Global Telecom Services Market

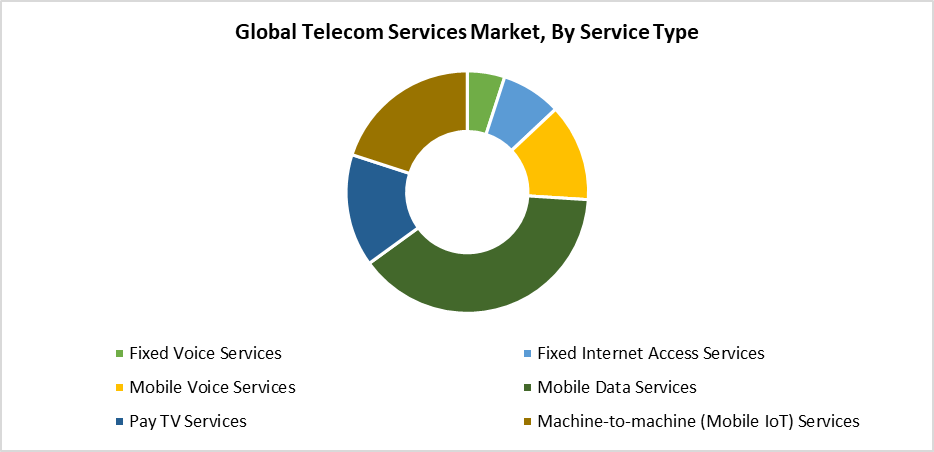

Global Telecom Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Fixed Voice Services, Fixed Internet Access Services, Mobile Voice Services, Mobile Data Services, Pay TV Services, Machine-to-machine (Mobile IoT) Services), By Transmission (Wireline, Wireless), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Telecom Services Market Summary

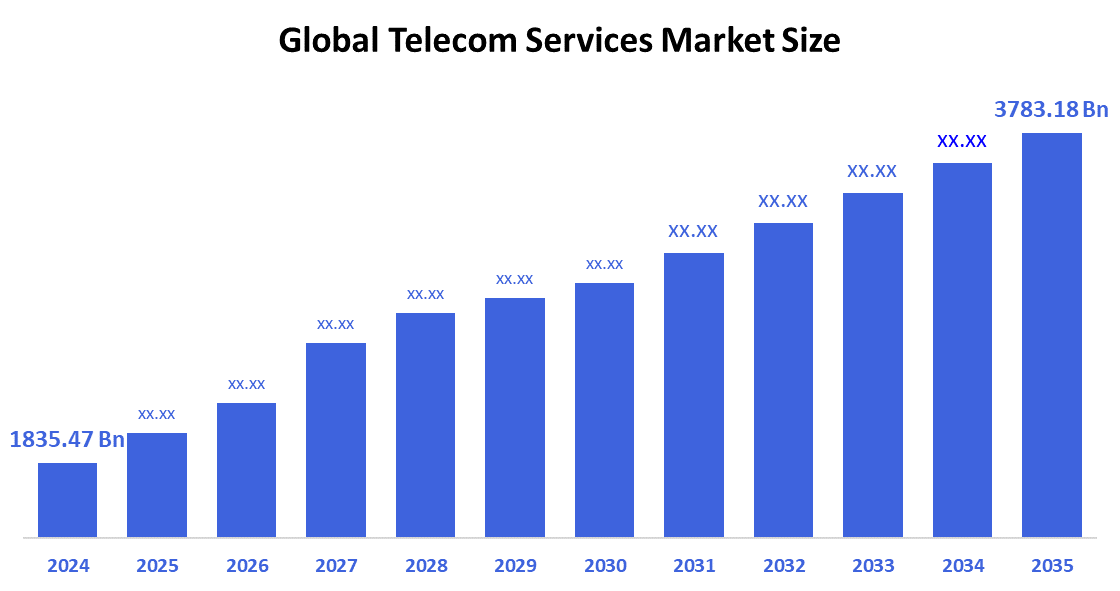

The Global Telecom Services Market Size Was Estimated at USD 1835.47 Billion in 2024 and is Projected to Reach USD 3783.18 Billion by 2035, Growing at a CAGR of 6.8% from 2025 to 2035. Government policies encouraging investment and growth, technological developments like 5G and better broadband infrastructure, rising global demand for mobile devices and digital services, and increased data consumption from streaming and e-commerce are all factors driving the telecom services market's expansion.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the greatest revenue share of 33.2%, dominating the telecom services industry.

- With a 39.3% market share in 2024, the mobile data services segment led the market by service type.

- In 2024, the wireless segment dominated the market with a 21.5% market share based on transmission.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1835.47 Billion

- 2035 Projected Market Size: USD 3783.18 Billion

- CAGR (2025-2035): 6.8%

- Asia Pacific: Largest market in 2024

The telecom services market encompasses all services that transmit voice data and video signals through wired or wireless networks over long distances. The industry encompasses internet access and data communication solutions as well as mobile and fixed-line services. Digital communication adoption across the globe, along with mobile device proliferation and internet speed requirements, fuels the industry growth. Urbanization trends, together with e-commerce growth and cloud service dependency, fuel market progress. The ongoing adoption of 5G networks and escalating consumer demands for uninterrupted connectivity and data-heavy services compel telecom operators to enhance their network infrastructure and service offerings.

The telecom sector undergoes major transformations because of recent technological developments. The Internet of Things relies on 5G technology to deliver ultra-fast and low-latency communication, which enables smart cities and autonomous systems. AI and machine learning technologies improve predictive maintenance and customer service functions, while virtualization, along with cloud-native designs, optimize network operations. The global telecom industry receives government support through rural broadband initiatives and favorable regulations and spectrum distribution to tackle the digital divide. The combined efforts of these programs accelerate global digital transformation while stimulating telecom sector innovation worldwide.

Service Type Insights

The mobile data services segment led the telecom services market with the largest revenue share of 39.3% in 2024. The quick spread of smartphones, rising internet usage, and an increase in data-intensive activities like online gaming, video streaming, and remote work are the main drivers of this growth. Mobile data services experienced increased user engagement because of widespread 4G and 5G network deployment, which enhanced mobile internet speed and reliability. Telecom providers launched affordable data packages together with bundled services because they needed to meet increasing customer requirements. Mobile data stands as the most powerful and rapidly expanding segment within the telecom sector because it remains essential in telecommunications plans due to the expansion of digital consumption.

During the forecasted period, the machine-to-machine (M2M) services segment is anticipated to grow at a significant CAGR. The Internet of Things (IoT) ecosystem's explosive growth is the main driver of the expansion. M2M services automate data exchange operations between devices, so human interaction becomes unnecessary. Applications in connected cars and smart cities, as well as industrial automation and remote healthcare, rely heavily on this essential service. The rising implementation of smart meters, together with asset tracking systems and intelligent transportation networks, drives increasing demand. Edge computing and 5G connectivity advancements enhance M2M communications through improved speed and operational efficiency and scalable solutions. The telecom services industry's M2M sector will experience substantial expansion because governments and corporations dedicate funding to real-time data solutions and digital transformation projects.

Transmission Insights

The wireless segment led the telecom services market with the highest revenue share of 21.5% in 2024. Mobile connectivity requirements continue to rise because people extensively use smartphones, tablets, and wireless devices, thus making wireless services dominant. The rapid deployment of 4G and 5G networks has enhanced wireless communication by delivering fast data transmission, together with minimal delay and expanded network reach. The growing importance of wireless technologies serves both businesses and individual users who need connectivity while moving between locations and accessing the internet remotely. Wireless solutions experience heightened demand because they enable next-generation technologies such as smart homes and connected cars, and the Internet of Things. Wireless transmission will remain a vital factor in shaping the future direction of telecom services.

The wireline segment of the telecom services market is anticipated to grow at a significant CAGR throughout the forecasted period because of increasing demand for reliable and high-capacity network infrastructure. Wireless services continue to gain popularity, yet landline connections remain essential for data-demanding applications, including cloud computing and enterprise networking, and data center operations. The rising adoption of fiber-optic networks, which deliver quick internet speeds and minimal latency, particularly in urban and business areas, contributes to this growth. Governments, together with telecom providers, are investing in modernizing existing wireline infrastructure to satisfy the rising demands of digitalization. The rapid pace of digital transformation across multiple sectors requires wireline services to deliver reliable and scalable connection solutions.

Regional Insights

The North American telecom services market is anticipated to experience significant CAGR because of its advanced technology infrastructure and strong consumer demand for quick and reliable connectivity. The market growth depends heavily on three main drivers: extensive 5G network deployment alongside rising IoT device usage, and strong telecom operator presence. The rising requirement for rapid data transfer finds its roots in the expansion of cloud services and digital entertainment platforms and the shift toward remote work environments. Industry development occurs because of public efforts to enhance network infrastructure and extend broadband services into rural areas. The global telecom services industry maintains North America as a key market because of its persistent investments in upcoming technological advancements.

Asia Pacific Telecom Services Market Trends

Asia Pacific held the largest revenue share of 33.2% and led the telecom services market in 2024. The leadership position stems from Asia Pacific's large, fast-growing population, together with its increasing smartphone usage and developing internet infrastructure between cities and rural areas. Strong infrastructure development, along with extensive 5G deployment initiatives within China and India, and Japan, plays an essential role for the region. Mobile application usage alongside digital services and e-commerce platforms has led to a substantial increase in data consumption. The market gains strength from both government-led telecom infrastructure investments and initiatives that promote digital transformation. Asia Pacific stands as the most energetic and promising region of the global telecom services market since it combines well-established economies with emerging ones.

Europe Telecom Services Market Trends

The European telecom services industry grew significantly during 2024 because of its advanced digital systems combined with strong regulatory systems and high market demand for modern connectivity solutions. 5G technology received widespread adoption throughout the region because of its growing data needs, while fiber-optic network investments also expanded. The rapid digital transformation across multiple sectors, such as manufacturing, healthcare, and transportation, creates a rising demand for reliable high-speed telecom services. EU programs focusing on cybersecurity development and rural broadband expansion, along with cross-border communication promotion, help strengthen the industry. European telecom service providers find promising growth potential through the combination of a high-tech customer base and a favorable regulatory structure.

Key Telecom Services Companies:

The following are the leading companies in the telecom services market. These companies collectively hold the largest market share and dictate industry trends.

- AT&T Inc.

- Vodafone Group Plc

- China Mobile Limited

- Telefonica S.A.

- Deutsche Telekom AG

- SoftBank Corp.

- Orange S.A.

- Nippon Telegraph and Telephone Corporation

- Verizon Communications Inc.

- China Telecom Corporation Limited

- KDDI Corporation

- Others

Recent Developments

- In May 2023, Verizon Communications Inc. said it will use up to 100 MHz of the C-Band spectrum it recently purchased to roll out 5G Ultra Wideband in many areas in the U.S. states of Wisconsin, Illinois, Ohio, Arizona, Pennsylvania, and West Virginia. The corporation was supposed to provide more bandwidth as the licensed spectrum became fully available. By the end of 2023, the extra bandwidth would be used to help provide remarkable speed and capacity.

- In February 2023, the telecom product that AT&T Inc. and software startup ServiceNow launched can help Communication Service Providers (CSPs) manage their inventory of fiber and 5G networks. AT&T Inc. has contributed significantly to the strategic design and technical aspects of the ServiceNow Telecom Network Inventory. The ServiceNow Platform served as the foundation for the offering, which is available to telecom providers globally.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the telecom services market based on the below-mentioned segments:

Global Telecom Services Market, By Service Type

- Fixed Voice Services

- Fixed Internet Access Services

- Mobile Voice Services

- Mobile Data Services

- Pay TV Services

- Machine-to-machine (Mobile IoT) Services

Global Telecom Services Market, By Transmission

- Wireline

- Wireless

Global Telecom Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |