Global Surgical Adhesion Barriers Market

Global Surgical Adhesion Barriers Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Synthetic Adhesion Barriers, and Natural Adhesion Barriers), By Formulation (Film/Mesh, Gel, and Liquid), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Surgical Adhesion Barriers Market Size Insights Forecasts to 2035

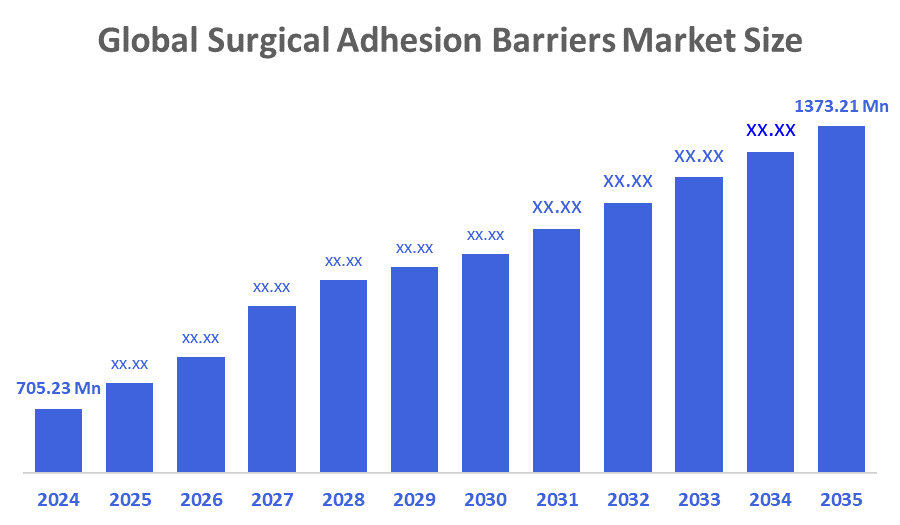

- The Global Surgical Adhesion Barriers Market Size Was Estimated at USD 705.23 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.25 % from 2025 to 2035

- The Worldwide Surgical Adhesion Barriers Market Size is Expected to Reach USD 1373.21 Million by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Surgical Adhesion Barriers Market Size Was Worth Around USD 705.23 Million In 2024 And Is Predicted To Grow To Around USD 1373.21 Million By 2035 With A Compound Annual Growth Rate (CAGR) Of 6.25 % From 2025 To 2035. One of the main reasons behind this development is that more and more people are undergoing surgical operations globally, hence there is a greater need for adhesion barriers to be used to prevent the development of postoperative complications. Going through surgery is becoming more common around the world, and this is the main driver behind the growth of the surgical adhesion barriers industry. Further, the increasing number of older people and the growing number of chronic diseases will be needed, and consequently, this creates a higher demand for adhesion barriers.

Market Overview

The worldwide Surgical Adhesion Barriers Market is essentially the worldwide business sector that is involved in the innovation, manufacturing and marketing of medical devices and biomaterials aimed at preventing or minimizing post, surgical adhesions. Adhesions comprise scar tissues which link the internal organs and tissues after surgery, thus posing the risk of various complications such as blockage of the intestines, inability to conceive, persistent pain, or dysfunction of the organs. A surgical adhesion barrier is a medical device for preventing adhesions that may develop after a surgical procedure. Adhesions are abnormal scar tissue bands that can form between internal organs or between organs and the tissues surrounding them. They may lead to pain, discomfort, and complications such as bowel obstructions. Generally, surgical adhesion barriers consist of biocompatible materials that are introduced at the surgical site to serve as a physical barrier between tissues; thus, they do not stick to each other during healing.

In February 2020, Baxter International completed its acquisition of the Seprafilm Adhesion Barrier and related assets from Sanofi, in a deal valued at $350 million. The product line strengthens Baxter’s Advanced Surgery portfolio and has a global presence in the U.S., Japan, China, South Korea, and France.

Report Coverage

This research report categorises the Surgical Adhesion Barriers Market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the surgical adhesion barriers market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the surgical adhesion barriers market.

Driving Factors

The market for surgical adhesion barriers offers numerous opportunities for growth and innovation. One of the primary factors is the development of next-generation adhesion barrier products that boast better effectiveness and safety ratings. The manufacturers may concentrate on developing new formulations that can prevent adhesions better, cause fewer side effects, and are easier to apply/divide. Moreover, adhesion barriers combined with other medical devices and surgical instruments can yield superior solutions for surgeons, thus enhancing patient outcomes and accelerating the growth of the market. Besides, there is another vital opportunity for increasing the market in the emerging economies. The healthcare infrastructure is on the rise, and the awareness of the advanced surgical techniques is also increasing, which propelled the market expansion.

Restraining Factors

However, certain restraints of the Surgical Adhesion Barriers Market could limit its expansion. The main challenge is one of the major ones: the high price of adhesion barrier products, which may restrict their use, especially in price-sensitive markets. On the other hand, the danger of complications and side effects that could result from the use of adhesion barriers may also be one of the reasons for their limited usage. Market players may also be challenged by regulatory hurdles and tough approval processes, forcing them to deal with complicated regulatory environments to launch new products.

Market Segmentation

The surgical adhesion barriers market share is classified into product type and formulation.

- The synthetic adhesion barriers segment dominated the market in 2024 and is projected to grow at a remarkable CAGR during the forecast period.

Based on the product type, the surgical adhesion barriers market is segmented into synthetic adhesion barriers and natural adhesion barriers. Among these, the synthetic adhesion barriers segment dominated the market in 2024 and is projected to grow at a remarkable CAGR during the forecast period. These products are becoming popular because of their high performance and the option to customise them for surge applications. Typical synthetic membranes have a number of advantages, which include being very uniform, having a predictable rate of breakdown, and a lower risk of infection. They are very highly preferred in different surgical procedures.

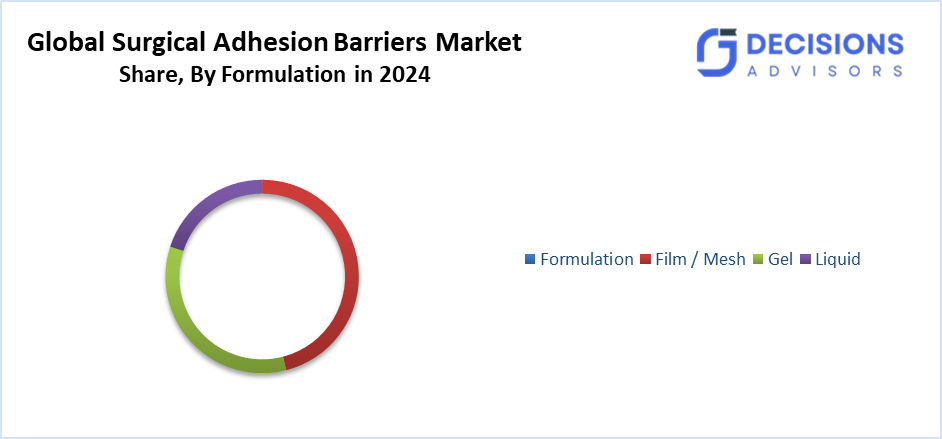

- The film/mesh segment accounted for the highest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period.

Based on the formulation, the surgical adhesion barriers market is classified into film/mesh, gel, and liquid. Among these, the film/mesh segment accounted for the highest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period. These products have been preferred primarily for the convenience with which they are applied, their flexibility, and their provision of a physical barrier that inhibits tissue adhesion. Film/mesh adhesion barriers have gained a lot of popularity, especially in surgeries of the abdominal and pelvic areas, where the surgeons can quickly place them on the large surfaces.

Regional Segment Analysis of the Surgical Adhesion Barriers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the surgical adhesion barriers market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the surgical adhesion barriers market over the predicted timeframe. The rise in healthcare spending, better medical facilities, and greater consumer awareness of the latest surgical techniques are some of the main factors that drive the market growth in this region. China, India, and Japan are the key markets to watch out for. Increasing aged population, a higher incidence of chronic diseases, and the growing number of surgeries will create demand for adhesion barriers in the Asia Pacific.

In February 2022, Gunze Limited announced the launch of its new TENALEAF Absorbable Adhesion Barrier in Japan, designed to support medical professionals in reducing post-surgical complications and improving patient outcomes.

North America is expected to grow at a rapid CAGR in the surgical adhesion barriers market during the forecast period. Regionally, a significant share will be held by North America in the surgical adhesion barriers market, which is mainly due to the high occurrence of chronic diseases, a highly developed healthcare structure, and the presence of leading market players. Continuously rising surgical cases, innovations in surgical methods, and positive reimbursement policies are some of the main factors that are fueling the need for adhesion barriers in North America.

In June 2025, the American College of Surgeons (ACS) Surgical Adhesions Improvement Project will advance global research into intraperitoneal adhesions, a complication affecting up to 93% of patients after abdominal or pelvic surgery. The initiative is driving new prevention strategies, assessment tools, and therapeutic innovations to improve patient outcomes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the surgical adhesion barriers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Anika Therapeutics, Inc.

- Atrium Medical Corporation

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company

- FzioMed, Inc.

- Getinge AB

- Integra LifeSciences Corporation

- Johnson & Johnson (Ethicon, Inc.)

- Mast Biosurgery AG

- Medtronic Plc

- Sanofi S.A.

- Stryker Corporation

- Terumo Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2024, ARC Medical, a Canadian company, announced a clinical plan to evaluate its liquid adhesion prevention devices—JOCOAT and IPCOAT—through global clinical trials, aiming to reduce post-surgical adhesions in orthopaedic, gynaecological, and abdominal surgeries.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the surgical adhesion barriers market based on the below-mentioned segments:

Global Surgical Adhesion Barriers Market, By Product Type

- Synthetic Adhesion Barriers

- Natural Adhesion Barriers

Global Surgical Adhesion Barriers Market, By Formulation

- Film/Mesh

- Gel

- Liquid

Global Surgical Adhesion Barriers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current market size of surgical adhesion barriers?

The market was valued at USD 705.23 million in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 1,373.21 million by 2035.

- What is the forecasted CAGR for the market?

The market is projected to grow at a CAGR of 6.25% from 2025 to 2035.

- What are the main product types in the market?

The market segments into synthetic adhesion barriers and natural adhesion barriers, with synthetics dominating in 2024.

- Which formulation held the highest market share in 2024?

The film/mesh segment accounted for the highest share and is expected to grow substantially.

- Which region is expected to grow the fastest?

North America is anticipated to grow at the fastest CAGR during the forecast period.

- Which region will hold the largest market share?

Asia Pacific is expected to hold the largest share, driven by rising healthcare spending and surgeries in countries like China, India, and Japan.

- Who are some key players in the market?

Major companies include Baxter International Inc., Johnson & Johnson (Ethicon), Medtronic Plc, Anika Therapeutics, and B. Braun Melsungen AG.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |