Global Thermal Printing Market

Global Thermal Printing Market Size, Share, and COVID-19 Impact Analysis, By Technology (Direct Thermal Printing, Thermal Transfer Printing), By Product Type (Desktop Printers, Mobile Printers, Industrial Printers, POS Printers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Thermal Printing Market Summary

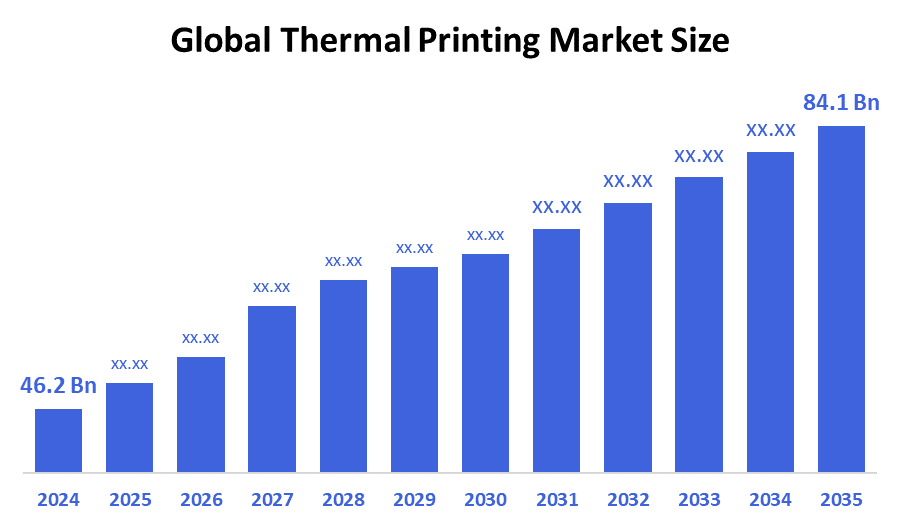

The Global Thermal Printing Market Size Was Estimated at USD 46.2 Billion in 2024 and is Projected to Reach USD 84.1 Billion by 2035, Growing at a CAGR of 5.6% from 2025 to 2035. The market for thermal printing is expanding as a result of rising demand for effective barcode and label printing from the expanding logistics and e-commerce sectors, improvements in mobile printing technology, and the uptake of low-cost and low-maintenance printing solutions.

Key Regional and Segment-Wise Insights

- In 2024, North America held the greatest revenue share of 34.3% in the thermal printing market.

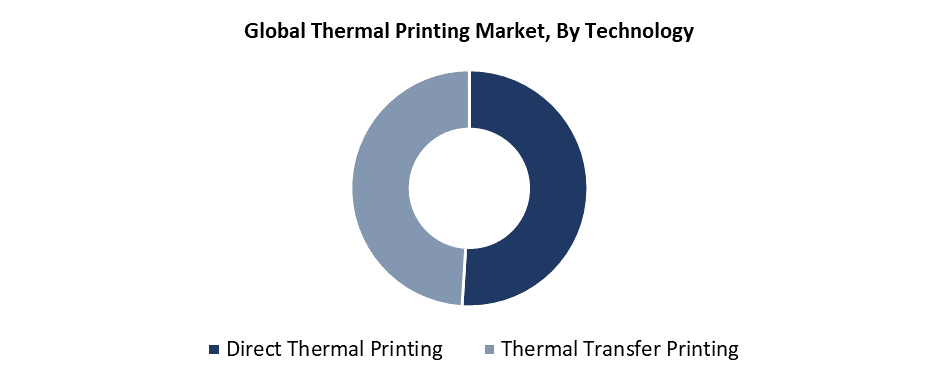

- With the most revenue share of 51.5% in 2024, the direct thermal printing segment dominated the market by technology.

- In 2024, the desktop printers segment held the biggest market revenue share and dominated the market based on product type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 46.2 Billion

- 2035 Projected Market Size: USD 84.1 Billion

- CAGR (2025-2035): 5.6%

- North America: Largest market in 2024

The market for thermal printing represents the field that focuses on heat-based printing technology that produces text and images on paper and other materials. These printers serve multiple industries, including manufacturing, retail, healthcare, and transportation, through their use for printing labels and barcodes as well as receipts and tags. The market expansion mainly stems from increasing demand for fast, reliable, and affordable printing solutions, especially across logistics and e-commerce sectors. The market growth of thermal printers has been driven by increasing consumer requirements for accurate inventory tracking systems. Thermal printers serve as a preferred printing solution for high-volume applications because their reduced mechanical components lead to lower maintenance expenses and enhanced operational dependability.

Thermal printing systems have become more capable due to recent technological advancements. New developments in wireless networking and mobile integration, together with high-resolution printing technology, have extended the applications of thermal printing while boosting its operational efficiency. The development of thermal printing materials and methods advanced rapidly because smart packaging spread and anti-counterfeit labeling became essential. Various national governments promote thermal printing technology through their automation and digitalization programs within the healthcare and logistics sectors. The market expansion receives additional momentum through pharmaceutical labeling requirements and food safety regulations, and supply chain management solutions, which make thermal printing vital for contemporary commercial and industrial operations.

Technology Insights

The direct thermal printing segment led the thermal printing market with the largest revenue share of 51.5% in 2024. This technology remains popular because it avoids using ink, toner, and ribbons and provides both affordability and easy operation with minimal maintenance needs. Businesses in retail and logistics, along with transportation and healthcare sectors, extensively use direct thermal printers because these devices suit temporary printing needs for shipping labels and receipts and barcode tags. The wide adoption of these printers stems from their ability to deliver rapid printing results with superior output quality and simple operational procedures. The segment's growth continues because supply chain management and e-commerce require efficient labeling solutions. The advantages of direct thermal printing make it a key driver for expanding the thermal printing industry throughout all sectors.

The thermal transfer printing segment of the thermal printing market is anticipated to grow at the fastest CAGR during the forecast period. The technology’s ability to generate durable, long-lasting, and resistant prints to heat, moisture, chemicals, and abrasion explains its rapid growth. The manufacturing sector, healthcare industry, logistics, and electronics sectors depend on thermal transfer printing for their essential product identification and legal compliance requirements. Printer technology, together with ribbon materials, have enhanced print precision and efficiency, which drives faster adoption of the system. Thermal transfer printing will experience substantial growth throughout the upcoming years because of its growing market need for dependable, flexible printing methods.

Product Type Insights

The desktop printer segment led the thermal printing market with the largest revenue share in 2024. The market leadership of desktop thermal printers stems from their compact design and budget-friendly pricing, together with their user-friendly features, which attract both small to medium-sized businesses and retail establishments. Businesses utilize these printers to generate labels and receipts as well as barcodes in point-of-sale, inventory management, and shipping operations. The rapid rise of desktop thermal printers stems from their combination of cost-effectiveness and compact design, and user-friendly installation and maintenance features. These printers maintain their market leadership because they serve businesses across many industries and deliver consistent results while remaining flexible to different applications.

During the projected period, the industrial printers segment of the thermal printing market is anticipated to grow at the fastest CAGR. The expansion of printing solutions with extended durability and top-quality performance continues to grow because manufacturing logistics and healthcare industries require them. Industrial thermal printers specialize in processing extensive print jobs at enhanced speed, along with precise accuracy and dependable operations, which makes them perfect for heavy-duty applications, including barcode labeling, asset tracking, and compliance tagging. The rate at which printers get adopted increases because of recent technological breakthroughs, which offer better connectivity and automation capabilities. Industrial printer demand continues to rise because businesses focus more on operational efficiency and traceability, which will drive strong market expansion throughout the upcoming years.

Regional Insights

North America led the thermal printing market with the largest revenue share of 34.3% in 2024. The established industrial infrastructure of this region, together with automation adoption across manufacturing and retail, healthcare, and logistics sectors, drives its market dominance. Market expansion continues to grow because businesses seek precise and efficient labeling and receipt printing systems that improve supply chain tracking and regulatory requirements. Businesses in North America increasingly adopt thermal printers with mobile connectivity and cloud integration features as technology advances. Industry growth accelerates because government programs provide support to automation systems and build smart infrastructure while promoting digitalization. The worldwide thermal printing market leadership of North America stems from its combination of innovative governmental frameworks, strong industrial sectors, and supportive regulatory frameworks.

Asia Pacific Thermal Printing Market Trends

The Asia Pacific thermal printing market earned its position as one of the most profitable sectors in 2024. Rapid industrial growth and urban expansion, along with manufacturing, logistics, and retail and healthcare sectors, require efficient printing solutions, thus creating strong market demand. The market expansion in the Asia Pacific receives extra momentum from the expanding e-commerce sector and rising needs for efficient inventory control and product marking solutions. Market attractiveness increases because of rising infrastructure investments and governmental initiatives for digital transformation and smart manufacturing operations. The large customer base and technological progress enable widespread adoption of thermal printing equipment. These factors combine to make Asia Pacific the fastest-growing and most promising area of the global thermal printing market.

Europe Thermal Printing Market Trends

The European thermal printing market grows significantly in 2024. The region's dedication to sustainability, combined with industrial modernization and energy efficiency initiatives, acts as the primary force behind this substantial market development. Stringent rules regarding safety standards and product tracking, along with labeling requirements, have created increased market demand for reliable thermal printing solutions. The European advanced manufacturing sector, together with healthcare facilities and retail businesses, implements thermal printing solutions to enhance their supply chain control and operational effectiveness. Market growth occurs because governments back green technology initiatives alongside smart infrastructure development, and businesses embrace automation alongside digital transformation trends. In 2024, Europe stands as a key driving force behind the global expansion of the thermal printing market.

Key Thermal Printing Companies:

The following are the leading companies in the thermal printing market. These companies collectively hold the largest market share and dictate industry trends.

- Zebra Technologies Corporation

- Citizen Systems Japan Co., Ltd.

- Brother Industries, Ltd.

- Sato Holdings Corporation

- Honeywell International Inc.

- TSC Auto ID Technology Co., Ltd.

- GoDEX International Co., Ltd.

- Seiko Epson Corporation

- Bixolon Co., Ltd.

- Toshiba TEC Corporation

- Others

Recent Developments

- In April 2025, Source Technologies declared that it has expanded its portfolio in the thermal printing sector by acquiring the printer assets of AMT Datasouth. Through the acquisition, Source Technologies' product line is expanded to include thermal printing solutions for receipt, barcode, and label printing.

- In March 2025, Distribution Management (DM) declared that Brother's thermal desktop and industrial printers have been added to its product line. This collaboration supports Brother's expansion goals by expanding DM's thermal printing, mobile, and labeling solutions offerings. Brother hopes to increase its presence in a number of industries, including state and municipal government, by utilizing DM's vast reseller network.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the thermal printing market based on the below-mentioned segments:

Global Thermal Printing Market, By Technology

- Direct Thermal Printing

- Thermal Transfer Printing

Global Thermal Printing Market, By Product Type

- Desktop Printers

- Mobile Printers

- Industrial Printers

- POS Printers

Global Thermal Printing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 219 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |