Global Tinplate Market

Global Tinplate Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (Single Reduced Tinplate, Double Reduced Tinplate, Coated Tinplate, and Uncoated Tinplate), By End-Use Industry (Food & Beverage Packaging, Personal Care & Cosmetics, Paints & Chemicals, Electrical & Electronics, and Industrial Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 ? 2035

Report Overview

Table of Contents

Tinplate Market Summary, Size & Emerging Trends

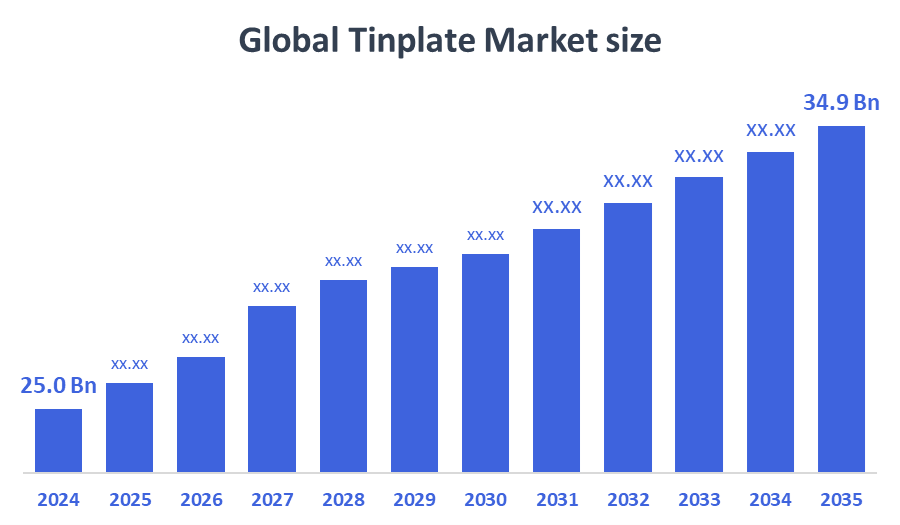

According to Decision Advisors, The Global Tinplate Market Size is Expected to Grow from USD 25.0 Billion in 2024 to USD 34.9 Billion by 2035, at a CAGR of 3.08% during the forecast period 2025-2035. Rising consumption of canned foods, growing awareness around sustainable materials, and rapid industrialization in emerging economies are further supporting market expansion. However, raw material cost fluctuations and rising competition from aluminum and plastic alternatives pose potential challenges to market growth.

Key Market Insights

- Asia Pacific is expected to maintain the largest market share through 2032, accounting for around 40% of global revenue.

- Single reduced tinplate dominated the product type segment due to its extensive usage in general packaging.

- Food & beverage packaging held the largest share among end-use industries, driven by strong global demand for preserved and ready-to-consume food items.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 25.0 Billion

- 2035 Projected Market Size: USD 34.9 Billion

- CAGR (2025-2035): 3.08%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Tinplate Market

Tinplate is a thin, tin-coated steel sheet known for its high corrosion resistance, strength, and formability, making it a preferred material for a wide range of packaging applications. It is extensively used in food and beverage cans, aerosol containers, paint cans, and small electrical enclosures due to its ability to preserve product integrity and ensure safety. With growing emphasis on sustainability, the market is gradually transitioning toward thinner gauge tinplate that minimizes material usage without compromising durability. Manufacturers are also investing in enhanced coating, lacquering, and printing technologies to meet stringent regulatory standards and evolving branding requirements. These innovations support attractive, functional, and eco-friendly packaging solutions. As industries seek alternatives to plastic, tinplate continues to gain prominence for its recyclability, long shelf life, and compatibility with diverse consumer and industrial packaging needs.

Tinplate Market Trends

- Increased usage of double reduced tinplate in lightweight and high-strength packaging solutions.

- Surge in demand for premium printing and coating technologies to enhance product branding and visual appeal.

- Growing adoption of tinplate in personal care and cosmetics packaging due to its recyclability and luxury appeal.

Tinplate Market Dynamics

Driving Factors: Consumers and regulatory bodies are increasingly favoring eco-friendly alternatives to plastic

The tinplate market is driven by the rising demand for sustainable and recyclable packaging, especially in the food and beverage sector. Consumers and regulatory bodies are increasingly favoring eco-friendly alternatives to plastic. Tinplate’s durability, corrosion resistance, and aesthetic appeal make it ideal for shelf-stable and premium packaging. Additionally, urbanization and growing consumption of canned products in emerging economies fuel demand. Technological advancements in coating and printing also contribute to tinplate’s expanded usage across multiple industries.

Restraints: Tinplate production is energy-intensive

Despite its benefits, the tinplate market faces restraints such as fluctuating raw material prices especially steel and tin which directly impact production costs and profitability. Additionally, tinplate production is energy-intensive, raising concerns over carbon emissions and operational expenses. Competition from alternative materials like aluminum, PET, and composite plastics further restricts market expansion. Complex recycling processes in some regions and limited consumer awareness in developing markets also hinder growth, particularly where cost-effective plastic packaging remains dominant.

Opportunities: Demand is increasing in premium sectors like cosmetics

Growing environmental awareness and global regulatory shifts against single-use plastics offer significant opportunities for tinplate manufacturers. Demand is increasing in premium sectors like cosmetics, health supplements, and specialty foods, where metal packaging adds value. Emerging economies are rapidly urbanizing, leading to higher consumption of canned and processed goods. Technological innovations, such as thinner gauges and improved coatings, allow for lighter, cost-effective, and attractive packaging. Localized manufacturing and digital printing further open doors for customization and market penetration.

Challenges: Competition from more lightweight and cost-effective alternatives

The tinplate market faces several challenges, including rising production costs due to energy-intensive processes and volatile raw material prices. Regulatory pressures on industrial emissions and environmental compliance also increase operational complexity. Supply chain disruptions, particularly for tin and steel, can lead to inconsistent availability. Additionally, competition from more lightweight and cost-effective alternatives like aluminum and plastic remains a threat. Manufacturers must also balance maintaining material integrity while reducing tinplate thickness, which can compromise performance if not managed properly.

Global Tinplate Market Ecosystem Analysis

The tinplate market ecosystem involves raw material suppliers (steel and tin producers), tinplate processors, packaging manufacturers, brand owners, and retailers. Leading manufacturers are optimizing their production technologies to enhance coating efficiency and recyclability. Strategic collaborations with food, cosmetic, and chemical companies help packaging manufacturers expand application areas. Governments and environmental agencies play a vital role by supporting recyclable packaging materials through incentives and regulations.

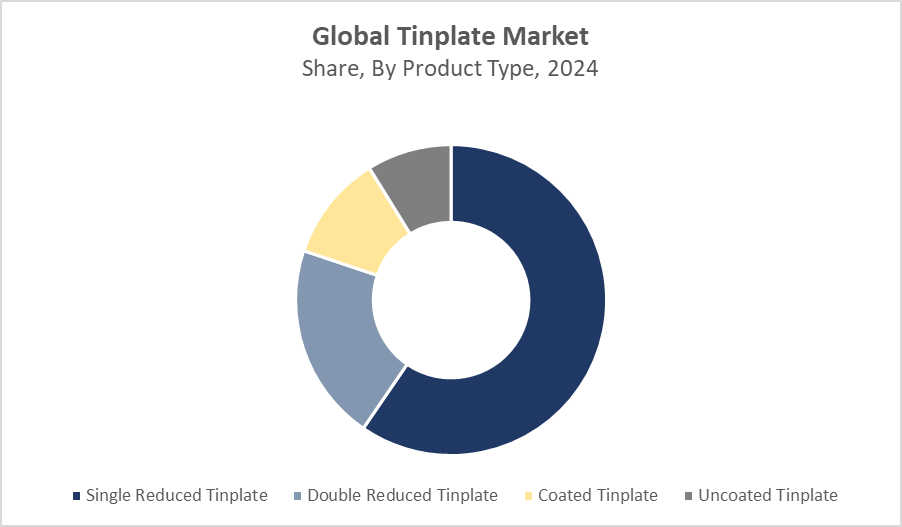

Global Tinplate Market, By Product Type

Single reduced tinplate dominated the global tinplate market in 2024, accounting for over 60% of total revenue. This dominance is attributed to its widespread use in general packaging applications, particularly for food containers, paint cans, and industrial packaging. The material is known for its excellent formability, strength, and moderate stiffness, which makes it easy to shape without compromising durability. Its versatility, cost-effectiveness, and ability to provide reliable corrosion protection make it the preferred choice for mass-market and everyday packaging needs.

Double reduced tinplate is rapidly gaining market traction due to its thinner gauge and higher tensile strength. This variant undergoes a second cold reduction process, resulting in increased hardness and reduced thickness, which is ideal for applications requiring lightweight yet strong packaging. It is particularly popular in beverage cans, cosmetic containers, and high-end personal care packaging, where product appearance, reduced material usage, and durability are critical. As demand for eco-friendly and efficient packaging rises, double reduced tinplate continues to expand its market share.

Global Tinplate Market, By End-Use Industry

Food & beverage packaging accounted for the largest revenue share of approximately 45% in 2024, reflecting its crucial role in the tinplate market. Tinplate’s excellent corrosion resistance and airtight sealing properties make it ideal for preserving shelf-stable foods like canned vegetables, soups, and ready-to-drink beverages. These properties ensure longer shelf life, maintaining product quality and safety. The material’s strength allows for durable packaging that withstands transportation and storage conditions. Growing consumer preference for convenience foods and beverages, combined with stringent food safety regulations, continues to drive demand in this sector.

The personal care & cosmetics segment is an emerging and rapidly growing market for tinplate packaging. High-end metal containers for creams, perfumes, and grooming kits benefit from tinplate’s premium aesthetic appeal and sturdy structure. Tinplate offers a luxurious and elegant look, which enhances brand perception and consumer appeal. Additionally, its recyclability aligns well with increasing eco-conscious branding strategies in the beauty industry. The rise in demand for sustainable, reusable, and attractive packaging solutions in personal care drives manufacturers to adopt tinplate, positioning this segment as a key growth opportunity in the coming years.

Asia Pacific is poised to lead the global tinplate market with an estimated 40% market share,

driven largely by rapid economic growth and urbanization in countries like India, China, and those in Southeast Asia. Rising disposable incomes and changing lifestyles have increased the demand for convenient and packaged foods, boosting the consumption of canned and processed products. The fast-growing Fast-Moving Consumer Goods (FMCG) sector also plays a vital role, with manufacturers increasingly adopting tinplate packaging due to its durability and recyclability. Moreover, expanding retail infrastructure and increasing health awareness further fuel the region’s preference for safe, long-lasting packaging solutions.

North America commands a significant share of approximately 28% in the tinplate market,

supported by a mature and well-established packaged goods industry. The U.S. and Canada show strong demand for recyclable and sustainable packaging, with consumers and regulators pushing for eco-friendly alternatives to plastics. This region benefits from advanced manufacturing capabilities and innovation in tinplate coatings and printing, enabling producers to offer high-quality, aesthetically appealing packaging. Additionally, growth in organic and premium food segments drives demand for tinplate’s protective qualities and premium look, reinforcing North America’s strong market position.

WORLDWIDE TOP KEY PLAYERS IN THE TINPLATE MARKET INCLUDE

- ArcelorMittal

- Tata Steel

- POSCO

- JFE Steel Corporation

- Novolipetsk Steel (NLMK)

- Baoshan Iron & Steel Co., Ltd. (Baosteel)

- Thyssenkrupp AG

- United States Steel Corporation

- U.S. Steel Košice

- Steel Dynamics, Inc.

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the tinplate market based on the below-mentioned segments:

Global Tinplate Market, By Product Type

- Single Reduced Tinplate

- Double Reduced Tinplate

- Coated Tinplate

- Uncoated Tinplate

Global Tinplate Market, By End-Use Industry

- Food & Beverage Packaging

- Personal Care & Cosmetics

- Paints & Chemicals

- Electrical & Electronics

- Industrial Applications

Global Tinplate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Tinplate Market in 2025?

A: The Global Tinplate Market size is estimated to be approximately USD 25.8 billion in 2025, growing from USD 25.0 billion in 2024.

Q: What is the forecasted CAGR of the Global Tinplate Market from 2025 to 2035?

A: The market is projected to grow at a CAGR of 3.08% during the forecast period from 2025 to 2035.

Q: What is the revenue potential of tinplate packaging in the Asia–Pacific region by 2035?

A: The Asia–Pacific region is expected to generate over USD 13.9 billion in tinplate packaging revenue by 2035, driven by urbanization and increased demand for packaged foods.

Q: Who are the top 10 companies operating in the Global Tinplate Market?

A: Leading players include ArcelorMittal, Tata Steel, POSCO, JFE Steel Corporation, Novolipetsk Steel (NLMK), Baosteel, Thyssenkrupp AG, United States Steel Corporation, U.S. Steel Košice, and Steel Dynamics, Inc.

Q: Which startups or recent entrants are innovating in the tinplate market?

A: While the market is dominated by large steel producers, emerging tinplate converters and coating specialists are innovating with sustainable lacquers, digital printing, and lightweight gauge solutions, particularly in Asia and Europe.

Q: Can you provide company profiles for leading tinplate manufacturers?

A: Yes. For instance, ArcelorMittal focuses on high-performance tinplate for food and industrial use, while Tata Steel emphasizes sustainable and lightweight tinplate solutions in Europe and South Asia.

Q: What are the main drivers of growth in the tinplate market?

A: Key drivers include rising demand for sustainable packaging, growth in canned food consumption, and regulatory pressure to reduce plastic use, especially in food and personal care segments.

Q: What challenges are limiting the adoption of tinplate products?

A: Challenges include high energy and production costs, volatility in steel and tin prices, and competition from alternatives like aluminum and plastics. Recycling complexity in some regions also poses a hurdle.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 165 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |