Global Soy Leghemoglobin Market

Global Soy Leghemoglobin Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Production Method (Extraction, Fermentation, and Synthetic Biology), By End-Use Industry (Plant-Based Meat, Food Additives, Nutraceuticals, and Cosmetics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Soy Leghemoglobin Market Summary, Size & Emerging Trends

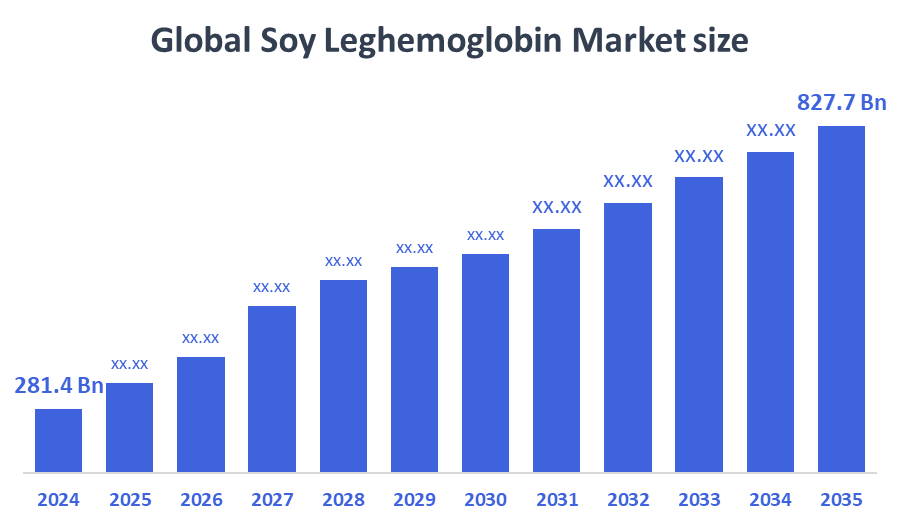

According to Decision Advisor, The Global Soy Leghemoglobin Market Size is Expected to Grow from USD 281.4 Billion in 2024 to USD 827.7 Billion by 2035, at a CAGR of 10.31% during the forecast period 2025-2035. Rising consumer demand for plant-based meat alternatives and natural food ingredients is a key driving factor for the soy leghemoglobin market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the soy leghemoglobin market during the forecast period.

- In terms of production method, the fermentation segment is projected to witness the fastest growth due to technological advancements and scalability.

- In terms of end-use industry, the plant-based meat segment accounted for the largest revenue share in the global soy leghemoglobin market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 281.4 Billion

- 2035 Projected Market Size: USD 827.7 Billion

- CAGR (2025-2035): 10.31%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Soy Leghemoglobin Market

The soy leghemoglobin market focuses on the production of a heme-containing protein primarily derived from soy, which is utilized to impart meat-like flavor and color to plant-based products. This protein acts as a natural colorant and flavor enhancer, improving the sensory attributes of meat alternatives. It finds extensive use in food and beverage, nutraceutical, and cosmetics industries. Supportive government initiatives promoting sustainable food innovation and consumer preference for clean-label products are accelerating market growth. The trend toward plant-based diets and environmental sustainability further fuels demand. The market is poised for steady expansion, driven by continuous innovation in production methods and growing consumer awareness.

Soy Leghemoglobin Market Trends

- Increasing consumer preference for natural and clean-label ingredients supports market growth.

- Fermentation and synthetic biology are transforming production, enabling higher yields and cost efficiencies.

- Strategic collaborations between biotech companies and food manufacturers are driving new product development.

Soy Leghemoglobin Market Dynamics

Driving Factors: Growing Demand for Plant-Based Meat and Natural Food Ingredients

The growing demand for plant-based meat is fueled by increasing health and environmental awareness worldwide. Consumers seek natural, sustainable food ingredients, making soy leghemoglobin a key additive for authentic meat flavour and colour in plant-based products. Regulatory approvals in major markets have facilitated broader adoption, while advancements in biotechnology have improved production efficiency and quality. Furthermore, expanding uses in cosmetics as natural colourants and antioxidants provide additional revenue streams, collectively driving significant market growth.

Restrain Factors: Regulatory Uncertainties and Production Cost Challenges

Market growth faces challenges from complex and varied regulatory frameworks that differ across regions, causing delays and uncertainties for product approvals. Many consumers remain cautious about adopting novel food ingredients, limiting demand growth. High production costs compared to traditional additives impact profitability. Additionally, supply chain disruptions and inconsistent raw material availability pose significant risks, restricting manufacturers’ ability to scale operations efficiently and meet growing market needs, thus restraining overall market expansion.

Opportunity: Emerging Applications and Technological Innovation

Emerging applications of soy leghemoglobin in food additives, cosmetics, and nutraceuticals create new opportunities for market expansion. Technological innovations, especially in synthetic biology, are enabling more efficient, cost-effective production methods that enhance product quality. Rapid urbanisation and increasing disposable incomes in emerging economies boost demand for plant-based and natural products. These factors combined offer substantial growth potential, encouraging investment in research and development and helping manufacturers to diversify applications and reach new customer segments.

Challenges: Scaling Production and Regulatory Compliance

Scaling up production of soy leghemoglobin while ensuring consistent quality and compliance with stringent safety standards is a major technical hurdle. The dynamic and often stringent regulatory environments across global markets require continuous investment to navigate, which can be costly and time-consuming. Additionally, competition from alternative plant-based proteins and synthetic colourants challenges market share. Manufacturers must innovate and optimise processes to maintain a competitive edge while meeting evolving consumer and regulatory demands.

Global Soy Leghemoglobin Market Ecosystem Analysis

The ecosystem comprises soy raw material suppliers, fermentation and synthetic biology technology providers, food and cosmetic manufacturers, and regulatory bodies. Leading players focus on innovation, cost reduction, and product quality enhancement. Collaborative ventures and mergers expand geographic reach and application scope. Regulatory frameworks guide food safety and labeling, influencing market dynamics. The ecosystem’s growth hinges on balancing innovation with compliance and consumer acceptance.

Global Soy Leghemoglobin Market, By Production Method

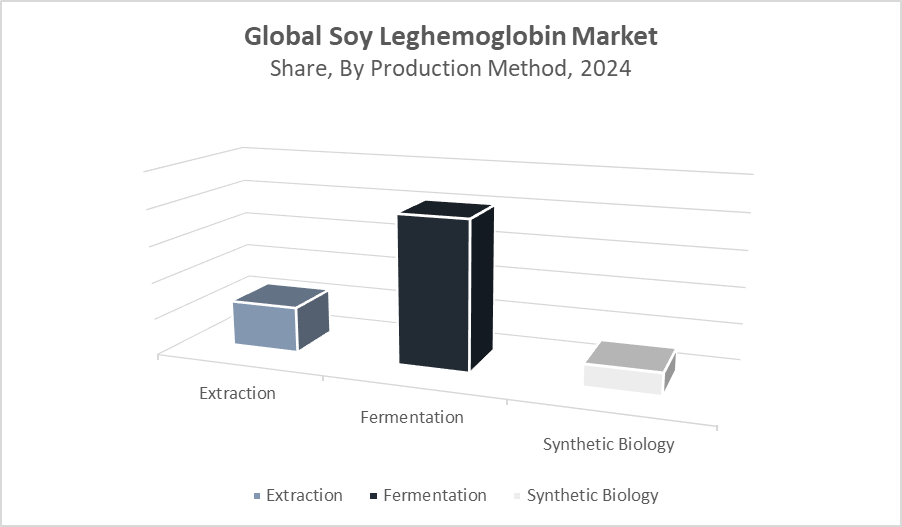

Fermentation-based production holds approximately 65% market share and leads the soy leghemoglobin market due to its scalability, cost-effectiveness, and ability to produce consistent, high-quality protein at industrial volumes. This method supports large-scale manufacturing required to meet the rising demand, particularly from the expanding plant-based meat sector. Its efficiency and ability to maintain purity make fermentation the preferred choice for many producers aiming for mass-market applications.

Extraction from soy accounts for about 25% of the market and remains important mainly for brands focused on natural product claims. Although this method is less scalable and generally more expensive than fermentation, it appeals to consumers who prioritize minimally processed, “clean label” ingredients. Due to these attributes, extraction retains a significant role in niche markets that emphasize natural origins and transparency.

Global Soy Leghemoglobin Market, By End-Use Industry

Plant-based meat is the largest and fastest-growing application of soy leghemoglobin, commanding approximately 70% of the market. This segment benefits from the increasing consumer shift toward sustainable, health-conscious eating habits. Soy leghemoglobin is critical in replicating the taste, aroma, and color of real meat, providing a realistic sensory experience that appeals to flexitarians and vegans alike. The surge in demand for plant-based meat alternatives from both retail and foodservice sectors is fueling continuous market expansion.

Food additives and nutraceuticals make up about 20% of the soy leghemoglobin market. In this segment, soy leghemoglobin is used to improve flavour profiles and add functional benefits such as antioxidant properties. Nutraceutical applications are gaining traction as consumers increasingly seek natural ingredients that support health and wellness. The versatility of soy leghemoglobin in enhancing both taste and nutrition drives its adoption in dietary supplements and fortified foods.

Asia Pacific is the largest market for soy leghemoglobin in 2024,

driven by rapid urbanization, rising disposable incomes, and increasing health awareness across countries like China, India, and Japan. The region’s expanding plant-based food industry, combined with growing demand for natural food ingredients, supports strong market growth. Government initiatives promoting sustainable food systems and investments in biotechnology further strengthen Asia Pacific’s leading position.

India is experiencing significant growth within the Asia Pacific soy leghemoglobin market,

fueled by rapid industrialization, a large vegetarian population, and rising demand for plant-based protein alternatives. Increasing consumer awareness about health and environmental benefits of plant-based diets, coupled with government support for biotechnology innovation, is driving adoption. Growing urban middle-class consumers with higher disposable incomes are increasingly embracing plant-based foods and nutraceutical products.

North America is the fastest growing market for soy leghemoglobin,

fueled by strong consumer demand for plant-based meat and alternative proteins. The U.S. and Canada benefit from advanced biotechnological infrastructure, extensive research and development, and supportive regulatory environments. Increasing investments by food manufacturers and startups in sustainable and innovative food solutions accelerate market expansion at a rapid pace.

The United States is a major contributor to North America’s fast growth,

driven by its robust food tech industry and high consumer acceptance of plant-based alternatives. Strong presence of key players investing in soy leghemoglobin production and innovation supports market momentum. Additionally, rising awareness of environmental sustainability and health consciousness among consumers fuels continuous demand in the food, nutraceutical, and cosmetics sectors.

WORLDWIDE TOP KEY PLAYERS IN THE SOY LEGHEMOGLOBIN MARKET INCLUDE

- Impossible Foods

- Indigo Agriculture

- LegenDairy Foods

- MycoTechnology Inc.

- Clara Foods

- Motif FoodWorks

- Greenleaf Foods

- The EVERY Company

- Calysta Inc.

- Others

Product Launches in Soy Leghemoglobin Market

- In March 2024, Impossible Foods introduced a next-generation soy leghemoglobin ingredient designed to offer improved flavor stability. This innovation aims to enhance the taste and shelf-life of plant-based meat products, addressing common challenges like off-flavors and degradation during storage. By advancing the quality and consistency of their soy leghemoglobin, Impossible Foods strengthens its competitive edge and supports wider consumer acceptance of plant-based meats. This launch marks a significant step toward better sensory experiences in alternative protein products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the soy leghemoglobin market based on the below-mentioned segments:

Global Soy Leghemoglobin Market, By Production Method

- Extraction

- Fermentation

- Synthetic Biology

Global Soy Leghemoglobin Market, By End-Use Industry

- Plant-Based Meat

- Food Additives

- Nutraceuticals

- Cosmetics

Global Soy Leghemoglobin Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: Which production method dominates the soy leghemoglobin market?

A: Fermentation dominates the market with around 65% share due to scalability and efficiency.

Q: What are the primary end-use industries for soy leghemoglobin?

A: Key end-use industries include plant-based meat, food additives, nutraceuticals, and cosmetics.

Q: Which end-use industry contributes the most to market revenue?

A: The plant-based meat segment accounts for about 70% of the market, making it the largest contributor.

Q: What are the major drivers of the soy leghemoglobin market?

A: Key drivers include the rising demand for plant-based meat alternatives, consumer preference for natural ingredients, and advancements in biotechnology.

Q: What are the main restraints affecting market growth?

A: Major restraints include regulatory uncertainties, high production costs, and supply chain disruptions.

Q: What emerging opportunities exist in the soy leghemoglobin market?

A: New applications in cosmetics, food additives, and nutraceuticals, along with innovations in synthetic biology, present strong growth opportunities.

Q: What are the key challenges faced by manufacturers in this market?

A: Challenges include scaling up production, ensuring product consistency, navigating strict regulatory standards, and competing with alternative protein solutions.

Q: How is synthetic biology contributing to market growth?

A: Synthetic biology is enabling more cost-effective, higher-yield, and customizable production processes, expanding industrial scalability.

Q: Which countries in Asia Pacific are driving regional growth?

A: China, India, and Japan are key contributors due to urbanization, biotech investments, and a shift toward plant-based diets.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 182 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |