Global Sweet Protein Extracts Market

Global Sweet Protein Extracts Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (Thaumatin, Brazzein, Monellin, and Curculin), By Form (Powder, Liquid, and Concentrate), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Sweet Protein Extracts Market Size Summary, Size & Emerging Trends

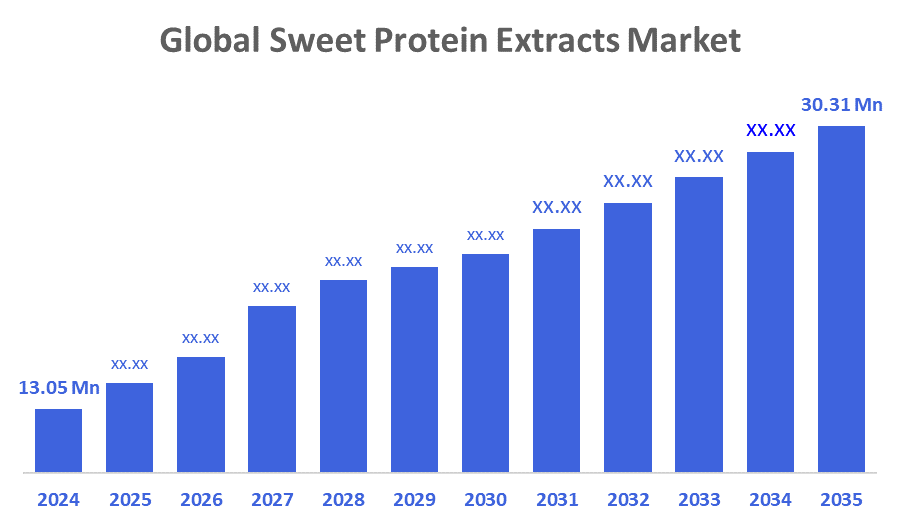

According to Decisions Advisors, The Global Sweet Protein Extracts Market Size is expected to Grow from USD 13.05 Million in 2024 to USD 30.31 Million by 2035, at a CAGR of 7.96% during the forecast period 2025-2035. Rising concerns over sugar consumption, growing preference for natural sweeteners, regulatory push toward sugar reduction, and innovations in extraction processes are key driving factors.

Key Market Insights

- Asia-Pacific is projected to be the fastest-growing region due to shifting dietary preferences and increasing disposable incomes.

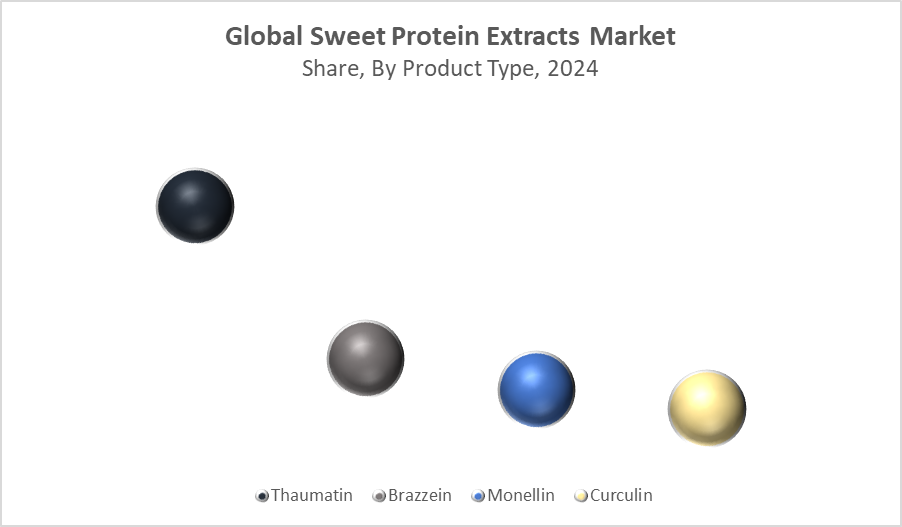

- Thaumatin accounted for the largest product share in 2023, owing to its high sweetness potency and regulatory acceptance.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 13.05 Million

- 2035 Projected Market Size: USD 30.31 Million

- CAGR (2025-2035): 7.96%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Sweet Protein Extracts Market

The sweet protein extracts market revolves around the development and commercialization of naturally derived or bioengineered sweet proteins, known for their high-intensity sweetness and low caloric content. Key proteins such as thaumatin, brazzein, monellin, and curculin are extracted from tropical plants or produced using precision fermentation, enabling their use across various industries including food and beverages, nutraceuticals, and personal care. These proteins offer a clean-label alternative to synthetic sweeteners and align well with sugar-reduction strategies and diabetic-friendly product development. Rising health awareness, consumer demand for natural ingredients, and regulatory pressure to reduce added sugar are significantly boosting adoption. Furthermore, the growing preference for plant-based nutrition and functional foods supports expansion. Technological innovations are improving taste stability, heat resistance, and scalability, helping to lower costs and increase commercial viability.

Sweet Protein Extracts Market Trends

- Increasing R&D into improving sweetness profiles, taste masking, and heat stability of proteins.

- Use of precision fermentation and biotechnology to enhance production efficiency.

- Product development aligned with clean-label, vegan, and sugar-reduction trends.

Sweet Protein Extracts Market Dynamics

Driving Factors: Consumers prefer clean-label products

The sweet protein extracts market is driven by increasing health awareness, which fuels demand for low-calorie, natural sweeteners as alternatives to sugar. Consumers prefer clean-label products with non-artificial ingredients, reinforcing this trend. Additionally, government regulations and policies aimed at reducing sugar consumption in processed foods and beverages encourage manufacturers to seek healthier sweetening options. These combined factors create a strong growth environment for sweet protein extracts across food, beverage, and nutraceutical industries worldwide.

Restrain Factors: Sweet proteins can be sensitive to heat and pH changes

Despite its potential, the market faces challenges such as high production costs and limited availability of raw materials, which restrict large-scale manufacturing. Sweet proteins can be sensitive to heat and pH changes, causing stability issues in certain formulations like baked goods or acidic beverages. Additionally, consumer awareness about these proteins remains low in many developing regions, slowing market penetration. These factors collectively limit the broader adoption and scalability of sweet protein extracts globally.

Opportunity: Innovations in fermentation technology

There is a significant opportunity for sweet protein extracts in emerging sectors like functional beverages, nutraceuticals, and low-calorie confectionery, driven by health-conscious consumers. Innovations in fermentation technology and protein engineering are helping to reduce production costs and improve taste profiles, making these proteins more commercially viable. Growing health awareness in emerging economies further opens untapped markets, while expanding applications beyond traditional food uses enhances the potential for sweet protein extracts to capture a larger share of the natural sweetener market.

Challenges: Sensory acceptance is critical

Key challenges for the market include navigating complex regulatory approval processes in different countries, which can delay product launches. Sensory acceptance is also critical, as sweetness profiles may vary across regions and consumer preferences. Cost competitiveness compared to other sweeteners like stevia or sucralose remains a hurdle. Furthermore, ensuring consistent supply and maintaining high product quality across diverse geographies poses logistical and operational difficulties, requiring coordinated efforts throughout the supply chain.

Global Sweet Protein Extracts Market Ecosystem Analysis

The global sweet protein extracts market ecosystem includes plant cultivators, bioengineered fermentation producers, flavor and ingredient companies, regulatory bodies, and end-use industries like food and beverages. Ingredient developers work to enhance taste, solubility, and production scalability, enabling better product integration. Food and beverage brands focus on innovative formulations to meet consumer demand for natural sweeteners. Regulatory frameworks ensure quality control and proper labeling, while strategic partnerships between biotech firms and food manufacturers drive commercial growth and market expansion worldwide.

Global Sweet Protein Extracts Market, By Product Type

What factors enabled thaumatin to lead the global sweet protein extracts market in 2024?

Thaumatin led the global sweet protein extracts market in 2024, capturing approximately 55% of the total revenue share, due to its exceptional sweetness intensity, natural origin, and versatile functional properties. As a highly potent sweetener up to 3,000 times sweeter than sucrose, Thaumatin allows food and beverage manufacturers to achieve desirable sweetness with minimal quantities, supporting clean-label and low-calorie product formulations. Its status as a natural flavor enhancer and its approval as a food additive in major markets like the EU, U.S., and Asia have also contributed to its widespread adoption. Thaumatin is not only used for its sweetness but also for its ability to mask bitterness and improve mouthfeel, making it ideal for use in functional beverages, dairy products, nutritional supplements, and pharmaceutical applications.

Why is brazzein gaining traction in the global sweet protein extracts market in 2024?

Brazzein is rapidly emerging as a promising sweet protein in the global market, accounting for approximately 20% of the total share in 2024. Its rising popularity is driven by a combination of high sweetness potency, clean taste profile, and exceptional heat and pH stability, making it ideal for a broad range of food and beverage applications. With a sweetness level estimated to be 500–2,000 times greater than sucrose, Brazzein provides a highly efficient sugar alternative, especially for health-conscious and diabetic-friendly formulations.

Global Sweet Protein Extracts Market, By Form

How did the powder form gain a competitive edge in the sweet protein extracts market in 2024?

The powder form has solidified its position as the dominant format in the global sweet protein extracts market in 2024, accounting for approximately 65% of total revenue. This leadership can be attributed to its superior stability, extended shelf life, and ease of storage and transportation, which make it highly attractive for both manufacturers and end-users across industries. Powdered sweet proteins are easier to dose, blend, and incorporate into a wide range of food and beverage applications, from baked goods and dairy alternatives to nutritional supplements and functional drinks. Their low moisture content enhances microbial stability and reduces the need for preservatives, aligning with the growing demand for clean-label and minimally processed products.

What made liquid sweet protein extracts a preferred format in 2024?

Liquid sweet protein extracts secured an estimated 30% share of the global market in 2024 due to several distinct advantages. Their ready-to-use, concentrated form makes them highly convenient for direct incorporation into beverages, syrups, and liquid food products without additional processing steps. This format supports quick blending and uniform distribution of sweetness, which is particularly valuable in beverage manufacturing and other liquid applications. Additionally, liquid extracts offer excellent solubility and consistent flavor profiles, which helps manufacturers maintain product quality and sensory appeal. The liquid form also enables precise dosing and ease of automation in production lines, contributing to operational efficiency.

North America dominates the sweet protein extracts market with the largest revenue share,

propelled by increasing health concerns such as rising obesity and diabetes rates. Government initiatives like sugar taxes and restrictions on sugary products have accelerated demand for natural, low-calorie sweeteners. The region benefits from well-established regulatory frameworks that facilitate quicker approvals and commercialisation. The U.S. leads innovation, particularly in beverages, sports nutrition, and dietary supplements, where consumers actively seek clean-label, plant-based alternatives. Additionally, high consumer awareness and willingness to pay a premium for healthier products support sustained market growth.

Asia-Pacific is the fastest-growing market,

fueled by growing health awareness and a rapidly expanding middle class with higher disposable incomes. Countries like China and India are experiencing increasing adoption of sweet protein extracts across health drinks, low-calorie snacks, and functional foods due to rising lifestyle diseases and changing dietary preferences. Rapid urbanisation and expanding retail infrastructure further boost market penetration. Regulatory environments in these countries are becoming more favorable, encouraging innovation and acceptance of novel sweeteners. The region’s large population base offers significant untapped potential for growth.

Europe maintains steady growth

with a strong focus on plant-based and clean-label sweetener demand. Consumer preference for natural, organic, and health-focused products drives adoption, especially in countries like Germany, France, and the UK. Harmonized regulatory standards around health claims and ingredient transparency facilitate smoother market entry for sweet protein extracts. The growing popularity of dairy alternatives and organic confectionery products further contributes to market expansion. Additionally, increasing sustainability awareness encourages the use of natural sweeteners in food and beverage manufacturing.

WORLDWIDE TOP KEY PLAYERS IN THE SWEET PROTEIN EXTRACTS MARKET INCLUDE

- Givaudan SA

- Tate & Lyle PLC

- International Flavors & Fragrances Inc. (IFF)

- Symrise AG

- Conagen, Inc.

- Sweegen Inc.

- Joywell Foods

- Amai Proteins

- Ingredion Incorporated

- Cargill, Incorporated

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the sweet protein extracts market based on the below-mentioned segments:

Global Sweet Protein Extracts Market, By Product Type

- Thaumatin

- Brazzein

- Monellin

- Curculin

Global Sweet Protein Extracts Market, By Form

- Powder

- Liquid

- Concentrate

Global Sweet Protein Extracts Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 176 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |