Global Surfactants Market

Global Surfactants Market Size, Share, and COVID-19 Impact Analysis, By Source (Synthetic, Biobased), By Product (Non-Ionic Surfactants, Amphoteric Surfactants, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Surfactants Market Summary

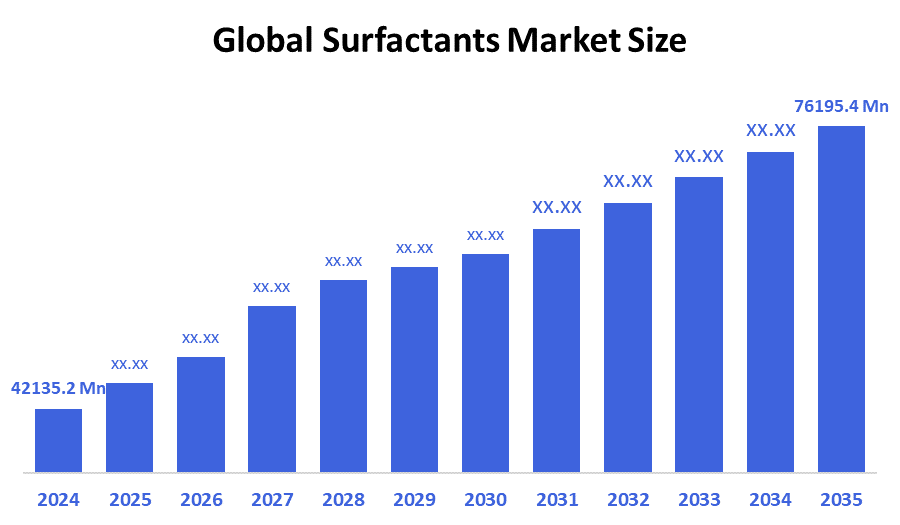

The Global Surfactants Market Size Was Estimated at USD 42135.2 Million in 2024 and is Projected to Reach USD 76195.4 Million by 2035, Growing at a CAGR of 5.53% from 2025 to 2035. The market for surfactants is expanding due to factors like urbanization, rising disposable income, cleaning product demand, industrial applications, eco-friendly formulations, personal care, and growing hygiene awareness.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific dominated the surfactants market, holding the largest market share of 35.4%.

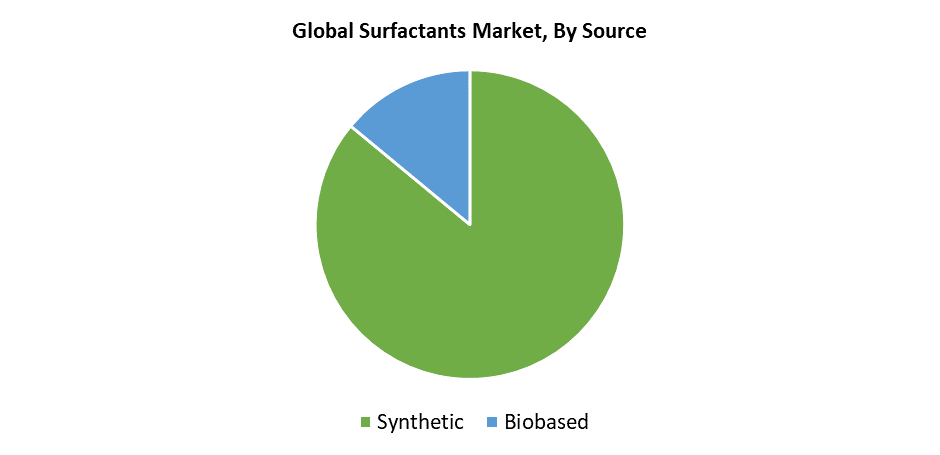

- In 2024, the synthetic segment held an 86.3% revenue share and dominated the surfactants market based on source.

- In 2024, non-ionic surfactants held a 12.6% revenue share and dominated the surfactants market based on product.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 42135.2 Million

- 2035 Projected Market Size: USD 76195.4 Million

- CAGR (2025-2035): 5.53%

- Asia Pacific: Largest market in 2024

The surfactants market includes the production and utilization of surface-active substances, which reduce tensions between liquids or between liquids and solids. These substances have widespread usage across industrial sectors and medicinal fields, as well as personal care products and agricultural and detergent sectors. The market growth stems from the rising requirement for cleaning and hygiene products, primarily in developing nations that experience increasing urbanization and disposable income levels. The adoption of environmentally sustainable practices has driven manufacturers to produce biodegradable surfactants. The market expands through the increasing personal care industry, together with rapid industrial growth and expanding applications of surfactants in the agricultural and oil recovery sectors.

Technological advancements significantly shape the surfactant market because they enable the production of innovative, sustainable products. Scientists focus on bio-based surfactants derived from renewable resources because these solutions reduce environmental damage. Product sustainability and efficacy are being improved by enzyme-based formulations and nanotechnology. Environmental regulations from various governments push companies to reduce hazardous chemicals and promote the adoption of safer alternatives. Research and development programs alongside eco-friendly product subsidies encourage industry members to adopt sustainable surfactant technologies. The surfactant market grows both environmentally responsible and resilient through the combined effect of these advancements.

Source Insights

The synthetic segment dominates the surfactants market by generating 86.3% of the total revenue in 2024. Synthetic surfactants dominate the market because they present better availability and maintain consistent quality at lower costs than natural surfactants. The excellent effectiveness together with high adaptability of synthetic surfactants makes them essential for multiple sectors, which include industrial and domestic cleaning and personal care applications. The capacity to modify synthetic surfactants through chemical processes for particular applications drives their increased demand. The synthetic surfactant market segment maintains its market leadership because it benefits from established production methods and scalability, and strong industry adoption, while bio-based surfactants gain popularity. The synthetic surfactant market segment drives the majority of revenue in the surfactant industry.

The biobased segment of the surfactants market is expected to experience the fastest CAGR throughout the forecast period. The rapid expansion occurs primarily because of government requirements for biodegradable materials and customers who prefer sustainable products. The synthetic counterparts of biobased surfactants are less toxic and more biodegradable since they are produced from renewable sources like plants and natural lipids. The development of green chemistry, together with biotechnology advances, has reduced production costs and improved performance of biobased surfactants, thus accelerating their adoption across industrial and personal care sectors. The recognition of environmental impact will drive a rapid increase in the biobased surfactants market growth.

Product Insights

The non-ionic surfactants segment led the surfactants market by generating 12.6% of total revenue in 2024. The segment maintains its market dominance because of its exceptional performance across multiple applications, including personal care products and household and industrial cleaning solutions. The market favors non-ionic surfactants because they possess minimal toxicity alongside biodegradability and perform well across different pH ranges and water hardness levels. Their ability to work with multiple surfactant solutions enables them to become versatile formulation options. The adoption of non-ionic surfactants by consumers is rising because they deliver mild and environmentally friendly products for cleaning and cosmetics applications. The market dominance and growth of this segment receive support from continuous research, which aims to improve its environmentally sustainable characteristics.

The amphoteric surfactants segment is expected to grow at the fastest CAGR throughout the forecasted period. Their unique dual functionality enables them to serve as both cationic and anionic surfactants, which makes them adaptable for use in various applications, including detergents and medicines, and personal care products. The outstanding mildness of formulations using amphoteric surfactants, together with their excellent surfactant compatibility and foaming capabilities, makes them preferred ingredients for products targeting sensitive skin and environmentally friendly solutions. The growing consumer preference for gentle biodegradable chemicals, together with strict environmental regulations, drives the strong market demand for amphoteric surfactants. Modern production technology developments enhance both performance and cost-effectiveness of these surfactants, thus accelerating their market adoption during the upcoming years.

Regional Insights

The Asia Pacific dominated the surfactants market with the largest revenue share of 35.4% in 2024. This growth is because industrial sectors are growing alongside rising disposable incomes and increasing urbanization. The demand for industrial cleaning agents, together with household detergents and personal care products, continues to rise across China, India, and Southeast Asian countries. The expanding pharmaceutical and cosmetics sectors within the region serve as major drivers for surfactant consumption. The market growth received additional momentum from increasing sanitation and hygiene awareness after the epidemic period. The regional production capacity benefits from the available raw materials combined with government initiatives that encourage manufacturing and export activities. The Asia Pacific region has emerged as a primary growth market within the global surfactants industry due to increased funding for research on bio-based and environmentally friendly surfactants.

Europe Surfactants Market Trends

Europe demonstrates a significant revenue share, accounting for 23.4% revenue share in 2024. The established sectors of personal care and detergent, along with industrial applications, and the rising demand for sustainable surfactant products, drive Europe to maintain its substantial market share. The strict environmental regulations in Europe force producers to create new biodegradable and bio-based surfactants, which drives market growth. The adoption of advanced surfactant compositions receives additional support from consumers who understand product safety and sustainability better. The research and development focus, along with government green chemistry support programs in Europe, provide additional market strength. The European surfactants market maintains its global lead because of its efficient supply networks and developed infrastructure systems.

North America Surfactants Market Trends

The North American surfactants market accounted for a substantial revenue share of 25.5% in 2024. The leadership position stems from strong industrial and personal care and housekeeping sector demand, combined with advanced manufacturing facilities and state-of-the-art technology. The increasing use of sustainable and eco-friendly surfactant products by North American consumers leads producers to create new biodegradable and bio-based surfactant products. Regulatory standards regarding chemical safety and environmental impact provide additional incentives for the adoption of green alternatives. The market growth receives support from research and development investments and the increasing awareness of sanitation and hygiene, which became especially important after the epidemic. The region maintains the highest revenue share because it hosts numerous major industry players and maintains a strong supply chain network.

Key Surfactants Companies:

The following are the leading companies in the surfactants market. These companies collectively hold the largest market share and dictate industry trends.

- Akzonobel N.V

- Godrej Industries Limited

- BASF SE

- Kao Corporation

- Solvay S.A

- Henkel Adhesives Technologies India Private Limited

- Dow

- Bayer AG

- Huntsman International LLC

- Clariant AG

- Evonik Industries AG

- Stepan Company

- Others

Recent Developments

- In May 2025, CalCare AOS, a novel biobased alpha olefin sulfonate surfactant technology, will be introduced to the North American market through an exclusive agreement between Pilot Chemical Company and Novvi LLC. The domestic, industrial, and institutional (I&I), and personal care (PC) sectors are the focus of this sustainable innovation, which provides excellent performance while advancing sustainability objectives. The collaboration combines Pilot's sulfonation skills and market presence with Novvi's knowledge of bio-based alpha olefin feedstocks. Pilot will manufacture CalCare AOS in its Middletown, Ohio, facility as the only sulfonator and distributor, becoming the first company in North America to commercialize this sustainable surfactant technology on a large scale.

- In January 2024, Nouryon made the announcement during the ACI Annual Meeting and Industry Convention in Orlando, Florida, about the introduction of Berol Nexus surfactant. Specifically created for the North American cleaning market, this next-generation, multipurpose hydrotrope offers improved cosurfactant performance. In order to promote sustainability goals, Berol® Nexus is designed for use in domestic, commercial and institutional (I&I) cleaning applications, with an emphasis on low-temperature washing. Nouryon's Senior Vice President of Home and Personal Care, Suzanne Carroll, highlighted the company's dedication to providing customers with cutting-edge, environmentally friendly ingredient solutions that enable them to develop unique and excellent cleaning products across a range of market niches.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the surfactants market based on the below-mentioned segments:

Global Surfactants Market, By Source

- Synthetic

- Biobased

Global Surfactants Market, By Product

- Non-Ionic Surfactants

- Amphoteric Surfactants

- Others

Global Surfactants Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 211 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |