Global Sterile Barrier Systems Market

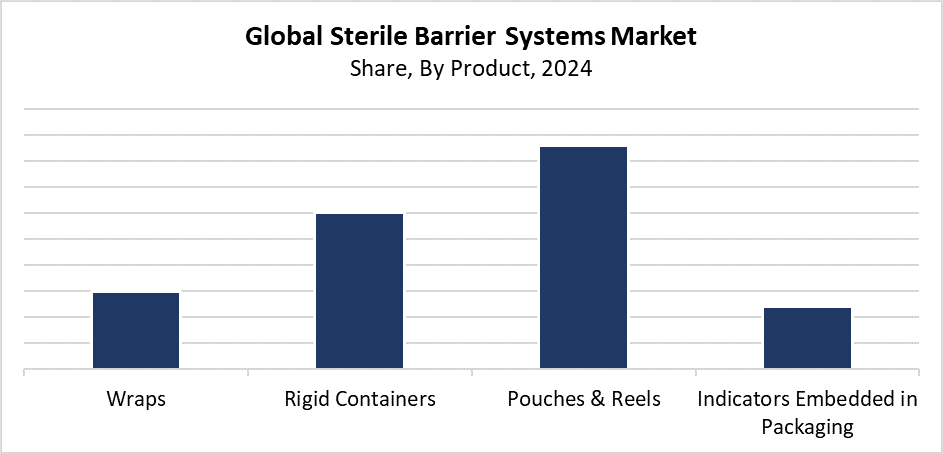

Global Sterile Barrier Systems Market Size, Share, and COVID-19 Impact Analysis, By Product (Wraps, Rigid Containers, Pouches & Reels, Indicators Embedded in Packaging), By End Use (Hospitals, Ambulatory Surgical Centers, Outpatient Clinics, Long-term Care Facilities & Nursing Homes, Diagnostic Laboratories & Imaging Centers, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Sterile Barrier Systems Market Summary

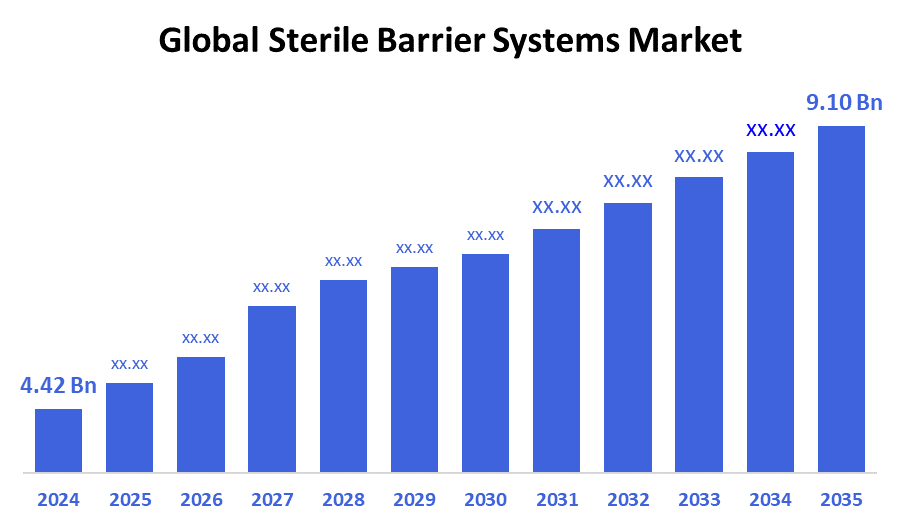

The Global Sterile Barrier Systems Market Size Was Estimated at USD 4.42 Billion in 2024 and is Projected to Reach USD 9.10 Billion by 2035, Growing at a CAGR of 6.79% from 2025 to 2035. The market for sterile barrier systems is expanding due to the requirement to prevent contamination and guarantee product safety, the necessity for sterile packaging in healthcare, the rise in surgical operations, and stricter regulations.

Key Regional and Segment-Wise Insights

- In 2024, North America held the greatest revenue share of 35.42% in the market for sterile barrier systems.

- In 2024, the pouches &reels segment held the biggest revenue share of 43.24%, leading the market by product.

- In 2024, the hospitals segment held the biggest revenue share of 48.27%, leading the market by end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4.42 Billion

- 2035 Projected Market Size: USD 9.10 Billion

- CAGR (2025-2035): 6.79%

- North America: Largest market in 2024

The Sterile Barrier Systems market exists as a dedicated sector for packaging technologies that maintain the sterility of medical devices and materials until their intended use. The technologies serve as essential components for sterile environments, including surgical settings, where they prevent contamination and maintain patient protection. The market growth stems from increasing healthcare facility infection control knowledge, combined with rising chronic disease cases requiring sterile instruments and a rising preference for minimally invasive surgical methods. The expanding worldwide surgical procedure volume, together with the emerging nations' healthcare development, serves as an additional driver for market expansion.

SBS technology advances through the development of new materials that combine multilayer laminates with permeable films to enhance barrier protection while maintaining package integrity. Modern sealing technology, together with automation systems, has boosted production efficiency and product reliability. Healthcare standards improvement through FDA and European Medicines Agency (EMA) sterile packaging regulations, along with government programs, encourages market adoption. The development of hospital infection control programs, together with patient safety measures, supports growth through the promotion of advanced sterile barrier systems. The worldwide sterile barrier system market continues to grow through ongoing technological developments because of these multiple combined factors.

Product Insights

The pouches &reels segment dominated the sterile barrier systems market with the largest revenue share of 43.24% in 2024. The extensive application of this packaging method for surgical instruments and medical devices, along with its ability to maintain sterility and prevent contamination, drives its market leadership. Hospitals, along with healthcare providers, find pouches and reels ideal because they offer multiple uses and easy operation while functioning with various sterilization methods, which include radiation, ethylene oxide, and steam. Their reliable performance stems from their ability to maintain package integrity and allow sterilant penetration. The growing adoption of pouches and reels stems from advancements in material technology, which include enhanced barrier films and stronger seals.

During the forecast period, the sterile barrier systems market's rigid containers segment is expected to grow at the fastest CAGR. The quick rise of this market segment stems from its enhanced durability, together with reusable design features and superior protection of delicate medical instruments when compared to standard packaging alternatives. Rigid containers work best for costly medical equipment and advanced surgical instruments because they provide outstanding protection against both contamination and physical damage. The increasing demand for sustainable packaging solutions drives the adoption of rigid containers, which serve multiple purposes and reduce medical waste production. The market for sterile barrier systems experiences growth in the rigid container segment because of new developments in durable, lightweight materials and enhanced sealing methods.

End Use Insights

The hospital segment dominates the sterile barrier systems market by generating the largest revenue share of 48.27% in 2024. Hospitals represent the primary consumers of sterile barrier systems because they perform numerous surgical operations while maintaining rigorous infection prevention protocols. The market demands efficient sterile packaging solutions because patient safety initiatives grow stronger, surgical volumes increase, and minimally invasive treatments become more prevalent. Hospitals require reliable packaging solutions to maintain sterile conditions of medical devices while minimizing healthcare-associated infection risks. The global development of healthcare infrastructure worldwide reinforces the hospital segment's leadership position in the sterile barrier systems market.

The ambulatory surgical centers (ASCs) segment in the Sterile Barrier Systems market will experience the fastest CAGR throughout the forecast period. This rapid growth results from the increasing popularity of outpatient procedures since they offer enhanced convenience, reduced expenses, and shorter recovery periods compared to traditional hospital care. Medical facilities such as ASCs need sterile barrier systems that ensure both safety and sterility for all medical equipment utilized in minimally invasive procedures. The requirement for effective sterile packaging solutions grows with the rising number of ASCs across the globe because of improvements in surgical technologies and patient education.

Regional Insights

North America leads the sterile barrier system market by generating the largest revenue share of 35.42% in 2024. The market dominance of this region stems from its advanced healthcare infrastructure, coupled with regulatory controls and the extensive adoption of modern sterile packaging techniques. The market grows substantially because of major medical device manufacturers and increasing patient demand for less invasive surgical treatments. Rising awareness about infection control and patient safety measures in hospitals and surgical facilities drives the need for efficient sterile barrier systems. Government regulations, including FDA standards, create market confidence because they establish essential requirements for sterile packaging. The current position of North America as the market leader for sterile barrier systems stems from its robust healthcare infrastructure and continual technological progress.

Europe Sterile Barrier Systems Market Trends

Sterile barrier systems in Europe will experience substantial market growth because of increasing healthcare costs, together with rising surgical procedures across the region. The rising popularity of advanced sterile packaging solutions stems from stricter regulations by the European Medicines Agency and heightened infection control practices. The market advances because of increased demand for minimally invasive surgeries and improved healthcare infrastructure development. The market expansion occurs through technological progress in sterilization methods alongside advancements in packaging materials, which enhance product performance and safety standards. European sterile barrier systems will see market growth through government initiatives that focus on patient safety and hospital infection prevention, thus becoming a vital sector for manufacturing expansion.

Asia Pacific Sterile Barrier Systems Market Trends

The sterile barrier system market in the Asia Pacific is anticipated to grow significantly throughout the forecast period because of rising medical procedures and expanding healthcare facilities, as well as increased awareness about infection control. The demand for sterile medical packaging continues to rise because of population growth combined with higher healthcare budgets and more chronic surgical cases in China, India, and Japan. The implementation of government healthcare improvement initiatives and advanced medical technology adoption drives increased market demand. The region provides cost-effective manufacturing bases that attract international medical device and packaging corporations. Asia Pacific stands as one of the fastest-expanding markets for sterile barrier systems.

Key Sterile Barrier Systems Companies:

The following are the leading companies in the sterile barrier systems market. These companies collectively hold the largest market share and dictate industry trends.

- ASP

- ONE TRAY

- Case Medical

- STERIS

- Hermann Müller

- Cardinal Health

- 3M

- UFP Technologies, Inc.

- STERIVIC Medical Co., Ltd

- Medline Industries, LP

- ZUNO MEDICAL

- DuPont

- Others

Recent Developments

- In July 2025, Techno Plastics Industries, Inc. and Universal Plastics & Engineering Company, Inc. were purchased by UFP Technologies, Inc. The company's proficiency in thermoplastic molding and precision film components for the medical device sector is anticipated to be strengthened by these acquisitions.

- In April 2024, Aesculap, Inc. unveiled AESCULAP Aicon RTLS, a sterile container system that incorporates real-time location service technology. The goal of this integration is to make Sterile Processing Departments more efficient.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the sterile barrier systems market based on the below-mentioned segments:

Global Sterile Barrier Systems Market, By Product

- Wraps

- Rigid Containers

- Pouches & Reels

- Indicators Embedded in Packaging

Global Sterile Barrier Systems Market, By End Use

- Hospitals

- Ambulatory Surgical Centers

- Outpatient Clinics

- Long-term Care Facilities & Nursing Homes

- Diagnostic Laboratories & Imaging Centers

- Others

Global Sterile Barrier Systems Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |