Global Strategic Mineral Stockpiling Market

Global Strategic Mineral Stockpiling Market Size, Share, and COVID-19 Impact Analysis, By Mineral Type (Battery Materials, Rare Earth Elements, Others), By Stockpiling Entity (Government Agencies, Public-Private Partnerships, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Strategic Mineral Stockpiling Market Summary

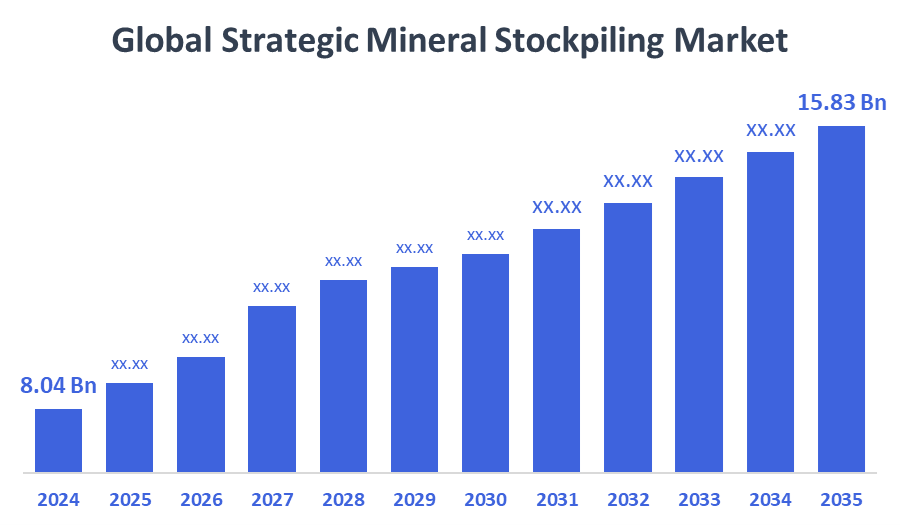

The Global Strategic Mineral Stockpiling Market Size Was Estimated at USD 8.04 Billion in 2024 and is Projected to Reach USD 15.83 Billion by 2035, Growing at a CAGR of 6.35% from 2025 to 2035. Growing demand for critical minerals, supply chain interruptions, geopolitical unrest, resource security-promoting government policies, and the growing need to support advanced technology and renewable energy sectors that depend on these vital minerals are all driving growth in the strategic mineral stockpiling market.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific region held the largest revenue share of 59.6%, dominating the market for strategic mineral stockpiling globally.

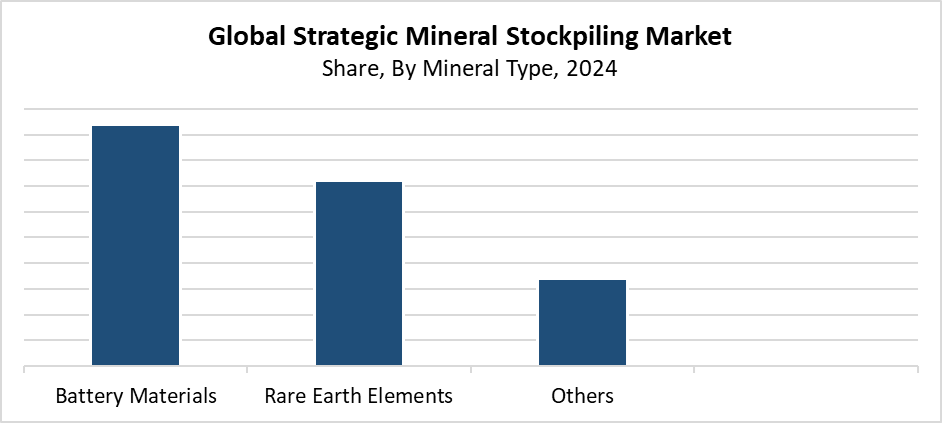

- In 2024, the battery materials segment held the largest revenue share of 47.5%, dominating the market by mineral type.

- By stockpiling entity, the government agencies segment led the market by holding the biggest revenue share of 42.6%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 8.04 Billion

- 2035 Projected Market Size: USD 15.83 Billion

- CAGR (2025-2035): 6.35%

- Asia Pacific: Largest market in 2024

The market for strategic mineral stockpiling handles vital mineral storage and management, which supports industrial operations. National security and technological progress. The list of essential minerals for electronics, renewable energy, defence, and aerospace equipment production includes lithium, cobalt, rare earth elements, and several others. The market experiences growth because of rising mineral demand, while supply chain disruptions, geopolitical instability, and resource shortage concerns persist. The demand for secure mineral deposits grows because of increasing investments in electric vehicles and renewable power systems. The practice of stockpiling essential raw materials receives backing from governments and businesses because it guarantees uninterrupted resource availability and protects them from international market instability.

The effectiveness of hoarding procedures continues to improve because of technological advancements, which enhance recycling methods, inventory management, and mineral recognition. Supply chain transparency innovations like blockchain and digital tracking are becoming more popular. The goal of governments around the world is to lessen reliance on outside resources by establishing and expanding mineral reserves through strategic policies and financial efforts. The main objective of public-private sector partnerships focuses on creating sustainable extraction methods and stockpiling solutions to enhance supply chain durability. The strategic mineral stockpiling market grows because of these elements. They also drive new industry developments.

Mineral Type Insights

The battery materials segment held the largest revenue share of 47.5% in 2024, and led the global strategic mineral stockpiling market. The increasing demand for lithium, cobalt, nickel, and other vital minerals needed to produce batteries for electric vehicles (EVs), portable gadgets, and renewable energy storage systems is what is causing this domination. The fast worldwide adoption of clean energy, together with rising EV sales, has made the need for continuous availability of these essential battery materials more important. The need to stockpile resources has become a priority for governments and businesses because of supply chain instability and geopolitical risks. Battery materials now serve as a core strategic element. This determines how mineral stockpiling industry policies and investment decisions will be made.

The rare earth elements (REE) segment of the strategic mineral stockpiling market is expected to grow at a significant rate throughout the forecast period. High-tech applications use REEs to support electronics, renewable energy technology, defence systems, and electric vehicles. Strategic stockpiling needs arise from the expanding worldwide requirement for these elements, together with their limited availability in specific geographic regions. The combination of trade restrictions and geopolitical tensions has created growing concerns about the reliable and secure supply of rare earth elements. Government entities, together with business organisations, establish REE stockpiling as their main focus to protect supply chains and maintain steady production of essential technologies. The rare earth elements market shows increased growth potential because of technological advancements in inventory management and recycling, and extraction methods.

Stockpiling Entity Insights

The government agencies segment led the strategic mineral stockpiling market by holding the largest revenue share of 42.6% in 2024. The leadership derives from their need to protect economic stability and national security, as well as maintain essential supply chains for technology, energy, and defence sectors. The United States, along with China and the European Union, have increased their mineral supply security initiatives through cobalt, lithium, and rare earth element acquisition programs. These reserves function as part of broader strategic plans which aim to reduce foreign dependence. They protect against international political disruptions. The mineral stockpiling sector now depends heavily on government institutions because they receive higher funding levels, gain legislative backing, and establish long-term strategic plans.

The public-private partnerships segment of the strategic mineral stockpiling market is expected to experience significant growth during the forecast period. The growing need for essential minerals requires governments to work together with private companies for supply chain protection, resource optimisation, and investment growth. These partnerships enable resource sharing and risk reduction while providing access to advanced extraction, processing, and storage mineral technologies. The system provides better supply chain visibility, which helps businesses develop sustainable methods. The government backs these partnerships to speed up stockpiling activities through military, renewable energy, and electric vehicle programs. The cooperative concept functions as a key development engine for the changing mineral stockpile environment because it enhances market fluctuation and geopolitical threat response.

Regional Insights

The North American strategic mineral stockpiling market experiences steady growth because of rising resource security problems and escalating geopolitical conflicts, and expanding industrial requirements for advanced minerals used in clean energy systems and defence operations. The United States and Canada work to build their stockpiles of essential resources like cobalt, lithium, and rare earth elements to reduce foreign dependency. The U.S. Defence Production Act, along with domestic mining and processing financial support programs from the government, are driving market expansion. The supply chain resilience improves as public organisations work together with commercial entities. The region's transition to clean technology drives continuous market growth because it requires a steady supply of essential minerals.

Asia Pacific Strategic Mineral Stockpiling Market Trends

The Asia Pacific region led the strategic mineral stockpiling market by holding the largest revenue share of 59.6% in 2024. China leads the world because it aggressively stockpiles minerals while dominating the global market for essential resources such as lithium, graphite, and rare earth elements. Japan, South Korea, and India are among the nations that are increasing their reserves to ensure the sustained availability of vital raw materials required for electronics, renewable energy, and electric vehicles. The region's position in the market has been further enhanced by rapid industrialisation, robust government support, and rising investments in mining and processing facilities. The Asia Pacific region continues to conduct supply chain management and mineral stockpiling operations because of ongoing geopolitical tensions and its pursuit of resource self-sufficiency.

Europe Strategic Mineral Stockpiling Market Trends

The strategic mineral stockpiling market in Europe experiences significant growth because the region focuses more on supply chain security, technological advancements, and energy transition. European countries actively work to reduce their dependence on imported minerals because they require lithium, cobalt, and rare earth elements for electric vehicles, renewable energy systems, and defence equipment. The European Union established the Critical Raw Materials Act to support domestic sourcing initiatives, recycling programs, and stockpiling efforts. Geopolitical conflicts, together with worldwide supply chain disruptions, have created an urgent requirement to safeguard enduring access to vital resources. The entire continent benefits from government-private sector-academic institution partnerships, which drive advancements in inventory management. These partnerships also foster sustainable supply chain practices.

Key Strategic Mineral Stockpiling Companies:

The following are the leading companies in the strategic mineral stockpiling market. These companies collectively hold the largest market share and dictate industry trends.

- Albemarle Corporation

- MP Materials Corp.

- China Molybdenum Co., Ltd. (CMOC)

- Anglo American plc

- Lithium Americas Corp.

- M2i Global Inc.

- Critical Metals Ltd.

- BHP Group

- Glencore plc

- Rio Tinto Group

- Others

Recent Developments

- In April 2025, Lithium Americas Corp. was able to start full-scale operations later this year after obtaining final environmental permissions for its Thacker Pass lithium project in Nevada, USA. Using closed-loop water management and sustainable extraction methods, the project will generate 60,000 metric tons of lithium carbonate per year. This milestone strengthens the supply chains for renewable energy and electric vehicles while strengthening North America's key lithium deposits.

- In February 2025, at its Mountain Pass location in California, MP Materials Corp. finished commissioning a new rare earths separation facility. With a 15,000 metric ton annual production capacity, the plant uses cutting-edge solvent extraction techniques to increase the purity of rare earth elements. By increasing domestic supply for defence, clean energy, and high-tech industry, MP Materials can strengthen the strategic rare earth stockpile of the United States.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the strategic mineral stockpiling market based on the below-mentioned segments:

Global Strategic Mineral Stockpiling Market, By Mineral Type

- Battery Materials

- Rare Earth Elements

- Others

Global Strategic Mineral Stockpiling Market, By Stockpiling Entity

- Government Agencies

- Public-Private Partnerships

- Others

Global Strategic Mineral Stockpiling Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |