Global Thermal Management Materials Market

Global Thermal Management Materials Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Phase Change Materials (PCMs), Thermal Interface Materials (TIMs), Gap fillers, pads, greases, adhesives, Graphite & Graphene-Based Materials), By End Use (Consumer Electronics, Automotive & Transportation, Industrial & Manufacturing, Telecommunications, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Thermal Management Materials Market Summary

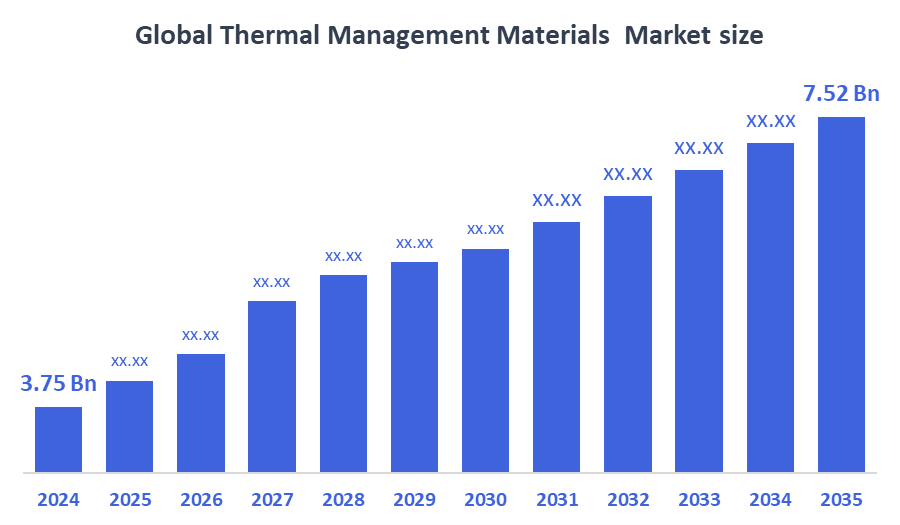

The Global Thermal Management Materials Market Size Was Estimated at USD 3.75 Billion in 2024 and is Projected to Reach USD 7.52 Billion by 2035, Growing at a CAGR of 6.53% from 2025 to 2035. The growth of the thermal management materials market is driven by rising demand for efficient heat dissipation in electronics, increasing adoption of electric vehicles, advancements in 5G technology, and the need for high-performance materials in renewable energy and industrial applications.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific thermal management materials market held the largest revenue share of 46.3% and dominated the global market.

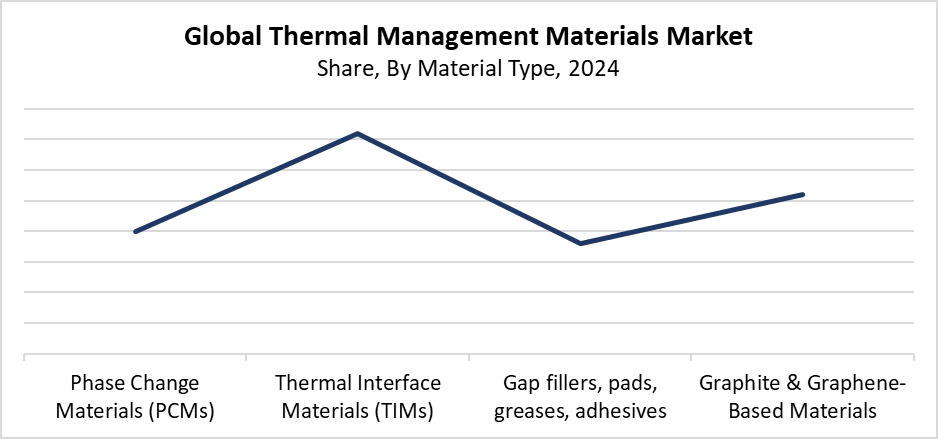

- In 2024, the thermal interface materials (TIMs) segment held the highest revenue share of 36.2% and dominated the global market by material type.

- With the biggest revenue share of 47.4% in 2024, the consumer electronics segment led the worldwide market by end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3.75 Billion

- 2035 Projected Market Size: USD 7.52 Billion

- CAGR (2025-2035): 6.53%

- Asia Pacific: Largest market in 2024

The market for thermal management materials includes multiple substances, which serve as heat control solutions for industrial equipment, automotive systems, and electronic devices. These materials, including phase change materials, heat sinks, thermal interface materials, and thermal greases, serve to remove extra heat, which results in better system operation and reliability. The market develops because of three essential factors, which include the strong growth of consumer electronics, the increasing demand for electric vehicles, and the need for reliable cooling systems in high-performance computing and telecommunications equipment. Advanced thermal management solutions are becoming more and more in demand across a variety of industries due to the shrinking of electronic components and rising energy efficiency demands.

The thermal management materials market undergoes major transformations because of technological progress. New developments in nanomaterials, such as carbon nanotubes and graphene, are facilitating lightweight, compact designs and increasing thermal conductivity. Thermal solutions with high performance have become essential because 5G networks, renewable energy systems, and data centres continue to expand. The government provides vital support to energy-efficient industries and green technologies through its programs. The electronics manufacturing sector follows strict thermal performance standards while EV adoption receives subsidies. This motivates companies to develop advanced thermal management solutions, thus creating market growth.

Material Type Insights

The thermal interface materials (TIMs) segment led the thermal management materials market with the largest revenue share of 36.2% in 2024. The extensive usage of TIMs in consumer electronics, automotive, and industrial applications to improve heat transmission between components and heat sinks is responsible for this dominance. The market requires high amounts of thermal greases, pads, and gels, and phase change materials because electronic devices shrink while their power output grows. This makes thermal management crucial. The expanding 5G infrastructure, together with the growing adoption of electric vehicles, creates a higher need for efficient heat dissipation solutions. The thermal conductivity of TIMs, together with their reliability and user-friendly nature, makes them vital for maintaining device longevity and performance across various industrial sectors.

The graphite and graphene-based materials segment of the thermal management materials market is anticipated to grow at the fastest CAGR throughout the forecasted period. These materials' outstanding thermal conductivity, combined with their lightweight and flexible nature, which suits advanced computing systems, electric vehicles, and next-generation electronics, drives their rapid growth. The heat dissipation abilities of graphene surpass conventional materials. This enables the development of compact high-performance devices. The demand for high-performance thermal solutions in batteries and small electronic components drives the rapid growth of adoption. The market expansion of Graphite and graphene-based materials into various high-tech industries occurs because research continues to improve their production efficiency, and costs decrease.

End Use Insights

The consumer electronics segment led the thermal management materials market with the largest revenue share of 47.4% in 2024. The extensive use of laptops, game consoles, smartphones, tablets, and other portable electronics that need effective thermal management to preserve performance and avoid overheating is what is causing this domination. Electronic devices need proper heat management systems to operate reliably and deliver safe performance because their components have become smaller and more potent. The research area focuses on using phase-change materials, together with thermal interface materials, and graphene-based technologies to improve heat dissipation. The demand for advanced thermal management solutions continues to rise because digitalisation and remote work expansion drive the need for high-performance consumer electronics. The segment maintains its dominant market position through this development.

The automotive and transportation segment of the thermal management materials market is expected to grow at the fastest CAGR during the forecast period. The market growth stems from the need to prevent battery overheating in electric vehicles and hybrid electric vehicles while maintaining safety standards. The operation of motors, batteries and power electronics depends on thermal management materials to control heat. This leads to improved component performance and extended lifespan. The market demands advanced thermal solutions because government authorities enforce strict regulations. These aim to decrease emissions while making fuel consumption more efficient. The automotive industry adopts cutting-edge thermal materials because manufacturers need to develop lightweight, energy-saving vehicle parts. The automotive and transportation sector will lead the worldwide growth of the electric vehicle market.

Regional Insights

The Asia Pacific thermal management materials market led globally in 2024 by holding the largest revenue share of, 46.3%. The region maintains its dominance through its fast industrial growth and expanding electronics manufacturing, and electric vehicle (EV) market, especially in China, India, Japan, and South Korea. Advanced thermal management systems are becoming more and more necessary as a result of expenditures in 5G infrastructure and the rising demand for consumer goods like laptops and smartphones. The adoption of thermal materials in automotive applications accelerates because of government initiatives which promote sustainable transportation. Renewable power systems. Asia Pacific leads the thermal management materials market growth because of its key manufacturers and ongoing research activities, which establish the region as an industry leader.

North America Thermal Management Materials Market Trends

The North American market for thermal management materials experiences steady growth because the automotive, aerospace, and consumer electronics sectors need these materials. The growing adoption of electric vehicles (EVs) and the region's focus on technological development create two main drivers for market growth. The deployment of 5G infrastructure together with data centres requires advanced thermal solutions to handle heat dissipation effectively. Strict environmental and energy efficiency regulations promote the use of high-performance sustainable thermal materials. The presence of major manufacturers and research institutions promotes continuous development in graphite-based solutions and thermal interface materials. All of these elements work together to give North America a substantial market share in the worldwide thermal management materials industry.

Europe Thermal Management Materials Market Trends

The European market for thermal management materials is growing significantly because electronics, automotive, and renewable energy sectors keep expanding their requirements. Germany, France, and the UK need battery thermal management systems to maintain safety and performance because electric vehicles and hybrids have become more popular in these countries. Data centre expansion and 5G network deployment across Europe require advanced cooling materials to meet their operational needs. Manufacturers are now required to adopt environmentally friendly thermal materials because strict environmental regulations and government programs support sustainable practices and energy efficiency. The region's strong research and development focus and major industry players together drive market growth. This positions Europe as a leading competitor in the global thermal management materials industry.

Key Thermal Management Materials Companies:

The following are the leading companies in the thermal management materials market. These companies collectively hold the largest market share and dictate industry trends.

- Union Tenda Technology Co., Ltd

- Indium Corporation

- E-SONG EMC

- Pcmwala

- Dycotec Materials Ltd

- Compelma

- Master Bond

- Boyd

- Fujipoly

- Others

Recent Developments

- In January 2025, Master Bond created EP53TC, a two-component epoxy intended for tiny potting applications, coating, bonding, and sealing when effective heat dissipation is essential. With a combined viscosity of 45,000–65,000 cps at room temperature, the epoxy is a flowable solution made with a specialized filler that has a particle size range of 5–30 microns.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the thermal management materials market based on the below-mentioned segments:

Global Thermal Management Materials Market, By Material Type

- Phase Change Materials (PCMs)

- Thermal Interface Materials (TIMs)

- Gap fillers, pads, greases, adhesives

- Graphite & Graphene-Based Materials

Global Thermal Management Materials Market, By End Use

- Consumer Electronics

- Automotive & Transportation

- Industrial & Manufacturing

- Telecommunications

- Others

Global Thermal Management Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 213 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |