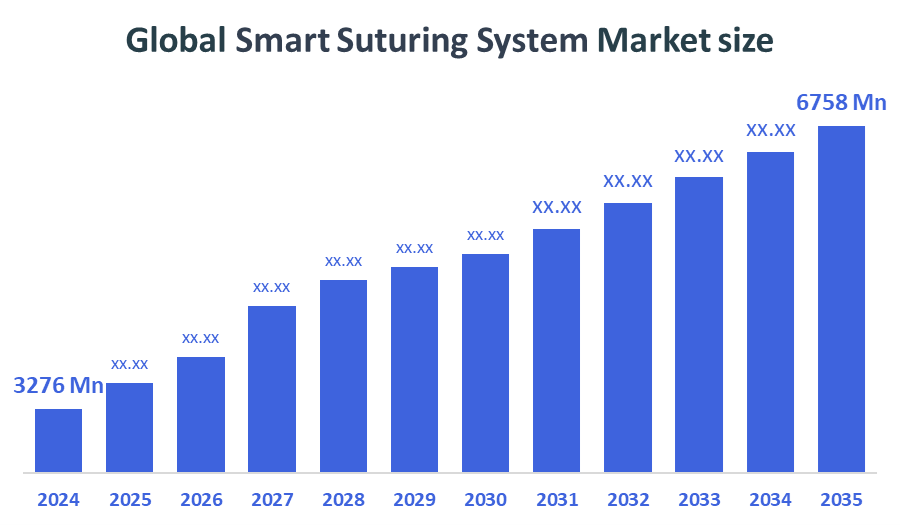

According to Decision Advisors, The Global Smart Suturing System Market Size is Expected to Grow from USD 3276 Million in 2024 to USD 6758 Million by 2035, at a CAGR of 6.8% during the forecast period 2025-2035. The smart suturing systems market growth is primarily driven by the increasing number of surgical procedures, growing demand for minimally invasive surgeries, and rising integration of automation and precision technologies in the operating room.

Key Market Insights

- North America accounted for the largest share of the smart suturing systems market in 2024, led by advanced surgical infrastructure and strong adoption of surgical innovations.

- Asia Pacific is projected to be the fastest-growing region due to rapid expansion of healthcare access, rising medical tourism, and growing investments in surgical technologies.

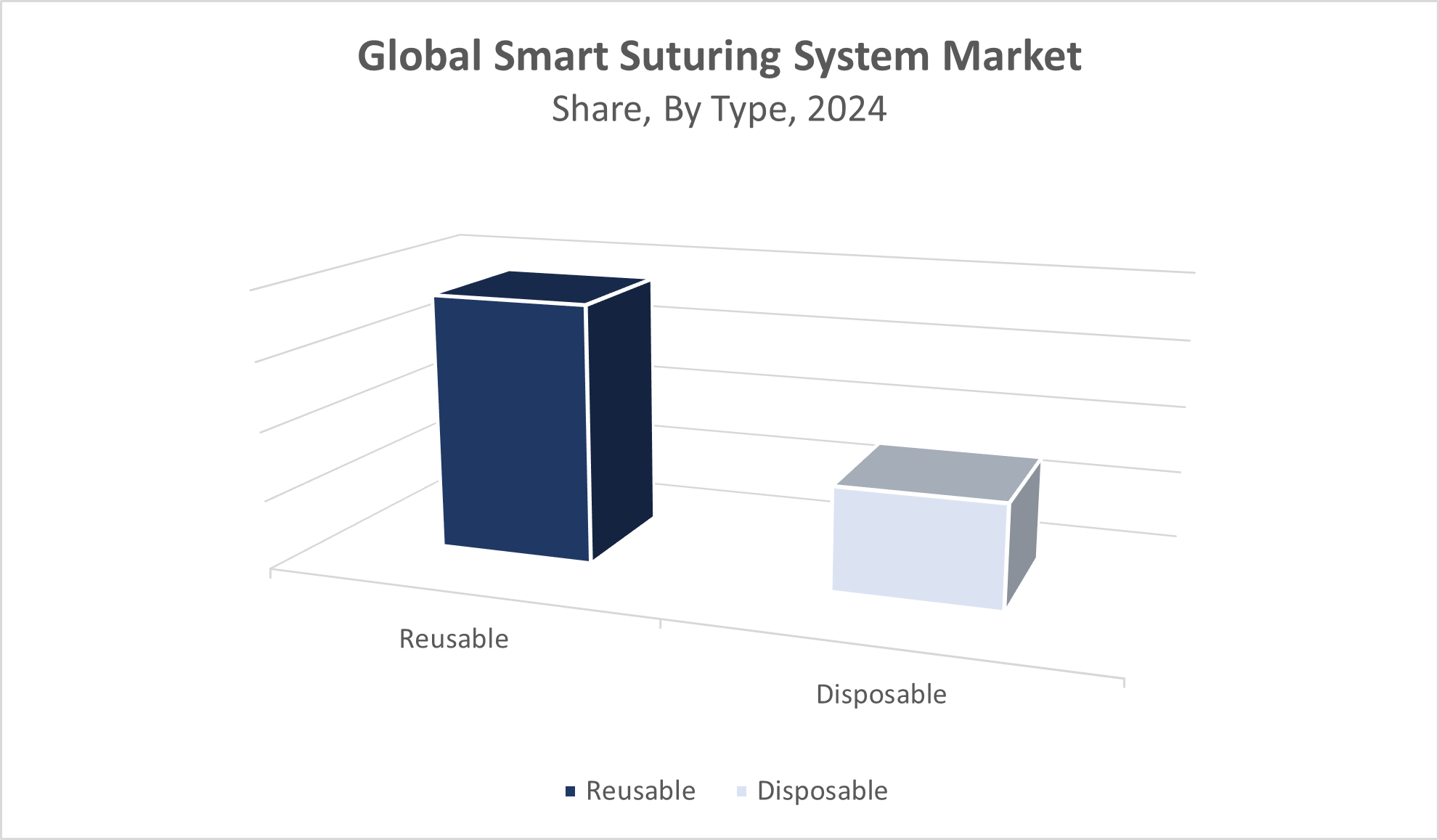

- In terms of type, the reusable smart suturing systems segment currently holds the largest revenue share, while disposable systems are expected to witness higher growth due to infection control benefits.

- Minimally invasive surgery remains the dominant application segment owing to reduced recovery time, fewer complications, and rising patient preference.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3276 Million

- 2035 Projected Market Size: USD 6758 Million

- CAGR (2025-2035): 6.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Smart Suturing System Market

The smart suturing systems market revolves around the development and deployment of advanced suturing technologies that enhance surgical precision, reduce manual errors, and streamline closure procedures across various types of surgeries. These systems integrate robotic assistance, sensor feedback, automated needle handling, and AI-guided placement to improve patient outcomes. Increasing surgical volumes, particularly in cardiology, gastrointestinal, gynecology, and trauma care, are propelling market demand. Growing acceptance of robotic surgery, rising investment in surgical automation, and demand for higher consistency in suturing performance are further supporting market expansion. Hospitals and surgical centers are increasingly adopting these systems to improve efficiency, reduce post-operative complications, and meet the rising complexity of modern procedures.

Smart Suturing System Market Trends

- Surge in adoption of robotic and AI-assisted surgical technologies, especially in minimally invasive and laparoscopic procedures

- Growing shift toward disposable suturing systems to mitigate cross-contamination and reduce sterilization overheads

- Rapid expansion of ambulatory surgical centers is driving demand for portable and easy-to-use suturing systems

- Development of intelligent suturing systems with feedback loops, force sensors, and automated error correction

- Strategic collaborations between device manufacturers and software firms to enhance suturing precision and integration with surgical robots

Smart Suturing System Market Dynamics

Driving Factors: Demand for precision

The smart suturing systems market is driven by the increasing number of surgical procedures globally, fueled by rising chronic illnesses, aging populations, and trauma cases. Demand for precision, speed, and safety in surgeries has grown, making smart suturing systems a preferred choice. The shift toward minimally invasive and robotic-assisted surgeries also boosts adoption. Hospitals are actively investing in surgical automation to improve outcomes and reduce operative time. Additionally, government initiatives supporting healthcare digitization and technological innovation further enhance market potential. Advancements in sensor technology and AI integration are improving system capabilities, attracting interest from surgeons and medical institutions worldwide.

Restrain Factors: High initial investment and ongoing maintenance costs limit adoption

Despite promising growth, the smart suturing systems market faces notable restraints. High initial investment and ongoing maintenance costs limit adoption, especially in small and mid-sized healthcare facilities. The systems also require specialized training, which can delay implementation and acceptance. Limited availability in rural and underdeveloped regions restricts market penetration. Additionally, concerns over system failures, data security, and automation reliability create hesitation among surgeons. The presence of conventional suturing tools that are cost-effective and familiar to medical professionals also hampers the switch to advanced systems. Overall, affordability, accessibility, and technical complexity remain key barriers to widespread adoption.

Opportunities: Disposable smart suturing devices are gaining traction due to infection control benefits

The smart suturing systems market presents strong opportunities driven by rising healthcare infrastructure in emerging economies and growing demand for efficient surgical tools. Expansion into outpatient clinics, mobile health units, and ambulatory surgical centers offers untapped potential. Disposable smart suturing devices are gaining traction due to infection control benefits, especially post-COVID-19. Technological innovation such as integrating AI, machine learning, and real-time feedback can further improve surgical precision and attract investments. Collaborations between device manufacturers and digital health startups can create next-gen systems tailored for diverse use cases. As medical tourism grows and surgical volumes increase globally, the market is well-positioned for significant expansion.

Challenges: Navigating complex regulatory environments and ensuring compliance across various countries

The smart suturing systems market faces several operational and strategic challenges. Supply chain disruptions, geopolitical instability, and dependence on imported components can affect timely product availability. Navigating complex regulatory environments and ensuring compliance across various countries is time-consuming and costly. There’s also a lack of standardization in system interoperability, making integration with existing hospital infrastructure difficult. Training and skill gaps among healthcare professionals further hinder smooth adoption. High R&D costs, competitive pricing pressures, and customer skepticism about automated tools’ reliability pose ongoing hurdles. These challenges require coordinated industry efforts to ensure safe, efficient, and scalable deployment of smart suturing technologies.

Global Smart Suturing System Market Ecosystem Analysis

The global smart suturing systems market ecosystem consists of medical device manufacturers, robotics companies, component suppliers, software developers, hospitals, and surgical centers. Manufacturers focus on integrating advanced features such as real-time feedback, AI-based pattern recognition, and robotic actuation to increase adoption and clinical outcomes. The ecosystem is also influenced by health regulatory bodies, R&D institutions, and training centers. A balanced interplay between innovation, cost control, and clinical validation drives the competitiveness and sustainability of this market.

Global Smart Suturing System Market, By Type

The reusable smart suturing systems segment accounted for approximately 64% of the total market revenue in 2024. These systems are preferred by large hospitals and surgical centers due to their long-term cost efficiency and high durability. They are designed for repeated use after sterilization, making them ideal for high-volume settings. Their advanced features such as robotic precision, automated needle handling, and programmable settings enhance surgical outcomes and reduce procedural time. Hospitals prioritize these devices for complex and lengthy surgeries where consistent performance and cost savings over time are critical.

The disposable smart suturing systems segment held a smaller market share of around 36% in 2024, it is projected to grow at a higher CAGR of 9.1% during 2025–2035, outpacing the growth of reusable systems. The rising emphasis on infection prevention, especially in post-COVID healthcare protocols, is fueling demand for single-use devices. These systems eliminate the need for sterilization, reduce cross-contamination risks, and are convenient in fast-paced environments like ambulatory surgical centers and outpatient clinics.

Global Smart Suturing System Market, By Application

The minimally invasive surgery (MIS) segment accounted for the largest revenue share of approximately 48% in the global smart suturing systems market in 2024. This dominance is due to the growing global preference for laparoscopic, endoscopic, and robotic-assisted procedures, which require high precision in confined surgical spaces. Smart suturing systems enhance control, reduce operating time, and minimize human error in MIS. These advantages lead to faster patient recovery, reduced post-operative complications, and shorter hospital stays. The segment continues to grow as healthcare providers shift toward value-based care, where clinical outcomes and efficiency are key performance indicators.

The open surgery segment held a significant revenue share of approximately 37% in 2024. While traditional in nature, open surgeries remain essential in trauma care, cardiovascular procedures, and complex organ surgeries where full access is required. Smart suturing systems are increasingly used in these procedures to enhance stitching speed, reduce fatigue, and improve consistency, especially during lengthy or high-risk operations. The demand for smart systems in open surgeries is being sustained by hospitals aiming to improve outcomes in emergency and high-complexity procedures. Although MIS is growing faster, open surgery remains a vital market segment with steady adoption of advanced tools.

North America led the global smart suturing systems market in 2024, capturing approximately 38% of the total revenue,

driven by a well-established surgical infrastructure, high per capita healthcare spending, and early adoption of advanced medical technologies, including robotic-assisted surgeries and AI-powered tools. The United States is the primary contributor, supported by the presence of major market players, ongoing clinical research, and strong reimbursement policies. Hospitals and ambulatory surgical centers in the region continue to invest in automation to improve precision, reduce surgery times, and lower complication rates making North America the most technologically advanced region in this market.

Asia Pacific is projected to grow at a CAGR of over 9% during the forecast period (2025–2035), making it the fastest-growing regional market.

Factors fueling growth include increasing healthcare access, rising surgical volumes, and large-scale government investments in digital health infrastructure and medical device innovation. Countries such as China, India, South Korea, and Japan are experiencing rapid hospital expansion and technology adoption. Additionally, the rise of medical tourism and growing demand for minimally invasive procedures further accelerate regional uptake of smart suturing systems.

Europe maintained a strong market position in 2024, accounting for approximately 27% of global revenue.

The region benefits from robust public healthcare systems, skilled surgical workforce, and favorable regulatory support for innovative medical technologies. Countries like Germany, France, and the UK are leading adopters of minimally invasive and robotic-assisted surgeries, creating consistent demand for precision suturing tools. While the region may not grow as fast as Asia Pacific, its mature infrastructure, high surgical standards, and focus on reducing post-operative complications make Europe a stable and strategically important market for smart suturing system manufacturers.

WORLDWIDE TOP KEY PLAYERS IN THE SMART SUTURING SYSTEM MARKET INCLUDE

- Medtronic Plc

- Ethicon (Johnson & Johnson)

- Boston Scientific Corporation

- LSI Solutions

- Smith & Nephew

- SuturTek Inc.

- Apollo Endosurgery

- Suture Ltd.

- Intuitive Surgical

- BD (Becton, Dickinson and Company)

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the smart suturing system market based on the below-mentioned segments:

Global Smart Suturing Systems Market, By Type

- Reusable Smart Suturing Systems

- Disposable Smart Suturing Systems

Global Smart Suturing Systems Market, By Application

- Open Surgery

- Minimally Invasive Surgery

- Trauma

Global Smart Suturing System Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. What is the projected market size of the Global Smart Suturing System Market by 2035?

The market size is expected to grow from USD 3,276 million in 2024 to USD 6,758 million by 2035.

Q. Which region holds the largest share in the smart suturing systems market?

North America holds the largest market share due to its advanced surgical infrastructure and early adoption of surgical innovations.

Q. What are the main types of smart suturing systems available in the market?

The market is segmented into reusable smart suturing systems and disposable smart suturing systems.

Q. Why is the disposable smart suturing systems segment expected to grow faster?

Disposable systems are gaining popularity due to infection control benefits, especially post-COVID-19, as they reduce cross-contamination and sterilization needs.

Q. Which application segment dominates the smart suturing systems market?

Minimally invasive surgery is the dominant application segment due to the benefits of reduced recovery time, fewer complications, and growing patient preference.

Q. What are the key challenges limiting the adoption of smart suturing systems?

High initial investment, ongoing maintenance costs, the need for specialized training, and limited availability in rural or underdeveloped regions are major restraints.

Q. Who are some of the top players in the global smart suturing systems market?

Leading companies include Medtronic Plc, Ethicon (Johnson & Johnson), Boston Scientific Corporation, LSI Solutions, and Smith & Nephew.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |