Global Surface Protection Tapes Market

Global Surface Protection Tapes Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade, War Analysis, By Type (Polyethylene (PE), Polypropylene (PP), and Polyvinyl Chloride (PVC)), By Material (Polished Metals, Glass, and Plastics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Surface Protection Tapes Market Summary, Size & Emerging Trends

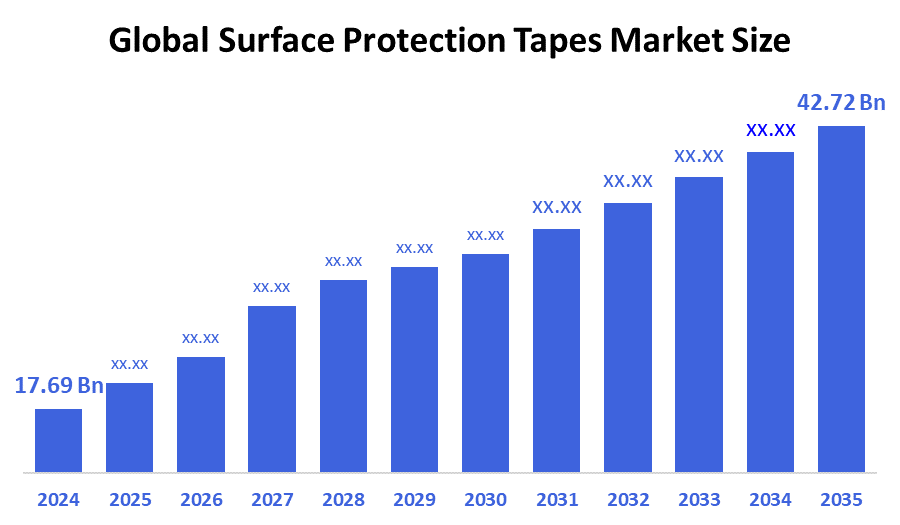

According to Spherical Insights, the Global Surface Protection Tapes Market Size is expected to Grow from USD 17.69 Billion in 2024 to USD 42.72 Billion by 2035, at a CAGR of 8.35% during the forecast period 2025-2035. The global surface protection tapes market is primarily driven by the growing manufacturing and construction activities that increase demand for protecting surfaces during handling, storage, and installation.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the surface protection tapes market during the forecast period.

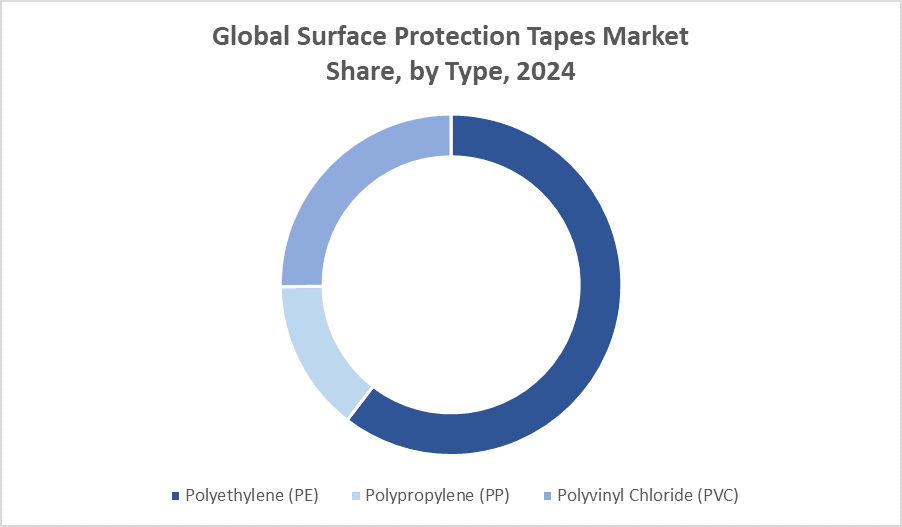

- In terms of type, the polyethylene (PE) segment accounted for the largest market share of the global surface protection tapes market during the forecast period

- In terms of material, the polished metals segment accounted for the major revenue share of the global surface protection tapes market during the forecast period

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 17.69 Billion

- 2035 Projected Market Size: USD 42.72 Billion

- CAGR (2025-2035): 8.35%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Surface Protection Tapes Market

The surface protection tapes market involves the production and use of adhesive tapes designed to protect surfaces from scratches, dust, dirt, and damage during manufacturing, transportation, and installation. These tapes are widely applied across industries such as automotive, electronics, construction, aerospace, and furniture, ensuring product integrity and enhancing durability. Governments worldwide are supporting the adoption of surface protection solutions through initiatives promoting industrial safety standards and sustainable manufacturing practices. These policies encourage the use of protective materials that reduce waste and improve product lifespan, aligning with environmental regulations and quality control measures. Innovations in adhesive technology and materials, such as eco-friendly and high-performance tapes, are driving market growth. Increasing urbanization and industrialization continue to boost demand, as these tapes play a critical role in preserving surface quality in high-value products. Overall, the market is expected to expand steadily, driven by ongoing industrial development and a growing focus on product protection and safety.

Surface Protection Tapes Market Trends

- Rising demand for eco-friendly, biodegradable tapes to support sustainability.

- Advanced adhesives offering stronger grip, easy removal, and resistance to heat and moisture.

- Industry-specific tapes designed for unique applications like automotive and delicate surfaces.

- Emerging smart tapes integrated with IoT for real-time surface monitoring and maintenance.

Surface Protection Tapes Market Dynamics

Driving Factors: Rising urbanization and industrialization

The growth of the surface protection tapes market is driven by increasing manufacturing and construction activities worldwide, which demand reliable solutions to prevent surface damage during handling and installation. Rising urbanization and industrialization boost the need for protecting valuable products in automotive, electronics, aerospace, and furniture industries. Advancements in adhesive technology improve tape performance, attracting more users. Additionally, growing awareness of sustainability fuels demand for eco-friendly tapes. Government initiatives promoting industrial safety and quality standards further support market expansion. Overall, these factors collectively propel steady growth by ensuring product integrity, reducing waste, and enhancing operational efficiency across diverse sectors.

Restrain Factors: Improper application or removal of tapes may cause surface damage or adhesive residue

The surface protection tapes market faces restraints such as the availability of cheaper alternative protective materials, which can limit the adoption of tapes in cost-sensitive industries. Additionally, improper application or removal of tapes may cause surface damage or adhesive residue, reducing customer confidence. The market is also affected by fluctuations in raw material prices, impacting production costs. Limited awareness about the benefits of surface protection tapes in some emerging regions hampers market penetration. Moreover, stringent environmental regulations on chemical adhesives and disposal practices pose challenges for manufacturers to develop compliant products, slowing growth in certain markets.

Opportunity: Advancements in smart adhesive technologies like tapes integrated with sensors

The surface protection tapes market holds significant opportunities driven by rising demand across diverse industries such as automotive, electronics, construction, and aerospace, where surface quality is critical. Increasing urbanization and infrastructure development globally create a steady need for protective solutions. Innovations in eco-friendly and biodegradable tapes present a growing market segment, aligning with sustainability trends and regulatory pressures. Additionally, advancements in smart adhesive technologies like tapes integrated with sensors for real-time monitoring offer new applications and value-added benefits. Expanding e-commerce and logistics sectors also boost demand for protective tapes to safeguard products during transit. Emerging markets with growing manufacturing bases present untapped potential, while collaborations between tape manufacturers and end-users can lead to customized solutions, further driving market growth and diversification.

Challenges: Fluctuating raw material prices impact manufacturing costs

Challenges in the surface protection tapes market include the presence of cheaper alternatives that limit tape adoption in cost-sensitive sectors. Inconsistent application and removal can damage surfaces or leave adhesive residues, affecting customer trust. Fluctuating raw material prices impact manufacturing costs, creating pricing instability. Additionally, strict environmental regulations on adhesives require costly reformulations. Limited awareness in emerging markets slows market penetration, while technical limitations in some tapes restrict their use on certain surfaces. These factors collectively hinder faster market growth.

Global Surface Protection Tapes Market Ecosystem Analysis

The global surface protection tapes market ecosystem includes raw material suppliers, manufacturers like 3M and Tesa, distributors, and end-users across industries such as automotive, electronics, and construction. Regulatory bodies ensure quality and environmental compliance. Key players compete through innovation and market expansion, facing moderate supplier and buyer power, low new entrant threats, and moderate substitutes. The market sees high rivalry and growth driven by industrialization, especially in Asia-Pacific, North America, and Europe. Understanding this ecosystem helps stakeholders identify opportunities and manage risks effectively.

Global Surface Protection Tapes Market, By Type

The polyethylene (PE) segment accounted for the largest market share of the global surface protection tapes market during the forecast period, with an estimated share value of around 40%. This dominance is attributed to PE's excellent flexibility, durability, cost-effectiveness, and suitability for a wide range of surfaces and applications, including electronics, automotive, and construction. Its ability to provide reliable protection without leaving residue makes it a preferred material among manufacturers and end-users, driving its widespread adoption across various industries.

The polyvinyl chloride (PVC) segment is significant in the global surface protection tapes market, accounting for an estimated market share of around 30% during the forecast period. PVC tapes are favored for their strong adhesion, excellent chemical resistance, and durability, making them suitable for protecting surfaces in industries like automotive, construction, and electronics. Their versatility and ability to withstand harsh environments contribute to their widespread use, supporting steady growth within the market.

Global Surface Protection Tapes Market, By Material

The polished metals segment accounted for the major revenue share of the global surface protection tapes market during the forecast period, with an estimated share value of approximately 50%. This is due to the high demand for protecting delicate and reflective metal surfaces from scratches, dust, and damage during manufacturing, transportation, and installation. The need to maintain the aesthetic and functional quality of polished metals in industries like automotive, aerospace, and electronics drives this significant market share.

The glass segment accounted for a substantial market share of the global surface protection tapes market during the forecast period, with an estimated share value of around 25%. This is driven by the growing demand to protect fragile glass surfaces from scratches, dust, and breakage during handling, transportation, and installation across industries like construction, automotive, and electronics. The use of specialized tapes that offer strong adhesion yet residue-free removal makes them ideal for safeguarding glass surfaces, contributing to the segment’s significant market presence.

Asia Pacific region is expected to account for the largest share in the surface protection tapes market during the forecast period, with an estimated market share of approximately 45%.

This growth is driven by rapid industrialization, expanding construction activities, and increasing manufacturing output in countries like China and India. The region’s growing automotive, electronics, and infrastructure sectors further boost demand for surface protection tapes, making Asia Pacific a key market for manufacturers and suppliers.

India is projected to experience a significant CAGR in the surface protection tapes market during the forecast period, driven by rapid industrialization, infrastructure development, and expanding automotive and electronics sectors. Growing awareness about surface protection and rising demand for high-quality products are also fueling market growth, positioning India as a key emerging market in the global surface protection tapes industry.

European market is expected to grow steadily at a CAGR of around 6%, supported by stringent quality standards, increasing industrial safety regulations, and rising demand across automotive, construction, and electronics sectors. The focus on sustainable and eco-friendly products further drives market growth in the region.

WORLDWIDE TOP KEY PLAYERS IN THE SURFACE PROTECTION TAPES MARKET INCLUDE

- 3M Company

- Tesa SE

- Avery Dennison Corporation

- Nitto Denko Corporation

- Intertape Polymer Group Inc.

- Berry Global Inc.

- Compagnie de Saint-Gobain S.A.

- Chevron Phillips Chemical Company

- Scapa Group plc

- LINTEC Corporation

- Others

Product Launches in Surface Protection Tapes Market

- In May 2025, Intertape Polymer Group launched the IPG Polyethylene Surface Protection Film Tape (PESP), offering durable protection for surfaces in industries like automotive, marine, and construction. It features a low-tack adhesive for clean removal, UV resistance up to 30 days, and high conformability to protect both flat and intricate surfaces. Moisture-resistant and easy to tear, this tape is ideal for temporary outdoor use and efficient application.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the surface protection tapes market based on the below-mentioned segments:

Global Surface Protection Tapes Market, By Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

Global Surface Protection Tapes Market, By Material

- Polished Metals

- Glass

- Plastics

Global Surface Protection Tapes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What are the key drivers fueling growth in the Global Surface Protection Tapes Market?

A: Increasing manufacturing and construction activities, rising urbanization, advancements in adhesive technology, and growing demand for eco-friendly tapes are the main growth drivers.

Q: What are the main challenges facing the Global Surface Protection Tapes Market?

A: Challenges include fluctuating raw material prices, availability of cheaper alternatives, improper tape application causing surface damage, and stringent environmental regulations on adhesives.

Q: What opportunities exist in the Global Surface Protection Tapes Market?

A: Advancements in smart adhesive technologies such as tapes integrated with sensors, growing e-commerce sectors, and increasing demand for biodegradable and eco-friendly tapes offer significant growth opportunities.

Q: Who are the top companies operating in the Global Surface Protection Tapes Market?

A: Leading players include 3M Company, Tesa SE, Avery Dennison Corporation, Nitto Denko Corporation, Intertape Polymer Group Inc., Berry Global Inc., Compagnie de Saint-Gobain S.A., Chevron Phillips Chemical Company, Scapa Group plc, and LINTEC Corporation.

Q: Can you provide examples of recent product launches in the Surface Protection Tapes Market?

A: Yes. In May 2025, Intertape Polymer Group launched the IPG Polyethylene Surface Protection Film Tape (PESP), featuring durable protection with UV resistance, low-tack adhesive for clean removal, and moisture resistance ideal for automotive, marine, and construction industries.

Q: Which industries are the major adopters of surface protection tapes?

A: Automotive, electronics, construction, aerospace, and furniture industries are the primary adopters.

Q: How does the Asia Pacific market compare with North America in terms of growth?

A: Asia Pacific is expected to show higher market growth due to rapid industrialization and expanding manufacturing sectors, while North America maintains a steady but comparatively slower growth rate.

Q: What are the latest trends shaping the Surface Protection Tapes Market?

A: Trends include rising demand for eco-friendly and biodegradable tapes, development of industry-specific tapes, and the emergence of smart tapes integrated with IoT technologies for real-time surface monitoring.

Q: What is the long-term outlook for the Global Surface Protection Tapes Market from 2025 to 2035?

A: The market is expected to sustain steady growth driven by ongoing industrialization, urbanization, innovations in adhesive technology, and increasing demand for surface protection in high-value industries

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | May 2025 |

| Access | Download from this page |