Global Sulphur Coated Urea Market

Global Sulphur Coated Urea Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Coating Thickness (Thin, Medium, and Thick), By Application (Cereal & Grains, Fruits & Vegetables, and Oilseeds & Pulses), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Sulphur Coated Urea Market Summary, Size & Emerging Trends

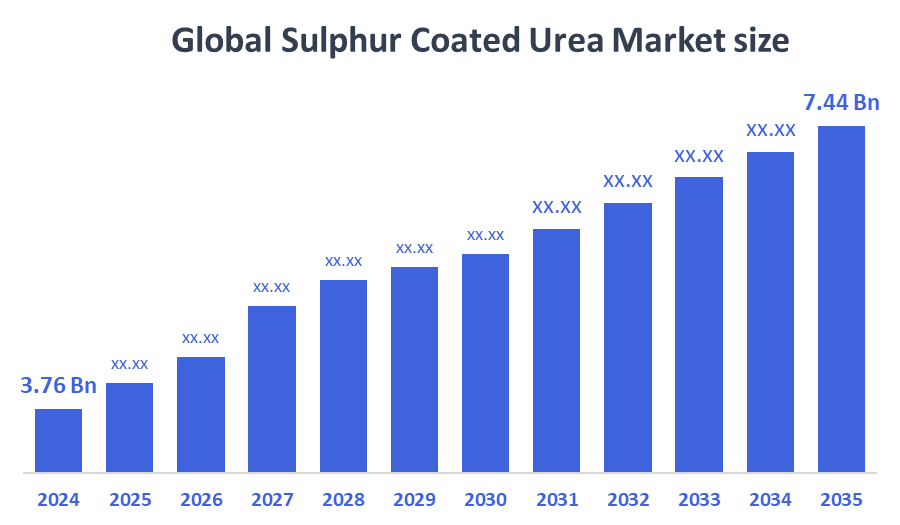

According to Decision Advisor, The Global Sulphur Coated Urea Market Size is Expected to Grow from USD 3.76 Billion in 2024 to USD 7.44 Billion by 2035, at a CAGR of 6.4% during the forecast period 2025-2035. Increasing demand for efficient and slow-release fertilisers to boost crop yields and reduce environmental impact drives market growth. Adoption in sustainable agriculture practices and government subsidies for eco-friendly fertilisers also support expansion.

Key Market Insights

- Asia Pacific is expected to hold the largest market share during the forecast period.

- Regarding coating thickness, the medium thickness segment dominates due to optimal nutrient release rates.

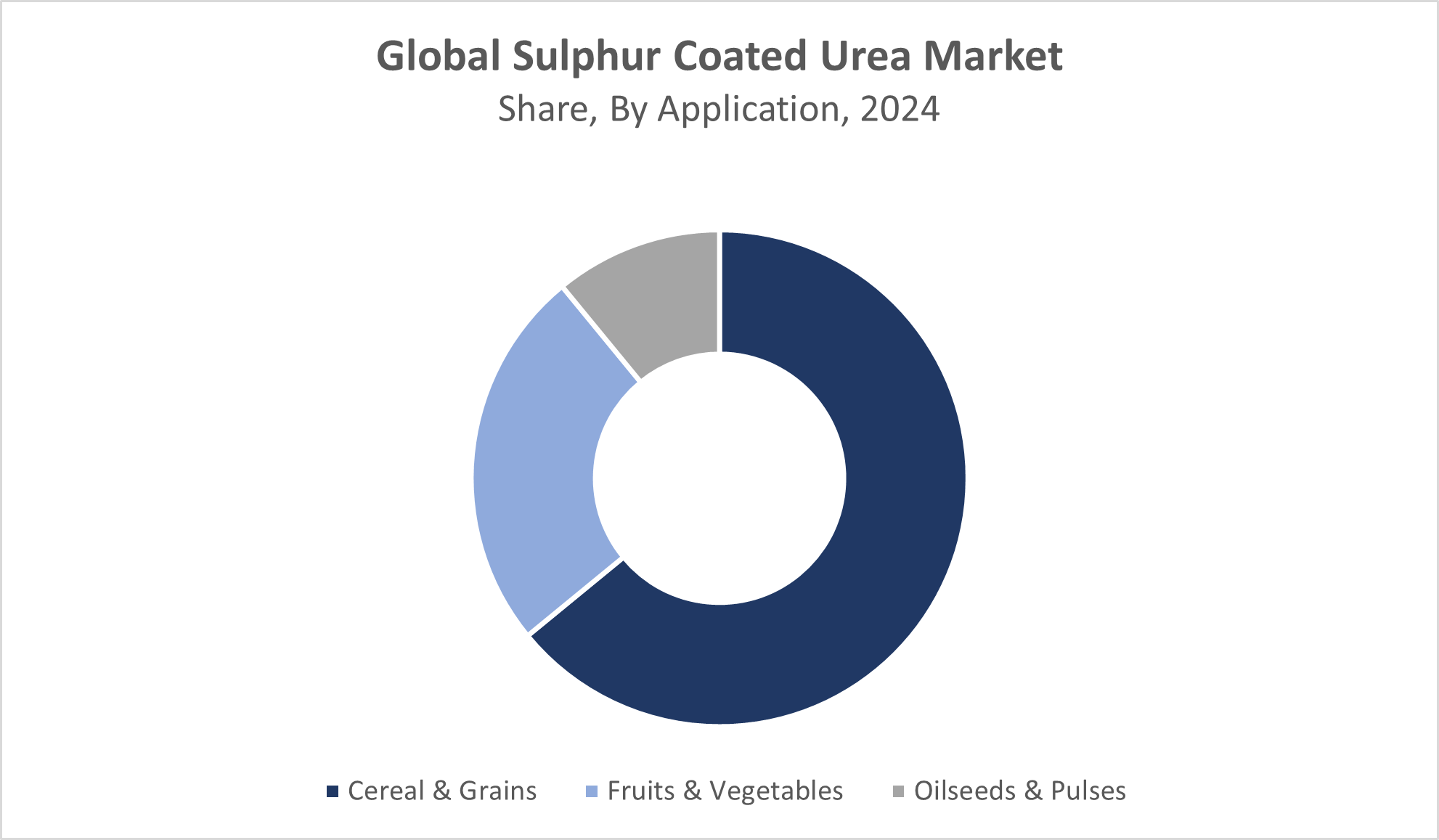

- Among applications, cereal & grains account for the largest demand share, driven by staple food crop production.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3.76 Billion

- 2035 Projected Market Size: USD 7.44 Billion

- CAGR (2025-2035): 6.4%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Sulphur Coated Urea Market

Sulphur coated urea is a specialized slow-release nitrogen fertilizer where a layer of sulphur encases urea granules, controlling the nutrient release rate. This coating improves nitrogen use efficiency by minimizing rapid nutrient loss through leaching and volatilization, ensuring a steady supply to crops. It is extensively used in cereal crops, fruits, and vegetable farming to boost yields and enhance soil health. The market is growing due to rising adoption of sustainable agricultural practices aimed at reducing environmental pollution and improving fertilizer efficiency. Stricter government regulations targeting chemical runoff and soil contamination further support its demand. Additionally, ongoing innovations in coating technologies are enhancing the product’s effectiveness and durability. Expansion of organic and precision farming techniques also drives market growth, as farmers seek eco-friendly, efficient fertilizer solutions to meet increasing global food demand while protecting natural resources.

Sulphur Coated Urea Market Trends

- Increasing preference for controlled-release fertilizers to improve nutrient efficiency and reduce pollution.

- Advances in coating technologies improving sulphur layer uniformity and nutrient release consistency.

- Growing collaborations between fertilizer manufacturers and agricultural research institutions for product innovation.

Sulphur Coated Urea Market Dynamics

Driving Factors: Farmers prefer slow-release fertilisers

Rising demand for higher crop yields and sustainable farming practices is fueling the adoption of sulphur-coated urea. Farmers prefer slow-release fertilisers to reduce the frequency of applications, enhancing soil nutrient balance and minimising environmental impact. Additionally, government incentives and subsidies supporting eco-friendly and sustainable agriculture are encouraging wider use. These factors combined help farmers optimise crop productivity while promoting soil health, making sulphur-coated urea an attractive choice in modern farming practices globally.

Restrain Factors: High production costs of sulphur coated urea limit affordability

High production costs of sulphur coated urea limit affordability, especially in developing regions with low awareness of coated fertilisers. This restricts market penetration where traditional fertilisers dominate. Moreover, competition from other controlled-release fertilisers, such as polymer-coated urea, poses challenges to growth. Supply chain disruptions and the fluctuating price of raw materials, particularly sulphur, add uncertainty and increase production expenses, further constraining market expansion in certain regions.

Opportunity: Emerging applications in high-value crops like fruits

Emerging applications in high-value crops like fruits, vegetables, and specialty plantations offer significant growth potential for sulphur coated urea. Technological innovations in coating techniques enhance fertilizer efficiency and durability, driving demand. The rise of organic farming and environmentally sustainable agriculture also presents lucrative opportunities. Furthermore, increasing investments in smart agriculture and precision farming technologies are expected to expand the market, as these methods require optimized nutrient delivery systems like sulphur coated urea for maximum crop performance.

Challenges: Navigating the complex and varying regulatory frameworks across countries

Scaling up production while maintaining consistent quality and cost-effectiveness remains a major challenge for manufacturers of sulphur coated urea. Additionally, navigating the complex and varying regulatory frameworks across countries for fertilizer approval demands considerable time and resources. The presence of alternative nitrogen sources and competing fertilizers limits market share growth, forcing companies to continuously innovate and optimize production processes to remain competitive in a crowded marketplace.

Global Sulphur Coated Urea Market Ecosystem Analysis

The sulphur coated urea market ecosystem involves raw material suppliers (sulphur and urea), coating technology developers, fertilizer manufacturers, and agricultural distributors. End-users include farmers, cooperatives, and agribusiness firms focused on efficient crop production. Leading players invest heavily in R&D to improve nutrient release efficiency and support sustainability. Regulatory agencies play a crucial role by enforcing environmental standards and quality regulations, which directly impact manufacturing practices, product formulations, and global market accessibility for industry participants.

Global Sulphur Coated Urea Market, By Coating Thickness

Medium coating accounting for about 50% of the market share, the medium coating segment dominates the global market. This coating thickness provides a balanced nutrient release profile, making it suitable for most common crop cycles, including grains, vegetables, and pulses. Medium-coated urea is highly favored due to its cost-efficiency, versatility, and effectiveness in minimizing nitrogen loss. It meets the needs of a wide range of farming practices, which contributes to its strong adoption across diverse agricultural regions.

The thin coating segment holds approximately 25% of the global sulphur coated urea market share. This type of coating allows for faster nutrient release, making it ideal for short-duration crops and seasonal farming cycles where immediate nitrogen availability is crucial. Farmers prefer thin-coated urea in regions with shorter growing seasons or when quick plant growth is needed. However, its limited control over long-term nutrient release makes it less suitable for crops with extended nutrient requirements.

Global Sulphur Coated Urea Market, By Application

Cereal and grains represent the largest segment, accounting for approximately 45% of the global sulphur coated urea market share. This dominance is driven by the extensive global cultivation of staple crops such as wheat, rice, and maize, which require consistent nitrogen input for optimal yields. Sulphur coated urea is widely adopted in this segment due to its controlled nutrient release, minimising leaching and ensuring better fertiliser use efficiency, especially crucial in large-scale farming operations across Asia, North America, and Europe.

The fruits and vegetables segment holds around 35% of the market, driven by the growing demand for high-quality produce and the need for precise nutrient management. These crops are often cultivated intensively and require controlled nutrient application to ensure optimal growth, color, and shelf life. Sulphur coated urea helps in maintaining soil health and provides a steady nitrogen supply, improving both yield and quality. The segment is expanding, particularly in greenhouse farming and organic production systems.

Asia Pacific dominates the global market with approximately 45% revenue share in 2024.

This is primarily driven by intensive agricultural practices, a large farming population, and the growing need to improve crop productivity in countries such as China and India. Rising awareness about sustainable and slow-release fertilisers, supported by government initiatives to reduce nitrogen runoff and enhance soil health, has boosted adoption. Additionally, increasing food demand due to a growing population further supports market expansion in this region.

North America holds around 25% of the market and is projected to be the fastest growing regional market.

Growth is propelled by the adoption of advanced farming technologies, such as precision agriculture and smart irrigation systems, which require controlled nutrient application. The U.S. and Canada are leading in implementing environmental regulations encouraging the use of slow-release fertilizers to curb nitrogen pollution. Rising interest in high-efficiency fertilisers and sustainable farming practices also supports the regional market’s strong growth trajectory.

Europe accounts for about 20% of the global sulphur coated urea market,

representing a mature but steadily growing region. Demand is largely influenced by organic farming trends, environmental awareness, and stringent EU regulations governing fertilizer usage. Farmers are increasingly adopting eco-friendly nutrient solutions to meet sustainability targets and avoid nitrate contamination. Countries like Germany, France, and the Netherlands are focusing on improving soil quality and reducing chemical runoff, thereby maintaining stable demand for sulphur coated urea.

WORLDWIDE TOP KEY PLAYERS IN THE SULPHUR COATED UREA MARKET INCLUDE

- Nutrien Ltd.

- Yara International ASA

- SQM S.A.

- Haifa Group

- Agrium Inc.

- Kingenta Ecological Engineering Group

- Coromandel International Ltd.

- K+S AG

- Compass Minerals

- Others

Product Launches in Sulphur Coated Urea Market

- In January 2024, Nutrien Ltd. launched a new medium-thickness sulphur coated urea product designed for improved nitrogen release control and enhanced crop yield efficiency. This product targets cereal and vegetable crops, aiming to reduce nitrogen losses and support sustainable agriculture.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the sulphur coated urea market based on the below-mentioned segments:

Global Sulphur Coated Urea Market, By Coating Thickness

- Thin

- Medium

- Thick

Global Sulphur Coated Urea Market, By Application

- Cereal & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

Global Sulphur Coated Urea Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. What are the key benefits of using sulphur coated urea?

It provides a steady supply of nitrogen to crops, minimizes nutrient loss due to leaching and volatilization, enhances crop yields, and supports sustainable agricultural practices by reducing pollution.

Q. Which region dominates the sulphur coated urea market?

Asia Pacific holds the largest market share due to intensive farming practices, a large farming population, and government initiatives promoting sustainable agriculture.

Q. What are the common applications of sulphur coated urea?

It is primarily used in cereal and grain crops, fruits and vegetables, and oilseeds and pulses to improve nutrient efficiency and crop yield.

Q. What are the main challenges facing the sulphur coated urea market?

High production costs, regulatory complexities, competition from other controlled-release fertilizers, and supply chain disruptions pose challenges to market growth.

Q. Which coating thickness segment holds the largest share?

The medium coating segment dominates, offering balanced nutrient release suitable for a wide range of crop types and farming practices.

Q. How is the market expected to grow in the coming years?

The global market size is projected to grow from USD 3.76 billion in 2024 to USD 7.44 billion by 2035, with a CAGR of 6.4% driven by increasing demand for efficient and sustainable fertilizers.

Q. Who are the key players in the sulphur coated urea market?

Key players include Nutrien Ltd., Yara International ASA, SQM S.A., Haifa Group, Agrium Inc., Kingenta Ecological Engineering Group, and Coromandel International Ltd., among others.

Q. How do government regulations impact the market?

Stricter environmental regulations encourage the adoption of slow-release fertilizers like sulphur coated urea to reduce nitrogen pollution and improve soil health, thus supporting market growth.

Q. Are there any recent product innovations in this market?

Yes, for example, in January 2024, Nutrien Ltd. launched a new medium-thickness sulphur coated urea product designed to improve nitrogen release control and enhance crop yields.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 165 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |